CVRX: Quality CEO, product, but high risk investment.

The device is great, but the trial results could disappoint.

CVRX sells an FDA-approved device to treat the symptoms of Heart Failure using Baroreceptor Activation Therapy (BAT), electrical modulation of our nervous system.

What is Heart Failure?

Simply put, heart failure means our heart can't pump enough blood to the rest of the body. As a result, our heart can enlarge to get more blood in it, pump harder to make more blood reach our body, and/or pump faster. There are two types of heart failure: HF with reduced ejection fraction (HFrEF) and HF with preserved ejection fraction (HFpEF).

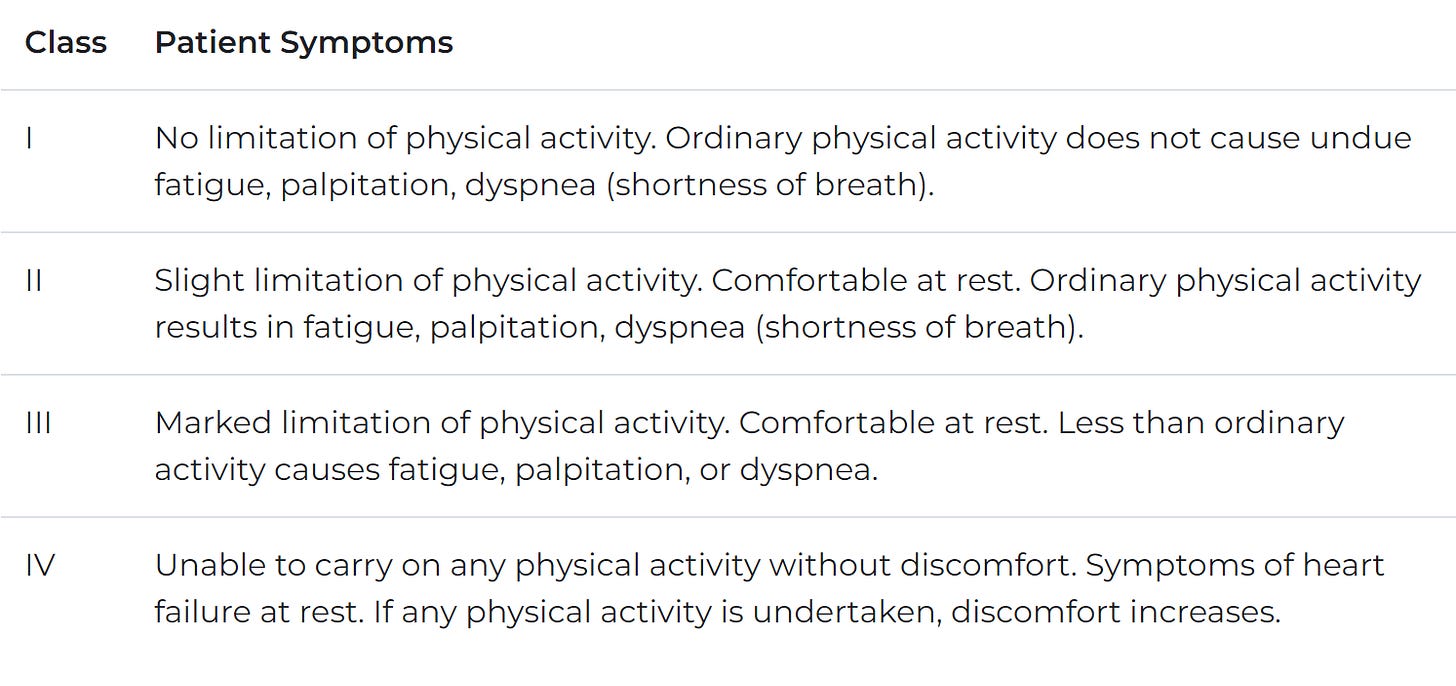

Let's go over physiology. Our hearts have four chambers: the right/left atrium (top, which receives blood) and right/left ventricle (bottom, which pumps out blood). We receive oxygen-rich blood in the left atrium, pump it to the left ventricle (LV), and subsequently out to the body. Not all blood that enters the ventricle will leave. Thus the "ejection fraction" measures what fraction of blood that goes into the LV exits the LV. About 65% is standard, and anything under 50% is diseased (HFrEF). HFrEF typically means our ventricle cannot contract therefore, it fills up but cannot pump out adequate blood. HFpEF means our ventricle cannot relax and fill up properly, thus maintaining a regular EF but still pumping inadequate blood. Causes of heart failure vary, and the disease is chronic. Beyond ejection fraction, New York Heart Association (NYHA) Class is a key functional diagnostic consideration. The NYHA classifies patients into four categories based on physical symptoms as described here.

There are other types of heart failure and the pathophysiology is much more complex than described, but CVRX has a treatment specifically for HFrEF.

Baroreflex Activation Therapy (BAT):

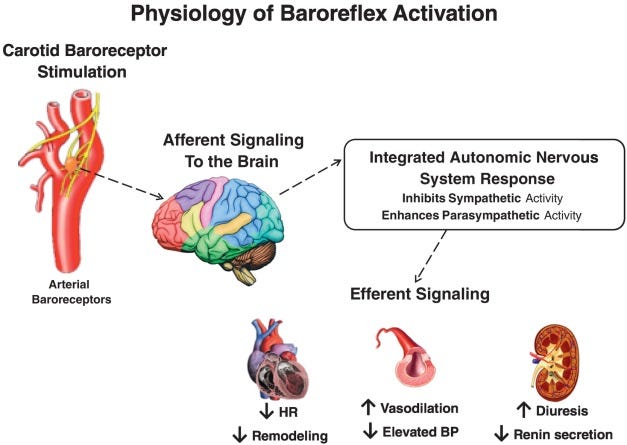

BAT electrically stimulates baroreceptors (blood pressure receptors) in our carotid artery to activate our baroreflex and control heart failure. Our body tries to maintain equilibrium at all times, correcting any abnormality. If we have high blood pressure, baroreceptors sense this and reduce it. We should use our baroreflex to sense high blood pressure and take corrective actions such as dilating blood vessels and reducing our heart rate. Still, our receptors adapt to chronically high pressure and fail to sense any abnormality. High blood pressure becomes the norm, and our heart continues to pump harder, leading to heart failure. The therapy works by activating baroreceptors, thus causing our body to take action and reduce blood pressure by reducing sympathetic activity (fight or flight response) and increasing parasympathetic activity (rest and digest response). Such a response opposes the conditions leading to heart failure where our heart tries to pump harder, faster, and tightens blood vessels.

In a nutshell, BAT calms your ass down and gives your heart a break.

This sums up the physiology so let's move to the device.

Let's take a quick journey through the history of device HF treatment. We start with the implantable cardioverter-defibrillator (ICD) in the 1980s intended to help people with heart failure with an abnormal heart rhythm (it's basically a pacemaker to prevent heart attacks from arrhythmia). Cardiac Resynchronization Therapy (CRT) was then introduced in 2002 to help patients with a wide QRS complex synchronize heart rhythms via electrical signals. Although CRT was a gamechanger for heart failure, 20 years of clinical evidence has narrowed the patient population to a specific subset of HF patients. CRT is only intended for those with a wide QRS complex (a specific cadence of heartbeat) leaving more than 50% of HF patients with no device treatment (only drugs). Between 2002 and now, there have been few attempts at a device therapy for HF via autonomic nervous system modulation using Vagal and Spinal Cord Stimulation, but these have all failed. Now we have two new options on the horizon: Cardiac Contractility Modulation (CCM) and BAT. Both have been around for 20 years, but are just now hitting their stride. Both have no significant mortality data out, but CCM has more evidence and has failed in small mortality trials. CCM has only demonstrated benefits for NYHA class III patients with a LVEF (Left Ventricle Ejection Fraction) between 25-45% leaving a gap for patients with a LVEF under 25% not indicated for CRT (can be 10-15% of HF patients) (source)

CVRX sells Barostim, a combination lead and pulse generator, to treat HF in patients not indicated for CRT. As explained before, it sends electrical signals to the carotid artery to activate the baroreflex. Patients will typically be referred to get the surgery from their electrophysiologist or cardiologist which can be performed in 1 hour by a vascular surgeon with a quick recovery. After the device is placed, a patient's doctor (typically an EP) will wait 3 weeks and then start the device by sending a certain level of stimulation. The frequency and width of the pulse is fixed for the device, but the amplitude can be modulated to achieve a desired effect. It typically takes 3 months to see a response.

Company History

CVRX has a long and difficult operating history. It was founded in 2001 to treat hypertension and heart failure with BAT, but Medtronic approved the first CRT in 2002, so CVRX shifted solely to hypertension. Why compete with Medtronic, which has a supposedly great device for all heart failure? Their shift to hypertension hit a huge roadblock in 2010 due to safety issues in a randomized control trial (efficacy was there). CVRX then pivoted back towards Heart Failure for a few reasons: 1) Medtronic expected to come out with data on a new renal denervation device for hypertension (simplicity). If successful, there is competition. If unsuccessful, devices would have a hard time commercializing in hypertension. 2) J&J, an investor in CVRX, wanted to go after heart failure. 3) CRT wasn't serving all patients (as discussed before).

They then ran three trials (phases 1,2,3) supporting FDA approval in 2019 using Barostim to treat heart failure symptoms in patients with class 3 HFrEF with LVEF < 35%. However, CVRX once again hit speed bumps along the way. Just as CRT has a targeted patient population (wide QRS) and CCM is only for those with LVEF >25%, CVRX had to reconfigure its trial to target a specific population. Originally, the device was intended for all patients, but the trial failed to show efficacy in 2017, leading to mass layoffs (90% of the sales team). CVRX pivoted to a subset of patients with NT-proBNP levels < 1600 pg/ml. BNP (and NT-proBNP) is a hormonal marker of heart failure, and increased levels signal worse outcomes. After focusing on this less severe patient group, the company came back and reported positive data in 2019, leading to FDA approval.

The company is in a unique situation because of its phasic approval. Barostim was one of the first breakthrough devices (before they were handed out like candy) and pioneered a trial design with an interim approval for symptom improvement and later approval after mortality data in late 2022/early 2023.

Nadim Yared, a Quality CEO:

CVRX's success is partially attributable to their CEO, Nadim Yared. Born in Lebanon and educated as an engineer in Paris, he quickly rose through the engineering ranks at GE in his early career. After moving to the US to head a division of Surgical navigation at Medtronic from 2002-2006, he joined CVRX in 2006 (midst of hypertension trial). His story is amazing and I highly recommend this podcast where he walks us through it (podcast). He actually received the CVRX job offer while escaping a revolution in the Middle East where his family was vacationing. He also serves on the board of Advamed, the foremost medical device lobbying group and has navigated CVRX through multiple pivots and trial redesigns. His leadership is partially responsible for FDA's willingness to allow a two phase trial design and the breakthrough device program. Even though he doesn't own a substantial number of shares, nearly half of his shares are owned in a trust for his children. I haven't spoken to Nadim, but all signs point to him as a quality CEO, an intelligent fanatic. Who leaves Medtronic as they're rising the ranks to become CEO of a startup and doesn't jump ship when the main trial fails? Someone who believes in what they're building (or an idiot).

Now, let's discuss commercialization.

Total Addressable Market (TAM)

Let's use a top down approach to evaluate the potential patient population. According to the company, there is a $1.4B market for the device in the USA (using a $25.5k ASP).

Although this market whittles their target market down, there are other qualifying characteristics for CVRX's target market. Patients must:

Be on guideline-directed medical therapy (GDMt) and unresponsive (on optimal drug therapy).

Have an LVEF < 25% (CCM is potential competition in Class 3 patients with LVEF 35-45%).

Not have other potential comorbidities not explicitly discussed by CVRX as contraindications (COPD, dialysis).

This market is one where CVRX operates with no competition. After further whittling down the target population to where they are the only option, the immediately addressable market is $89M in the USA.

They still have room to penetrate this market with a run rate < $15M in revenue currently. These patients have tried medical therapy and have no other options for symptomatic relief.

Sources:

Incidence of 1 million (whittled to 44k patients based on their criteria of class 3 LVEF < 35%, etc), % with stable medical management, % with LVEF < 25%, % with other comorbidities.

Reimbursement

Barostim has an ASP of $26-$28k and is typically reimbursed in an outpatient setting using an APC code. That code covers all device and procedure costs (except for physician fees) and is paid to the surgery center. In addition to APC reimbursement, centers receive Traditional Pass Through payment (TPT payment) for Barostim, additional reimbursement to cover the cost of innovative devices. TPT payment is granted for 2-3 years by CMS to track utilization and ultimately make a decision on reimbursement. Barostim's APC code, 5465, pays $30k to cover all costs for the hospital with an additional TPT payment up to $35k (cost of device) added. These numbers are all subject to cost of living and location based adjustments. Inpatient hospital reimbursement works a similar way except it is reimbursed via a DRG code (not an APC) paying $22k and New Technology Add-on Payment (NTAP, similar to TPT) which covers up to 65% of the device cost ($23k). The inpatient reimbursement is consistent at 43-45k and surgery center reimbursement is slightly less. It’s complicated and seemingly designed to cause headaches. If you want to know more, check out the brochures here and this guide on cost-to-charge ratio.

All this said, the upshot is this: with NTAP and TPT payment, the total reimbursed to hospitals is 40-45k for inpatient procedures and slightly less for outpatient procedures (based on a brief discussion with the reimbursement team at CVRX). Without the NTAP/TPT, reimbursement would be $22k for inpatient procedures and $30k for outpatient procedures causing the ASP to drop to $22-25k similar to Inspire Medical. Clearly, the extra payment matters to hospital profits and it's in CVRX's best interest to push their commercial intentions as hard as possible while they have the TPT so utilization numbers are high supporting a positive coverage decision.

I also don't believe it's a coincidence the TPT payment will expire close to the release of the mortality data. Current payment isn't tied to that data, but I expect CMS to account for the mortality when making a coverage decision in 2023.

Reimbursement is a lynchpin of the commercial rollout for CVRX as explained by the CEO on the Q4 earnings call.

Without adequate reimbursement, hospital utilization will drop off.

Barostim's private pay coverage is less important because of their patient population (HF patients are usually older individuals), but private insurance coverage isn't standardized and heavily dependent on the plan type. (Often requires prior authorization among other paperwork).

Commercial rollout

How is the rollout so far? CVRX uses a hierarchical strategy for sales where account managers each control one “territory”, sell to multiple “implanting centers” and each center has a target case volume of 12 implants/year. manager. They've had success in the US growing active centers from 19 to 56 and territories from 6 to 17 from Q121 to Q122. 133% Q122 US revenue growth was overshadowed by a decline in European revenue. COVID waves and the timing of implantation also affects revenue patterns. Active centers typically don't ramp linearly; Here's what Nadim had to say about timing of implantation:

Centers have an initial burst and ramp to ~1 per month (the target) after 12 months. Although CVRX has to spend in advance of revenue, investors can clearly see a pathway to future growth based only on their current implanting centers. 12 months from now, their current 56 implanting centers should be doing $18M in revenue, 50% growth without any additional centers. If they add 7 centers per quarter (lower than their 1.5 year average of 8.6), they'll have another year of 100% growth assuming the same cadence.

With such success in the US, why isn't it successful in Europe? There are a few reasons, but I would primarily attribute to 1) lack of mortality data and 2) their focus on the US. The tech is new and reimbursement is immature there.

Barriers to Adoption

Patient Workflow

The surgery is simple, but requires coordinating multiple schedules from the cardiologist to the EP to the Vascular surgeon. Cardiologists see less severe heart failure patients, heart failure specialists tend to more severe heart failure (class 3-4), electrophysiologists are most comfortable with electrical therapy, and vascular surgeons perform the surgery. So the question becomes: how can we convince doctors unfamiliar with device based therapy to refer patients for Barostim and coordinate surgeon schedules to actually get the surgery? The long term answer is increasing access for Eps. EPs outnumber HF specialists by 3x and are often more willing to try new tech (especially electrical modulation) Here's what some industry experts had to say about the topic:

"But by being an EP, we deal with a lot of heart failure patients because we have to implant these patients with various devices. And as a result, we deal with a lot of heart failure management…..So it's that additional burden of navigating multiple surgeon schedules such that a procedure can be performed. So that's really the burden is matching up the schedules….it's not a challenging procedure once you get past the difficulties of actually addressing the scheduling issues"

"I mean, EPs are certainly implant-based, right? So they understand programming from pacemakers to implantable defibrillators…. I think it's a gatekeeper thing……So if you're looking at Class II, Class III that aren't quite ready for transplant or LVADs or something like that, a lot of those patients are already in the electrophysiologist's hands….. And now if you look at Barostim and if you could get an electrophysiologist to do that in the same amount of time [as a CRT device], they're going to be all over it because there's more patients out there that are indicated for this."

CVRX is currently in trials for BATwire, an easier, less invasive, ultrasound guided procedure to implant Barostim, potentially performed by an EP. Initial safety data is encouraging and I look forward to seeing progression.

High cost

Briefly discussed before, I wanted to reemphasize the importance of strong reimbursement. Hospitals are paid by the procedure which includes all device costs. For a device with an ASP of $27k and total reimbursement between $22-30k depending on procedure location, hospitals do NOT want to be left on the hook paying for it out of pocket. Currently, it's reimbursed through a "T code" which is temporary, thus hospitals are wary of using the device immediately. One could easily file appeals on a patient by patient basis for reimbursement, but this means more paperwork and doctors for damn sure don't want more paperwork. They need reimbursement to stay strong, eventually establishing a permanent code for the device. In addition, the additional TPT/NTAP payment makes the procedure much more accretive for a hospital's bottom line, artificially boosting revenue growth.

Mortality Data.

This one is the elephant in the room and the primary reason the stock isn’t higher.

CVRX is currently like Schrodinger's device: it can either have positive mortality and hospitalization results or not. We won't know either way until we unblind the data (which is already collected). Currently, the device is approved for symptomatic relief and mortality data won't change this approval. However, it will impact further commercialization and reimbursement. On one hand, symptomatic relief helps a large swath of people in need. On the other hand, improvement in mortality could be seen as necessary for some doctors. Although they've seen strong growth without the data, I would argue reimbursement and commercialization will be an uphill battle with negative mortality data. CCM has been available since 2019, but "has not yet met a widespread acceptance by clinicians, probably because of the lack of randomized clinical trial evidence for reducing clinical endpoints, such as cardiovascular mortality and hospitalizations" (source). CCM isn't directly comparable because outcomes aren't as strong and it's traditionally seen as an adjunct to CRT , but the comparison is helpful as a guide.

We can argue either way, but I think poor mortality data severely hurts the stock. With poor data, I expect the stock to drop 40% in a day and growth to slow to 40% (still fast but a far cry from the current 100% US growth). Uncertainty about reimbursement and the optics of poor data will hurt sales.

So now we must try to answer three questions:

What are the chances they have good data?

What's the value with positive data?

What's the value with negative data?

What are the chances they have positive data?

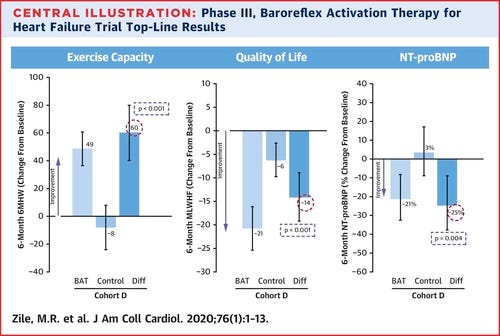

So far, we have interim data showing symptomatic improvement in three QOL characteristics: 6 minute walk distance (6MHWD), quality of life score, and NT-proBNP.

The patient characteristics are those with LVEF < 35%, NT-proBNP < 1,600 pg/mL, 6MHWD between 150-400m, and a recent hospitalization (or elevated NT-proBNP).

Let's look at each characteristic's predictive value

6-Month 6MHWD

Older studies show minimal correlation between walking distance and clinical outcomes (mortality/hospitalization), but newer studies have demonstrated some correlation. "The magnitude of 6MWD improvement to show a benefit in QOL is ~80m which is higher than a 30-50m increase in 6MWD observed in HF trials." Improvements in 6MWD vary between interventions with common drugs showing no benefit but CRT demonstrating some benefit. Device therapies such as CRT, CCM, and MitraClip seem to improve 6MHWD more than drugs, even when drugs can show some mortality benefit. (source)

Overall, the role of improving 6MHWD in predicting clinical outcomes is murky since devices seem to improve it in comparison to drugs even when drugs have a similar mortality benefit. Barostim could improve exercise capacity without improving mortality.

QOL score

Although improvements in QOL are useful, they may or may not be predictors of improvements in mortality. Recent data presented by advocates of CVRX point to data stating QOL is a predictor of HF mortality, but this only holds true in HFpEF (no difference in HFrEF) (source). However, older data does show some correlation between QOL improvement and hospitalization, though it does point out that large studies have generally shown minimal QOL improvements with the intervention tested (beta blockers) (source). Since QOL lacks standardized measures and has only recently been emphasized by medicine, studies on its predictive value are sparse. Improvements in QOL can predict outcomes, but patient populations vary and most studies showing a correlation are done in severe patients (source)

Overall, QOL has an unclear predictive value due to a lack of relevant data.

NT proBNP

NT-proBNP is a hormonal measure related to heart stress thus it's natural to believe it's a predictor of clinical outcomes. Baseline NT-proBNP is often correlated to clinical outcomes (part of the reason why CVRX had to restrict the patient population) and improvements in NT-proBNP are often predictive of mortality. Hooray!!!! Finally a measure without ambiguity we can bank on…..not so fast.

CVRX's trial data is unique because the patient population is restricted to NT-proBNP < 1600 pg/mL. Most HF studies don't have this limitation because elevated NT-proBNP at baseline is a predictor of clinical events and studies want an intervention which can help everyone (source). Ultimately, reductions in the range of 10% or to <1000 pg/ml are seen as significant reductions (source, source). Barostim led to a 25% reduction in NT-proBNP.

That being said, the NT-proBNP response is therapy dependent. Increased BNP decreases sympathetic outflow (calms us down), thus BAT impact on our nervous system could systematically reduce NT-proBNP without clinical improvement. (source)

Sadly, NT-proBNP is once again a murky predictor with minimal real predictive value due to mixed patient population and therapy dependent responses. I would lean in a positive direction, but NT-proBNP is still not a great predictor.

Putting it together

While it's insane to say a therapy with substantial QOL improvements and fantastic interim data in a trial designed to show benefits could fail, the clinical data leaves us with an ambiguous answer. I'd say it's a coin flip going into the readout. Insider buying from is encouraging because major shareholders could have more access to information.

Valuation

It's tough to value a company like CVRX because a) it's growing 100% per year b) there is an important trial readout and c) it's burning a shit ton of cash.

Cash Levels:

Operating expenses are expected to be in the $55-60M range for the year on $20-23M in revenue. Their market cap is $125M with $131M cash on hand. They burned $11M in Q1. Based on their current guidance, they'll burn $45M this year and likely the same next year meaning they have 2 years of cash left before they'll raise again. The company believes they can reach profitability without needing to raise more money though this depends on serious growth. It's hard to predict the timing of profitability, but I believe 3 years to break even is reasonable if they can meet their sales targets. Per account manager, they expect $1.5M in revenue (5 implanting centers * 12 devices * 25K ASP) while total compensation for high performing sales managers is in the range of 300k. DTC marketing efforts for patient awareness contributes to SG&A too. I'd expect a per territory cost of 600k per year at maturity. Gross margins are expected to be 75% and R&D margins will likely be in the 10-20% range as they mature. Based on this year's OPEX, they would need $20M in quarterly revenue to hit break even (4Q23 with 100% revenue growth for two years).

Valuation:

Highly innovative, fast growing Medtech companies like INSP, TMDX, and SWAV trade at a trailing P/Sales of 15-20X. With 20M of US revenue growing 100%, CVRX is at 6X 2022 revenue. Another possibility is an acquisition where the price can be much higher. J&J owns quite a chunk and Medtronic previously acquired a similar company, Ardian (without clinical data) for 800M in 2010.

Binary result

We can discuss the valuation, cash burn, and profitability all we want, but ultimately, the fate of the stock hinges on mortality data in 2023.

Bull Case: We have positive Mortality data and end up with a company growing 100% with 2+years cash on hand, strong management, serving an underserved market with an easy to implement product. Reimbursement tailwinds will push the product into the hands of lots of HF physicians. I'd put it on par with the SWAVs, TMDX, and INSP of the world and at 12X 2023 Sales, the stock is worth $22 at the end of 2023.

Bear Case: We have neutral Mortality Data (no benefit) and end up with a company still serving an underserved market, but potential headwinds from an ASP perspective due to reimbursement headwinds. Doctors have an excuse not to use the device, thus making sales hard. I wouldn't expect them to close up shop, but it’s an uphill battle for reimbursement, adoption, and cash burn thus I'd expect growth to slow to 50%. The stock can stay flat to slightly down over 2 years.

Heads I win, tails I don't lose too much, I'll take that bet. Due to the expected volatility around the data release, my position is small. Please do your own due diligence, none what I write or say is investment advice.

![Yes, Bill, very good question. When we plotted all of the revenue units,

starting from [TVRO] being the time or the day of the first implant as a new

account, right? And you line up all of the accounts like this, and then you

add them up and you try to analyze them month by month what is

happening, right? You would see a first blip, the first 2 months, 1, 2, 3

revenue units. Then sometimes theres silence for 3, 4 months. And then

they start doing 1 every other month for another 6 months, and then they

start going closer to 1 a month. And lim talking here averages, right? Yes, Bill, very good question. When we plotted all of the revenue units,

starting from [TVRO] being the time or the day of the first implant as a new

account, right? And you line up all of the accounts like this, and then you

add them up and you try to analyze them month by month what is

happening, right? You would see a first blip, the first 2 months, 1, 2, 3

revenue units. Then sometimes theres silence for 3, 4 months. And then

they start doing 1 every other month for another 6 months, and then they

start going closer to 1 a month. And lim talking here averages, right?](https://substackcdn.com/image/fetch/$s_!ugLL!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F9cb85f30-904d-4bb9-a3ca-0e2c6a48d927_937x326.png)