Intuitive Surgical Deep Dive: Aimed for the Heart, Hit the Prostate

Modelling the future and lessons learned

Substack isn’t the best way to post extreme long form analysis, but we can try. I find navigation difficult so I put the information into a word doc with collapsible sections here: ISRG.docx

I also built an excel model for the revenue growth and market calculations found here: ISRG model.xlsx. Feel free to ask me any questions about the model. Download a copy and play with the assumptions.

For the writeup, I want to get into the Company History, Business and Moats, Industry/Competition, Financials, Growth and Risks, and Lessons Learned. FF to the last three sections if you don’t care about the reasons or sources behind my conclusions.

TLDR: Intuitive is too rich for my eyes likely returning 6% over the next ten years. Competition and increased scrutiny on prices represent risks to growth and margins. Even holding margins consistent, the assumptions needed for the stock to return 12-15% IRR are unreasonable. Intuitive’s history does provide some lessons for investors even if one doesn’t buy the stock. A short term acceleration in revenue could might happen, but valuation prevents me from investing. If one is ok with holding for an 8% return over 10 years and/or is betting on short term revenue acceleration, then ISRG could be a good stock to own.

Company History: Aimed for the Heart, Hit the Prostate

Intuitive Surgical's origins trace back to SRI International, a research institute at Stanford. In the early 1990's, SRI developed a surgical robot which caught the eye of DARPA (Defense Advanced Research Projects Agency, a US agency focused on innovation). DARPA, known for funding the internet, joined the project as a partner wanting to use the technology to perform remote surgery on soldiers. In mid-1995 Dr. Frederic Moll, alongside John Freund and Robert Younge, founded Intuitive surgical with intentions to commercialize SRI's research. The current CEO, Gary Guthart joined the company in 1996 as a control systems analyst.

Intuitive's first "Da Vinci" robotic system released in 1998 starting first in Europe with heart surgeries while seeking approval from the FDA. Intuitive went public in 2000 with FDA clearance for gallbladder surgery and gastroesophageal disease surgery approval following quickly thereafter. Initially, the prohibitively high cost of accessories and lack of clinical evidence led the robot to be used like a treadmill in a basement: as a coat rack. Intuitive's saving grace came in the early 2000s with prostate surgery (hence the title "Aimed for the Heart, hit the prostate"). Urologists used robotic surgery to perform difficult prostatectomies because other minimally invasive approaches were not viable and open surgery led to high complication rates.

Even though Intuitive started seeing clinical success, co-founders Moll and Younge left in 2002, likely disappointed the robot wasn't being used for heart surgeries. Moll continued to work on surgical robotics and created Hansen Medical (now Auris Health) focused on catheter navigation and Mako Robotics for orthopedic applications.

It may be hard to believe, but Intuitive's steepest competition came in its earliest days. Computer Motion, another surgical robotics company sued Intuitive for patent infringement in 1998. Litigation dragged on for years, burning cash, and hurting sales for both companies. Tired of litigation, the two companies merged in 2003 under Intuitive. The FDA approved the Da Vinci system for more indications such as robotic hysterectomy and sales picked up. Since then, Intuitive has been one of the best performing business with a correspondingly great stock performance. (Source 1, Source 2, Source 3).

Business and Moats

Business:

Intuitive makes money three ways: system sales, system contracts, and disposables. System sales are sales of the Da Vinci robot with an average selling price (ASP) of $1.5-2 million. System contracts are yearly contracts paid by the hospital for servicing, ~12% of the original system sales itself. Disposable revenue comes from instruments used during surgeries (each instrument has a limited life. Intuitive is the sole source for most instruments used with the Da Vinci system, thus margins for this segment are extremely high. On recent financial statements, a line item for 'operating leases' shows up, but that represents system sales paid for over time or on a usage-based model rather than upfront. You can see their revenue breakdown by year between systems, disposables, and service contracts.

About 70% of their revenue is recurring (disposables and services), up from 57% in 2012. Intuitive surgical combines the best of capital-intensive businesses with the best of SaaS businesses. It sells an expensive product with a long lifecycle (5-7 years) and high switching costs all while receiving high-margin recurring revenue from the sale of accessories and contracts. Sure, Gillette sells razors and razor blades but imagine a razor-razor blade model where razors cost $1000000+ and require regulatory approval to start selling. It’s harder to switch surgical systems than razors.

The Moats

A moat is distinct from competitive advantages. Competitive advantages are objectively measured (i.e. better results) while moats often cannot be measured (status quo, brand loyalty, regulation).

Moat 1 with Hospitals: Hospitals commit so much capital up front for a Da Vinci system that constantly switching the systems isn't realistic. Intuitive originally had trouble selling for this exact reason: hospitals wouldn't commit $1+ million to buy a low usage system that could be litigated out of existence. However, once they're in a hospital, the upfront investment in terms of capital and surgeon training keeps the Da Vinci there. Hospitals are willing to trial new systems, but the Da Vinci system is squarely in first place with minimal replacement risk.

Moat 2 with Doctors: Doctors hate change. They hate it. Imagine this: a hospital buys a Da Vinci System, requires their doctors to train on it for 1 year (average time to become proficient, source + anecdotal conversations) and then performs procedures for 5 years. Putting aside the extra millions spent to buy a new system, Doctors do NOT want to switch robotic systems unless there are clear and demonstrated benefits. This leads to a chicken/egg issue where new entrants need adoption to create clinical data and need clinical data to drive adoption. Some say switching between robotic systems is easier than the switch from laparoscopic to robotic surgery, but I believe there will have to be a step change difference between systems for people to switch.

Moat 2a with Students: Intuitive's tentacles extend to those in residency (the last step between medical school and becoming a full-time doctor). Da Vinci is in 100% of top residency programs (vaguely defined but impressive nonetheless). People who train on Intuitive are going to use Intuitive and most people are training robotically/with Intuitive. getting younger users on the product is a key moat and reminiscent of other stalwarts like Ansys, Autodesk, and Excel.

The People: I'll separate this section but the company reputation can be considered a ‘hiring moat’. The company was ranked #7 by Glassdoor among top places to work in 2020 and CEO Gary Guthart has phenomenal reviews. He is paid well, but is also a company man through and through, having been there since 1996, akin to a founder. His engineering background also lends credence to the idea that Intuitive will continue to innovate rather than focusing on near term financial results.

As a bioengineer, I can speak to industry perceptions around Intuitive and simply put: They're great. Students want to intern there, and professionals love to work there. It is an innovative company located in the Bay Area with a funnel of talent from top universities. I can't speak to internal culture, but bioengineers looking for a fast-paced, innovative environment would love to work there.

Industry and Competition

Buckle up for this section where I'll cover Robotic surgery, the TAM, and the competition.

Industry overview:

Types of surgery

There are three types of surgery: Open, Laparoscopic, and Robotic. Both laparoscopic and robotic are minimally invasive techniques. Abstracting to the highest level the pros and cons are as follows:

Open surgery means cutting a patient open and leads to long recovery times, pain, and visible scarring. Laparoscopic surgery is a minimally invasive technique using fiber optic cameras and small incisions which minimizes recovery time and improves many patient outcomes (scarring, pain, infection risk). However, Laparoscopic methods aren't appropriate for every type of surgery and aren't perfect. Surgeons lose the ‘feel’ of open surgery, have to use unnatural tools and it places musculoskeletal stress on a surgeon due to awkward. Robotic Surgery completely abstracts direct surgeon patient interaction, using a robot to make incisions and operate on the patient. The robot is more stable with more elegant tools/movements and is more comfortable for a surgeon. However, it also abstracts all 'feel' and even with advanced visualization, many surgeons were resistant to use robotic surgery (especially older surgeons).

Outcome measures:

It's hard to generalize outcome measures for each modality across all surgeries, but if one could do it as follows. Minimally invasive techniques are better than open surgery, but the difference between laparoscopy and robotic is minimal when considering traditional surgical complication metrics for many surgeries. However, robotic surgery could have potential benefits with non-traditional metrics such as long-term readmission, consistency of outcomes, and patient comfort.

I'm too curious to let it stand so we’ll analyze the 6 main surgical markets independently.

Urology: Both Partial Nephrectomy and Prostatectomy are common Urological procedures on the Da Vinci system. Prostatectomy was the first major surgery performed consistently on the robot and as mentioned before was Intuitive’s saving grace. It skipped the middle step of laparascopy and went directly from open to robotic surgery. For most Urological procedures, outcome measures are great with less blood loss and better recovery times compared to all other approaches. The present and future of urology is robotic as open surgery is anatomically difficult for this field and laparascopy was never done.

Gynecology: The second field to grab hold of robotic surgery was gynecology. When I spoke to an OB/GYN about her surgical experience, 85%+ of her hysterectomies (removal of uterus either for cancer or personal reasons) were done robotically. Robotics certainly beats open surgery, but for simpler procedures, laparoscopy is certainly an option. One piece of anecdotal evidence regarding patient outcomes is noticeably more pain on sites incised laparoscopically compared to sites incised robotically (perhaps due to the inherent stability of a robot). For both surgeon and patient satisfaction reasons, Robotic surgery is well-penetrated in the gynecological field. It has relatively good outcomes, even comparing to laparascopy, although costs are higher.

General surgery: Bariatrics, Cholecystectomy, Hernia, and Colorectal

Bariatric: Bariatric surgery is surgery done for weight loss. According to a 2016 systematic review of Robotic vs Laparoscopic bariatric surgery, " There were no significant differences between Robotic bariatric surgery (RBS) and Laparoscopic bariatric surgery (LBS) with respect to post-operative complications, major complications, the length of hospital stay, reoperation, conversion, and mortality. Nevertheless, RBS was burdened by longer operative times and higher hospital costs when compared with LBS." However, "incidence of anastomotic leak [a key complication of abdominal surgery] was lower with robotic surgery" (source). Another 2020 study found robotic bariatric surgery cost ineffective. However, others have found lower mortality with robotics and potential for better outcomes if long term outcomes were evaluated. As a high revenue surgery, Bariatric is a key market. Outcomes are mixed here so physician discretion can decide method of surgery.

Cholecystectomy: Cholecystectomy is the removal of a gallbladder. Outcomes here are murky with low rates of complications with both laparascopy and robotic surgery so we need more long-term evidence (source). Some have suggested using robotics for more complex cases and others have found some benefits with this approach. One promising new technique is single site robotic cholecystectomy which compares favorably to single site laparascopy for cosmetic and pain reasons (source).

Hernia Repair: there are two types of hernia repair: ventral (through the chest) and inguinal (through the groin). Robotic surgery is the best option for ventral hernias, but the evidence is a little unclear for inguinal hernial repair and often up to surgeon discretion (source). However, inguinal hernia repairs can make up most robotic surgeries for general surgeons (source) suggesting there are benefits to the approach. In Europe, cost is a prohibitive factor for hernial repairs because reimbursement is low compared to the USA. I've heard anecdotes of hospital execs preventing surgeons from doing hernia repairs robotically because the margins were negative. Hernia is a near term growth driver but could bring down revenue per procedure.

Colorectal: This is another market with ambiguous outcomes but higher costs (source). However colorectal surgeons perform lots of robotic surgeries and perceptions in the field are that robotic surgery provides some benefit clinically and lots of benefit in terms of comfort.

Summary: Using traditional metrics, robotic surgery often does not offer lower complication rates than laparascopy even though it is better than open surgery. However, long term outcomes and doctor/patient comfort must also be weighed against the high costs to performing robotic surgery.

Bonus: Bronchoscopy: Here, Da-Vinci recently introduced the Ion platform for doing lung biopsies. It is not a monopoly, but robotic techniques are clearly better than traditional ones. (source)

One important Note: Robotic Surgery is going to improve, laparascopy will not. As advanced robotic systems enter the market, robotic outcomes will get better while laparascopy will stagnate. The timeline of improvement and costs of future improvements is unknown, but in 50 years, I expect most surgery to be done robotically at a low cost.

I can’t recommend this piece by the New Yorker enough. Although it does get ahead of itself, the article does a great job telling the story of robotic surgery: https://www.newyorker.com/magazine/2019/09/30/paging-dr-robot

Total Addressable Market:

Now that we understand general outcome measures and adoption, the next step is to establish a TAM. We need to segregate soft tissue surgery, Intuitive's playing field, from joint surgery, which has more established systems like MAKO and Globus Medical. The investor presentation identifies 6 million near term potential surgeries and 20 million total soft tissue surgical procedures.

Assuming they maintain the current per procedure revenue rate ($2000), the immediate TAM is $12 billion. For all 20 million soft tissue procedures, the TAM is $40 billion (for disposables)

Robotic Surgery Market Share

The usual stat touted is “robotic surgery is 3-5% of all surgery” but the market share is higher than that for Intuitive with 1.2 million procedures of their current target 6 million (although this excludes bronchoscopy with ION). We can further break down the market share in line-of-sight procedures within the USA. (source, source). Robotic surgery (thus Intuitive) has a market share in the 20% range of addressable procedures.

Data sources: General surgery 1 and 2, Urology, Gynecology (anecdotal estimates)

If we assume an even split between US and non-US procedures, (it works out within a reasonable error if you back calculate it, check the excel for details), the market share is as follows: 25% US, 20% overall, 13% OUS. The excel has more details for those interested.

System TAM:

With 6,000 hospitals in the US and 3,500 placements, the market share math appears simple, but hospitals may choose to buy more than one robot and some hospitals may buy none. It's better to look at the number of Operating Rooms (ORs). There are ~200k non-Ambulatory Surgery Center operating rooms in the US. ~30% of these ORs are "integrated operating rooms" meaning 66k have the capabilities for a robot. Long term, most ORs will become integrated which is just connected certain electronics. Of the fifteen most common procedures in ORs, ~25% are soft tissue surgeries. If we assume this surgery split is consistent across all procedures and ORs, there are currently ~16,000 potential US placements for surgical robots in soft tissue surgery. This is back of the hand math but gives an approximation of Intuitive's market share in terms of installed base (3700/16000 = ~25%).

The rest of the world is difficult to predict, but if the global market split for ORs tracks the split for procedures (50/50 split), there are another 16,000 international operating rooms for Intuitive. (Market Share: 2300/16000 = ~15%).

With a $1.9M ASP, the remaining US TAM is ~23B, OUS remaining TAM ~ 26B. The higher margin yearly service contracts have a TAM of ~7.4B (32k ORs*12% rate*1.9m ASP).

40B disposables + 30B systems + 7.4B services = 77B worldwide TAM

The Growth Conundrum:

Growth in robotic surgery is a conundrum. Intuitive continues to grab share from open surgery while laparascopy stagnates in many fields even though costs are high and outcomes are often ambiguous, why is that?

Let's look at three perspectives: the patient, the doctor, and the hospital.

For patients: Patients may be unaware of clinical benefits so good marketing can lead patients to ask for robotic surgery. If it's the same outcome as laparascopy and possibly less pain, why not request it from your doctor since insurance pays for it? Patient demand is a key driver of growth for Intuitive and the price insensitivity is part of that puzzle.

For doctors: There are a few benefits. Robotic surgery leads to more consistent outcomes and greater doctor comfort. A doctor performing an open/laparoscopic surgery will have different results at 7:30 am and 3:30 pm as surgery takes a toll. Increased comfort and ease of navigation lead to consistent results using a surgical robot. Another benefit of robotic surgery stems from the procedure data. Each surgery is tracked with detail so doctors can review previous surgeries, examine mistakes, and improve. The advanced visualization on a robot is also difficult to take away once accustomed to it, even after losing the feel of laparoscopic surgery.

For hospitals: Between all three actors, hospitals are the ones who bear the cost burden of robotic surgery. Costs are higher but reimbursement is the same so hospitals find a way to make up the difference. They can do this in two ways: volume of surgeries and improvements in long term outcomes such as readmission rates. First and foremost, buying a surgical robot will drive more patients (and doctors) to the hospital. Second, Hospital stays are so costly that even slight reductions in hospital time can lead to immense savings. In addition, the $2000 in disposables per cases pales in comparison to the total cost of some cases so even slight improvements in outcomes can make a purchase worth it.

Intuitive's direct to doctor selling model helps sell robots by convincing hospitals the Da Vinci will be used so costs will be recouped. A surgeon might request a robot and say "I want to perform 100% robotic surgeries in 2 years" so the hospital is more likely to buy that robot. If all doctors want to perform robotic surgery, the Da Vinci system transitions from being a luxury into being a tax, a fantastic transition for a business to make. Hospitals will have to buy a robot rather than wanting to buy a robot.

This article by @daviesbj walks us through why urology adopted robotic surgery.

Keeping up with the Joneses: On a hunch, I think there is a version of the prisoner's dilemma occurring between hospitals that have competition. All hospitals attract patients by having robotic surgery, so they buy the machines even if the greatest social benefit accrues if only one hospital buys the machine.

For each individual hospital, the best decision is to buy the robot even if public costs are inflated and total profits for the hospitals are decrease.

How Intuitive sells the systems: Intuitive's selling model starts with a doctor. They go to a doctor observe their surgeries suggest potential improvements using a robotic system. Doctors usually adopt it quickly and will then go (with Intuitive) to the hospital exec team to buy a robot. It can be hard convincing execs unless a substantial number of procedures will be done on the robot, so doctors must convince hospitals that usage will be high. While the accessory revenues must be approved by a different team, buying a surgical robot is a huge purchase that is made at the top.

Competition:

Intuitive is a monopoly, but competition is on the horizon from larger companies like Medtronic and J&J and startups like CMR surgical and Transenterix. Segregating soft tissue surgery from other surgery is important as companies like Mako, Zimmer Biomet, and Globus Medical aren't direct competitors to the Da Vinci system.

Transenterix (Ascensus Surgical (ASXC)): Let's start with the hype stock: Transenterix. They are FDA approved for several surgeries yet have performed less than 10000 procedures to date. Most doctors I spoke to had never heard of the company and the system was described as too bulky for use in an OR. They supposedly fix some pitfalls of the Da Vinci system such as including haptic feedback and reusable instruments, but these slight advantages aren't enough. I give this company a < 5% chance of disrupting Intuitive on any time frame. It

CMR surgical: CMR surgical has launched a robot directed at simpler surgeries. It sells primarily in Europe and is gathering data for FDA approval. The company is involved in most public hospital bids (for govt run healthcare systems) and has a usage-based pricing model. I believe they are the foremost competition for Intuitive. They are not likely to disrupt Intuitive in the current market but are targeting simpler surgeries. CMR's system has more mobility and can be used in outpatient centers. Threat of disruption is low, but CMR is Intuitive's biggest competition for future growth.

Medtronic: Medtronic's surgical system is still in development after setting an initial launch in 2018. It is planning to enter human trials soon. There are many unknowns about the robot, but scuttlebutt says it will have 4 separate carts for four arms instead of one big system like Intuitive. After eventual approval, Medtronic will certainly have an advantage selling systems compared to a startup. With the volume of accessories/instruments sold by Medtronic to hospitals, they can bundle these and sell at a discount to hospital. In addition, surgeons may find using Medtronic instruments on a robot natural because of a history of using Medtronic instruments in other surgeries. Chance to disrupt Intuitive within 5 years- 1/10, 10 years - 3.5/10

J&J/Google: A J&J/Google joint venture with Verb surgical fell flat on its face as Google pulled out of the partnership, but J&J continues to develop the project in collaboration with Fred Moll from Auris Health (remember him, he was a founder of Intuitive Surgical). This system is so far off that it is hard to judge if the Verb venture will turn into anything. It plans to start trials in 2022 and management has provided little guidance on development. If the product is developed, J&J will have the same advantages as Medtronic selling to hospitals. Chance of disruption: 5 years - 0/10, 10 years 1/10.

Titan medical: Titan is a startup aiming at the single port side of robotic surgery (only one incision). Although Titan has partnered with Medtronic, Intuitive sells a single port system (Da Vinci SP) which is already achieving clinical success.

Auris Health: Auris Health competes with Intuitive's Ion system meant for bronchoscopies, not the Da Vinci system. It has an edge in terms of time in the market (approved in 2018 vs Ion approved in 2019) but Intuitive's scale lends an advantage when selling systems. Regarding technical specifications, Auris' platform has better visualization but a larger bronchoscope which hinders the ability to reach smaller parts of the lung. I cannot tell which platform is "better", but they are similar enough that relationships will drive system sales, not technical evidence for now. There is room in the market for both systems.

Verdict on competition: The stiffest competition Intuitive faces in the near term is CMR surgical which has launched in Europe and is competing for placements in government hospitals. It is cheaper and could win some bids. I expect Intuitive's growth to continue although at a slower rate than the overall robotic surgery market as different hospitals trial new systems. With robotic surgery still early innings, there are many opportunities for new robots to enter the market. Short term disruption is unlikely, but larger competitors have the salesforce/network to sell the robot once developed. Intuitive must keep innovating even if it's a monopoly right now.

Financials

Putting some numbers to the story.

Historical Numbers

The numbers are phenomenal. FCF margins are ~25% with gross margins at 70% and EBIT margins at 30%.

The historical growth numbers are great too, averaging around 15% revenue growth since 2012 and accelerating to 20% in 2019 before declining slightly in 2020 as the pandemic killed elective procedures. Nonetheless, the recovery is breathtaking (Q2 numbers out)

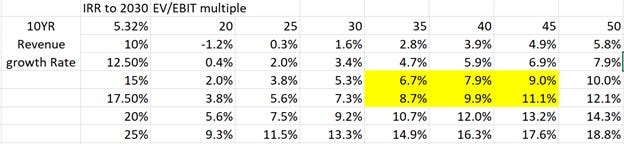

The valuation at face value looks demanding at 23x Sales (even with such high EBIT margins). Let's do a back of the napkin reverse DCF and generate a sensitivity analysis for the 10-year IRR assuming the following: 25% FCF margins, 30% EBIT margins, and all cash accumulates to the company.

One could certainly argue Intuitive will outperform the market going forward especially considering the relatively high valuations of US indices, but it certainly isn't a fat pitch. As I'll explain in a minute, a 40x multiple and 15-17% revenue growth are my expectations for Intuitive.

Target Multiple

Predicting market sentiment is a fool's errand, but we can get a rough estimate based on comparable companies. In ten years, Intuitive will be much more mature so we can value it based on similar companies with great products growing in the 15-20% range with expected 20-30% EBIT margins.

There are two sets of companies: mature ones and those that are growing steadily. I included columns for pre-covid and current margins, growth rates, and valuations since lockdowns can distort earnings. From the list, a 35x EV/EBIT multiple is reasonable as the robotic surgery market matures, but the multiple could reach as high as 60 (although those companies either have distorted earnings or more growth).

Building out revenue growth

Unlike predicting multiples, we can feel some certainty about modeling revenue growth. The excel sheet has all the assumptions so I won't bore you with the nitty gritty (email me if you have questions on the excel, it can get messy). The excel has the following assumptions to make:

Based on the assumptions, the overall revenue growth rate is ~16%. From a market share perspective (assuming 2-4% procedure growth in line with population growth/international markets developing), they end up capturing 23% of the total target market of 20 million procedures.

Assuming Robotic surgery grows to 30% of all surgery from the current 3-5%, taking share away from open surgery while laparascopy holds stable, Intuitive would then have 75% of the robotic market in 2030. Accounting for new competition and the current moat, a 75% market share is reasonable. Now what if we bump up the system growth numbers up to 12 and 17% for US/OUS respectively, and utilization growth per system up to 6%. Intuitive then captures 30% of the target 20 million soft tissue surgery procedures and has revenue growth of 18% into 2030

To achieve 20% revenue growth for 10 years, Intuitive must capture ~35% of the target soft-tissue procedure market (assuming margins, ASP, and revenue per procedure stay consistent). Even then the IRR is < 15%. If you're buying Intuitive for > 15% long term IRR, you're betting on increases in revenue per procedure, ASP, or expansion into new markets beyond robotic surgery.

If you shorten the model, and assume the same multiple compression, the risks become even higher. Intuitive might accelerate revenue in the short term with new markets but is too expensive long term.

Although great companies often surprise to the upside, Intuitive's valuation is too rich for me. Considering the 20% returns I aim for from other companies at the top of my portfolio such as TBTC and PFMT (writeups linked), Intuitive is a pass for me. However, if you are willing to take a long-term time horizon and are ok with average returns (8%), intuitive is a safe place to compound your capital. In addition, a short-term bet on accelerating revenue growth is possible too.

Growth and Risks

With a high valuation, the growth opportunities turn into risks as the onus is on Intuitive to exploit their growth opportunities which are priced into the stock. There are a few growth triggers and a fair amount of risk

Growth Drivers

Increasing installed base: The stickiness of the surgical system means growing the installed base is a leading indicator of future revenue growth because hospitals only buy systems when they intend to use the system. Opportunities are available, especially in international markets, for Intuitive to place more systems, but each incremental sale increases in difficulty. Selling more systems to a single hospital is easier than selling to a new hospital (up to a point) but in general, each incremental system will be more difficult to sell.

In addition, smaller hospitals and outpatient centers currently don't buy Da Vinci Systems because they either don’t want to pay that much or don’t need a surgical robot. There is opportunity for Intuitive to innovate 'down the ladder' into smaller clinics but competition is steepest here and insurance reimburses less.

Increased revenue per procedure: Since the revenue per procedure is a function of accessory instruments, some surgeries have higher costs. For example, Bariatric surgery typically fetches $3k while hernia surgery fetches $1k. As people push for lowering healthcare costs and Intuitive introduces longer lasting instruments, the revenue per procedure will decrease. In fact, recently introduced instruments can be used for 12-18 procedures (vs 10 for the older ones). Applying such a change retroactively would have hurt revenues by 7%.

Expansion into other surgical procedures: This is simple. Can Intuitive expand to new surgical indications and fully address all soft-tissue surgery? They certainly have the brand to sell any newly developed indications and cash to buy startups.

One risk is the creation of procedurally specific robotics such that each type of surgery could have its own surgical robot. This approach is feasible for larger hospital systems and specialized centers, but the enormity of Intuitive means this risk is minimal.

Future Opportunities and Risks

Better Robotic Surgery: Here lies the greatest risk and greatest opportunity. AI, augmented reality, etc are buzzwords thrown around for many startups, but there lies real potential behind advanced robotic surgery. The robot could become more than a better tool for the surgeon. It could augment a surgeon’s capabilities. Cost and computing power will be limiting factors and any revolutionary tech will take time, but Intuitive has a distinct data advantage. BUZZWORD ALERT. Yet another "data advantage", Stay with me here, it does exist.

When over 1.2 million procedures are performed on the Da Vinci system each year they have quantitative and qualitative data on what does/does not work. Intuitive is well positioned to develop or acquire any new tech.

Improving robotic surgery is also a risk as innovation could disrupt Intuitive. If a speculative new company like Vicarious Surgical develops a groundbreaking robotic system in the next 5 years, we could see growth slow dramatically.

Lawsuits and Bad Behavior. Axios highlights lawsuits against Intuitive Surgical citing an abuse of monopoly power. Intuitive allegedly threatens hospitals to shut down robotic systems, ‘forces’ them to buy overpriced instruments, and restricts hospitals against third-party repair services. Litigation, whether it’s for patent infringement, patient safety, or even antitrust, is nothing new, but increased scrutiny is certainly not a good thing. Although, they might not lose these lawsuits, the larger risk is a break in the hospital relationship leading to an increased willingness to switch systems. While they did originally sell robots by abusing their power, they have tried to be more mutually aggregable with hospitals.

Lessons

Lessons from my research

Lesson A) Patients are not passive actors: In healthcare, we ascribe adoption of revolutionary treatments to doctors and hospitals, but patients are a key driver of demand. With the invention of the internet, patients have swaths of information at their fingertips and are empowered to ask for treatments from their doctor. Patient demand for robotic surgery was key to driving growth. Great healthcare companies can be driven by patients.

Lesson B) To quote Charlie Munger: "Show me the incentives and I'll show you the outcome". In this case, the incentives driving outcomes were not for management but for the customers in the ecosystem. Doctors were dually incentivized with 1) better outcomes in the case of prostatectomy and hysterectomy and 2) more comfort in the surgical process. Hospitals were incentivized with more patient demand, doctor demand, and possibly better long-term outcomes (since hospital stays/readmissions are so expensive). Patients were incentivized by less pain and quicker recovery to get robotic surgery. All these combined to drive growth for Intuitive. Incentives need not be explicit either. They are often subtle mindsets of decision makers.

Lesson C) the best businesses are often those that struggle and come out on top. Everyone is always enamored with the newest asset-lite startup, built on a laptop, backed by easy venture capital money, but I like my businesses tough to build with some struggle behind them. A difficult to start business is a difficult to disrupt business. There are examples where one company can pave the way for others by struggling through creating a market, but a capital heavy model and difficult to create product minimizes disruption risk. See the troubles at any of the competitors (Integrated surgical systems, Medtronic, J&J, Transenterix, etc.).

This has come down a lot since Adu. How are you feeling now about it?

This is a great write-up Adu, very thorough analysis and very balanced.

Do you have any thoughts on the potential of Intuitive being a key enabler of remote surgery, allowing expert supervision or perhaps true telesurgery in developing nations, crisis situations, or even just driving more widespread high-specialism surgeries in the developed world?

Luke