Liquidia (LQDA): Opportunity in uncertainty

What do Martin Shkreli, the co founder of 10 billion dollar pharma co., hedge funds and day traders have in common?

Full Disclosure: I am not a lawyer. This is a very risky investment. Lots of credit goes to @GalahadCapital for discussing the idea and co-writing this.

What do Martin Shkreli, the co-founder of 10 billion dollar pharma co., hedge funds and day traders have in common? (Hint: They're not all formerly incarcerated or love the 'Wu-Tang Clan).

They're invested in Liquidia (LQDA), a biotech company with a great product reliant on the ruling of upcoming patent litigation. This type of stock is way out of my zone of confidence, but irrational self-confidence and love for researching new ideas keeps me interested. I believe we're betting on a weighted dice and the potential upside compensates for the large downside risk. However, there are a number of risks, both legal and commercial which makes this the riskiest stock on my blog (and in my portfolio).

LQDA's short term price action is driven by the patent lawsuit, the bulk of my writeup. However, I do want to review why the commercial opportunity for Liquidia is enticing if they can win in court.

Liquidia: Brief Description

Liquidia is a biotech company founded in 2004 by Joseph Desimone, a professor at UNC, to commercialize PRINT (particle replication in non wetting templates), a scalable platform for creating drugs with precise shapes. Liquidia went public in 2018 and acquired RareGen in 2020.

Liquidia's target market is Pulmonary Hypertension and more specifically Pulmonary Arterial Hypertension (PAH). The $10B giant in PAH is United Therapeutic, led by Martine Rothblatt, the only transgender Fortune 500 CEO and creator of SiriusXM. UTHR sells Treprostinil in injected, oral and inhaled forms, but Liquidia's new product YUTREPIA will compete with UTHR's inhaled treatment for PAH, Tyvaso. Liquidia's CEO, Roger Jeffs, joined the company after it acquired RareGen and is the former co-founder of UTHR. RareGen sells a generic version of injectable Treprostinil, competing with UTHR's injectable Remodulin.

Liquidia's Technology: PRINT

Particle replication in non-wetting templates (PRINT) is finally jumping from science experiment to commercialization. It's an award winning technique developed by Joseph Desimone(Wiki Page) at UNC-Chapel Hill. PRINT draws from semiconductor manufacturing processes to scalable produce drug particles of a single shape. While the technology can work for many particles, PRINT is especially valuable to create dry powders for inhaled therapies, because it's gentler than traditional techniques and cheaper than advanced techniques (link).

The Market

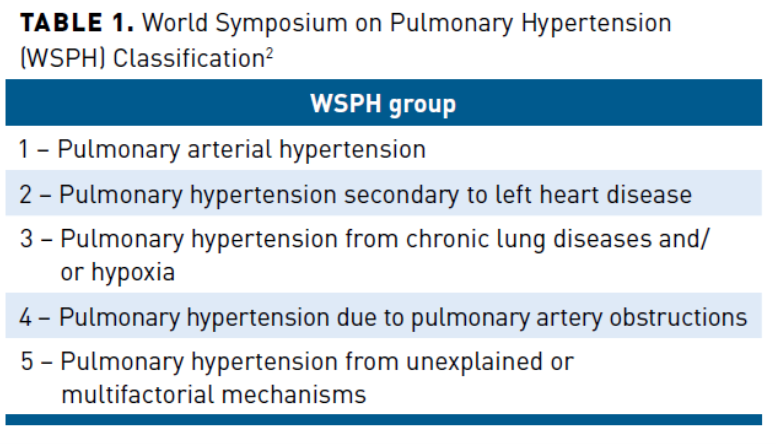

There are two markets for Liquidia: PAH (group 1 PH) and PH-ILD (group 3 PH)

Liquidia's initial target market is pulmonary arterial hypertension (PAH), known as group 1 pulmonary hypertension (PH). Causes of PAH are unknown and multifaceted. PAH is fairly rare with an estimated incidence of 500-1000 in the USA and prevalence of ~35000 (These numbers can be debated). PAH is a progressive disorder characterized by high blood pressure in the lung arteries and treatment is reserved for severely symptomatic patients, because diagnosis requires an invasive right heart catheterization surgery .

Treatment Options -

There is no cure for PAH, but a number of drugs administered in a variety of forms serve as treatments. The treatment pathways are three-fold: Nitric Oxide modulation to dilate vessels (Viagra is actually in this category), Endothelin receptor antagonists to prevent vessel narrowing, and prostacyclins which dilate vessels and prevent vessel growth. Single treatments less effective than combination therapy. The situation is analogous to a stopped car: patients need all wheels turning (multiple drugs) for effective therapy.

UTHR dominates the Prostacyclin market with Treprostinil, available in oral, parental, or inhaled form. Other prostacyclins require frequent dosing or continuous infusion because they have a short life so Treprostinil is favored for patients at home. Currently, the typical treatment pathway starts with oral therapy, transitions to inhaled therapy, and move to inhaled and then parenteral (injected) as the disease worsens. Oral Treprostinil seems like the best option but has side effects and is ineffective for severe patients. Inhaled therapies are an alternative route for patients who don't want infused therapy, but Tyvaso, UTHR's inhaled Treprostinil requires a bulky nebulizer. Tyvaso is still used in 3,000 PAH patients (500M PAH revenue)

Here's a key point: Nebulized vs dry powder.

Tyvaso uses a nebulizer, a multi-part machine with an instruction handbook for assembly. YUTREPIA (dry powder Treprostinil) requires an inhaler. Nebulizers make patients look like Bane from 'The Dark Knight'.

Now United isn't stupid: they know patients prefer an inhaler over a nebulizer so they partnered with MannKind (MNKD) in 2018 to bring to market Tyvaso DPI (Dry Powder Tyvaso). However, YUTREPIA is better than Tyvaso DPI for a few reasons

Ability to dose higher (which has shown beneficial effects, source)

More drug delivered per dose

Patent on dosing between 100-300 mcg, a potential game changer if higher dosing is proven effective and tolerable.

Standard inhaler

Ability to store the drug indefinitely without refrigeration

Source: Q122 LQDA Earnings Call.

Conversion from Nebulizer to Inhaler.

Liquidia expects 80-90% of nebulized patients will convert to Yutrepia, consistent with patient surveys. UTHR, on the other hand, changes their tone and estimate of the conversion percentage progressively.

Here's a timeline. I call it "A Timeline of Cognitive Dissonance" aka "Oh shit, competition is coming"

3/19/2019:

"I do believe there will be a very rapid replacement of nebulizers with that dry powder inhaler. It’s so small. It’s so convenient… I think there’s going to be a 100% replacement of nebulizers with MannKind"

6/01/2021:

"we do think about 70% of PAH and PH-ILD patients will migrate to DPI over time. But we do think there's going to be a portion, maybe that remaining 30%, whether it's 70-30, whether it's 80-20, we'll continue to prefer to use the TD-300, the current nebulizer for Tyvaso"

3/15/2022:

"Longer term, again, as we all learn and as Pat talked about, we think the convenience of the DPI inhaler will lead to Tyvaso being around, as you talked about, Hartaj, 60% to 70% of Tyvaso use in PAH.""

5/4/2022:

"my estimate is that we'll probably see somewhere around 60% of the patients on Tyvaso DPI and about 40% on the nebulizer. I'd say that's -- I think that's a pretty good estimate for Group 1. I think Group 3 may be a little bit more 50-50"

6/9/2022:

"And for PAH, DPI utilization, we gave some metrics as our anticipation is around 60% utilization in PAH for Tyvaso DPI and the balance 40% would be continuing to use the nebulized version. In PH-ILD, it was more of a balanced perspective of expecting DPI utilization to be around 50-50"

8/3/2022:

"Our view is that there's going to be a, kind of, a leveling out at about 50-50 between nebulized and Tyvaso DPI."

It's as if UTHR recognizes Liquidia has a better product and is progressively hedging their bets to investors. Keep in mind the strong majority of patients like the inhaler better than the nebulizer in UTHR's study: BREEZE (link). "With the nebulizer at baseline, 31% of patients agreed/strongly agreed that they were satisfied and 45% of patients provided a neutral response. At Week 3, 96% (p < 0.0001) of patients agreed/strongly agreed that they were satisfied with the TreT inhaler". So they went from 6% strong satisfaction to 90%." Across the board, 80-90% strongly agreed the inhaler was easy to use and satisfactory. Keep in mind it's only 1 breath 4 times a day vs 4 times a day 9-12 breaths for nebulized Tyvaso.

Inhaled Treprostinil is better than nebulized Treprostinil, with the potential to add patients to therapy who were hesitant to use a nebulizer.

Bottom Line: Liquidia's Yutrepia is approved for PAH, a 500M-1B market based on current pricing. Inhaled Treprostinil is better than nebulized and most patients should convert.

The Upside: PH-ILD aka Group 3 PH:

Tyvaso was approved to treat PH due to interstitial lung disease, aka PH-ILD, an estimated 30,000 patient market with no treatment options. UTHR is targeting 3000 PH-ILD patients by the end of the year and 7,000 by 2025. They have exclusivity on the market until March 2024, but I expect Liquidia to launch when the exclusivity period ends (no additional trials needed for approval). PH-ILD has a high incidence of patients (lots of new diagnosis each year), thus ramping should be fast. The toughest part is convincing doctors a new treatment is effective and an invasive diagnostic surgery should be done (cardiac catheterization). However, United is doing a lot of heavy lifting with their rollout of Tyvaso for PH-ILD.

PH-ILD is the blue sky opportunity. Without it, Liquidia is a 320M market cap company targeting a 500M market with litigation uncertainty. With PH-ILD launch expected in 2024, Liquidia is targeting a $5B market as an oligopoly.

This sounds great, but LQDA's a microcap for a reason: the big fat legal overhang.

All credit goes to @Galahad for help writing and researching this part of the report. I highly encourage you to subscribe to his Substack and twitter account.

Onto the Lawsuit

Basic definitions:

What's an IPR? The Patent Trial and Appeal Board (PTAB) is a board regulating the validity of patents. An Inter Partes Review (IPR) petition is a common patent infringement defense where the accused files suit against the patent holder (United) asserting the patent itself is invalid. The PTAB decides to take IPR cases if there is a 'reasonable likelihood' that one of the claims will be invalid.

Invalidity vs non-infringement: Invalidity argues a patent shouldn't have been granted based on grounds of novelty, obviousness, or enablement (can't patent things you can't do). Infringement, on the other hand, argues the company doesn't infringe upon the claims. The burden of proof is on Liquidia to prove invalidity and on United to prove infringement.

Timeline And Development of The Lawsuit

On June 5th, 2020, Liquidia’s only competitor – United Therapeutics Corporation – filed a lawsuit against Liquidia for infringement of U.S. Patent Nos. 9,604,901 (the '901 patent) and 9,593,066 (the '066 patent) relating to United Therapeutics' product Tyvaso (treprostinil) Inhalation Solution. The lawsuit came as a result of Liquidia filing their NDA for the approval of LIQ861 – now known as Yutrepia. Upon initiation of the lawsuit, the FDA triggered a statutory regulatory stay on the final approval of Yutrepia until October 27, 2022, or earlier resolution or settlement of the ongoing litigation.

On July 24th, 2020, UTHR filed an amended complaint asserting infringement of U.S. Patent No. 10,716,793 (‘793) in addition to the already asserted infringement of U.S. Patent Nos. ’901 and ’066. However, the ‘793 patent was not subject to the FDA’s regulatory stay because it was not listed in the Orange Book for Tyvaso when Liquidia submitted the NDA for Yutrepia.

In October, 2020, LQDA provided an update on the U.S. Patent Trial and Appeal Board Decision on Inter Partes Review (IPR) of two of United’s Tyvaso patents. The update explained how PTAB had instituted IPR on patent ‘901, but denied institution on patent ‘066. This update meant that the 30 month stay would still be in effect, and that LQDA would have to argue invalidity and non-infringement in the district court regarding patent ‘066.

The difference between the district court, where the trial was held, and the PTAB, is nuanced but important. The PTAB IPR is filed by LQDA to review patentability, while cases filed by UTHR go to the district court to argue LQDA infringes (though LQDA can either argue invalidity or non-infringement as defense). For the PTAB to institute an IPR, one or more claims have to be unpatentable. The district court has a higher standard for invalidity than the PTAB thus both courts can rule differently.

Fast forward to August 2021, the PTAB instituted an IPR proceeding against the ‘793 patent. A couple of months later, in October 2021, the PTAB ruled in Liquidia’s favor in the IPR proceeding against the ‘901 patent. In its ruling, the PTAB found that seven of the nine claims were unpatentable. Only the narrower dependent claims 6 and 7 remain, both of which require actual storage at ambient temperature of Treprostinil sodium.

On November 5, 2021, the FDA issued a tentative approval for Yutrepia (Treprostinil) inhalation powder, which is indicated for the treatment of pulmonary arterial hypertension (PAH) to improve exercise ability in adult patients with New York Heart Association (NYHA) Functional Class II-III symptoms. What this means is that if the PTAB and/or the district court rules in Liquidia’s favor, the approval will no longer be tentative, and they can launch Yutrepia right away.

December 2021: The Court grants LQDA leave to file a motion for summary judgment of invalidity of the ‘066 and ‘901 patents due to collateral estoppel. Trial in the Hatch-Waxman litigation is scheduled for March 28-30, 2022. Later that month, on December 29th, UTHR filed a stipulation of partial judgment with respect to the ‘901 patent. Under the stipulation of partial judgment, UTHR agreed to the entry of judgment of Liquidia’s non-infringement of the ’901 patent based on the Court’s construction of certain terms in the patent. With this stipulation of partial judgment, only the ‘066 patent would serve as a basis for the on-going regulatory stay for final approval of Yutrepia (treprostinil) inhalation powder by the FDA.

That brings us to July 22nd, 2022, the PTAB rules in Liquidia’s favor in IPR proceeding against patent ‘793. In its ruling, the PTAB found that, based on the preponderance of the evidence, all the claims of the ’793 patent have been shown to be unpatentable.

Liquidia's won '901, but there are still two patents in litigation the '066 and '793.

I'm no lawyer so please take all of this with a grain of salt. UTHR is suing Liquidia for infringing on their patents, but LQDA has two defenses: invalidity and non-infringement. Invalidity argues a patent shouldn't have been granted based on grounds of novelty, obviousness, or enablement (can't patent things you can't do). Infringement, on the other hand, argues the company doesn't infringe upon the claims. The burden of proof is on Liquidia to prove invalidity and on United to prove infringement.

Patent 793:

The PTAB already ruled the patent invalid, but Judge Richard Andrews can rule differently in district court. Liquidia is in a precarious position because they couldn't make the same arguments with the PTAB and in the district court (due to something called estoppel, source). Liquidia 'used' their strongest argument of obviousness ('793 was obvious) in the IPR so it's possible Judge Andrews rules that the 793 is valid and infringed based on the weaker enablement argument put forth in front of him.

The PTAB's favorable ruling all but guarantees the '793 patent will not be an issue one year from now. The three scenarios are:

Option 1: Judge Andrews rules the 793 is valid and infringed. Liquidia would appeal and after 1 year and a decision from the court of appeals (90% of cases side with PTAB, LQDA in this case), they could then launch (end of 2023).

Option 2: Judge Andrews rules the '793 patent is invalid and the patent is longer of concern.

Option 3: Judge Andrews defers ruling on the '793 to the court of appeals so Liquidia could launch 'at-risk'. At risk launches have liability, but there is a high likelihood the appellate court sides with LQDA.

Judge Andrews previously commented he doesn't want to rush "the PTAB to a decision" and is aware of how further appeal could play out. A ruling depends on Andrews personal opinion which is hard to predict. I believe the judge will postpone his decision

Patent 066:

066 is a product by process patent with two independent claims, claims 1 and 8. All other claims depend on these claims so are less important and rarely discussed. Product by process patents are defined by the process, but patentability relies on creating a different product. You can't patent a new process which creates the same product (there are a million ways to form the same thing a compound).

Defining more terms: Obviousness vs anticipation. Obviousness means a claim is invalid because a product could be made by a person of ordinary skill in the art (POSA) by combining multiple references to prior art. Invalidity by anticipation means the product

Claim 1:

Claim 1 describes a "pharmaceutical composition comprising Treprostinil or a pharmaceutically acceptable salt thereof, said composition prepared by a process comprising providing a starting batch of treprostinil having one or more impurities resulting from prior alkylation and hydrolysis steps".

Here's the thousand foot view. UTHR, in the 2000s used a process published by Dr Robert Moriarty (link) to make Treprostinil with 99.7% purity through alkylation and hydrolysis. UTHR changed their process in 2006-2007 when they moved manufacturing operations from Chicago to Maryland, adding a step to make Treprostinil diethanolamine salt and removing a column chromatography step for regulatory reasons. The 066 patent describes the new process.

UTHR argument: UTHR argues the new product is different (thus valid) because Moriarty only disclosed how to make Treprostinil acid at 99.7% purity. The 066 patent describes a more stable Treprostinil salt, thus it isn't 'obvious' or anticipated by Moriarty. Liquidia supposedly narrows the 066 patent to include just Treprostinil acid, but it refers to a 'pharmaceutical product' which would require additional materials since treprostinil is unstable. Since the 066 creates a functionally different product (more stable salt version) with a different process, the patent is valid.

LQDA argument: The patent describes the same product as Moriarty, thus it isn't valid. The new product isn't different because both describe the same treprostinil acid at the same 99.7% purity. Same product, different process.

What does the judge focus on?

Judge Andrews' post-trial order is a glimpse into his though process. He asked both sides to answer two questions A) does the term 'pharmaceutical composition' carry patentable weight and B) Is Treprostinil alone a pharmaceutical composition or product?

Question A) Does the term 'Pharmaceutical composition carry patentable weight? Based on precedent, the answer is 'yes'. This places the burden to prove invalidity upon Liquidia, the focus of question B)

Question B) Is Treprostinil alone a pharmaceutical composition or product 'comprising' Treprostinil? The argument now shifts to whether or not the product in the 066 patent is obvious over Moriarty. UTHR argues Moriarty only discloses 99.7% UT-15 (treprostinil), active ingredient in the pharmaceutical composition, thus doesn't disclose the final product of 066. LQDA argues two things: A) Treprostinil itself is a pharmaceutical composition comprising treprostinil and B) the tresprostinil from Moriarty, although not the final pharmaceutical product, isn't pure treprostinil (99.7%) thus there are other compounds in

UTHR argues:

"Moriarty discloses only an experimental Treprostinil free acid compound, which alone is indisputably incapable of pharmaceutical use, whereas the ’066 patent claims a structurally different pharmaceutical composition/product that must include at least a pharmaceutically acceptable salt and/or excipients."

LQDA claps back: "In sum, every trial witness agreed that Treprostinil alone is the relevant “pharmaceutical composition/product” under the ’066 claims".

****LQDA also claims that even if 'comprising' ultimately requires more than Treprostinil, Moriarty still discloses a 99.7% (not 100%) pure composition (I disregard this argument, because I think 99.7% vs 100% is just semantics of impurities).

The 066 patent does contain a description of Treprostinil Salt unlike Moriarty, but is the step to making such a salt anticipated by Moriarty? To me, the answer is yes because of another patent: Phares 2005. It describes using diethanolamine salt to increase the stability of Treprostinil for oral formulations. However, both LQDA and UTHR don't discuss phares. Phares was in Liquidia's (rejected) IPR petition, but not used in the trial. A straight line from Moriarty to Phares to 066 exists, but Liquidia fails to argue it in court for some reason. Instead, the question is one of whether or not 066 is anticipated solely from Moriarty.

Liquidia's case edges out UTHR for one main reason: the 066 patent only really discusses Treprostinil and Treprostinil salt, not a final pharmaceutical product with an API (active ingredient) and an excipient (added for delivery). UTHR argues Treprostinil is useless without an excipient, but such an excipient isn't in the 066. In addition, the term 'comprising' means named element are essential, but not limiting, thus Moriarty does disclose a composition 'comprising' Treprostinil. The argument is stronger with Phares but still likely to win without it.

It comes to the following: Moriarty doesn't disclose a pharmaceutical composition more than UT-15, but neither does the patent! UTHR keeps saying “oh you need an excipient” but such an excipient isn't mentioned in 066. Just making it a salt is fairly easy to do chemically and actually disclosed in Phares. The right decision is Pro-Liquidia even though the arguments they made are weaker than I would want

Claim 8:

Claim 8 describes the storage of Treprostinil: "…., storing the Treprostinil Salt at ambient temperature, and preparing a pharmaceutical product from the Treprostinil salt after storage….". LQDA's argues non infringement, stipulating their batches of Treprostinil must be stored at ambient temperature to infringe and LQDA does not store Treprostinil at ambient temperature. UTHR argues they found three batches of LQDA drug at ambient temperatures (proving it's stable), but LQDA says those batches were intended for R&D and not commercial purposes. Since the patent requires storage at ambient temperatures, Liquidia can simply store their product at lower temperatures and not infringe.

The argument then shifts to the meaning of storage: UTHR argues keeping the drug at ambient temperature during periods of transport constitutes storage. LQDA counters with an analogy:

Counsel for Liquidia: "UTC points to evidence of using Treprostinil to make the particles as evidence of storage at ambient temperature. Essentially, Your Honor, they say you take milk out of your refrigerator. You store it in your refrigerator. You put it on the counter. Now that it's on the counter and I'm using it to pour it into my cereal so I can have breakfast in the morning. That's storage, when I put it back on the counter. That's not storage. You don't store your milk on the counter while you're using it. You store it in the refrigerator. "

A simple analogy, but the judge seems to side with Liquidia. He even rejected a pre-trial motion (from UTC) attempting to shift the burden of proof to Liquidia (link). Simply put, UTC tried a desperate move (and failed) because they likely couldn't prove infringement.

I believe UTHR's argument on Claim 8 is flimsy and Liquidia wins. They don't store Treprostinil at ambient temperatures, thus they do not infringe.

Wow, That's a lot of legal and chemical jargon to get to three conclusions:

The 793 patent is a done deal and a matter of when, not if, it will be invalidated

066 claim 1 invalidity is slightly in Liquidia's favor (60/40)

Liquidia should not infringe upon 066 claim 8.

Potential red flag for Liquidia: No IPR institution

The PTAB denied Liquidia's IPR petition for patent 066. IPR institution requires only a "reasonable likelihood that the petitioner with respect to at least 1 of the claims challenged", thus a complete non-institution is suspicious. Liquidia argued a different case in the IPR petition (a stronger case IMO though some disagree), but I don't understand why. The PTAB has a lesser burden of proof (preponderance of the evidence) compared to the district court (clear and convincing evidence, link).

There are a number of green flags.

Insiders has collectively bought 20M + worth of stock on the open market and in a public offering AFTER THE TRIAL ENDED. Keep in mind this is a 300M market cap company

Liquidia received and rejected a licensing offer in October 2020 (Court case filed, no full drug approval) for $150 million upfront (50% contingent on full drug approval) and low double digit royalties of sales. It's suspected to be UTHR because Liquidia rejected it because of a "lack of obligation to commercialize LIQ861.

Is UTHR delaying the inevitable? UTHR paid 100 million for a 4 month accelerated approval voucher for Tyvaso DPI. Imagine what they would do to delay Liquidia by years

We've seen this movie. UTHR filed a similar patent infringement suit against SteadyMed in 2016, eventually losing in the PTAB. UTHR subsequently acquired SteadyMed for $216 Million, when the company was still in trials with no approved product.

CEO knows the market: Roger Jeffs is the science behind UTHR. Do want to bet against this man?

Conclusion: 3 scenarios.

Scenario 1: Liquidia loses their case on the 066 patent, effectively killing the company. They can't launch until 2028 and the stock drops 70% on the news.

Scenario 2: Liquidia wins on the 066 and either the 793 decision is postponed pending appeal or ruled in LQDA's favor. Yutrepia is launched within 1 month of ruling and the stock jumps possible 100-200% on the day of judgement.

Scenario 3: Liquidia wins on the 066 but loses on the 793, thus they must wait one year for the final decision from the court of appeals to launch. It's nearly a guarantee the court of appeals sides with Liquidia (they have the same standards as the PTAB, not the district court), thus this essentially delays launch by a year to the end of 2023. The stock likely drops on the day of the ruling because of the possibility for further dilution and bad headline news.

Keep it Simple Stupid:

With the stock where it's at, modeling precise financials is less important than understanding the legal case. I believe Liquidia should be worth 15-20$ if the patent case is favorable because they could capture the majority of $4B market by 2030. Based on UTHR's valuation, the company would be worth $5B (half of United is Tyvaso), a 10X from here.

any feel on the news out just now