ATTR-CM and ESC

Does the timing of separation matter?

For those still living under a rock, Alnylam reported some interesting results in ATTR-CM. The market is fascinating to explore because it features a mix of intellectual property, commercial, scientific, and clinical considerations. The next major news event is the European Society of Cardiology Aug 30 - Sep 2 where Alnylam will present detailed data on vutrisiran. The main focus is trying to parse what those curves could look like. Vutrisiran is approved for ATTR- polyneuropathy and the HELIOS-B trial evaluated it in ATTR-CM, a ‘10x larger’ market.

Brief Plug:

If you like my work, please support me at Adu Subramanian (buymeacoffee.com). I’m currently trying to bootstrap a website at www.subradata.com to 1) index presentations (www.subradata.com/search_presentation), 2) track changes in clinical trials, and 3) provide a free version of BioPharm Catalyst (www.subradata.com/catalyst_data_display)

Go here: Sheet to edit describing mortality curves

Best source explaining kaplan meier curves: zedstatistics on youtube.

Relevant tweets

BBIO partnership

BBIO expectations at longer time

Important publications to consider:

Excel file with all ATTR-CM drugs in development:

My big takeaway

Separation on CVH/CVM in the monotherapy arm doesn’t look great.

All cause mortality looks better but in the mono arm I still expect separation at 20-25 months.

patent litigation is a key unknown and I’ve heard both sides. I think it’s more reliable to assume expiry in 2028, but idk

Part D vs Part B: drug plans want to control part D spend under new IRA, but patients are more willing to take those drugs. For Medicare advantage plans, they will encourage usage with part D drugs.

Total Addressable market:

The TAM is where I think I am most variant compared to other investors. I believe ATTR-CM is a 10B domestic market (35,000) patients. New imaging methods for diagnosis and effective treatments have led to increasing prevalence (See epi section). Both Alnylam and Pfizer beat estimates for their ATTR franchises. Vyndamax does 6B in run rate revenue while growing 50%+

“We are accelerating growth by working with physicians to drive improvement in identifying appropriate patients with ATTR cardiomyopathy and helping patients to access and stay on the therapy once it is prescribed.

With strong growth through the second quarter, we believe there is additional opportunity to identify more patients who could benefit from our Vyndaqel products because of high unmet need. It is estimated that nearly half of those with this progressive and deadly disease have yet to be diagnosed.” - Pfizer Q2 earnings

IF you believe the market is that large, any approved drug in an oligopoly is worth > 0.

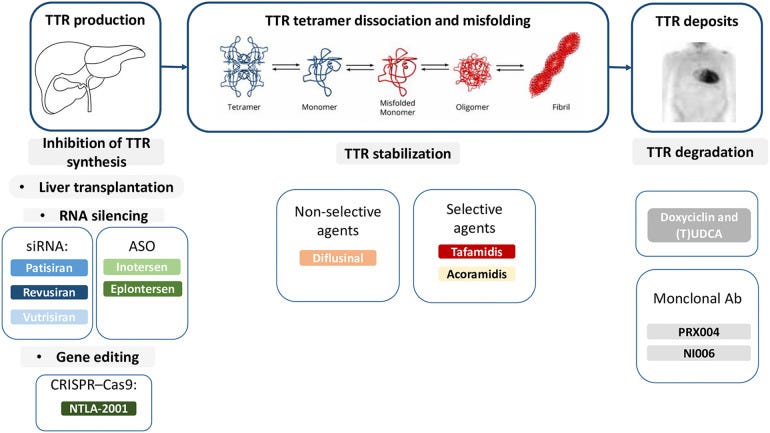

Pathophysiology

ATTR-Cardiomyopathy is a specific manifestation of ATTR amyloidosis. The ATTR protein is physiological but has little use, potentially serving some purpose transporting thyroid hormone/retinol. No humans with complete ATTR knockout exist, but mice ATTR knockout models are physiologically normal. There are hypothetical neuroprotective effects supported by early mice model data and correlations between stable TTR and neuroprotection against stroke (link). However, arguing knockdown via RNAi isn't safe doesn't hold weight yet.

Variant vs wild type: ATTR-CM occurs when either a variant form of ATTR or normal ATTR misfolds, aggregates, and deposits into cardiac tissue. The deposition leads to wall thickening and ultimately heart failure. One possibility is the deposition of wild type ATTR proteins because they tend to aggregate on their own. On the other hand, variant ATTR proteins can misfold and aggregate because the mutation increases the risk of misfolding. Variant ATTR has a worse prognosis because the variant structure carries a higher risk of misfolding and deposition. In addition to cardiomyopathy, ATTRv-PN is another manifestation of variant ATTR where variant TTR protein can be more directly neurotoxic to nerve fibers (still a theory).

Silencers like vutrisiran stop the production of TTR protein leading to less deposition in the heart, liver, etc. On the other hand, stabilizers stabilize the variant form of TTR to prevent abnormal deposition.

The differential injury hypothesis is still unproven, but I agree with it. The following article was published before Helios-B delivered, but I think silencers will have greater benefit for variant ATTR and mixed phenotype ATTR (link)

Acora vs Tafa data

My take: I think Tafa is a worse drug, but KOLs do not see it because the data hasn't shown it yet.

Acoramadis has increase TTR stabilization. BBIO has shown data implicating better mortality with early increases in stabilization (link)

Imaging results are consistent with more improvement on acoramadis. Look at LVEF, strain, etc.

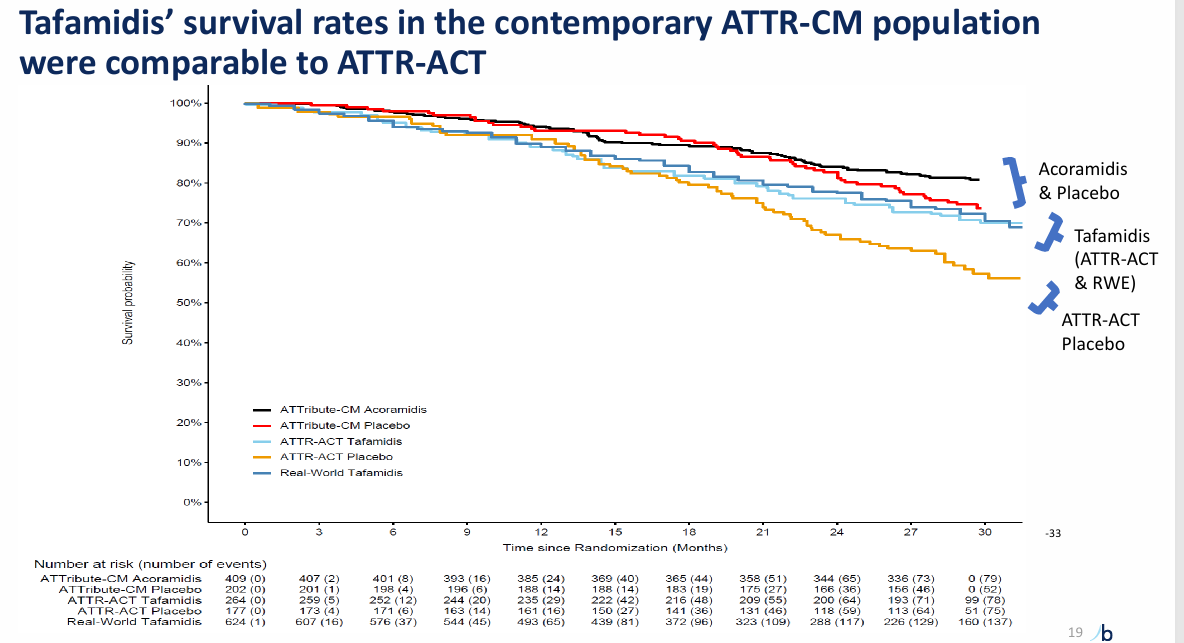

Survival on Acoramadis approaches near normalization unlike Tafamadis. (link)

The magnitude of benefit is still unclear. KOL surveys peg docs all over the place with around 1/3 believing the drug is better/worse/same. I could find a KOL to tell you anything. Surveys can be useful, but all they show are that people have mixed opinions.

Vutri data - Meat of the article.

We have the P values and hazard ratio for ACM and the composite endpoint, but why is the HR so strong and p value not more significant? Predicting the overall population is more difficult than doing each population independently. I look at the monotherapy arm because I think that’s important for the initial launch.

Basic principles: The p value is calculated based on the number of events and the KM curve shapes. More events and earlier separation = more stat sig.

Composite in the mono group:

In the phase 2 BBIO trial, survival on the composite at 30 months was 50% in the placebo arm at 30 months. Using conservative assumptions we can put placebo survival at 50% at 36 months. Here is an example curve. Separation happens fairly late at 27 months.

If the number of events is greater, the separation happens even later.

Overall, this benefit doesn't inspire confidence.

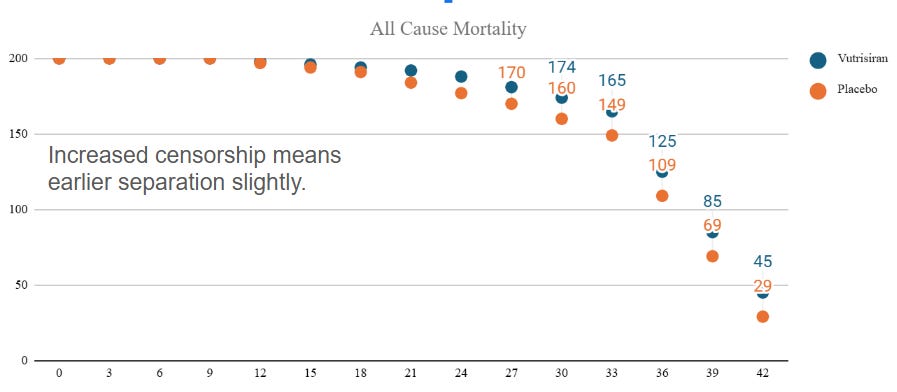

Mortality:

The mortality data is stronger but goes out to 42 months. For reference in projections, ATTRibute-CM has 78% survival at 30 months for the placebo arm. It's also harder to project because of likely censorship after 30 months. I trust this chart less, but from a first principles perspective, the separation likely occurs earlier than in the composite because there are many fewer events.

Let's assume 80% survival at 30 months go from there, the numbers can look like this:

I think the censorship numbers could come in greater skewing results to an earlier shift (less events = earlier separation with greater p value).

Let's take the extreme conservative approach and assume they hit the endpoint at 36 months: when does separation occur then?

Alnylam Commentary

They sound much more certain on the earnings call than in the initial call.

Earnings Call:

'“I think what you will see at ESC is going to give you further color about the robustness of this data and how we can actually be able to communicate effectively, both primary composite and secondary endpoints as well as the all-cause mortality. We believe there's going to be a clear differentiation for our products."

Original call Waffling: ". I mean, first of all, look, I think you're alluding to BridgeBio, and they're going to have to speak to their own data. We've searched through, for example, their peer review in New England Journal Paper, we can't find reference to the 42% or some of the other p-values that have been cited. What patients and physicians really care about is mortality. It was a secondary endpoint in the study. And in that paper, we don't see a single number that points to the magnitude or [indiscernible] [ mortality ] benefit."

How silencers compare to stabilizers

We do not have enough information to judge the differences and are limited to a few pieces of information

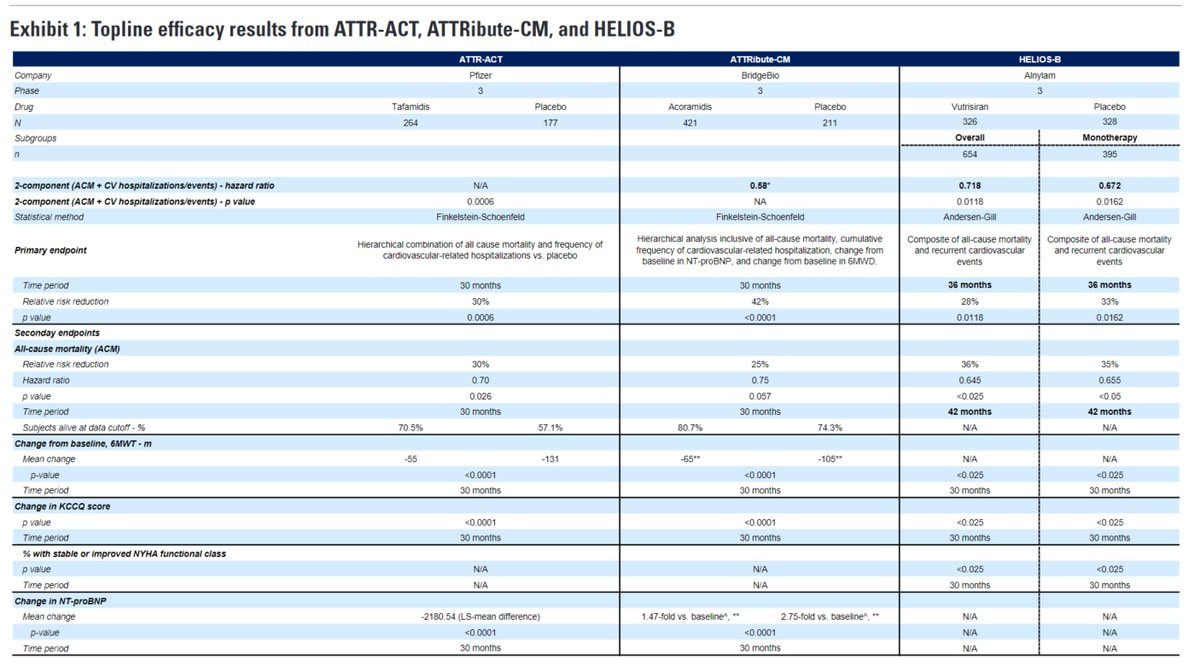

In a contemporary population, Vutri demonstrates a statistically significant and clinically meaningful benefit in ACM/CVH with RRR ~30%. Acora is slightly better at 35% RRR at 30 months and Tafa is 30% RRR at 30 months in a different population.

The benefit on all cause mortality is nominally higher for vutrisiran at 42 months than data to date for acoramidis and tafamidis (35% RRR vs 25% at 30 months vs 30% at 30 months). The key difference will be the timing of curve separation

Both monotherapy and combination therapy work, but monotherapy seems to work better, especially in ACM.

Putting these two pieces of information together, the ideal therapy should be combination with stabilizer and silencer, right? Improvement on hospitalizations for stabilizer and improvement in ACM for silencer. but……..

Patent, patents, patents.

The ideal therapy is combination silencer and stabilizer, but no payor is shilling out 500k for two therapies. Thus, the expiration of tafamidis' patent is the single biggest driver to the DCF value of any acoramidis Unsurprisingly, BBIO believes the patent is defensible, ALNY thinks it will expire. Uncharacteristically, PFE has resigned themselves to early expiry of the patents and generic entry. They can choose to fight this expiry with some polymorph patents (BBIO), but these patents are typically weak. I do not know if the polymorph is valid and need a legal expert on the topic. Regardless, I believe Pfizer will fight generics tooth and nail since Vyndamax (tafamidis) annualizes 6B in sales.

“The only winners in a lawsuit are lawyers” - The bible

Part D vs Part B

Unlike patent litigation, I'm in the weeds understanding part D vs part B dynamics. Part B covers healthcare professional administered drugs. Part D covers oral drugs under a pharmacy benefit

For part D, the insurance carrier is responsible for 60% of the amount beyond the catastrophic coverage limit while in part B, the insurance plan is responsible for 100% of the coverage. Another key difference: in 2023, patients are responsible for 5% of drug costs (for a 200k drug, that's 10k per year!) while in 2024 and 2025, patients are responsible for 0%. Part B coverage reimbursement is great for doctors because they are paid the cost of the drug plus 6%, but I think the dynamics favor a push for orals from both the insurance plan side (see white bagging) and the patient side.

Key takeaway. Part D plans will encourage patients limit use of part D drugs because they bear an increased burden in the catastrophic coverage phase. However, Medicare advantage plans who cover both part B and part D costs will encourage the use of part D drugs because the total cost (to the plan) is less. Patient out of pocket costs will be lower in 2025 compared to 2023 for expensive oral medications which will improve utilization and adherence. For example, a 200k drug would have a $10,000 yearly out of pocket expense in 2023 and $2000 out of pocket expense in 2025.

My stock thoughts

I own Bridge Bio because I like the pipeline. ATTR-CM is upside optionality on Pfizer extending their patent estate. Overall, they’re in a poor position with vutrisiran in a soft launch (approved in neuropathy) while BBIO waits for approval and the clock ticks down on vyndamax. Still, even if acoramidis is reserved for 10% of the population, the TAM is large.

I do not own ALNY but I generally like their approach to drug development and think their platform is validated. They’re doing a soft launch in ATTR-CM because it’s approved for ATTR-PN so the real launch should be fast.

Commercial rollout for these drugs cannot be predicted as it stands. Too many unknowns. But the next event is ESC and that’s what the meat of the post is about.

Before I conclude, a word on other approaches

On Wainua, I think the trial succeeds. It’s over-powered and Alnylam demonstrated a clear proof of concept. However, commercial considerations are another beast. One could argue ATTR-CM is a less severe disease so patients would rather have an at home administration, but increased frequency of injections could cause them to shy away. I think we should wait for another couple quarters of ATTR-PN rollout to make firm judgements

On next generation antibody approaches (NI006) …. Looks good, too early to tell. I like the idea of reversing disease, but they have a long way to go.

On gene editing a la NTLA…. Dude, who tf is getting that drug when a once-a-year Alnylam drug could be in the works. Please explain to me the benefits.

Also, none of this is financial advice obviously. DYODD, etcetera. I may own positions in stocks mentioned in the article