UPDATE 3/20: After speaking with the CEO yesterday, I wanted to add some takeaways. I asked about a few things such as scalability in growth, the pipeline conversion and timeline, insurance reimbursement rates, and insider ownership.

Scalable growth: He believes they have the capacity to scale growth with their current manufacturing and sales team. The market is large enough (30k a year patients) for a lack of recurring revenue not to hinder growth too much. As more leads are generated through increased awareness, the OPEX will scale effectively.

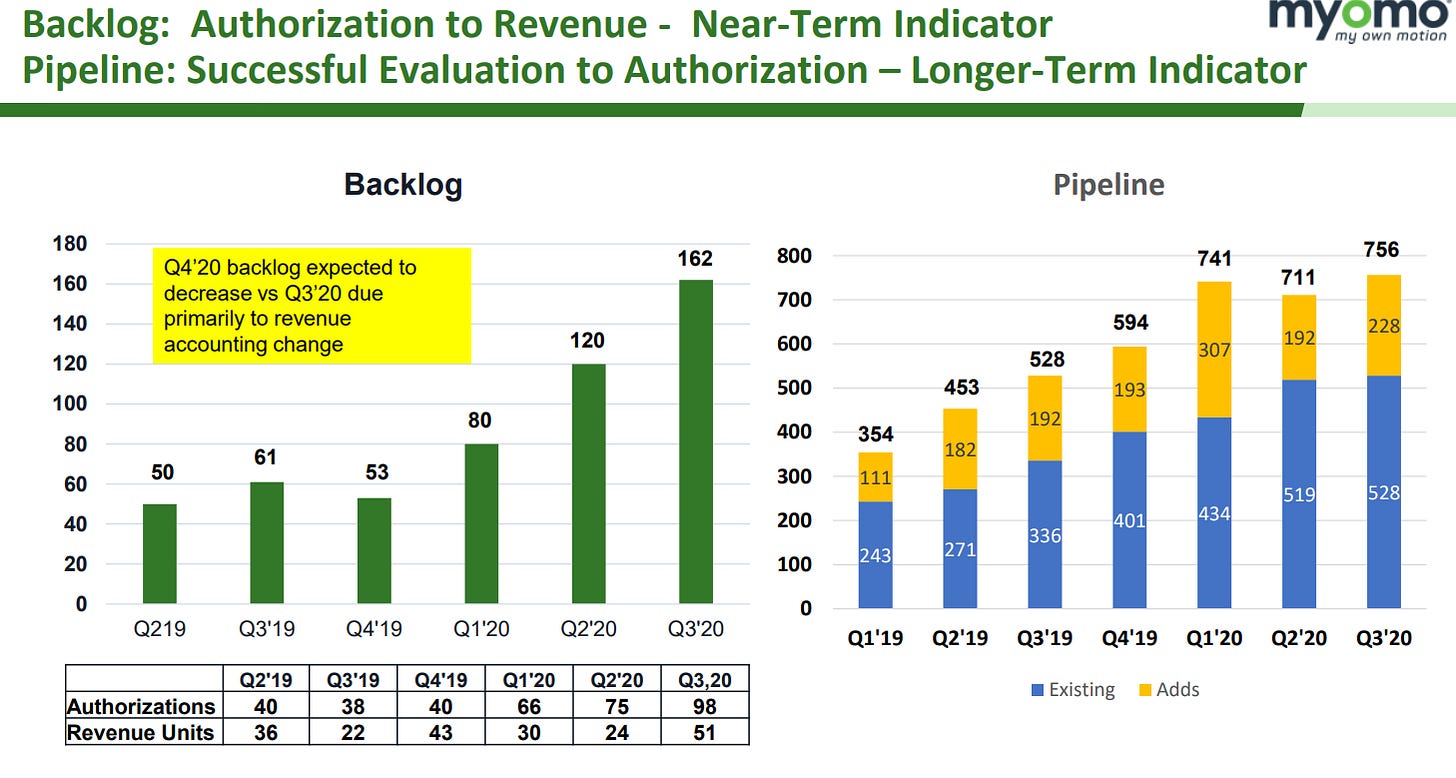

Pipeline conversion and churn: Churn each quarter is ~25% and typically for extraneous reasons such as patients switching jobs or having another stroke. Typically the conversion cycle is 6-9 months from lead generation to revenue recognition, in line with my estimates. Pipeline adds were slowed due to COVID and reduced ability to spend in the 4Q due election ad spending (ads cost more on FB), but the pipeline adds in Q1 will be a record number putting them on track for a great 2H21. They had 300 adds up to March 1st.

Insurance reimbursement: Currently, they are reimbursed on a case by case basis and 50% of cases are approved. For rejected cases, the two cited reasons are a) the device is experimental, which it isn’t and b) it isn’t medically necessary. The CEO mentioned court cases that determined it was medically necessary (I found this one, the case was ruled that it could go to further litigation that the patient was denied service). As more people use the MyoPro device, cases like this where citing it as an “unproven service” won’t be an issue for Myomo. I asked if the trend for approvals was positive and he said it has been flat. Long term (>5 years), they are looking to contract with insurance suppliers so people do not have to be approved individually. For Medicare part B, they applied for reclassification in December and they are attending mid year hearing as a part of the approval process. As I have noted elsewhere, they are trying to reclassify themselves as a myoelectric device (like a lifetime prosthetic) rather than durable medical equipment (like a wheelchair which is leased and returned). This reclassification would both expand the market and make approval easier. The category switch is appropriate, because the MyoPro is meant for lifetime use and is a myoelectric device.

Insider ownership: It was certainly awkward asking if the CEO was aligned for the long term to his face but it still shed some light on this issue. He and other directors had invested quite a bit into the company but were diluted like other shareholders once coming public. He said the pay at the company was at the lower end of the salary range for most employees, but all employees have ownership in the company through their compensation plan. I know the board of directors certainly have options and warrants with strike prices >50 but the number of potential shares granted are low. I did get the impression that he was invested in the company and wanted everyone at the company to be invested as well.

Miscellaneous notes: He cited increased awareness and organic, word-of-mouth advertising as a key driver for decreased customer acquisition costs. They expect the MyoPal device for kids in Q122.

Overall, I liked him, but he didn’t put any numbers behind the statements he made and repeated similar points to what was in the 10k/earnings calls when I asked him questions. He has built companies before which affords him credibility, though I would like to talk to other employees about him and the company. I still remain bullish on the company.

UPDATE 2/23: Their presentation on 2/17 mitigated some of the risk listed below so I thought I would add an update here. They talked about how there are ~30k new patients that become eligible for the MyoPro each year. That new population is 900mil in new revenue each year. It lessened my worries about the Recurring revenue AND lessened concerns over patient eligibility as they cited that they could capture 10% of the 300k chronic arm paralysis market each year. In addition, their gross margins should improve to 70-75% as their revenue recognition changes to recognizes sales on delivery. These are just headline number, but should make the company screen better and look better to investors unwilling to dig deeper. Management also mentioned consumers marketing the Myomo device organically on Tiktok and other social media platforms (showing a person with a Myomo device playing a guitar on Tiktok) which is great for increasing their direct billing sales without using a provider. Keep in mind this is without Medicare part B (main Medicare) approval. They have HSPCS codes and have been approved as a provider in 40 states meaning they can enter contracts with commercial payors, but no fee schedule has been set yet under Medicare. That’s the update! Full disclosure: I have added to my position on current dip, good luck to all invested. It is a great company with a great mission.

Myomo is a medical device company that sells an assistive device for those with reduced strength in their arms. The device uses the impulses generated by a persons brain and amplifies them to strengthen movements. The target population are a specific set of patients with chronic arm paralysis (basically you have trouble using your arm) such as stroke survivors, spinal cord injuries, Brachial plexus injuries and other various conditions.

Market: Management sizes the total market opportunity at 3M people with chronic arm paralysis in the USA and 1% of the global population growing at 250k each year. Not all of these patients will get a Myomo device, but there is still a large and growing unmet medical need

Industry: Myomo has no direct competitors, but there are two other companies focused on augmenting human movement: Ekso Bionics (EKSO) and Rewalk Robotics (RWLK). Myomo is focused on upper limb mobility while the other two competitors are focused on lower body mobility. Myomo's technology is patented until 2039. The patents are, at a simple level, for a device that measured muscle signals and 'amplifies' them using the forces from the brace.

Sales Rollout: The device is very expensive at > 30,000$, but growth has been impressive the past few years due to an increase in insurance reimbursement.

Source: company presentation

Revenue growth was 80%+ in the last year and has accelerated. This can partially explained by an increase in the ASP. The company is pushing towards increasing the direct billing revenue portion of their pipeline. This means the company directly bills an insurance provider rather than having to circuitously go through a medical provider. This has had a material impact on revenues as management noted on the Q3 earnings call. One year ago, the ASP was 27,000$, but in Q3, the ASP was 38,000$. (source: company 3Q earnings call). Another factor affecting their outstanding pre announced 4Q revenue results is a change in the revenue recognition. Certain billers started recognizing revenue on delivery thus pushing revenue ahead. The revenue recognition methods are variable for the direct billing, O&P/VA, and international sales (see the image below for details).

Their revenue growth is buoyed by the dual tailwinds of increases in ASP and an increase in authorization number which led to the robust growth seen in the past year.

For a more detailed look at future growth, we can look at the back log and pipeline numbers. He backlog represents units that have been authorized, but haven't been delivered. The churn on the backlog recently decreased from a historical 20% down to 5% (3Q CC). The pipeline represents the people that are engaged with Myomo to get a new MyoPro.

The current process Myomo goes through is fairly difficult to get authorization as a lot of leads have to get insurance authorization through the appeal process.

The conversion from the pipeline is fairly low, but this can provide a lever for growth. However, as the pipeline grows, revenue growth should accelerate. COVID dampened the pipeline since they couldn't add as many customers that were locked down and reluctant to get a new device. However, management has repurposed their advertising strategy and expect the pipeline new adds to return to Q1 number.

Their goal is to get to cash flow breakeven in 4Q21 and set the goal of 300 new pipeline units per quarter and 7 million in revenue in a quarter to get there. The sales cycle can take a fairly long time(6-12 months), thus they want to expand their pipeline now. The long sales cycle means growth could slow in the middle of 2021 but accelerate in the latter half of the year due to the shutdown effects and subsequent decrease in pipeline adds followed by a return to normal.

Future growth:

International expansion - Currently, they have a CE mark and are working towards insurance coverage in Germany. In addition, they recently entered a Joint venture in China to sell the MyoPro device. (Source). Myomo is partnering with a Ryzur Medical, a local medical device company, and plan to take a 20% stake in the JV with a commitment from Ryzur Medical to invest $8-20 million over 5 years. In addition, Myomo will receive an upfront license fee of $2.5 million and have a minimum purchase commitment of $10.75 million over 10 years. The initial minimum numbers aren't large, but the market opportunity is huge in china, providing them another avenue for growth.

Medicare coverage - Myomo was recently certified as a provider by medicare, but CMS codes for coverage/fees are TBD. The upshot of becoming a provider means reduced friction for Myomo devices being reimbursed. While they were previously reimbursed via other device designations, Myomo can now directly enter into contract with insurances, thus reducing friction in the process. In addition, once a fee for Myomo is determined, it can be used by those covered by Medicare.

Downsides: From the information laid out so far, the company looks like it has a proprietary device playing into a large market with catalysts on the horizon in the form of international expansion and increased coverage. However, there are some downsides and red flags with the company

No recurring Revenue - In a world where every type of company has some recurring revenue or a device upgrade cycle, Myomo devices are expected to last for long periods of time like a car, thus there are only a finite number of sales that can be made. In addition, more units have to be sold each year to sustain growth. While this may lead to medium term gains, the long term opportunity is limited. The warranty on the battery and device is 1 and 3 years respectively and the patient has to resubmit to insurance if they would like a new device. A form of recurring revenue could be introduced through newer models and renewals, but as of right now, there is no recurring revenue.

Low insider Ownership - According to a company filing in April, insider ownership stands at <10%, which is very low for a fast growing microcap company. For a company as small as Myomo, I would expect and like to see more insider ownership.

Reliance on insurance - The price point for Myomo devices are extremely high and any sales are reliant on insurance reimbursement. In fact, Myomo had previously guided for Medicare coverage to be established by the end of 2020, but due to COIVD, this failed to materialize.

Low Conversion rate of Pipeline - Currently only 15% of all patients referred to Myomo in the pipeline are approved and sold a device.

Delays in Business - In addition to the aforementioned delays in Medicare coverage, Myomo had also delayed the release of a pediatric MyoPro that was intended for a 2020 launch. However, the delays could be a function of COVID as recent financial performance has been excellent.

Valuation: Myomo has a net cash of 13 million indicating a runway past 2021 based on previous cash burn estimates. The EV/Sales based on FY20 results is ~6.8 indicating the company is undervalued if it can sustain growth. However, the risks outlined above make me apprehensive about taking a large stake (10%). The company highlights a large TAM, but only a select few of those who get chronic arm paralysis are eligible for a Myomo device thus capping their future potential. This is a 'Prove it" story and if revenue growth continues to accelerate with an increase in the conversion rate from the pipeline and international growth, I would buy more for the next 1-3 years.

Predicting revenue based on the pipeline:

Disclosure: I bought a speculative 1% position two weeks ago at 12$ and I plan to add more as I have done more research and the stock price is breaking out/relatively cheap.

Company website: https://myomo.com/

update?