Companies I'm watching in 2024

A list of companies I find interesting, not all longs, list subject to change

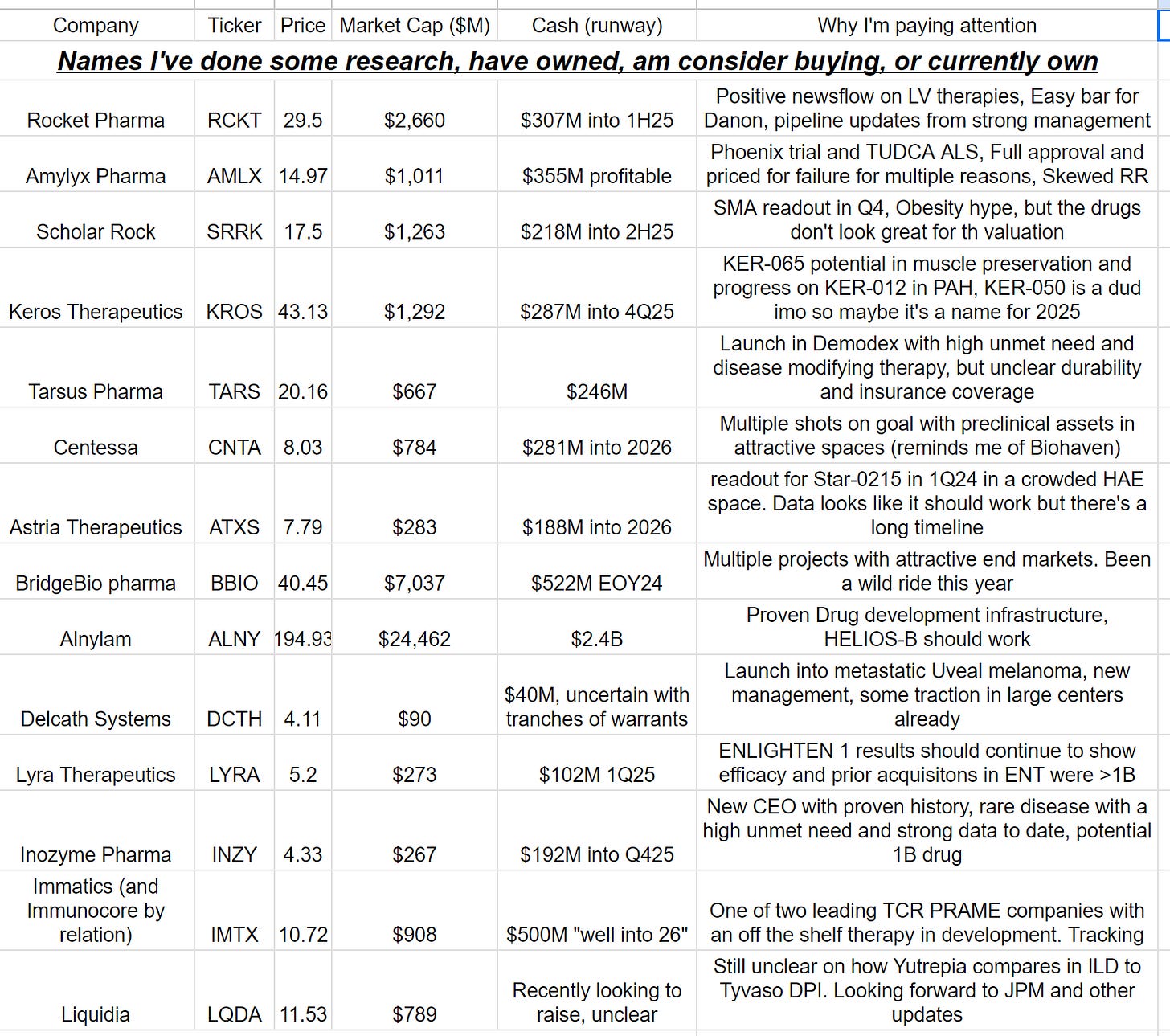

2023 is in the books and 2024 is here (tautological and obvious I know, but I need an intro lol). Here’s a set of companies with interesting set ups for 2024. I own some, may own some in the future, and may never own any. The point of hte post is simply to collect setups which look interesting. My favorites as of right now are CNTA, INZY, LYRA, ALNY, AMLX. Subject to change and quickly.

For each company I’ve researched I jot down my notes on 1) Catalysts, 2) why I’m interested, 3) a brief summary of how I’m thinking about the stock, 4) open question and 5) resources/helpful links (if applicable). It’s just a journal of thoughts.

For each company I want to look into more, I only write down why I’m interested.

Quick mea culpa: I wrote in October about the radiopharmaceutical space and meant to write about companies such as PNT, FUSN, ATNM, and RYZE in the following months. Big pharma had other plans with acqusitions of half the public radiopharma batch. The publicly trading space is limited so I’ve decided to put it on the back burner. I sold FUSN too early and it’s much less attractive at the current prices imo.

Here’s a summary of all the names: https://docs.google.com/spreadsheets/d/1LwXCz_5Z2RyVBTpvPpcdqGMtuoTlu71kskQKXqFODqo/edit?usp=sharing

Without further adieu, let’s get into some stocks

Rocket Pharmaceuticals (RCKT)

Catalysts: LAD PDUFA March 31, FA product filing first half 2024, Danon disease enrollment, PKP Study enrollment, wave two assets disclosed this year.

Why I'm interested: Strong Management, easy bar for Danon disease, positive roadmap of news.

Summary: Rocket has a diversified portfolio of gene therapy assets in rare diseases including two nearly commercial Lentiviral therapies and an AAV in development. The Lentiviral based therapies will be their foray into commercial rollout and the AAV therapies are their pipeline. The clinical data for both LV therapies (LAD deficiency and Fanconi Anemia (FA)) is strong and meets high unmet needs. Although other LV therapies haven't done well, The FA treatment is unique because it doesn't require bone marrow conditioning. FA is a bone marrow disease and some people can mutate themselves out of it through genetic mosaicism (review here). Basically, a single mutation in a cell corrects the defect and corrected bone marrow cells have a survival advantage over the non corrected ones. Similar principles apply to gene therapy so no bone marrow conditioning is required. I model out peak sales in LAD-1 of 100M based on an incidence of ~50-100 and 2M/treatment, FA of 600M with an annual incidence of 200-300. Beyond LV, Danon disease is the biggest near term opportunity for them. There is potentially 2B in peak sales. The FDA rolled out the red carpet for them in the pivotal study and will allow accelerated approval based on LAMP2 protein expression and LV mass reduction with a natural history control arm in a 12 month study. Patient demand is high (according to management) and all data shown to date is strong. Shares are markedly less attractive but the company checks a lot of boxes: Management isn't promotional and has delivered constantly, news flow over the next few months should be positive (approvals, filings, trial enrollment), The Danon product looks like a homerun, and they are planning to disclose an additional wave of assets this year. Their goal is one new IND per year and there is a distinct possibility that they are doing 2B+ in sales in 2030 with a strong pipeline to boot. They will need to raise before pivotal data from Danon. It's a prime acquisition target imo.

Questions: How will the commercial rollout for LAD and FA proceed? IS there value beyond Danon?

Amylyx Pharma (AMLX)

Major Catalysts: TUDCA readout 1Q24, phoenix readout 2Q24, Updates on Commercialization for Relyvrio

Why I'm interested: Multiple readouts with lots of uncertainty even though the drug has full approval and a high unmet need

Summary: AMLX is fascinating for many reasons. They have an approved ALS therapy combining multiple molecules which may or may not be synergistic. TUDCA-ALS is an ongoing trial testing TUDCA alone in ALS. Two Adcoms and patient lobbying led to a controversial full approval and high unmet need led to a fast ramp in sales. The drug works fairly well but tastes like crap and management was dodgy on the last earnings call about a drop off in sales growth. The stock is relatively flat amidst a broader XBI recovery in Nov/Dec because it seems people are holding their breath and unsure on multiple fronts. It trades at an EV/Sales ~1.5-2 with a US TAM of ~3B. The drug works (in my opinion) and the risk reward seems skewed in the positive direction. The ideal scenario is a TUDCA-ALS fail/lack of clean win and a partial/clean Phoenix win. I think the drug stays on the market even without a p < .05 but the commercial rollout will be hampered. My range for the stock is as follows: Fail: $6 (Cash), mixed outcomes: $15-20 (depends on exact stats but expect flat until a few quarters of data), clean win: $50 (expecting revaluation based on ~8X EV/Sales.

Open questions: The most interesting (and unclear scenario) is what happens if TUDCA-ALS is positive AND phoenix is positive? What happens to commercialization and insurance coverage?

Resources: Twitter from the GOAT

Scholar Rock (SRRK)

Catalysts: Q4 Apitegromab data in SMA, high dose Spinraza data from BIIB 1H24.

Why I'm interested: A dynamic SMA market and the tailwind for muscle preserving therapeutics with pivotal data incoming means the company may be an opportunity to be long/short as we await the Q4 data.

Summary: SRRK's SMA asset is an IV version of a subcutaneous drug from Roche/BHVN (also in development for SMA) so it may not have huge LT value in SMA even if clinically successful. I was long the company at times in the last year but sold recently because success seems largely priced in at this point. The obesity asset is interesting, but there are likely better ways to play myostatin targeting for muscle preservation (namely KROS). SMA data is due in Q4 so there is plenty of time to wait and see how the market treats the stock.

Open Questions: Is targeting only myostatin enough for preserving muscle in GLP1 combos? Who is the target market for a myostatin targeting agent? What is the addressable market for their SMA asset and how will SRRK compare to Roche and BHVN? How will high dose Spinraza data improve the market opportunity (Roche's myostatin SMA agent is testing only in Evrysdi patients)?

Tarsus Pharma (TARS)

Catalysts: Lyme disease and Rosacea readouts 1H25, continued commercial progress for XDEMVY

Why I'm interested: Potential blockbuster first in class therapy with market uncertainties

Summary: XDEMVY, their commercial product, is the only approved drug for demodex blepharitis (DB), an eyelid disease where patients suffer but won't progress to blindness. It's a disease modifying therapy competing with largely homemade treatments for symptom relief. 2024 will be a pivotal year to monitor coverage and prescriptions. DB is caused by mites and XDEMVY is the only disease modifying therapy available. I did a series of KOL calls on the topic and came away encouraged. Feedback from patients on message boards are mixed but lean positive while insurance coverage is with prior authorization required (CIGNA PA, BCBS Mich PA, Kaiser may not have PA, Certain Aetna Plans have no PA)

Open Questions: Will insurance cover the drug? What is the long term data on recurrence

Resources: I've been monitoring reddit and Facebook groups for Dry eye disease and Demodex. I also subscribe to Slingshot Insights which will have surveys on insurance coverage.

Centessa Pharma (CNTA)

Catalysts: POC data for ORX750 in 2024, Registrational data for Serpin PC Hemophilia B therapy in 1H2025, Data from Phase 1/2a LB101 CD47 lockbody in solid tumors

Why I'm interested: Multiple programs in hot areas and management is willing to cut bait on programs which don't work

Summary: Centessa has 3 unrelated assets in different stages of development: 1) a SerpinPC targeted therapy for hemophilia B 2) ORX750 for Narcolepsy and 3) CD47 Lockbody. The heme B asset is fairly undifferentiated but still has potential because other therapies have shown some issues with excess clots. The Orexin and CD47 assets are too early to judge, but both are in hot areas. Cash position is strong. Reminds me a little of Biohaven last year where early clinical data into multiple indications could get hot and turn the tide on a small company.

Open Questions: How will SerpinPC compete in Heme B? Will ORX750 be differentiated on efficacy and safety?

Astria Therapeutics (ATXS)

Key Catalysts: 1Q25 phase 1 data from STAR-0215 in HAE

Why I'm interested: A pivotal readout in 1Q25 for every 6 month dosing in Hereditary Angioedema which can differentiate them from incumbents and other therapies

Summary: Astria has a pivotal readout for Star-0215 in HAE soon. It's essentially a long half-life formulation of Takhzyro, an already approved therapy. All data on the PK/PD profile supports a positive efficacy and safety profile. However, it's a crowded space with multiple, larger players and STAR-0215 won't be approved until 2028. Another concern is Anti Drug Antibodies which have shown up in 33% of volunteers (no detail on neutralizing ADAs). Management has poorly managed the cash position and dilution but maybe they have a diamond in the rough.

Key questions: What is the required bar for efficacy in attack prevention? Where does the stock trade on positive results? Is Q6M dosing required to differentiate themselves from IONS, PHVS, etc?

Resources: https://twitter.com/search?q=%24atxs&src=typed_query&pf=on - lots of good ink spilled.

Bridge Bio (BBIO)

Catalysts: FDA approval Acoramadis YE24, ph3 readout Encalaret for ADH1, PH3 readout BBP418 in LGMD YE34, PH2 update 1H24 AAV for CAH.

Why I'm interested: multiple assets which could each work and justify a large portion of the valuation.

Summary: The crown jewel is Acoramadis for ATTR-CM with expected approval this year. There's a lot riding on the drug because of the debt/cash position. I’m worried about the constant delays for their other drugs like Encalaret and Infigratinib, but I’m willing to wait another quarter because the clinical data is strong. It’s a consensus long at this point and the share price is up quite a bit. I can justify owning both BBIO and ALNY heading into HELIOS-B as a way to hedge your bets.

Open Questions: Is Acoramadis truly differentiated from Tafamadis? Enough to take share as a second entrant with BID dosing? Where does the stock trade on positive Helios-B results?

Alnylam Pharma (ALNY)

Key catalyst: Helios-B readout 1H25

Why I'm interested: ATTR-CM is a larger market than people are modeling (I estimate a 20B market) and ALNY is positioned to capture a large portion of it with positive phase 3 HELIOS-B results. Helios B should work and ALNY has a track record of developing therapies at high success rates. Is this the next Vertex?

Summary: ALNY has too many moving parts to track all of them and I'm most interested in the HELIOS-B readout. Upside/downside is ~40% and I actually like the risk reward going into the readout. Data to date has been positive on Patisiran (IV) and longer term follow-up with a larger study means Vitrusiran (SC) can hit stat sig. Q3M dosing will differentiate it from orals and it may even be used in combination. In the future, they even have a 1/year therapy in development for ATTR-CM

Open questions: Can it hit stat sig in HELIOS-B? Enough for a big commercial win?

Delcath Systems (DCTH)

Catalysts: Commercial Rollout of HEPZATO

Why I'm Interested: Management has set good expectations for the launch but the stock price is still lower than earlier in the year.

Summary: HEPZATO is a liver directed therapy approved for uveal melanoma planning to launch in 1Q24. Delays on the most recent earnings call are concerning but they have a product which works for a specific set of patients with liver limited disease. I've heard from doctors that starting treatments can be troublesome because it requires multispecialty coordination. In addition, the TAM may be limited to a subset of patients without extrahepatic metastasis. However, management has laid out a path to 15 total sites performing treatments by the end of 2024 at a rate of 1-2 per month. The cash position is unclear because of a tranche of warrants triggered once quarterly revenues reach $10M meaning there is a virtuous cycle of good performance -> less dilution. New management, niche market, strong commentary on potential interest, and a potentially fast ramp to 100M in revenues (like Kimmtrak).

Open questions: What is the TAM for uveal patients? Do they need to work outside of uveal melanoma to work as a stock?

Lyra Therapeutics (LYRA)

Key Catalysts: Enlighten 1 data 1H 2024, End of phase 2 meeting LYR-220 2024.

Why I'm interested: Positive clinical results derisk the readouts and other ENT companies have been acquired for $1B+

Summary: Lyra therapeutics is developing LYR-210 and LYR-220 for chronic rhinosinusitis. They're targeting a billion dollar pre surgery market for patients ineligible/don’t want surgery. The drug is an old active ingredient with new delivery which clearly works so the clinical readout is fairly de-risked. Investors are concerned over the commercial rollout and new in house manufacturing so upside is unclear on a positive readout. I've heard positive doctor feedback. People compare the product to Sinuva (which failed) but that's not appropriate.

Questions: What does reimbursement look like? How does LYR-210 fit with balloon sinuplasty into a presurgical chronic rhinosinusitis market?

Good sources: See this comparison from twitter on LYR-210 vs Sinuva if you want to understand the differences (even though they are different products)

https://twitter.com/BiotechElmo/status/1700930159325421750

Inozyme (INZY)

Key catalysts: Adult ENPP1 deficiency data Q124, Interim ENERGY 1 data in infants 2H24.

Why I'm interested: New CEO who's built multiple rare disease companies (Billion dollar exits) with a therapy showing good data in an area with high unmet need.

Summary: INZY is a hot stock (up 3X in 23) developing INZ-701 for ENPP1 deficiency. ENPP1 deficiency leads to dysregulation of pyrophosphate and abnormal regulation of calcium deposition which is deadly in infants and hinders QOL in adults. Data to date shows increases in Serum Pyrophosphate but patient oriented outcomes haven't been reported. Increasing pyrophosphate has previously been reported as beneficial for mortality and QOL, but evidence in ENPP1 is scarce. The ENERGY-1 interim data in infants will be proof of concept in 2H24. The FDA has agreed to serum PPi (pyrophosphate) as the primary endpoint and trends on secondary endpoints for approval. Therapies targeting rare diseases with comparable disease epidemiology do 1B in revenue

Open questions: Will improvements in pyrophosphate lead to better survival in infants? What data does the market need to see to revalue the stock higher?

Sources: Good VIC pitch

Immatics (IMTX)

Why I'm interested: A play on PRAME and a next generation TCR bispecific akin to Immunocore but at a much lower valuation. TCR works in solid tumors….can it be the next big thing?

Summary: Both IMCR and IMTX are developing TCR based oncology therapeutics. IMCR has one approved product for uveal melanoma and IMTX has a few in the pipeline targeting similar antigens. While IMCR has only off the shelf therapies, IMTX's most developed asset is an autologous therapy targeting PRAME. TCR therapies are unique because they can target intracellular antigens. However, tumors often avoid destruction with downregulation of MHC molecules, thus more data is needed before declaring it the next big thing. It's how I would play IMCR's PRAME asset since IMTX is targeting PRAME in multiple ways.

Open Questions: What is the durability for PRAME therapy? Can IMTX replicate IMCR's TCR bispecific platform?

Resources: Overview of TCR - link

Names I need to research more but look interesting on the surface

United Therapeutics (UTHR)

I've written extensively about Liquidia and my most recent article explained why UTHR could maintain Tyvaso DPI share. They targeted 4B in revenue by 2025. Current Market Cap is 10B and EV 6B

Spruce bioscience (SPRB)

Neurocrine reported good data in congenital adrenal hyperplasia (CAH) and SPRB has a similar therapy in development. Management has massaged the stats on prior trials and have a pivotal readout upcoming. Investors see 'post-hoc analysis' and microcap in the same sentence and run but the data actually doesn't look too bad in my opinion. In case you're feeling lucky and want a stock which could go up 200% in a day.

Mineralys (MLYS)

I usually don't buy IPOs because they often come public on the heels of hype and Mineralys followed this trending IPOing after Cincor's acquisition. The thesis is simple: Phase 3 readout in HTN + cash through readout + small market cap + underperformance without explicit news (GLP???) = potential.

Kura/Syndax (KURA/SNDX)

Both are developing Menin inhibitors with multi B market potential in AML: is there any differentiation between them? Does it matter if Menin is first line therapy? Kura's product has less QTc elongation but more differentiation syndrome and targets only a specific subset of patients in AML (NPM mutant). Could be an interesting year as investors judge the products and pipelines with a clearer clinical picture

Ironwood pharma (IRWD) -

They have a cash cow with Linzess and used the cash to buy VectivBio and develop Apraglutide for short bowel syndrome. The incumbent therapy is once daily Gattex and does $750M in sales. Topline results for Apraglutide due in March 2024. I like the data, dosing, and market for Apraglutide, but there may be limited upside based on their current market cap. In addition, noo drug is without risk and I'd rather not be exposed to a situation where the company has no pipeline and needs to pay off debt using a melting iceberg.

New Amsterdam Pharma (NAMS)

Revival of CETP? I heard about the drug on Peter Attia's podcast (link) and want to learn more. William Blair (and a few other Sell-siders) called out the company for 24. Old target with failures + biological feasibility + optimized drug = high upside surprise? Color me intrigued

Accelyrin (SLRN)

I just want to know what's going on behind the scenes after the clinical trial issues. Here's a great thread on the company if you approach it with clean eyes (link). It trades at cash with PoC data expected this year.

Bicycle Therapeutics (BCYC)

Padcev continues to eat everyone's lunch and Bicycle's Nectin-4 therapy can't compare. I think the current share price doesn't reflect the totality of their pipeline based on a surface look. I don't like the long timelines (AA off the table because padcev) so I'm searching for catalysts.

Revolution Medicines (RVMD)

Best in class RAS(ON) therapy. Crowded space, but RVMD has the cash for multiple large trials and molecules which seem to be best in class (thread). Potential M&A target if they demonstrate Proof of concept.

Gossamer Bio (GOSS)

Less interesting for 2024 than 2025 because of the phase 3 readout for seralutinib. I like the early stage data and it's valued for failure. They still need to raise, but what's a PAH drug worth?

Aura Bioscience (AURA)

Another name for end of the year because pivotal data in their choroidal program isn't expected until 2025. However, run up into the end of the year could precipitate as people discover the stock.

Other companies (medtech, etc.)

Maxcyte - I played this one in 2023 and I think the majority of the run has been captured because Casgevy will launch slowly. Still keeping my eye on it.

Streamline health - An interesting microcap whose largest customer canceled their contract for seemingly unrelated reasons (cloud vs on premise solution). Revenue could re-accelerate and show some operating leverage.

Cogstate - a digital health/services company running clinical trials for Alzheimer's disease companies. Positive CNS news flow should flow to them as they benefit from a general upswing in AD funding. The last year has been mixed because of delays to their trial pipeline. They are still positioned to take advantage of a tailwind for AD funding.

Sanara - recent data published on Cellerate helps the sales people sell the product. Growth is strong and they're launching new products.

Shameless plug for those who read to the end: Check out my website www.subradata.com. User interface isn’t great, but it allows you to receive updates on clinical trials and new guidelines.

If you want to support me directly: https://www.buymeacoffee.com/adusubramanian?new=1