Redbubble: COVID Boosted Bust or Strong Marketplace Business?

An exploration of a company I recently started using, hoping to crowdsource investment thoughts.

Business Overview and History:

Redbubble (ASX:RBL, OTCMKTS:RDBBY) operates a marketplace connecting artists and buyers of custom designed print-on demand goods. The products on the core marketplace include stickers, wall art, T-shirts, other clothing, and some home décor. In addition to the core marketplace Redbubble, the company also owns TeePublic, acquired in late 2018, which focuses on selling print-on-demand (POD) T-Shirts through a similar model. The two marketplaces are still operated separately. While traditional retail operates by mass producing designs on clothes and leveraging scale to drive down costs, Redbubble uses a different approach as a 'Print-On-Demand' business, filling each order after it is made made.

The process looks something like the following:

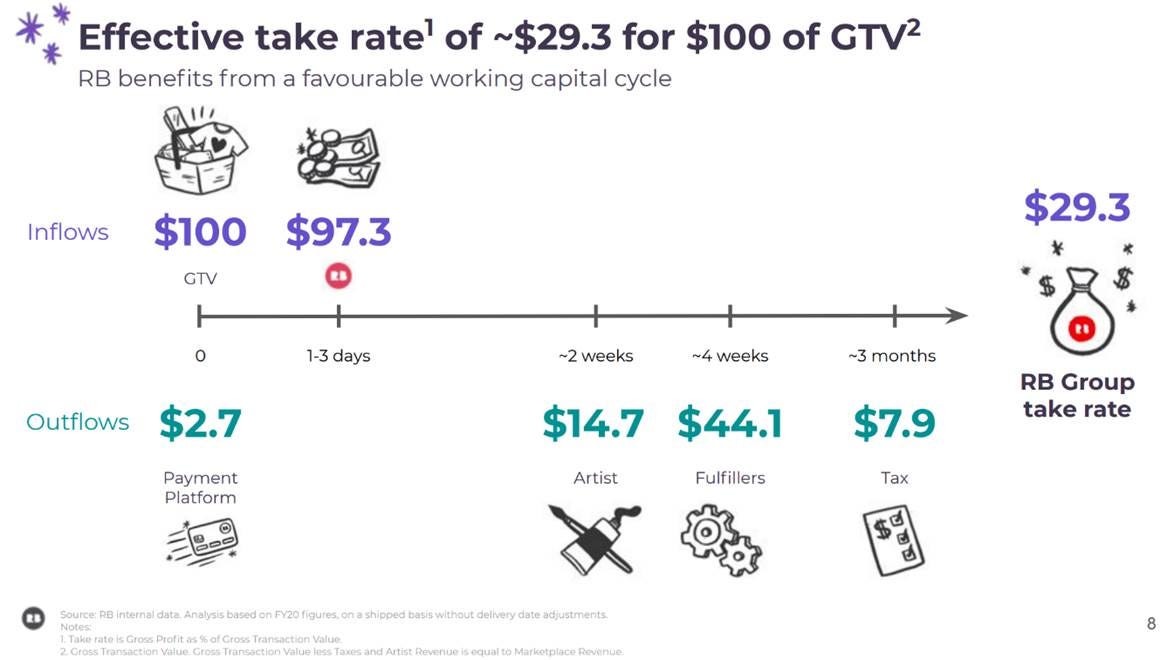

Redbubble serves only as the marketplace between artists and customers. All shipping and printing is outsourced, thus Redbubble holds no inventory. It's a two-sided marketplace with buyers on one side and artists on the other. Their take rate is around 25% and a typical transaction looks like this.

A cursory look at the financials shows a consistently growing business accelerated by COVID, similar to an Etsy or Amazon. However, slowing growth in the quarters (late 2019) before the pandemic was masked (no pun intended) by the acquisition of TeePublic. The slowing growth even led to the company ousting the CEO in February 2020 to appoint cofounder Martin Hosking as interim CEO. Before the company reported more results, COVID swept the world and turbocharged growth at the company.

Two sided marketplaces are typically great investments because of the network effects associated with the business but slowing growth at the core platform before the pandemic could be a sign of a staggering business. I have heard smart bull and bear theses so I thought I would take a look at the business, especially considering the recent drop in the share price.

The ultimate question we're trying to answer: Has the Pandemic boosted Redbubble past escape velocity, or will it return to earth after a COVID-Induced Run? We likely won’t have a clear answer, but I’ll lay out what could go right and what could go wrong.

Side Note on Masks:

Before we get into the rest of the article, I thought I would add a note about mask sales. They represented 12 million in FY20 and ~9% of 1H21 marketplace revenue. Overall, these numbers aren't too large, but for any calculations I will use revenue ex masks. The mask story is immaterial if you’re bearish or bullish long term.

Industry and Competition

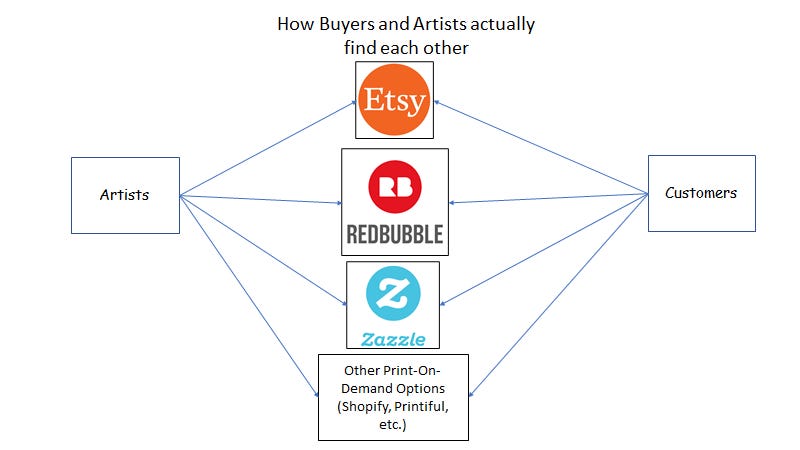

Redbubble's competition is from larger marketplace companies such as Etsy and Amazon with POD divisions, stand alone POD marketplaces (Zazzle, Society6), and POD platforms like Printify and Printful. Companies like Printify and Amazon can hold inventory and operate both the fulfillment and marketplace sides of the business.

Redbubble is larger than any other POD business in terms of GMV, thus offering a scale advantage when signing up artists, but the low friction to sign-up and upload designs leads to artists using many channels to sell their designs. Artists who want to maximize their potential revenue opportunities sell on multiple marketplaces, thus Redbubble is often beholden to the Google search results (explored in detail later). If artists have the same product on multiple sites, Google controls distribution because buyers are still platform agnostic. This effectively turns a potentially differentiated supply of artists and designs into a commoditized. Redbubble still isn’t the go-to site for all POD business.

Redbubble's business is unique because of their focus on the artists. While other POD businesses may play the role of platform akin to Shopify giving artists a ‘business in a box’ to sell their designs, Redbubble plays the role of aggregator, bringing artists together to sell through the marketplace.

I would argue barriers to entry make starting a POD marketplace difficult but not impossible. Companies like Redbubble certainly have a scale advantage, but the capital light nature of the business means it lacks any physical capital moat. Redbubble’s moat lies solely in their scale and number of members since their fulfillment is outsourced. any capital investment for new entrants would be customer/artist acquisition.

Redbubble is the largest artist-buyer marketplace but they continue to compete with similar platforms though the pandemic likely increased the distance between them and their competition. By leading more artists and buyers to the platform, the flywheel continued to spin. Even if sales were juiced by COVID, they likely still managed to convert some customers to repeat customers.

For a point of anecdotal evidence, my introductory experience with Redbubble was last year and though I haven’t created an account, I have bought multiple times and plan to buy more. The idiosyncratic nature of some of their designs make purchases great gifts. A Redbubble membership doesn’t offer any benefits but I still search through Redbubble rather than Google for designs.

Side Note: Two intriguing public companies associated with the POD industry are Kornit Digital (KRNT) and Delta Apparel (DLA). Delta Apparel has a fast-growing subsidiary, DTC2Go, that serves as a fulfiller for print-on-demand platforms like Redbubble. DTC2Go owns the largest network of Digital printing devices in the world which is more sustainable printing method than traditional printing. DTC2Go basically holds the T-Shirts and prints designs on them. DLA could be an interesting value play as their high growth division is obscured by a larger, more cyclical, apparel business. Kornit Digital on the other hand, designs and sells these digital printers to companies like DTC2Go for printing purposes. Both are potentially intriguing stocks, especially DLA due to valuation.

Redbubble as a Marketplace

The primary bullish argument is that Redbubble is a two-sided marketplace with favorable dynamics and a strong brand, especially with artists. Andrew Rosenblum, in his 1Q19 letter, cites a 'maniacal focus on serving the artist community' as Redbubble’s competitive advantage. According to Rosenblum's experience with the company, they are hyper-focused on their artists and have always been that way. Redbubble's artist community is robust with the company giving users the ability to follow artists and rewarding artists that meet certain thresholds. Martin Hosking, the founder and ex-CEO, certainly seemed hyper focused on the artist community. In fact, the original issue at Redbubble wasn’t getting artists but rather finding demand as people often posted designs even without anyone to buy them! One example of their artist-centric approach is the refusal to offer paid advertising for artists because they believe it would lead to newer artists being turned away from the platform. Whether you agree with it or not, they obviously are conscious of any inequities it would introduce and weighed that against the possible revenue benefits.

With this artist centered approach instead of the ‘business in a box’ approach mentioned before, they are the go-to source for new artists but not for all creators. With the creator economy on the rise and influencers selling their merch online, they could be missing a massive opportunity as print-on-demand is a great option for creators to leverage their influence and sell items without holding large amounts of inventory. However, their focus on artists could also be an advantage in acquiring new artists and fostering a great brand.

From my anecdotal perspective as a buyer, I don't know the full strength of the artist community. The lack of loyalty from many artists certainly isn’t encouraging. Redbubble is certainly the first place many artists go for a side hustle/post their designs, but bigger artists selling their designs as more than just a side hustle have little reason not to use multiple platforms.

In addition, Redbubble is growing through new SKUs, which looks like chasing 'vanity growth’ through GMV rather than maximizing happiness with their current base. By constantly introducing new products, Redbubble makes the supply on the platform the products offered rather than the artists. At its core, Redbubble's supply should their artists, not the products they offer.

This is an area of diligence I need help with. I know little about the Redbubble community thus I don't know how well the company treats artists. They seem to have the strongest community among newer artists but have had issues in the past regarding plagiarism and copyright violations from designs.

Let's look at the overall market in which Redbubble operates: Bill Gurley, in a 2012 blog post, lays out 10 factors for marketplaces business. Let’s look at Redbubble through this lens to see if the conditions exist for a successful 2 sided marketplace.

1. Does it offer a new experience vs the Status Quo? Yes, Redbubble morphs the typically difficult business of selling art and enhances the experience for both artists and buyers.

2. Does it offer Economic Advantages vs the Status Quo? Yes, Buyers have less friction to find designs and sellers have an additional source of income.

3. Can technology add value? Maybe, Visual search for artwork is always tedious but Redbubble does allow people the ability to search through thousands more designs than in person. However, this may expose buyers to the paradox of choice where the number of options overwhelm them and leads to dissatisfaction. I wouldn’t say technology makes the art much better, but it makes the experience of buying it better.

4. High supplier fragmentation? Yes, there are millions of artists who can join Redbubble.

5. Friction of supplier signup: Friction is minimal, Now this can both a good and bad thing. If supplier signup is difficult, it can be difficult to aggregate suppliers, but low friction to signup allows competition to sprout. However, Gurley point out that 'aggregating demand is much harder and more critical' so ease of supplier signup isn’t a huge advantage.

6. Is the TAM large? Yes, Sizing up the TAM is difficult and while Redbubble puts it 280B, this includes the entire home apparel market. The likely TAM is smaller, but with only a 1B market Cap, Redbubble doesn’t have huge TAM concerns.

7. Can they expand the TAM? Yes, the previous market for custom designed art is tiny compared to the possible market for Redbubble because they connect artists and buyers from across the world. By expanding access to custom designed art, Redbubble can take share from other sources competing for similar ‘jobs-to-be-done’ like gifting and home décor.

8. Are purchases frequent? No, this is a major hit on Redbubble's business. The average # of orders per customer is only 1.1/year. The low purchase frequency creates issues around customer acquisition and the need to reacquire customers.

9. Is Redbubble part of the payment flow? Yes. Redbubble is more than just a way for artists and buyers to connect, they are the intermediary through which the purchase is made.

10. Does it have network effects? Yes, the incremental customer experience is better than the previous customer experience. More buyers means more artist supply creating a better experience for everyone.

So far, Redbubble scores high with a score in the 8/10 range, but Gurley warns investors of the following: "finding a great opportunity is only a start, and this analysis could easily mislead one into underestimating the critical role that execution plays when it comes to marketplace businesses. Great marketplace execution is more nuanced and less systematic than other venture backed categories, and for every successful marketplace, you will find an amazing entrepreneur that out-executed the many others".

Even though the marketplace dynamics are there for Redbubble to succeed. There are still some potential execution issues with two major ones being repeat sales and their dependence on Google search.

Repeat Sales

This is a key part of Redbubble's story: Can they drive repeat purchases? Over the last 4 years, the % of repeat purchases have remained relatively consistent at ~40%. Coincidentally, Etsy also has similar repeat buyer metrics with ~40% of buyers being repeat purchases.

Note: the two graphs aren’t apples to apples because Etsy has repeat buyers wile Redbubble has repeat purchases.

Redbubble faces a couple issues with regards to repeat purchases. Purchases aren't made often (only 1.1 purchases per customer, FY2019 Report) and the average order value isn't large (hovers around 45$). While the artist community is strong at Redbubble and it holds a fairly high NPS in the mid 60s, driving higher retention and more buying among customers is key to keep the flywheel going.

Two metrics I defined for the company are the repeat purchase conversion rate (RPCR) and the repeat purchase rate (RPR). The RPCR is defined as the additional repeat purchases as a % of new purchases from the previous year (i.e. 35m additional repeat purchases from FY19 to FY20/153m new purchases in FY19). The RPR is the % of repeat purchases of total purchases from the previous year (139 repeat purchases in FY2020/(104+153) total purchases in 2019).

Overall, this shows that Redbubble loses quite a few customers after the initial purchase, converting only 20% of new purchases to repeat purchases (assuming 100% retention of older purchases). However, these numbers are only part of the story and require quite a few assumptions to mean anything. We could be feeling the trunk of an elephant thinking it's a snake.

One may grimace at the conversion rate, but the steadily increasing number of members on the platform is encouraging. Like Etsy, it likely has an increasing retention rate for each year a customer is with the platform (i.e., customers are less likely to churn the longer they are members). To me, the concerning part with Redbubble is the steadiness of their conversion rates. One would hope that these numbers get better over time as the marketplace grows and offers a better value proposition. One factor holding down their retention rates could be the low purchase frequency, so each customer has to be acquired through inorganic means multiple times. There is certainly room for improvement, but it requires execution. I am skeptical of how well new management can drive higher retention rates unless the products are simply bought more often.

Beholden to Google and Inorganic acquisition

The single biggest issue at Redbubble is their reliance on Google Search as a customer acquisition tool which has caused problems in the past. In late 2019, growth slowed to a crawl at the core Redbubble Platform (6%) and management attributed it primarily to inability to acquire customers through Google search. The slowing of growth doesn't show up in the financials because TeePublic grew 42% in the same period. This slowdown could have been just temporary, but the pandemic hit before we could figure that out.

One way to mitigate the Google burden is through Redbubble's App Ecosystem. Beyond just having more customers on the platform, app users are the real 'power users' of the platform. By bringing people into the app, it cuts out organic search and encourages customer loyalty. App usage data is encouraging and growing at > 100%, albeit off of a small base. It represented ~12% of marketplace revenue in FY2020.

Another way to reduce their dependence on Google’s algorithms is through other paid channels such as social media marketing though real organic growth will show up when users of the product start advertising of their own volition. Etsy’s growth trajectory was due in large part to people sharing the items they purchased from Etsy on social media. Redbubble sells Instagram-able products, so it should be able to leverage this organic growth channel. I am inept at using social media so someone else will have to share if Redbubble starts to be shared organically on Instagram. I certainly know laptop stickers are great conversation starters for in person interactions.

Redbubble has another big issue: Visual search sucks. It sucks bad. To borrow an infamous phrase from the Justice Potter Stewart, "I know it when I see it", but I don't know how to search for a design. I can spend a lot of time searching via keywords for a product that might not exist. The worst part of this issue is that art is subjective. Redbubble tries to solve the impossible problem of open visual search. However, Redbubble's scale gives it some advantage: I don't know what I want, but I know Redbubble has the best chance of having it because it has the largest number of designs out there. Even though visual search sucks overall, if Redbubble can aggregate enough supply, it shouldn’t matter because it will be the go to place to search for designs. In addition, they can try and solve this problem by creating artist-buyer relationships as mentioned in the next section

Redbubble's Future Growth

I wanted to talk about future growth opportunities, but this section morphed into a mix of a wishlist as a user.

More Artist Focus: There is room for further emphasis on the artist community with potential initiatives such as a list of trending designs and artists. In addition, a return to a social network like model (the original intention of the company) would offer buyers the ability to develop relationships with artists. I am much more likely to buy something from an artist who I know beyond their designs. Redbubble is slowly making the designs the supply of the platform, but plagiarism and the ubiquity of similar designs make this an increasingly homogenous supply. On the other hand, if they make artists the supply on the platform, the supply could be differentiated. By creating a buyer supplier relationship similar to a Youtuber, Instagram influencer, or podcaster, repeat sales are much more likely. The quality of designs do matter but a relationship with the artist drives returning customers/viewers.

Business in a box: As mentioned before, many POD business have taken the 'business in a box' approach to gathering supply similar to Shopify, where they give people the tools to start, manage, and grow their business (Ex; Printiful). As described earlier, Redbubble takes a different approach, aiming to build a community solely on Redbubble. Redbubble is used as a side hustle rather than a full-time business. If artists want to monetize a following rather than start a following, they should choose a different POD provider. Redbubble is missing a large of the market, but if management chose to shift strategy to tap into this market, I would be worried. Redbubble isn’t meant to create a full-time business, it’s a place for people to connect and find their group.

Licensing: This is where I see the largest opportunity. A substantial problem for Redbubble is monitoring designs for copyrighted content, specifically fanart. An artist can't post a design of a popular TV show without the approval of said TV show. However, Redbubble trying to open the fanart segment of the market by partnering with TV shows and movies. For a full list of their partners, check here.

They don’t have any large brand partners such as Disney, Nintendo, etc, because larger companies can design and sell merchandise but there is an opportunity among fanaticism with smaller brands. Redbubble can effectively crowdsource designs for smaller brands with a fanatic following (i.e. Rick and Morty). No other print-on demand company is doing this well.

Progress is often slow because of the number of lawyers involved thus the concept is still being proven out, but the potential for growth here is high. There is a long tail of brands with a small enthusiastic group of fans, often designing fanart at home. Redbubble gives them the opportunity to express themselves and find people who love the same brands.

Valuation

There is uncertainty surrounding Redbubble's future, but the stock looks neither cheap nor expensive on a trailing Basis. It trades around a market cap of 1B AUD with gross profit in the last 9 months of $184m AUD. The TTM Gross profit after paid acquisition (exactly what it sounds like) is ~$150m AUD.

Management has set lofty goals of 1.25 Billion in Marketplace revenue with an EBITDA margin ~10% in the medium term. If the company can sustain the high growth rates to get there 20-40% and demonstrates operating leverage it doesn't look expensive for a growing marketplace business building up to escape velocity. However, the pandemic may have juiced growth and these long-term goals may just be cannon fodder for analysts on the call.

Modelling Redbubble's growth to me is futile due to the uncertainty surrounding the business. To me, this is a binary stock. Either it works and the stock has a >20% IRR or it doesn’t and the stock stagnates/declines. If it does work, the company will accelerate growth through organic growth channels with favorable marketplace dynamics. If it doesn't, the same flywheel dynamics will push the stock lower amongst deteriorating financials. It isn’t priced for success and certainly not priced for failure.

Conclusion

What's my conclusion? Don't hate me, but I don't know. I wrote this as a starting point for new investors and to get some discussion around the company. Management must capitalize on this short-term boost and maintain their focus on artists to continue to drive growth. I hold a small starter position(<1%) and will add on signs of execution and vice versa. I would want to see Redbubble pursue some of the future growth opportunities I laid out above, lessen their dependence on paid acquisition/Google, and maintain steady growth rates in the >20% range. In addition, I want to see people using Redbubble more often and Redbubble’s member growth continuing to grow.

They may have had a boost from COVID, but it could have been exactly what the company need to kickstart a phase of continued growth. I am taking a wait-and-see approach to the stock. If you believe the recent turmoil is akin to buying Chipotle after the E Coli scare, more power to you. Great brands are often great buys after massive drawdowns due to temporary concerns. Redbubble has a great brand but the acquisition of TeePublic was a horrid move and I don’t know how well the new management can execute.

Side-note on new management incentives: the stock incentives for the new CEO are based on a 10% total return from the date of the options. This seems to bode well for shareholders as the stock price was higher than it is now when he was appointed in November.

I look forward to seeing if anyone has any opinions on the company or the stock. I’ve laid out what I think are the relevant bull and bear thesis, does anyone feel strongly on either side?

Hi Adu, thank you for your wonderful post. I recently wrote something on Redbubble myself (much less visually appealing): https://51win49loon.blogspot.com/2021/07/why-buy-redbubble-limiteds-stock-asx-rbl.html. Do you have any thoughts on the legal issues surrounding trademark infringing content uploaded on Redbubble?

Many thanks,

Martin

Hi Adu, first of all congrats on the post. I think you´ve synthesized very well Redbubble´s pros, cons and the challenges that lie ahead I´ve also been doing my research on the company over the last few months and my conclusion are quite similar. If I had to boil it down to one metric that would be REPEATABILITY. I think that´s going to be my driver of decision going forward which will depend on the execution capabilities of the management team. In any case, If you want to talk a little bit more in detail about the company or discuss all the news and the evolution going forward, I´d be happy to do it. Thanks, Patrick