Disclosure: Nothing in the post is financial advice. I no longer own any Liquidia (LQDA)

The legal battle is over but the war wages on. The original writeup stipulated 3 scenarios and the third scenario played out almost to perfection. I'm surprised by the accuracy of the call, but it was a fairly obvious timeline and with easy to define base rates. I originall wrote the following in August and it played out well. I originally thought Liquidia could have dominated their market, but after further research, I’ve changed my opinion.

After the 1.5 year legal battle, I'm an amateur legal scholar (at least according to my friends in law school) thanks in part to @LionelHutz_Esq on twitter (His blog: https://www.valoremresearch.com/), but the next question for Liquidia is commercialization. After doing some research, I think Yutrepia and Tyvaso DPI are essentially equivalent devices and Liquidia will have a hard time with commercialization. Here is a summary of the product characteristics and why I think the devices are equal.

I’ll spend the rest of the post discussing breaking down each individual argument and why I’ve sold my position

There are a number of potential differentiating factors I'll breakdown 1 by 1

Point 1 - Liquidia can titrate to higher doses

Counterargument 1a: Deposition into the lungs is better with Tyvaso DPI and requires less dose for equal effect.

The deposition into the lungs is better with United so less need for higher dosing. See the slide:

One can even look at the INSPIRE vs BREEZE study. Patients on 9-11 breaths of Tyvaso needed 80 mcg of Yutrepia and 54-60 mcg in Tyvaso DPI. (Figure S1 in the INSPIRE study and Methods of BREEZE)

Counterargument 1b: Outcomes data are similar for each drug

Outcomes for both are similar and potentially even better with TYVASO DPI (40 M 6MWD improvement vs 10M)

Patient satisfaction is not much different.

Counterargument 1c: PK parameters show Tyvaso DPI at lower doses is equal to Yutrepia at higher doses

Tyvaso DPI: At 48 mcg dose, the Cmax was 1.11ng/mL and the area under the curve (AUC) was .774 hr*ng/mL (label).

Yutrepia: at the 50 mcg dose, the Cmax was .572 ng/mL and the AUC was .428 h*ng/mL. Yutrepia would need to dose up to ~100 mcg to get to the Cmax and AUC levels in 48 mcg Tyvaso DPI. (Presentation)

Note: AUC is how much total drug is seen by the body and the Cmax is the max concentration in the blood.

Conclusion: Tyvaso DPI has better delivery and needs less dose to acheive the same effect

Point 2 - Refrigeration: Yutrepia doesn’t need refrigeration unlike TYVASO DPI

Counterargument 2a

The FDA label recommends storage in a fridge for TYVASO DPI, but unopened strips can be stored at room temperature for 5 weeks.

Conclusion: The refrigeration doesn't matter that much

Point 3 - Naïve patients: "Patients naïve to drug have been tested with Yutrepia but not Tyvaso DPI so doctors will choose Yutrepia for new patients"

Counterargument 3a

By that same logic, Yutrepia hasn't been studies in PH ILD patients yet which puts it at a disadvantage.

The clinical data, mechanism of action, and even the active molecule is the same

In addition, real world evidence likely includes patients naïve to treprostinil starting Tyvaso DPI with no issues: "New patient starts are trending around a 70-30 split between DPI and the nebulizer, respectively" - United Therapeutics Earnings Call August 2nd.

Conclusion: This is not a material issue. Data is better and more numerous for Tyvaso DPI

Point 4 - Adverse effect profile: "Yutrepia can uptitrate the dose because of less side effects."

Counterargument 4a

Yutrepia had 40% patients with cough, 25% with dyspnea, and 30% with headache.

Tyvaso DPI had 35% cough, 20% headache, and 10% dyspnea

Conclusion: The adverse event profile is similar if not worse for Yutrepia

Point 5 - High Resistance: "Yutrepia is a low resistance device which is important for patients with impaired lung function" (more detail below).

Counterargument 5a:

This isn't an issue for PAH patients because they can reach the requisite peak inspiratory pressures for delivery. See this article here which concluded: "

The probability of achieving effective dose delivery may be increased by using dry powder inhalers with increased device resistance, particularly when subjects do not follow the prescribed instructions and inhale comfortably" (source)

Counterargument 5b

Real world evidence shows no issues and patients seem to be readily accepting Tyvaso DPI. I have heard no anecdotal complaints.

Conclusion: This isn’t a material issue for TYVASO DPI

Point 6 - Discontinuations: "Tyvaso DPI has a high discontinuation rate in ILD patients"

Counterargument 6a:

A BTIG note picks on a specific single center poster (which I can't actually find) showing a higher than average discontinuation rate in PH ILD. I choose to the believe the data from the randomized controlled trial. Discontinuation rates were similar between placebo and treatment arms in the phase 3 INCREASE trial. https://x.com/sleepingbear84/status/1737839382558888102?s=20

Counterargument 6b:

Discontinuation rates in PAH were similar for both Yutrepia and Tyvaso DPI.

Conclusion: Data on discontinuation is scarce and a single center experience should be taken with a pillar of salt.

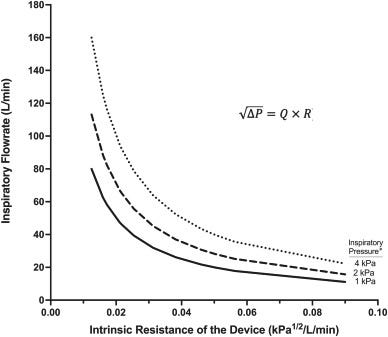

More detail on Resistance/Flow (most of what follows is from this paper and sources cited there, link)

One specific argument which I've heard thrown around is "Yutrepia is a low resistance device which is important for patients with impaired lung function". I even thought it was true for a while. However, a new paper on TYVASO DPI explains the logic of a low flow high resistance device. (link)

A device such as Tyvaso DPI requires 2kPa of peak inspiratory pressure for > 2s in a single breath. "With a low-flow device, such as Tyvaso DPI, the dispersed inhalation powder moves slowly with less inertia thereby reducing inertial losses and increasing the amount of the drug to be delivered to the peripheral lungs. In contrast, powders delivered with a low resistance move faster with greater inertia, thereby resulting in greater variability in drug delivery. Flow rates and particle deposition can be likened to a car driving around a curve. Similar to how a fast-moving car struggles to make a turn when speeding, particles moving at high speeds may encounter difficulties navigating the curves of the upper airways, leading to impact there. On the other hand, slower-moving particles can more easily reach the peripheral lungs, just as a slower car can maneuver the same turn more smoothly"

But can patients reach these levels?

An independent (somewhat) paper says PAH patients can reach the required levels fairly easily. Even with a low resistance devices, the PIP was > 2kPa. The study concluded: "The probability of achieving effective dose delivery may be increased by using dry powder inhalers with increased device resistance, particularly when subjects do not follow the prescribed instructions and inhale comfortably" (source)

The data is supported by the PK parameters in the Tyvaso DPI label

What about ILD patient ability to use Tyvaso DPI?

A 2013 paper suggest patients can reach nearly 10 kPa of peak inspiratory pressure so high resistance may not be an issue. (source)These are non PH ILD patients so take the data with a grain of salt. However, I've heard no KOLs discuss the higher resistance device as a meaningful barrier for TYVASO DPI.

Yutrepia may not need to be better - the risk reward

Even if Yutrepia not better, maybe they can take significant market share in PAH and PH ILD because of new patient starts. Let's look at the market share of drugs based on their entry into a market from this McKinsey report: link. Companies with specialty focuses, larger companies, drugs with multiple indications, and a > 3 year headstart all showed significant benefits to the first mover. Let's say LQDA can capture 25% of the PAH and 30% of the ILD market in 7-8 years. This is about 1B in sales and a 3-4B market cap (assuming no price degradation) Discounted back at 15-20% is a price per share around 15$. It's not very overvalued, but it's not crazy undervalued either. The stock isn't a slam dunk in my opinion because A) They don't have a definitely better production B) they're competing against a behemoth and C) they're a one product company.

The roadmap

I think the next few months have a few potential black swans on the radar

FDA approval for ILD with the patent situation isn't a given

Data from INSM on once daily trepostinil in PAH/PH-ILD could surprise to the upside and meaningfully change the long term picture.

There are a few ways Liquidia could win.

They show demonstrably better data with respect to discontinuations in PH ILD patients so doctors prefer to use their product. This is unlikely because discontinuation rates were similar in PAH patients and the adverse effect profile was slightly worse for Yutrepia.

Liquidia prices lower than United and captures share. However, I wouldn't want to be a single product company fighting based on price.

My Conclusion: The legal battle was a cut and dry story with clear catalysts, defined base rates, and an easy to handicap timeline. The commercial story is murkier and requires a different set of questions.

No subscription fee, but if you find the commentary helpful and want to donate to encourage more posting: https://www.buymeacoffee.com/adusubramanian

looks like you are really back, not just yearly !

So bullish and bearish?