ATTR Cardiomyopathy Breakdown

Understanding the landscape ahead of two key drug approvals. Product Labeling, Medicare reimbursement, Total Addressable Market, and the future

ATTR Cardiomyopathy is a lone bright spot for Pfizer (according to activist starboard), a part of a foundation for Alnylam, and a piece of a complicated puzzle for BridgeBio. The disease was rare until new diagnostics and effective treatments demonstrated an increased incidence and prevalence (sometimes by more than 5x over 10 years). Now, big pharma like Pfizer, AstraZeneca, Novo Nordisk, Bayer (via BridgeBio) are all in the market.

Transthyretin (TTR) is a normal protein in our bodies which plays a minimal role in transporting some hormones. Our bodies don’t require the TTR protein to function, but it exists naturally in the body. TTR is a tetramer made of 4 individual fibrils. These fibrils can dissociate and subsequently aggregate into clumps, depositing themselves in various tissues. The deposition of aggregated TTR is thought to drive the pathology of ATTR. More monomers, more disease. Patients may start with normal TTR proteins, but over time the TTR can dissociate and start to aggregate (‘wild type ATTR’). On the other hand, mutant forms of ATTR tend to misfold, breakdown, and aggregate faster leading to quicker progression.

ATTR presents as a spectrum of disease involving the nerves (ATTR with neuropathy, ATTR-PN) and the cardiac tissues (ATTR-CM), typically presenting in older adults. Pure ATTR-CM (cardiomyopathy) presents as heart failure while ATTR PN (polyneuropathy) presents with sensory issues. ATTR is progressive and debilitating though survival has increased dramatically since 2015.

How to treat ATTR - Mechanisms of Action

Stabilizers (Tafamidis - Pfizer, Acoramidis - BridgeBio): Stabilizers act by stabilizing the TTR protein to prevent dissociation into monomers and subsequent deposition. Acoramidis has higher stabilization than Tafamidis (95% vs 80%) supported preclinically and clinically by increasing serum TTR (stable protein).

Silencers (Vutrisiran - Alnylam, Eplontersen - Ionis/AstraZeneca, NTLA-2001 - Intellia): Silencers work by reducing production of TTR proteins. TTR plays a small role in hormonal transport but can be knocked out fairly safely with no safety issues after years of silencer therapies. Both Vutrisiran and Eplontersen silence the TTR mRNA while NTLA-2001 silences the gene itself via editing

Antibodies (ALXN2220 - AstraZeneca (NI006), NNC6019 - Novo): Both silencers and stabilizers attempt to slow the progression of disease, but antibodies go a step further—they attempt to reverse progression. Antibodies will bind to already deposited protein and try to clear it using out immune system. Isolated case reports of spontaneous reversal demonstrate Proof of Concept (Source)

Increasing Prevalence

ATTR used to be rare, but two key changes have spiked diagnosis rates.

Historically, cardiac biopsy was required for diagnosis but a seminal paper in 2016 shifted the paradigm. Gillmore et al showed high accuracy for non-invasive technetium99 scans to diagnose ATTR after exclusion of other types of Amyloidosis. Earlier diagnosis led to better management and slower progression even without new therapies. It’s part of why comparing trials run in different eras is difficult.

The second piece is the approval of Tafamidis and Pfizer’s ongoing campaign to drive disease awareness among physicians and patients. We’ll touch on this later, but many large and small pharmaceutical companies have commented on the increasing diagnosis rates of ATTR.

Comparing drugs

“Acoramidis is up for approval later this month (PDUFA Nov 29), and Vutrisiran should be approved next year (likely by the end of 1H25). At that point, Doctors will have to decide between Tafamidis, Acoramidis and Vutrisiran. Most KOLs see no differentiation, but there are some nuances when comparing across trials I want to explore.

Tafamidis is a good drug. Investors seem to shrug off Tafamidis as bad drug, but the ATTR-ACT trial does not accurately reflect real world data. The all cause mortality in the real world is much more comparable between all three drugs.

The baseline characteristics are also different. Contemporary patients are diagnosed earlier with less severe disease.

The earlier diagnosis favors drugs like Vutrisiran in first line use because they demonstrate a greater benefit for earlier treated patients. Furthermore, Acoramidis shows a greater benefit in patients with worse starting characteristics

In the weeds investors and scientists like to use biomarkers to draw conclusions on efficacy, but such practice doesn’t reflect real world practice in my opinion. Ultimately, treatment decisions hinge on functional outcomes like quality of life and mortality benefits. Slight differences in NT-proBNP levels do not affect prescriber decisions even if it’s a marker for disease benefit

Since the cross-trial comparisons on efficacy are unclear, I expect the majority of providers to stay with tafamidis in the first line setting initially. Over time, they will switch to Vutrisiran, Acoramidis, and potentially Eplontersen.

Second Line Use

Progression on tafamidis (defined via hospitalization, QOL) occurs in 20-30% of patients within 30 months. The second line market is large and growing. Providers will have to decide between switching to a more intense stabilizer like acoramidis or to a different drug class like vutrisiran. Basic principles dictate switching drug classes, but Acoramidis seems to work in more severe patients and a similar dosing schedule. I expect an approximately 50/50 split.

Key question: Labeling for Vutrisiran and Acoramidis

Tafamidis’ label reads indicated “to reduce cardiovascular mortality and cardiovascular-related hospitalization.”. Any drug trying to compete needs to have both mortality and hospitalization benefit on the label.

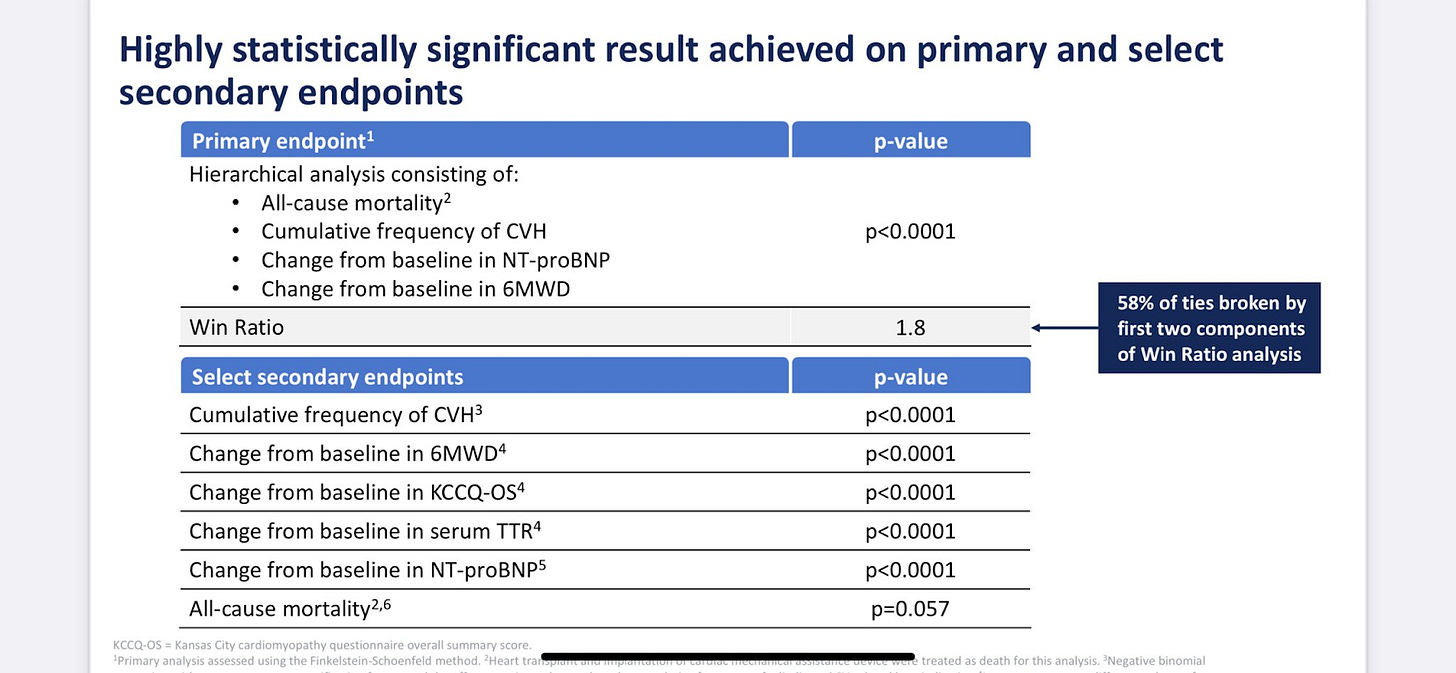

Vutrisiran achieved a statistically significant mortality benefit by extending the trial to 42 months (A little finesse by management).

Acoramidis didn’t show the same benefit on mortality.

However, I still think the benefit for mortality will be included. The FDA review documents for tafamidis say

“The hazard ratio for the all-cause mortality Cox-proportional hazard model was 0.7 (95% CI 0.51, 0.96) indicating a 30% reduction in risk of death in the pooled tafamidis group relative to the placebo group (p=0.026).”

I know investors and scientists draw a straight line at p < 0.05, but the difference between p = 0.026 and 0.057 is small when comparing different patient populations and acoramidis still demonstrated a benefit on all-cause mortality.

I’m also looking forward to Full data form Acoramidis on November 18 at AHA. They need to show continued improvement on All-Cause mortality to compete for first line use

Key Question: What are the dynamics of Medicare reimbursement?

Why care about Part B and D Medicare? Because it’s a matter of thousands of dollars for insurance and patients. Part B covers drugs which are infused (like vutrisiran) and part D covers oral drugs (like tafamidis and acoramidis).

Patients, under part B, pay 0 out of pocket costs. Patients, under part D, used to pay 5% of the drug cost after an initial 2000$ spending limit. Starting in 2025, they pay $0. However, insurance companies have different payment structures.

Patients covered with traditional Medicare are covered by the government on part B and a separate part D plan. The IRA increased the cost sharing for part D plans from 20% to 60% and thus patients with a dedicated part D plan will likely be pushed towards vutrisiran. (part D plans don’t want to bear that 60% cost!)

On the other hand, patients covered by Medicare Advantage are incentivized to use part D covered drugs. Medicare Advantage takes on the whole cost of the patient and thus covers part B costs too. Using part D means Medicare will cover 20% of the drug cost.

Key Question: What is the expected sequencing for use of drugs? What will the rollout speed be like?

Doctors Care about two things: Mortality and Quality of Life. On those metrics, most of the drugs look equal.

I expect the plurality of patients to start with tafamidis. About 25% will start with Acoramidis and another 25% Vutrisiran in 2025. Over time, this will shift towards Acoramidis and Vutrisiran. I expect both Vutrisiran and Acoramidis to compete on price to gain market share (tafamidis is 225K/year, Vutrisiran 500k/year in PN).

For second line treatment, I think it makes sense to split treatment 50/50 between acoramidis and vutrisiran.

And there’s one more wrinkle in how these drugs are rolled out

ATTR is on disease on a spectrum, so the FDA differentiates between ATTR-PN and ATTR-CM. The current standard of care is Vutrisiran or Eplontersen in PN and Tafamidis in CM.

The real-world experience has a gray area with ‘mixed-phenotype’ patients presenting with both Cardiac and Neuropathic symptoms. Alnylam obviously cannot encourage off label use but I suspect doctors are more open to using Vutrisiran in patients with Cardiomyopathy after HELIOS-B.

Question: I know that plenty of your prescribers for polyneuropathy are cardiologists. Have you noticed an inflection in the number of questions coming regarding the ATTR cardiomyopathy data?”

Answer: We've put, established very clear guardrails to make sure that we are promoting compliantly and making sure that the launch is ahead of us, not -- we're not in the launch phase.

Question: are there kind of significant impediments in place that really confine this drug to that true mixed phenotype population

Answer: So if you're in a cardiomyopathy -- if you're suspected of having a cardiomyopathy, physicians, especially in the United States, tend to go through scintigraphy. Now in polyneuropathy, not only because of our indication is hereditary, that you would actually go through a genetic testing to validate that. And then you would also have an additional neurological workup to make sure that that patient actually has the neurological manifestations of the disease

Keep in mind a substantial part of the subscriber are cardiologists.

Key question: Total Addressable Market in ATTR-CM?

Tafamidis is priced at ~200k and annualizes $6B in revenue while growing > 30%. Worldwide sales estimates peg the market at between 10-15B at peak. I think they could be underestimated the prevalence of ATTR-Cardiomyopathy. Recent data demonstrates an increased prevalence in older populations with up to 20% of HFpEF patients having the disease(source). Another estimate from EHR records estimates between 6-30/million as the incidence and 17-150/million as the prevalence. (source). Diagnosis via nuclear medicine and effective treatment options have drsatically increased the patient population. (source)

"In fact, in our best estimates, we believe about 20% patients only across the world are diagnosed. Therefore, this really is in a way, I'm going to date myself a bit of a blue ocean opportunity with some important players, which is only going to actually expand, increase access and availability" - Alnylam

"It is estimated that nearly half of those with this progressive and deadly disease have yet to be diagnosed….Diagnosis remains the biggest unmet need in this condition because there's almost half of patients that are still undiagnosed. So we do see a lot of growth opportunity in Vynda." - Pfizer

"The first is the ATTR-CM, which is one of the largest cardiomyopathies in cardiovascular disease, 300,000 to 500,000 patients, growing significant disease burden." - AZN

"One is the continued identification of new patients moved somewhere from like 35,000 identified patients to close to 50,000 now. And I expect that that's going to continue at an increased clip based on more and more people coming on to the playing field" - BridgeBio

ATTR is not a rare disease anymore. Let's assume drugs are priced at 200k/year like tafamidis. The US TAM is, on the low end, $10B (50,000 patients)

Drug developers will certainly get some pushback on pricing, but even a small, later line drug will be a blockbuster.

Key question: What does the future look like?

Combination therapy and Patent expiration.

Tafamidis comes in two formulations: Vyndamax (61mg) and Vyndaqel (20mg). source). The vyndamax formulation is patent protected out until 2035 while vyndaqel’s patents will expire in 2026 and can be extended to 2028 based on exclusivity. Europe and US Intellectual property is different but at the bottom line, Pfizer does not want us to think about exclusivity past 2028:

“Just to be clear, Dave, we shouldn't think beyond December 2028 on VYNDAQEL and VYNDAMAX.”

Expect payer restrictions to push for monotherapy until 2028 (see discussion on sequencing) but combination therapy could play a key role if tafamidis is generic. A combination of tafamidis and vutrisiran would likely be the preferred first line. The base case assumption is 2028 expiry, so any extension is the cherry on top. If you’re drinking the kool-aid at Bridge Bio, this thread supports potential patent extension. I can’t tell you either way.

IONS’ eplontersen, Intellia’s Gene editing, and next generation antibodies could play a role in the future.

Of those three, only the next generation antibodies could be truly paradigm shifting. As we’ve seen with ATTR-PN thus far, eplontersen has yet to take major share from vutrisiran and I do not expect they will do so in the future. Eplontersen is taken at home but that is really the only advantage. Eplontersen grew 44% while Vutrisiran grew 34% in the most recent quarter in ATTR-PN. Ionis/AstraZeneca are running a larger study to show more robust combination data (“we'll be the only company with a combination data.” - AstraZeneca) with tafamidis but I doubt cross trial comparisons will show significant differences.

Intellia’s NTLA-2001 is in trials for both Cardiomyopathy and peripheral neuropathy. Gene editing is a similar principle as other silencers. A one-time gene edit eliminates the infusion/pill burden, but the primary completion is end of 2027 and differentiation on outcomes is unclear. Further, reimbursement is uncertain, and the unmet need will be dramatically lower. Not a recipe for success.

Antibodies, on the other hand, could be potentially transformative because they are the only potentially disease reversing therapy in the pipeline. Initial safety and efficacy data is strong, and I look forward to updates from ALXN 2220 (NI006) and NNC6019. Primary completion dates for phase 2/3 trials between 2026 and 2029.

For example, NI006 shows signs of disease reversal with > 50% reductions in NT-proBNP in a dose dependent fashion. NT-proBNP is independently associated with a poor prognosis (source)

Bonus: What’s expected at AHA this weekend?

November 16-18 is the American Heart Association’s Scientific Sessions and I’m paying attention to two abstracts.

NTLA-2001 is presenting 1 year follow-up with functional outcomes and biomarkers. Keep in mind the TTR reduction was 87% which we’ll see how it translates to functional benefit. November 16

BBIO will present 42 months OLE data from Acoramidis. Cautiously optimistic about it, we’ll see how it compares to Vutrisiran. November 18

Conclusions

Tafamidis is a good drug and will maintain 1L share

Reimbursement dynamics are different based on the patient population. Medicare Advantage favors Oral drugs/at home injection. Traditional Medicare dynamics favor Vutrisiran

Labeling should be straightforward for Acoramidis. I expect a mortality benefit.

The TAM is huge with room for multiple billion dollar therapies. I believe BridgeBio doesn’t get enough credit for their programs.

Next generation approaches like antibodies have the potential to reverse disease. Alnylam is also working on a yearly drug.

Let me know what y’all think, where am I wrong, Where do you agree? If you enjoyed the post, please share, etc. Or don’t. Up to you. If you find my writing valuable, you can buy me a coffee and subscribe.

-Adu Subramanian

Disclosure: not financial advice. Own some $BBIO because I think they aren't valued for success unlike Alnylam

Definitions

NT-ProBNP: A biomarker for heart damage. NT-proBNP is an independent factor associated with increased mortality and hospitalization in heart failure patients. Patients with NT-proBNP > 3000 have worse outcomes and it’s well established as a marker for clinical improvement

6MWT: Functional test which measures the distance a patient can walk in 6 minutes. Trials use standardized protocols but the test can be influenced by patient and physician unblinding due to motivation, encouragement, etc.

NYHA Class: Measure of patient severity. Class I: No limitations, and ordinary physical activity doesn't cause shortness of breath, fatigue, or palpitations. Class II: Slight limitations, and ordinary physical activity can cause shortness of breath, fatigue, palpitations, or angina Class III: Marked limitations, and ordinary physical activity can cause symptoms Class IV: Inability to do any physical activity without discomfort, and symptoms are present even at rest

Your Midwit meme perfectly captures BBIO perception