CLPT: Putting numbers to the story.

A long term stock limited by capacity, building a surgical platform with an exciting drug delivery business, new innovations on the horizon, too expensive for me.

Let's start off with the basic two businesses: 1) Clearpoint sells surgical systems and disposable for intraoperative MRI surgery (iMRI), primarily for deep brain stimulation (DBS) and laser interstitial thermal therapy (LITT). In addition, they partner with biotech companies to develop delivery methods for new CNS drugs. The company has been written up a number of times by a number of people:

Michael Bigger at various times starting in late 2017 up to 2018 at prices around 2-4$.

Maxwell house in Early 2021 here.

A number of writeups on Seekingalpha Favorites here and here

The stock is almost cultish on fintwit to the point where someone runs an account for bagholders. I've owned the stock in the past (do not now), and as a Medtech Focused substack, I thought it was appropriate to write about it. I'll summarize the business case as best I can, but my real goal is to try and find a proper valuation for the business.

TLDR:

CLPT is a buy and hold as a platform company with the opportunity to capitalize on a sticky business model. It's a coffee can which is reminiscent of other great medtech companies. I believe it needs to grow into it's valuation, but one could argue for buying the stock even if it isn’t sorely undervalued.

Let's dive in!

Deep Brain Stimulation

What is DBS?

DBS can be used for a variety of neurological disorders including Parkinson's, Dystonia, Essential Tremor, and Multiple Sclerosis to treat issues with movement. Our brain is essentially a circuit using a flow of charge to transmit signals Movement disorders are analogous to off-kilter electrical signals. Electrodes implanted near important brain structures send electrical signals to correct any irregularities. Clearpoint's navigation is primarily used for Parkinson's and Dystonia patients receiving DBS.

Traditional methods

Historically, DBS implantation uses pre-operative imaging, stereotactic frames, and microelectrode recordings (MER). The patient is imaged and a frame is fixed to their head to allow precise surgery. The patient is left awake while electrophysiology recordings are actively taken to measure the patient response to electrode placement. People can call this 'flying blind' because there is no live visual guidance but there's a reason we have anatomy AND physiology. These electrode readings are valuable to understand patient responsiveness in real time. Electrophysiology is an established and often successful procedure since these MER recordings are can measure results in real time.

In addition, lots of patient do tolerate awake DBS.

Issues with traditional surgery: However, there are a couple main issues. 1) Patients may not tolerate awake DBS, especially Parkinson's patients (CLPT's target market).

Although patient satisfaction is about even with either awake or asleep DBS, there is a patient population that needs asleep DBS.

This brings us to the next option: Intraoperative CT (iCT). iCT guided surgery is an option with equivalent outcomes and costs to MER based procedures. iCT uses CT guidance to place DBS leads thus allowing patients can be asleep during the procedure. Companies such as Medtronic (StealthStation) and Brainlab offer iCT imaging systems and CT-guided placement gaining traction because it's fast and simple. iCT can do asleep DBS but there is another potential issue with MER that needs solving.

Problem #2) DBS placement with MER recording can be inaccurate:

"Two referral centers for DBS troubleshooting have reported that therapy failure in half of the evaluated leads was caused by suboptimal positioning". SOURCE. DBS devices have invented ways to circumvent inaccurate placement (higher power, directional stimulation, etc.) because surgical methods are limited. iMRI guided DBS has equivalent outcomes (as measured) compared to MER awake surgery but the live imaging means real time verification of placement. Although no direct iCT and iMRI comparison is available, MRI can image the brain better, thus requiring less attempts to place leads compared to iCT-guided surgery (anecdata).

Now, there's a few reasons the DBS segment isn't growing faster:

iMRI currently takes 2x the time as a CT guided approach

iMRI costs more than other methods (same reimbursement, but now you’re using a 12k CLPT device). Surgery is reimbursed the same to the hospital regardless of the applicator used, but using CLPT adds cost for the hospital.

MRI capacity is limited. Surgery requires an MRI machine which requires collaboration with other departments, a tough ask for a surgery which isn't leaps and bounds better than the traditional method.

CLPT has around a 10% share of 6,000 cases performed a year.

DBS Market Growth: There are 1 million patients treated for Parkinson's with an annual incidence of 60k. Anywhere from 15-20% of those patients are eligible for DBS and 12k patients are receiving DBS a year (source). The reason for this discrepancy is a separation of referral and treatment. Neurologists must refer patients to a neurosurgeon for DBS placement thus creating some friction. Although DBS has slowly trended toward "standard of care for patients with treatment-refractory motor circuit disorders — most commonly PD, dystonia and essential tremor.", one could easily argue that there is still room to grow (source). As DBS devices become better and awareness improves, the market will grow. Even without taking major share, iMRI procedures can expect to grow along with the market. Awake surgery is fading out while asleep DBS enters the forefront.

Ultimately, CLPT's growth here is constrained by MRI capacity and I would expect stable market share assuming no expansion into the OR or iCT guided procedures (10% growth). However, there is optionality with CLPT's expansion into the OR with the new SmartFrame array.

The expansion addresses the other 90% of non iMRI cases. Taking share is more difficult than maintaining a niche, especially when competing against industry giants. This is why we assume no market share gains going forward.

In summary, CLPT's iMRI approach to DBS implantation has a niche, but is expensive, capacity constrained, and creates friction through lengthy surgeries/collaboration with multiple players. It's a stable, slowly growing market, with some optionality based on OR expansion.

Further reading on asleep DBS: I would 100% read this review on Image guided DBS from a pioneer in DBS surgery, Kim Burchiel: Image-Guided, Asleep Deep Brain Stimulation

Laser Interstitial Thermal Therapy (LITT):

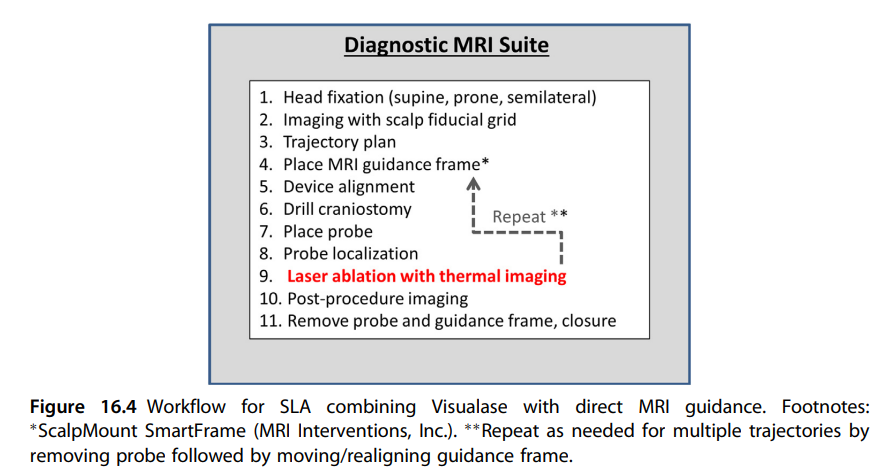

LITT is CLPT's second functional neurosurgery bucket, responsible for ~350 cases in 2020. LITT uses laser energy to ablate (burn) brain tissue for two main reasons: small/resistant brain tumors and epilepsy. CLPT lays out their market opportunity well in a recent presentation. There are two parts to any surgery: laser applicators ($12k) and navigation ($6k).

As one can see, they have a high market share in a growing market, attributable to a couple main reasons.

Advantage 1: MRI suite already used + patient Movement

Either way LITT is performed, we must take time in the diagnostic MRI suite to measure the temperature of brain tissue. Traditional LITT surgery moves patients between the OR and Diagnostic MRI suite (or use a mobile MRI) which can cause complications (source). Obviously, moving a patient mid neurosurgery isn't ideal. Surgeons use MR thermometry during LITT to measure the heat of brain tissue while the procedure happens to prevent shit from burning.

Advantage 2: Time is shorter with CLPT

Skilled neurosurgeons may also have shorter procedure times using CLPT than with traditional methods. Source. Optimized surgery can be quicker because no patient movement is required, even if there is a learning curve associated with the approach

Advantage 3: Real time verification of surgery

For DBS, we don't need the sub-mm accuracy of placement CLPT provides because we have a margin of safety. As long as we stimulate the designated area with an appropriate power/current, we can improve patient outcomes. If we mess up, we simply turn it down (not a great outcome, but not worse than we started). LITT, by contrast, is intended for small tumors thus real time guidance is extremely helpful. In addition, ablation of tissue means there is no 'second pass'. Once tissue is burned, it’s gone. We use MR thermometry as one way to measure this, but CLPT's accuracy is comforting for surgeons.

Disadvantage: High cost

CLPT can be much costlier than other methods of surgery for a couple reasons: longer OR time and the cost of disposables (source) Keep in mind this data is on a small sample and should be taken with a grain of salt. Also, this data is old and newer data has shown improved operating times as surgeons become comfortable with the device. Still, we keep running into this issue: CLPT is a premium product with a niche rather than a ubiquitous product….. for now. Many mainstream products originally started off addressing a niche.

The Market

Although LITT is a nascent market, it's growing quickly. Scientific evidence is accumulating on the safety and effectiveness of LITT to treat epilepsy (surgeon's opinion, Academic article 1, number 2). As a result, Cigna recently issued a national coverage determination for LITT covering particular tumor and epileptic patients (source). Most other insurers consider it generally unsafe/experimental, but I expect this to change in short order. Insurers follow evidence and the evidence is becoming abundantly clear.

Monteris Medical (maker of the laser ablation catheter, Visualase) grew 15-20% from 2018 to 2020 (source), verifying that the overall market is likely growing around 15-20%. Improving insurance coverage and doctor/patient awareness should sustain this market growth rate. I expect CLPT to keep a constant market share for navigation (30%) unless convincing data is published comparing iMRI to non-iMRI cases. Their share is already high

The upside: A new Laser catheter.

From that original slide, one sees CLPT receives $6k/case while the applicator companies receive $12k/case. However, CLPT is developing a laser applicator which could triple their per case revenue. Although every surgery won't convert to a CLPT applicator, the per procedure revenue will steadily increase as surgeons switch over to a likely more CLPT-compatible catheter.

Summary

In summary, LITT is an exciting market for CLPT. It's growing 15-20% with increasing insurance coverage, accumulating positive evidence, and upside on per case revenue with the introduction of a laser applicator. WE model in patient growth matching the market with per procedure revenues ticking up towards 15k in 5 years (75% conversion)

Drug Delivery and Biologics:

Ah yes….the hype machine. Everyone get's excited about those big ass TAMs seen on investor presentation. A podcast on Life sciences investing discussed CLPT primarily discussed this segment. (Value Hive). The novel part of my analysis is putting numbers to theory (scroll to the valuation segment to see it).

CLPT partners with biotech and pharma companies to develop delivery methods for CNS drugs. Partners often choose to use iMRI guided surgery to deliver the drug, but can choose to partner without using iMRI surgery. Instead, they may choose to use just the CLPT cannula, pretty much a delivery tube. For evidence that CLPT navigation isn't used for every patient, look at the centers participating in the Lysogene trial. There is a less than 50% overlap with CLPT centers, likely indicative that one can perform the procedures in non CLPT, simply using custom cannulas. CLPT can partner with these companies to develop new cannulas and/or workflows specific for their drugs, deriving revenue in all stages of commercialization. Their revenue is based on the number of disposables used rather than royalty payments.

There are three key qualitative questions

Question 1) How valuable is CLPT and iMRI to pharma companies?

I could explain the benefits iMRI for drug delivery no better than Paul Larson, a neurosurgeon at UCSF (possibly the best center for neurosurgery in the world), does here: https://www.pharmtech.com/view/imri-guided-gene-therapy-and-drug-delivery-for-cns-disorders. Or the world's foremost contract research organization (Charles River labs) through two PhD researchers here on bypassing the blood brain barrier. Obviously, live guidance solves many issues.

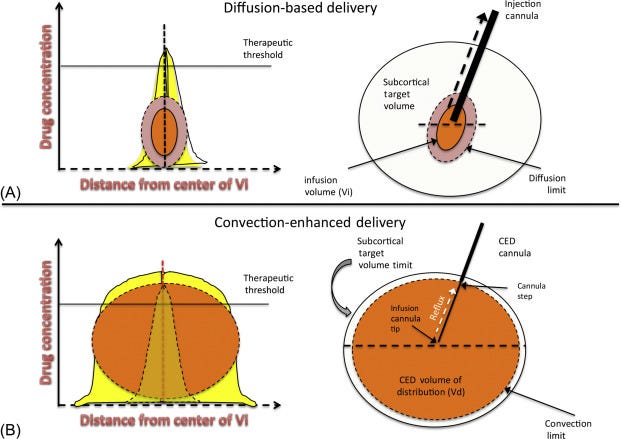

In addition, Convection enhanced delivery increases coverage of therapeutic targets in the brain. Instead of administering drugs and relying on diffusion (passive spread of drug), CED applies a pressure so convection (pressure driven flow) dominates delivery. It’s a novel, but promising technique used to administer CNS drugs while bypassing the BBB and increasing spread of the drug. However, there are still unanswered questions about its effects on the surrounding brain tissue with concerns on the distribution of interstitial fluid (source). Anytime we put liquid into the brain, the liquid already there must go somewhere! In addition, CED has had limited clinical success as there are no standardized protocols.

"This lack of standardization might be one of the reasons that CED has been unable to acquire clinical success, and part of the lack of standardization is that we still do not have a holistic understanding of how CED is affected by and exerts effects on the brain and tumor tissues…… Catheter placement is one of the most important steps in planning a CED intervention". There is a huge opportunity for CLPT to centralize and standardize protocols for CED, becoming the go to place for drug developers.

Question 2) Once drugs are approved, is CLPT written into the approval? (meaning they must be used for delivery)

CLPT's CEO lays It most clearly in the recent earnings call summarized by @Logos_LP here:

. The protocols are unclear without any FDA-Approved drugs. We expect FDA to mandate live guidance if all patients were dosed using it. For cannulas (the tube actually used for delivery), those will surely be written into approvals and require additional safety testing to add other cannulas (unnecessary for expensive therapies where the cannula is a minimal cost).

Question 3. Can these procedures scale?

Scale is the obvious limiting factor, but there are two mitigants: A) As mentioned before, CLPT is working on ways to expand their scale beyond the MRI suite to reduce friction. This includes new surgical workflows and custom devices. B) Larger trials are on the horizon and those companies will find a way to create capacity when needed even if it takes longer than expected. With enough money and a great treatment (both cost-effective and reduces disease), the long term capacity will meet demand.

Side Note: Robotic Assisted Surgery:

I haven't addressed competition yet because there isn’t much competition with respect to real time MRI-guided surgery. However, there is competition from robotic surgery platforms which I haven't mentioned. Robotic Surgery is intended to simplify surgery, making it quicker, easier, and is minimally invasive. It's an option for neurosurgeons, especially for routine cases, thus hindering CLPT's growth. However, I assume CLPT does not grow their DBS/LITT market share assuming surgical platforms compete for non iMRI cases (the majority of cases). CLPT has found it's niche and robotic surgery shouldn't take a bite out of it. Hospitals can easily support both a robot and a CLPT system. In addition, this type of surgery is only suitable for LITT or DBS placement. CLPT's Biologics business is a different beast due to their experience and potential regulatory capture.

New innovations:

BCI: although BCIs are expected to commercialize in the near future, commercial dynamics are foggy. CLPT is an underappreciated player here due to their ability to effectively merge MRI with MER to accurately place BCI devices.

The principal engineer at Blackrock neurotech discussed the value of CLPT saying:

CLPT enables precise delivery of BCI devices to specific locations in the brain not through MRI-guided delivery, but a fusion of MRI-imaging and subsequent MER recording. This lends credence to the ability of CLPT to develop novel products OUTSIDE of the MRI suite. Although BCIs will likely be niche for years to come, CLPT's innovative ability is on display.

Smartframe Array:

This is part of their expansion into the OR. The new Array product was approved in early 2021 and initial results are encouraging. It shortens surgery time by 30 minutes, allows surgery in the OR, and multi-trajectory approaches. (source) It’s designed to improve workflows and perform surgery in the OR, but maintain accuracy thus reducing friction.

A note: I haven't touched on the biopsy market because it makes up a small part of the market. Most tumors are large enough not to need MRI guidance, but CLPT once again has a niche.

Valuation

The hardest part of CLPT is putting numbers to the story. To invest in any company (especially those valued at >10X Sales), we need a way to value the stock. Without valuation, we can't be active equity investors. Investors don't create anything, help anyone, or perform any physical work so what use are we? Our job is to put numbers to a thesis, turning qualitative thoughts into quantitative data. Investors are no better than domain experts unless we can use this ability.

Let's value each segment independently

The DBS and LITT segment are fairly simple.

DBS:

We can make the following assumptions,

Slightly beating the market growth with 10% growth in patients treated

Minimal uptake of expansion into the OR

Maintenance of per case revenue of 12k.

All reasonable given the extra time and cost associated with iMRI and difficulties expanding to the OR. There is possible upside. I expect margins to stay negative and turning flat for the segment since their cases do require quite a bit of clinical support and they'll use it as the beachhead to enter new centers.

We assign a 5X sales multiple for a stable medical device company, in line with peers.

LITT:

Assumptions:

Growth of 15-20%

Matches market growth, stable market share of 30%

Average Rev/case increases to 14k in 2028, up from 6k today as they convert ~75% of their navigation cases to using the in house laser applicator.

Since they're riding market growth and increasing ASP, we can model margins as positive for the segment. As insurance coverage increases, selling the device will become easier.

We assign a 7X sales multiple for a medium growth medical device business.

Biologics:

Here is where modeling becomes more difficult. We know they have partners in clinical trials and pre clinical development. I've tracked their main clinical trials (in my opinion) and modelled the revenue for each trials as a function of a few key variables:

Percent chances of approval,

Phase of trial

Patient population,

Penetration of the drug once approved.

For all clinical partners, the revenue to CLPT is as follows

Let's walk through PTC therapeutics as an example. The assumptions are as follows

Maturity market of 1000 patients/year treated for AADC

50% penetration (2 possible gene therapies upcoming)

2 years to reach maturity (full penetration, linear ramp)

12k/case.

80% chance of approval, higher than 50% average given no other therapies and good data.

This leads to the following ramp in revenue: 1.2M in 2022, 2.4M in 2023/24, and 4.8M for the next four years.

For a Clinical trial still in development, let's use the rGBM trial entering phase 3 from Medicenna as an example. We can make the following assumptions leading to 300k in revenue each year from 2023 to 2026:

100 total patients for the phase 3 trials

Drug is administered over 4 years (duration of trial)

12k per patient.

We can then extend it to potential commercialization in 2027 with more assumptions:

Total patient population of 30k and a 5% penetration rate

5 years to ramp to maturity (linear ramp, this is imperfect but good enough as an approximation).

40% chance of approval (typical for phase 3 CNS drug).

This leads to 1.8M of expected revenue in 2027 and 3.6M in 2028

So this allows us to model out any clinical trial we know about (assuming no capacity constraints) by toggling the following variables:

For drugs in Trials

Approval chances of each phase

Size of each phase of trial

Revenue per patient

Duration of trials

Commercialized drugs

Year of approval

Approval chances for full approval

Time for drug to reach maturity sales

Patient population

Penetration rate at maturity

My assumptions can be debated, but I do believe the model is a fair approximation of revenue, using the right level of granularity.

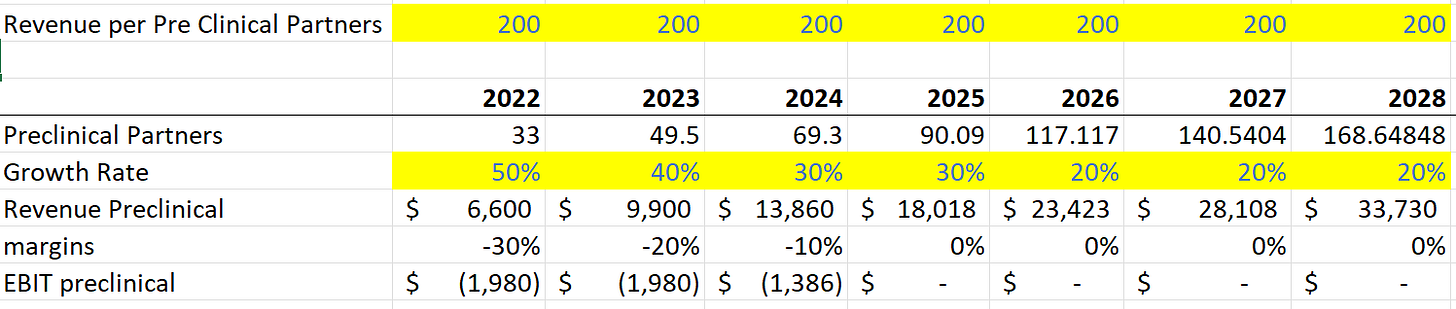

Another factor to consider is pre-clinical partners using CLPT. One could easily expect 10-20 patients treated at 10-12k/patient er year (100-240k per partner per year). As the number of partners grows (another adjustable variable), we can model out the revenue as follows.

Margins:

For commercialized and revenue in clinical trials, the EBIT margins will be around 30%. Since their partners are doing all marketing for the drugs, incremental margins will be high. Only expenses are clinical trial support. For Preclinical partners, the costs of R&D and clinical support lead to initially negative margins scaling to 0% margins once they are able to scale into each partner.

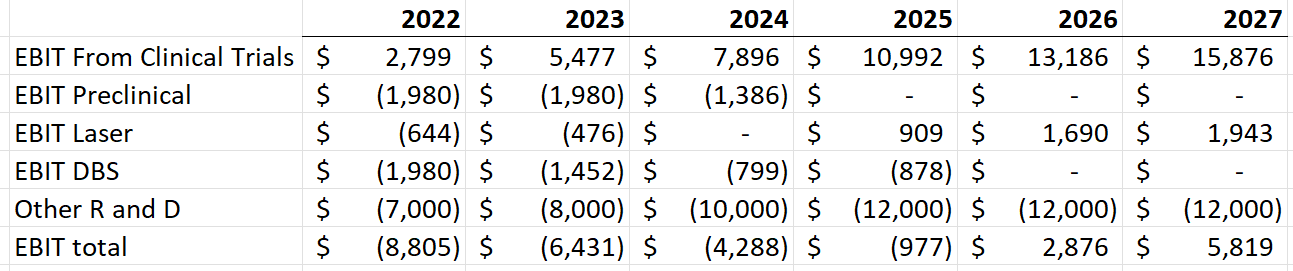

We can then value the segment as follows

We assign a 10X sales multiple for the high growth high margin biologics segment.

The ultimate valuation we get is this:

It's over valued now, but quickly grows into the valuation. It has 2X upside to a 20$ by 2026. Keep in mind, this doesn't factor in any upside from BCIs, market share gains in DBS or LITT, or uptake into the OR for DBS.

Here are the consolidated EBIT margins as well. I add in extra R/D expense for new products. With this addition, they will turn profitable in 2025. They have enough cash to fund themselves into profitability. Without the R/D spending, they would be profitable in 2023, heavily dependent on the biologics segment.

Why I don't hold it

I want to underline the biggest possible risk: an inability to scale without expansion into the OR. MRI capacity is the limiting factor for growth. As surgeons learn to perform 2 cases/day and some measures optimize capacity, this will certainly become less of a concern, but this takes time. I could easily see this growing 20%/year for 10+ years (no small feat), but lacking the 40% hypergrowth investors salivate over. The sticky nature of the product is reminiscent of Intuitive Surgical, but neuro is a harder (and smaller) market. The biologics side sets them up nicely for a low marginal cost recurring revenue stream as FDA approves drugs mandating the use of their technology. Management is making the right moves towards becoming a neurosurgical platform, raising money opportunistically for growth, expanding into the OR, and consistently introducing new products. CLPT is a coffee can stock. However, I believe it needs to grow into it's valuation in the short/medium term. One could easily make a bull thesis by changing some assumptions.

At this size, a takeout by a larger company is easily possible. Medtronic could acquire them to bolster their neuro division with pennies. The CEO has close ties at Phillips. Investors should take the long view and a takeout is the best way for the company to thrive without being beholden to quarterly fluctuations.

A Surgical Platform

The bottom line for any surgical platform is surgeon training and awareness. Once a surgeon is trained with CLPT, the marginal difficulty of performing another case drastically reduces. These surgeons will push CLPT for the right cases. CLPT's surgical centers are >50% academic and they're in the foremost American Neurosurgery hospitals. Surgeon awareness is hitting a tipping point, an encouraging sign for the company. Even if capacity is constrained and healthcare moves slowly, CLPT's stickiness should not be underestimated. Although they aren't ubiquitous yet, they aren't an upstart anymore.

Disclosure: Do your own DD, this is not financial advice.