PAH Summary

Some data, thoughts, 4 ways to play the space pre AVTE

A story in four parts:

Sotatercept and KER-012

AV-101 and GB002 - the inhaled TKIs

LQDA, UTHR, and the legal battle

TPIP - a new comer

Pulmonary Arterial Hypertension (PAH).xlsx - Google Sheets

The primary purpose of this post is to inform rather than give my opinion. I want to provide the above spreadsheet highlighting data from the clinical trials in progress. It's a detailed breakdown of results for Pulmonary arterial hypertension therapies. I want feedback. What information is missing? What programs are missing and relevant? How can the sheet be better formatted to be user friendly?

Basic Terms

Most people will skip this section, but I think understanding basic terminology will give you the best understanding into the disease.

NYHA Class - Classification of patients with pulmonary Hypertension based on physical ability. Class 1 is no limitation, II is mild limitation, III is market limitation, IV is unable to perform any activity without symptoms

6 minute walk distance (6MWD) - usually the preferred endpoint for clinical trials measuring how far a patient can walk in 6 minutes, somewhat noisy. Time to Clinical worsening (TTCW) is another endpoint which is preferred for consistency.

Pulmonary Vascular resistance (PVR) - A measure of hypertension which is Defined from other variables such as mean pulmonary arterial pressure (mPAP), Cardiac output (CO), and left arterial pressure. (PVR = (mPAP - LAP)/CO)

NT-proBNP: peptide that is induced in PAH with no function but used as a biomarker for disease severity in PAH. Correlates best with PVR and used for risk stratification.

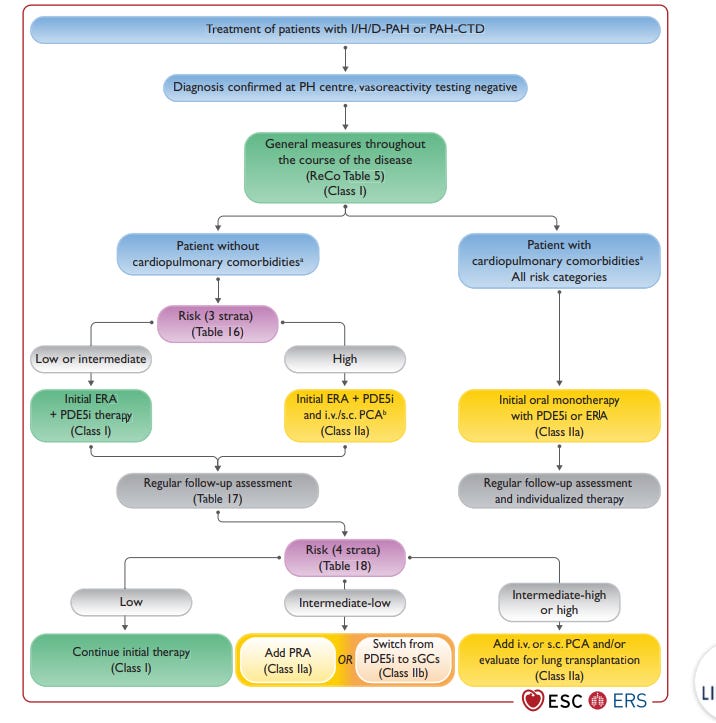

Current Treatment algorithm: How do physicians think about treating patients? Investors obsess over group 1 Pulmonary Hypertension (Known as PAH) but group 1 patients are a relatively rare population with an increasing incidence. Consensus guidelines are how physicians approach treating patients even with individual variability. Briefly, according to 2022 guidelines, three pathways can be targeted with drugs to alleviate symptoms and extend life.

Endothelin to stop vaso constiction

cGMP to vasodilate vessels

Prostacyclins to dilate vessels and prevent proliferation

Note: TGF-Beta therapies like Sotatercept target proliferation of the vessels. More proliferation leads to tighter vessels and functional issues.

The treatment algorithm stratifies patients by comorbidities and prefers to escalating use of doublet/triplet therapy in high risk patients. Further more, patients without comorbidities should start with combination therapies.

I want to highlight a few key points from the guidelines:

Changes from the 2015 guidelines→ 2022 guidelines emphasize earlier diagnosis

The treatment algorithm emphasizes the importance of comorbidities, risk assessment, and combinations over monotherapies.

Treatment is highly dependent on risk factors and patients often progress through lines of therapy due to clinical worsening. There are no disease modifying therapies available

The initial medication often starts with oral therapy, but progression onto inhaled therapies is common

Patients with comorbidities respond less well to PAH medication and are underrepresented in clinical trials.

There is lots of nuance deciding initial therapy and specific PDE5 inhibitors, ERAs, and prostacyclins can be preferred, but such decisions are less relevant to investors and the debates in the field.

Unmet need: Disease modifying, disease modifying, disease modifying. If I say it thrice, does it show up? 3 year mortality is still 25% for intermediate risk patients. Vasodilation of blood vessels is the primary way current therapies work while vascular remodeling is a harder target to hit because the unknown causes of PAH (source). If we can find a therapy to target the root cause of PAH and turn it into a truly chronic, Life long condition, that extends the lives of many.

Brief Note on TAM: The TAM is ~4B currently. Many therapies have been in use long enough to be generic, btu branded therapies are priced at 100-300k per year.

For public investors, the four main ways to play it are as follows IMO:

Sotatercept and KER-012, TGF-B class: a game changer with a fast follower

AV-101 and Seralutinib, cKIT and PDGFR class drugs: potential to replace a share of inhaled therapies

Liquidia and United therapeutics, treprostinils: a lengthy, now complete, legal battle.

Insmed, treprostinil palmitil: a newer, potentially better version of treprostinil

Sotatercept and KER-012

Phase 3 trial: Phase 3 Trial of Sotatercept for Treatment of Pulmonary Arterial Hypertension | New England Journal of Medicine (nejm.org)

Long term results: Merck presentation

Mechanism of action: TGF beta differentiation factor ligand trap

Clinical data: the best way to visualize the data is to look at the spreadsheet. Writing out number makes ones eye gloss over. Key highlights: + 34 M 6MWD in patients mostly already on triple therapy.

Sotatercept is rightfully heralded as the second coming of Jesus in PAH (link). However, while Sota is a novel drug class with potentially disease modifying benefits, there are concerns over long term adverse effects like bleeding. Anywhere between 10-25% of patients have harmless issues with telangiectasia and nosebleeds signaling a potential issue with vascular function. Specifically, these bleeding risks are in patients without changes in platelet counts (helps clot blood) indicating it may ' be a vascular skin manifestation' (source). In addition, case reports are out there on serious GI bleeds (Case). The issues could be a vascular manifestation because blocking BMP9 and BMP10 “can cause vascular skin manifestations". Some expected a black box, but the FDA label simply notes an increased risk of serious bleeding (Label). Sotatercept is a Ligand trap that binds many different proteins with both on target and off target effects unlike KER-012 which is designed to target specific ligands and minimize off target toxicity.

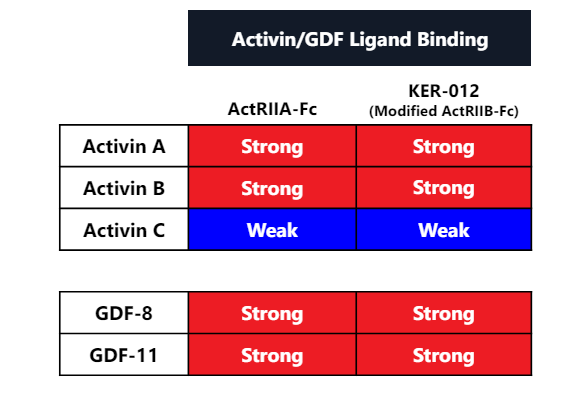

KER-012 is a targeted drug: KER-012 is designed to bind only Activin without the off target BMP binding action. TGF-beta has 33 ligands, but only 12 total receptors and every ligand binds each receptor with varying affinity so parsing the final effects are extremely difficult.

In theory, KER-012 binds the Activins and BMP required for effficacy while minimizing off target BMP9/10 binding. (source). Role of BMP ligands (link): "loss of BMP9 signaling contributes to the pathogenesis of PAH….but BMP may exert different roles at different stages of PAH (beneficial initially, more complicated at later stages)". My takeaway: The evidence seems mixed, but it seems the ligand trap approach can be optimized.

My opinion: I like KROS' approach. Patients will be on sota for a long time. KROS represents one of the only companies trying to make a better Sotatercept. While the trial won't read out for a long time, I think the drug is valuable.

Next steps for each drug:

Sotatercept approval in the EU

KER-012 Further updates on the Tropos PAH trial end of this year.

Inhaled Imatinib (AV-101) and Seralutinib (GB002)

Great twitter Thread on AVTE: LINK

Another great thread breaking down the bar for success: LINK

Background on Imatinib: Imatinib is PDGFR and cKIT targeted therapy. Oral therapy was highly effective in PAH for reducing PVR and improving 6 minute walk distance (IMPRES Phase 3 trial, published early 2010s). However, high rates of nausea, edema, and clinical worsening led to discontinuation. Both GOSS with Seralutinib and Aerovate with AV-101 (inhaled imatinib) are attempting to use an inhaled formulation targeting the same pathway to increase local concentrations within the lungs for PAH.

Drug 1: Seralutinib

Gossamer has quite the history, but in a nutshell here is the history. (in my words)

High flying stock end of 2022 because people thought it could match sotatercept's efficacy

Phase 3 TORREY Results didn't meet stat sig in 6MWD with only a placebo adjusted 7M benefit. PVR was better, but still didn't meet the bar for efficacy (20% decrease).

Gossamer blames patient enrollment criteria and post hoc analysis shows benefit in more severe patients. (TORREY results)

Further Open Label Extension supports Seralutinib has a clinical effect.

Placebo adjusted benefit in elevated risk patients is ~25M

Placebo to seralutinib switched benefits see a benefit.

Gossamer does a Dilutive share offering (2X the shares) and raises enough money to get through phase 3 (barely) in a shareholder unfriendly manner.

Phase 3 trial is currently ongoing in patients with severe disease

Defined as PVR > 400, Baseline 6MWD 150-450M, either NT-ProBMP > 300 or Reveal Lite score >4.

Partnership with Chiesi announced for a 50/50 split on revenues further limiting upside on success.

Q425 expected results

The data is all on the spread sheet for the trials.

My opinion: Gossamer has a drug that works. The initial trial wasn't designed well. The phase 3 is a coin flip and the partnership + dilution limits the upside. Count me out for a 1.5 year catalyst desert with limited upside.

Drug 2: Inhaled Imatinib - AV-101.

The most proximal catalyst in PAH is the Phase 2 readout of AV-101 expected in June.

Aerovate purposefully designed the trial to enroll more severe patients with a population comparable to sotatercepton 6MWD and PVR.

At a 500M market cap with a potentially novel PAH drug, Aerovate looks quite attractive if the trial hits. However, the bears would likely point out lack of proof of concept data, Seralutinib's failure in phase 2, different baseline populations than imatinib, and the potential for adverse events while administering such high doses of Imatinib. I have little to add in way of facts, my opinion is below.

My Opinion: The bar for success is a 20% PVR improvement and 20M 6MWD benefit in my opinion (similar to the Phase 2 TORREY trial). I hold no position because I can't get comfortable with the risk given lack of true proof of concept data in comparable populations. The baseline PVR and 6MWD in imatinib's phase 2/3 trials were > 1100 and between 350M and 400M, respectively. AVTE isn't comparable. Imatinib only showed a placebo adjusted delta of 20% in PVR when stratified for patients sub 1000 PVR and an absolute reduction of 13%. (link). Management has sounded confident that it can hit a 20% PVR reduction which seems to be the bar for success, but there are still outstanding questions about commercial potential and how it fits in the treatment paradigm if the PVR reduction is worse than Sotatercept but in line with other ERAs/prostacyclin (like Tyvaso).

Liquidia and United Therapeutics battling over the Prostacyclin

Liquidia: Legal hurdles cleared, Yutrepia could be better than Tyvaso DPI but L606 is the real gem.

I've covered Liquidia before so I'll keep this section brief. Since my last post here (thread here), Liquidia has officially cleared all legal hurdles for commercialization. FDA approval in PAH should be imminent with PH-ILD either at the same time or succeeding soon after. “So as of April 1, we have no legal impediments to prevent from getting approval in both PAH and PH-ILD”. People place a lot of emphasis on the PAH market but ultimately, Liquidia has to win in PH-ILD, a much larger market (3-5B duopoly vs 500M in Tyvaso PAH sales last year). PAH will be an uphill battle because I think Tyvaso DPI and Yutrepia are largely equivalent devices and United has proven they can maintain share even when generics enter the market (“we've got the vast majority of patients are on Remunity” - May 1st)

L606 Nebulized: Beyond Yutrepia, I want to highlight L606. L606 is a twice daily nebulized version of Treprostinil designed to be given in a convenient administration akin to an inhaler rather than the bulky nebulized version. Unlike TPIP (discussed below), L606 uses Treprostinil as the active ingredient and thus can be approved through the 505 pathway like Yutrepia: “a single Phase 3 placebo controlled efficacy study with L606 will lead to approval for both indications for PAH and PHILD…by 2028” - Jefferies 2024.

I firmly believe Yutrepia is equal to Tyvaso DPI in PAH, but the evidence isn't cut and dry, especially for PH-ILD where Tyvaso is growing. The ASCENT trial measuring Yutrepia in PH-ILD may prove better tolerability and efficacy. Oral Prostacyclin therapy is fairly toxic and easier administration of inhaled therapy means it can takes share from that segment of the market. I feel like both United and Liquidia management have reason to believe in their product. As with anything, you can find a KOL to support either position.

Here are the yet to be answered questions and how I think they get answered

Will Yutrepia be better than Tyvaso in PH ILD since discontinuation rates are fairly high for Tyvaso? Need both the ASCENT data and a potential head to head study.

Can Yutrepia take share from oral Treprostinil and how does the next generation therapy in development from United Therepeutics play into maintaining share? Orenitram currently does 325M in annual revenue. Answer only from real world evidence.

Will the FDA approve both PAH and PH-ILD at the same time? Answer will only come if/when approval arrives.

What will prescribers choose for initial therapy on inhaled Treprostinil? Will they prefer or sequence one in front of the other

What about United Therapeutics?

My Opinion: It's hard to be either long or short United at these prices. The stock is dirt cheap, but competition is heating up with Liquidia on its heels, the recent approval of Sota, and the potential success of TPIP/Inhaled Imatinib. They have a new oral therapy in development and have successfully fended off generic remodulin with a new infusion device. Still, they need to prove Tyvaso’s utility beyond PAH. I have nothing new related to PAH to add here.

Catalysts to Monitor

Phase 3 ASCENT trial data end of year

Initiation of L606 trial in PH-ILD

Data from Next Gen oral Treprostinil from UTHR.

Insmed’s Treprostinil Palmitil (TPIP)

Briefly, I think TPIP is worth mentioning. The limited data provided by the company is in the google spreadsheet. The phase 2 trial showed a BLENDED 20% reduction in PVR and 40M improvement in 6MWD. The inclusion criteria doesn’t define a 6MWD range unlike other Phase 3 trials in theoretically comparable populations, but the numbers are impressive. In phase 3 trials, Oral Treprostinil showed a 20% reduction in PVR for the whole population with the placebo population only showed a -2% change in PVR.

Regulatory Path: Treprostinil Palmitil is not Treprostinil: it's a new active ingredient. While it confers patent protection for the product, it also requires more in depth phase 3 programs. While Liquidia can apply for FDA approval based on a limited number of patients in open Label phase 3 studies, Insmed must run independent, large, randomized controlled trials in PH ILD and PAH. A once daily inhaled Treprostinil has the potential to be a multi billion dollar product, but investors will have to wait.

Next Catlayst

Topline results expected in 2025.

Conclusion

Please check out a new section of my website: www.subradata.com/catalyst_data_display for a slightly worse, but free alternative to Biopharm catalyst.

I’m hoping this is the start of a series where I collate the data and KOL opinions for a set of diseases. ATTR-CM next. Inspired by this tweet: https://x.com/biofeed/status/1760857186299715794.

Nice post!

This is great; thank you.