Stereotaxis ($STXS), A baby Intuitive Surgical?

A turnaround story looking to emulate Intuitive Surgical's success. Will it gain traction?

Robotic surgery is the future. For my first deep dive, I wrote about Intuitive surgical, the Behemoth of surgical robotics. It’s an 80B company which has handsomely rewarded shareholders for 20 years. Even though the surgery done by Intuitive machines is different, we can draw parallels between Intuitive and Stereotaxis given they have a similar business models and growing pains. If you believe Stereotaxis can follow in Intuitive Surgical footsteps, there is a long runway for compounding with an extremely high moat. In fact, I would argue Stereotaxis is the better investment right now given potential for growth, relative valuation, and future improvements in the business.

Selling Coat Racks: the story from the IPO.

Stereotaxis IPO'd in 2004 to much fanfare and the goal of revolutionizing interventional cardiology with Robotic Magnetic navigation of catheters. They sold plenty of systems with lots of hype but similar to Intuitive in its early days, Stereotaxis struggled to find consistent usage of the platform. The technology wasn't ready for commercial use with terrible user experience and large upfront costs. Hospitals realized no one was using this $1.5 million dollar system (which required a new hospital wing) so they stopped buying it. While the Da Vinci system found a use case with prostatectomies, Stereotaxis struggled to find a niche to champion their system. Stereotaxis suffered years of revenue stagnation and high operating costs, thus requiring constant dilutive financing.

After languishing for years, David Fischel took over as CEO and chairman of the board in 2017. Fischel is from DAFNA capital management, a hedge fund specializing in healthcare, and saw an opportunity in Stereotaxis to grow a business with great potential. He's managed Stereotaxis into a cash-rich, debt-free company ready to capitalize on a new wave of innovation. Stereotaxis operates with a minimal operating loss and $43M in cash. He demonstrated his leadership on Q3 earnings call. He mentioned potential opportunities in China and announced a deal with Microport EP to sell systems in China around a month later. Such behavior is characteristic of effective and reliable management.

Fischel may not be an industry veteran or a founder/CEO, but he is an experienced business analyst who knows medical technology. While we're taking a look at Fischel's tenure, we can also analyze his enigmatic and somewhat controversial compensation package. Fischel hasn't taken a salary since joining the company and the compensation plan ties his compensation to the total market cap of Stereotaxis.

"To meet the first milestone, Stereotaxis’ market cap must increase to $1 billion. Vesting of each of the remaining milestones is contingent upon Stereotaxis’ market capitalization continuing to increase in additional $500 million increments. Thus, full vesting of the award is contingent upon Stereotaxis’ market cap increasing to $5.5 billion. The award is designed to provide Mr. Fischel with approximately 10% equity ownership in Stereotaxis on a fully diluted basis if this highest threshold is accomplished."

Each 500m threshold will reward Fischel with 1% of the company in new shares. Modelling a compensation package after Tesla's Elon Musk is controversial with some pointing out misaligned incentives to pursue M&A fueled by stock (increased share count and same share price). However, anyone who has followed Fischel more closely would understand such tactics aren't likely. He manages operating losses well, doesn't over promise, and likely doesn't need the extra money (given he didn't take a salary when he joined the company). I trust Fischel and like the compensation package. In the unlikely scenario we see signs he is taking advantage of the compensation package, I am willing to change my mind.

Interventional Cardiology

Before I describe the business model I want to review interventional cardiology and how it’s a different from other types of surgery.

Stereotaxis doesn't serve the open/minimally invasive surgery and is nearly the sole player in interventional endovascular surgery. Endovascular surgery includes ablations, interventional cardiology, and other interventional applications. Endovascular surgery requires navigation of flexible and winding blood vessels often with rigid catheters. Physicians have to manually navigate these wires through blood vessels from a far off location (directing from the groin up to the heart). Navigational devices must balance rigidity for navigation and flexibility for safety. However, Stereotaxis' magnetic navigation can use a flexible catheter to navigate the vessels which improves safety.

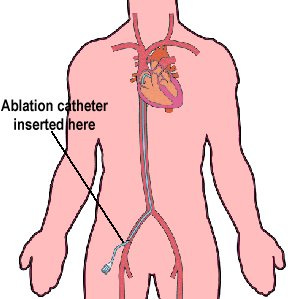

Ablation: Ablations are used to treat Arrhythmias i.e. irregular heart beats (quite literally, your heart can skip a beat). An ablation uses energy to burn part of the heart to stop it from beating abnormally. A catheter (just a device at the end of a wire) is inserted into distant vessel and threaded to the heart (see image). It relies on the mechanical skills of a doctor to push the catheter through blood vessels without tearing them. Once the catheter reaches the heart, the doctor must effectively administer energy to heart tissue to ablate (burn off) the right tissues with constant contact of the heart tissue. By ablating (killing) some tissue, the heart will stop beating irregularly. Stereotaxis' navigation is primarily used in ablation procedures.

For the Stereotaxis, it is important to distinguish different types of arrhythmias. An arrhythmia is an irregular heart of any kind, but it can originate in different locations in the heart. Atrial fibrillation (AF), ventricular fibrillation (VF) and ventricular tachycardia (VT) are all different types of arrhythmias with different treatments and diagnoses. Depending on the arrhythmia, robotic navigation can be more or less useful. Robotic surgery is more helpful for VT, VF, and complex AF since those procedures are more complex.

Other Interventional Procedures: Other interventional procedures in cardiology and neurology use a similar surgical approach where a wire is inserted through a vein far from the intended interventional area and guided manually. Sample procedures using interventional approaches include carotid artery stenting (stents to open up blood vessels) and clearing blood clots in the brain.

Business Model: Razors and Razor blades

Stereotaxis has a similar business model to Intuitive surgical with upfront system sales and revenue from each procedure. They sell multiple products: a robotic navigation system, a visualization tool called Odyssey Cinema, model S X-ray imaging system, and disposables for each procedure.

Magnetic Navigation System: Stereotaxis markets two robotic systems: the Niobe and Genesis. The Niobe is their legacy system while the Genesis is the new system released just last year. A robotic navigation system costs $1.5-2.0 million upfront and requires a hospital to build a separate wing to house large magnetic fields from the robot. The differences between the Niobe and Genesis system are subtle but innovative. The Genesis system is smaller, easier to install, and quicker to maneuver. The Genesis can be installed with a regular fluoroscopy (X-Ray) system to perform standard procedures so hospitals don't have to build a wing solely for Stereotaxis. One problem with the Niobe system were the 5-7 second delays between ablations as a result of the technology, but the Genesis cuts this delay down by 80%+. EDIT: Based on conversation I had, the delays were 5-7 seconds, but software has reduced this lag down to one second which genesis further reduced by 80%. However, construction still requires a new wing and is expensive. (source)

Odyssey Cinema: Beyond their navigation system, they also sell Odyssey Cinema, effectively a hub for physicians to monitor physiological details, visualize patient anatomy, and navigate catheters remotely (from another room). The system allows procedures to be recorded and displayed either in real time or on playback.

Model S Imaging system: The largest issue for installing a new Stereotaxis system is the construction requirement. For a new Niobe system, a hospital must build out an extra wing to house magnetic shielding equipment solely for the Niobe. While surgical robots for thoracic surgery (think ISRG) can be used in any operating room, a Stereotaxis system uses large magnets which requires shielding. Stereotaxis attempts to reduce this startup friction by selling a complete X-ray imaging system along with the RMN robot (the Model S imaging system). This allows hospitals to use the Stereotaxis system without dedicating a new wing to only robotic procedures. The new wing can do standard and robotic procedures if needed. The total cost of construction is the same as a regular X-Ray lab + the cost of a Stereotaxis robot, but doesn't require additional building costs.

Disposables: The primary disposable is the QuikCAS disposable. Stereotaxis also receives a royalty from J&J for cases where that catheter is used. However, STXS is developing a catheter in-house (expected next year) to increase per procedure revenue and improve catheter performance. A catheter designed specifically for robotic navigation will perform better than a similar one designed for manual navigation and outfitted with a device to make it compatible. Mapping systems are developed by multiple companies and used to give doctors a map of anatomical structures to monitor the procedure in real time. I encourage you to read Kerrisdale Cap's report on Acutus Medical ($AFIB) for an in-depth examination of a cardiac mapping company.

Open Platform: STXS wants to be an open platform for any mapping system. Even with several companies mapping systems, each procedure can be done with a Stereotaxis system. Stereotaxis wants to own the rails, not the trains. By owning the system itself, it provides a larger moat than selling solely catheters or mapping systems.

Robotic Magnetic Navigation Pros/Cons

Naturally, the next question to ask is "why robotic?"

Con: Added Time: For a standard AF case, robotic navigation is often slower (source) One Electrophysiologist who used the system saw little utility in using a more expensive robotic system that may add 30 mins to the procedure (times were cited by him). For more complex cases such as Ventricular Tachycardia, robotic navigation can actually decrease the time of procedure because of the complexity of ablation. Operator training is an important factor to consider for procedure timing. Although common perception is that robotic surgery is longer, experienced centers have skills/techniques to reduce procedure times (source). As better techniques are developed, efficiency will continually increase (~15:00 in this video) and increased training reduces procedure times. One RMN advocate, Dr. Tirok, developed efficiency techniques and a training program which replicated his results. Automation of movements is another potential solution for longer procedure times.

Pro: Constant Contact: Constant contact with cardiac tissue, key for ablation, is easier to achieve robotically than magnetically. See the video below for a visual of the difference between robotic and manual navigation

https://www.roboticep.com/toolkit/OldPhysiciansVideos/Catheter-Stability-Comparison.mp4

Pro: Cognitive Surgery: Navigating through a tortuous set of blood vessels requires extensive mechanical skill. Robotic Magnetic navigation shifts skill to the mind of the doctor rather than the mechanical abilities. When a doctor uses RMN, they are separated from the patient and navigating like a video game player thus it takes little mechanical skill compared to manual navigation.

Pro: Less X-Ray exposure: The doctor also incurs much less radiation with robotic navigation. When an electrophysiologist sits in an EP lab to perform an ablation, they receive a great deal of radiation exposure and shielding equipment creates long term orthopedic issues (Source). With remote navigation, a doctor is in a separate room. It's hard to imagine a doctor switching back to the physically demanding manual navigation after transitioning to the less demanding, less damaging robotic navigation. Some younger doctors may find pride in doing manual navigation, but the toll of a standard EP lab builds over time.

Con: Added Costs: Total costs for robotic ablation of atrial fibrillation is about double compared to manual ablation coming in at 12,000-15,000 dollars(assuming a 1200 case 6 year depreciation period for the robot). The actual disposables for Stereotaxis in each case cost ~$1500 (source). If we look at 2019 numbers, they received ~$26M from disposable revenue. With an installed base of 123 systems doing ~100 procedures per year, the disposables revenue per case to stereotaxis is ~$2100, in line with the scientific article plus any royalty fees. Adding a mapping system for the surgeon adds 3-7k per case. Robotic navigation is cheaper than other advanced interventions but still fairly expensive. I couldn't find many sources of information on VT vs regular ablation (a major market opportunity for Stereotaxis), but return on costs for robotic is higher for VT.

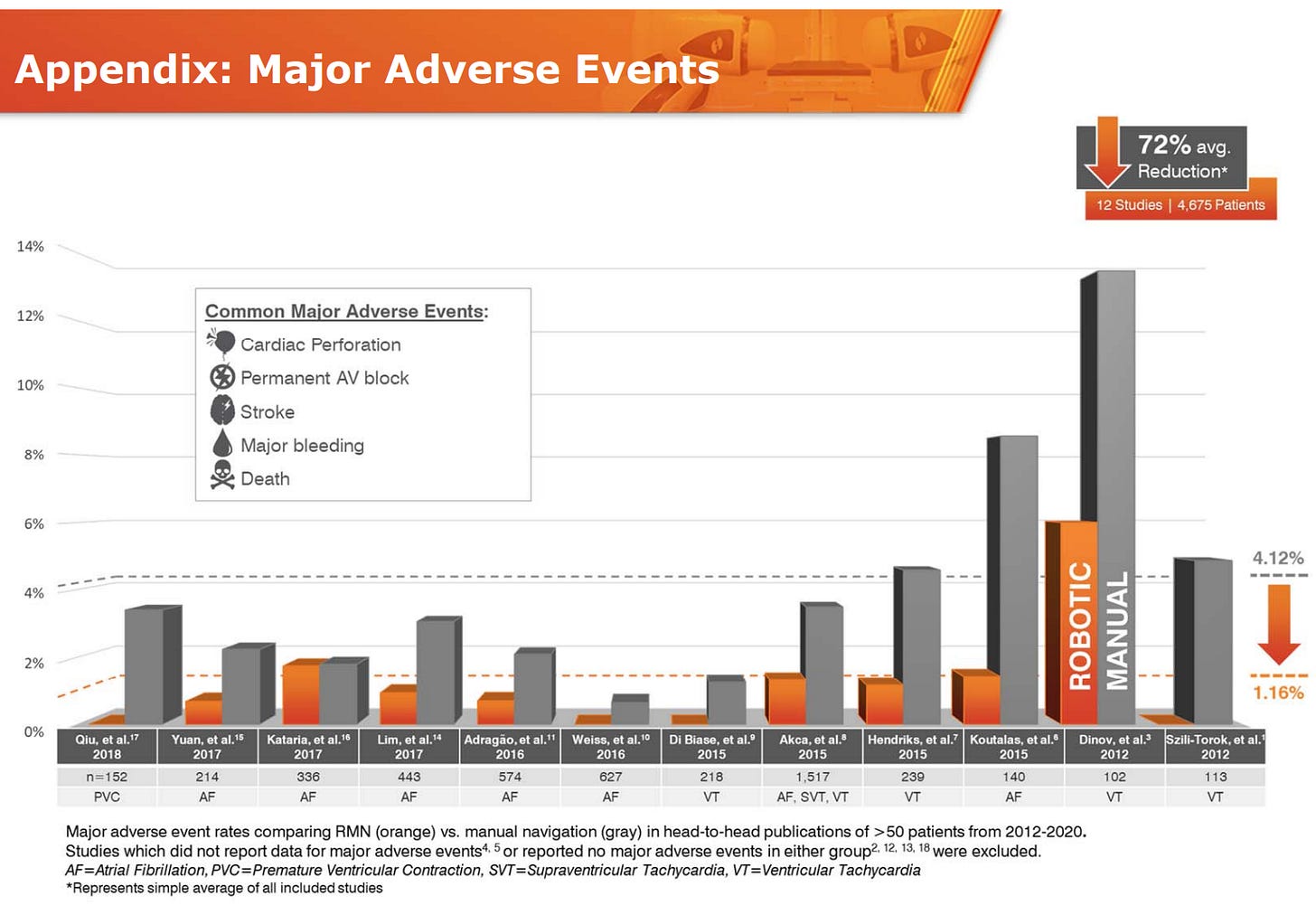

Pro: Less Complications: Does robotic navigation lead to better outcomes? The short answer is yes, but only if one is trained well on the system. As with procedure times, increasing training increases decreases complications. Intuitively, the robotic system should lead to better outcomes because of increased comfort for the surgeon, advanced automation techniques, and catheter design (magnetic catheters are soft rather than hard so there is practically no risk of perforation). However, proficiency in roboic navigation takes time and can be frustrating. Still. many studies have shown a reduced rate of complications

Keep in mind these studies are often with experienced operators so real world outcomes can differ. As more people are trained and automation technology improves, so will outcomes. Once again, RMN is most beneficial and used most widely for complex arrhythmias and ventricular tachycardia

Con: Training times: Based on a conversations, it takes 50-100 cases to become good at robotic navigation. Assuming a 100 cases/year (likely less for many centers who haven't widely accepted the technique), this means 6-9 months of training to become good. Such a long training period is difficult to stomach even if there is a light at the end of the tunnel.

Competition:

Beyond manual ablation, competition can be further brokwn down

Direct competition from other robotic navigation systems

Alternate therapies for arrhythmias (Drugs)

Advanced ablation methods (Can abstract the need for Robotic Navigation

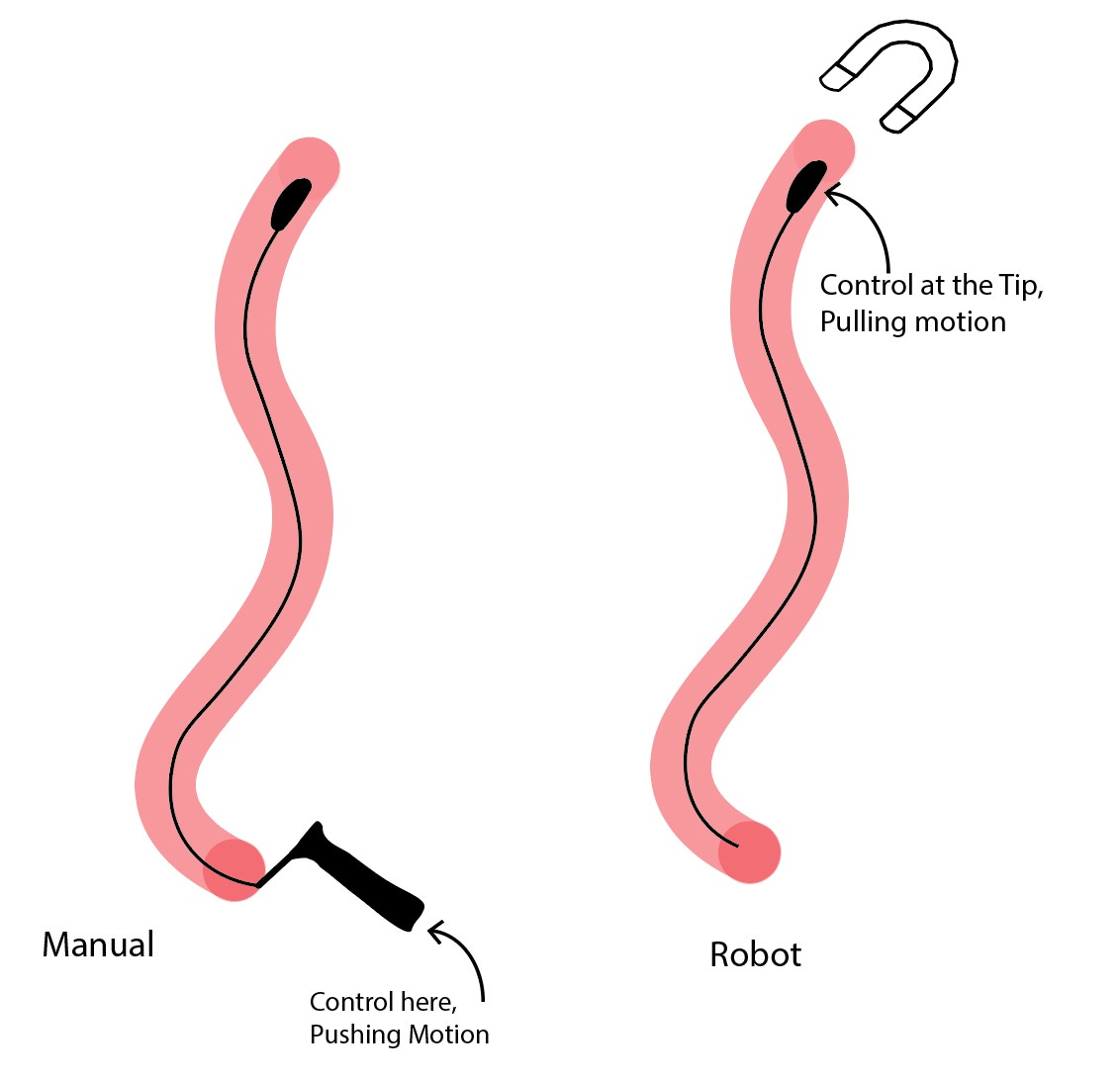

Direct Competition: There are two commercial systems available for EP procedures: the Sensei X (Hansen Medical) and the Amigo RCS (Catheter precision). Both have downsides and do not represent a serious threat to the platform Stereotaxis is building. The Amigo System is intended only to perform remote navigation so surgeons do not receive any radiation exposure. It's basically manual navigation from another room so the technology is severely limited. Not to generalize, but their website doesn't inspire confidence (Website). Sensei X is owned by a large company, Auris Health, with a founder experienced in robotic surgery (Fred Moll, Co-founder of Intuitive), but still has some issues. While the Stereotaxis uses magnetic navigation and pulls the catheter, the Hansen system pushes the catheter intending to mimic a surgeon's original movements. Sensei is more portable, responsive, and easier to learn but there is little mechanical difference between it and manual catheter navigation. A Stereotaxis system is more automated with mechanical advantages. (source)

Anti-Arrhythmia Drugs: Another form of competition is indirectly from anti-arrhythmia drugs. Historically, drugs were used to treat arrhythmias, but these led to high rates of recurrence (the irregular heartbeat returns) coupled with lots of side effects (source). Ablation was an underappreciated and understudied intervention since its invention in 1987 until the late 2010's. Now, ablation is recommended for most cases of AF and new evidence is emerging on the effectiveness of ablation for VT (source). Ablation is widely used for AF and I expect VT to follow in its footsteps. For example, ablation procedures increased by 10x over the past 20 years in Sweden with AF being the primary driver (100x more ablations for AF). VT ablation is in the middle stages of adoption and will follow a path similar to AF as ablation is widely adopted.

Pulsed field Ablation: The third bucket of competition are new technologies which increase procedure efficiency without requiring robotic navigation. Pulsed field ablation is a new innovation which could revolutionize the ablation industry. The technology selectively ablates cardiac tissues and makes procedures shorter, easier, and safer. It essentially abstracts the need for robotic navigation because it provides similar benefits.

However, PFA is only currently available for AF, so the VT market (where Stereotaxis dominates) is still open. One Electrophysiologist I spoke to even commented that PFA may have some mechanistic issues for ablating VT. I messaged David Fischel about PFA and he responded with a couple key points: A) PFA will take time to grow (5-10 Years) B)Robotics may turn out to be more important with PFA because of a requirement for constant contact, and C) a PFA catheter could easily be used/developed with Stereotaxis. I could see PFA abstracting the need for robotics in the short term, but I don't believe that robotics won't be the future. I see PFA as merely one roadblock to accelerating adoption.

Stereotaxis is a near monopoly with an increasingly effective solution and will likely play a large role in the future of endovascular surgery

Total Addressable Market

We can break the TAM into 2 segments: systems and disposables. The systems TAM is relatively straightforward. With 4,000-5,000 EP labs, the total TAM could be 8-10B ($2m system sale). However, a robotic system isn't warranted for every lab. I would expect ~20% of labs eligible to buy a system (costs and system requirements) putting the system TAM at 1.6-2B. Obviously, the new genesis system increases their addressable market by integrating a fluoroscopy solution (normal X-Ray), but there is still plenty of greenfield opportunity any way you slice it. Upgrades to the system which can be expected every 8-10 years provide 160m-250m in annual opportunity.

Disposables: Stereotaxis receives ~$1,500 in disposables per procedure and $300 in royalties. They perform about 100 procedures per system with an installed based of a little over 100 systems. In 2020, there were 360k ablations in the US (240k AF, 120k other, Source). Based on a number of conversations, the split between regular AF and complex AF/VT is about 55/45 meaning there are ~162k US patients where robotic navigation shines. Given there are about equal numbers of EP labs in the US and abroad, we can assume the worldwide TAM is double and concentrated in developed countries. Overall, STXS has only ~1.5% market share. Even if we assume they aren't used for regular AF procedures, they are less than 5% penetrated. At $2000 per case, the worldwide TAM is $648m based just on VT.

The new Catheter: Stereotaxis is developing a proprietary ablation catheter for use in robotic surgery. Instead of outfitting a standard catheter with their disposable set for navigation compatibility (from 2008), the in-house catheter is designed for robotic navigation and solves issues with navigation while increasing revenue per procedure. Each catheter will add $2500 in (high margin) revenue per case since they will receive all proceeds for the catheter instead of $300 in royalty fees. This means the TAM for just complex arrhythmias and VT shoots up to 1.3B worldwide. Originally expected later this year, approval is now set for 2022 in Europe and 2023 for the US (supply chain and manufacturing issues)

Increased need for Ablation: Those may underestimate the total market opportunity if we look out 5-10 years. There were an estimated 33 million people with AF in 2010 affecting 2-6 million in the high income countries. The prevalence of arrhythmias is only expected to increase over time as developing countries gain access to new diagnostic technologies and wearables improve awareness of arrhythmias. As Russell peters commented “people in Africa haven’t heard of lactose intolerance”. Arrhythmia is an issue for those privileged enough to worry about (or have an Apple Watch to diagnose it). Awareness of such a disease will only increase over time (source)

New Applications: The slide highlights an additional 10B in applications beyond endovascular surgery, but I have little insight into the nature of an immediate expansion, One could use magnetic navigation for interventional approach, but Stereotaxis wants to use it for endoluminal and interventional neurosurgery such as biopsies and clearing aneurysms. I can't underwrite this segment with much accuracy so I'd rather use the new applications segment as a "call option"

Valuation

Little Intuitive Surgical?

A note for those turned off by valuation above 10x Sales: I suggest you read Joe Frankenfield's thread here:

Of the 50 US companies with a 15 Yr IRR > 20%, only 2 had a P/Sales above 10, ISRG and REGN.

ISRG started with a P/S of 10.9 and returned 20x starting in 2006 (22% IRR). The model of sticky system sales and high margin recurring revenue is a useful heuristic when valuing STXS.

Numbers to the Story

I rarely model a full DCF and would much rather know which metrics matter and which metrics I can predict so let’s start with the metrics that matter

Systems sold and the total installed base: The revenue from each incremental system sold isn't as important as the total installed base. The company expects $11 million in system revenue for the 2021 and double that for 2022 driven in equal parts by system upgrades and greenfield systems. For 2021, there will be 7 total systems with 5 greenfield systems and for 2022, Fischel estimates low to mid teens systems sold. Overall, there is ample opportunity for new systems if they can get over the mental block some EP labs may have when buying a Stereotaxis system. New system sales in a large medical center in China is encouraging since Chinese medical centers may have less biased view on Stereotaxis and choose to make decisions on data instead (Source: Q2 transcript)

Procedures per system: The average number of procedures per system is currently ~100, but this number has lots of room for upside and is largely skewed towards some heavy users. For example, the new Genesis systems have a procedure run rate of 200/year and represent “power users” of the system. With an average of 100/year, this is only one procedure per three days meaning there is plenty of opportunity to perform more procedures robotically.

Revenue per procedure: We know the current revenue per procedure is around $2000, but with the introduction of an in house catheter, that should jump up substantially, possibly to 4000.

Margins on those revenues: The margins on systems sales changes from year to year and obsolescence charges can even make the system gross margin negative (they have to write off inventory which counts as a loss). However, if we look at historical numbers, we can expect system sale margins of 40-50%. Recurring revenue has gross margins of ~85%. Overall, if Stereotaxis can scale procedures, EBIT margins can reach 30%.

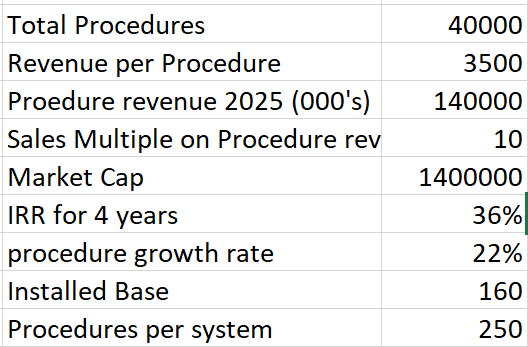

We can build a fairly simple model out to 2025: If we assess only VT market, we can expect Stereotaxis to dominate. With 120,000 VT procedures, let's say they capture 40,000 of these procedures in 4 years, a fast but reasonable 21% growth rate from 2019 numbers. If we assume they grow their installed base to 160 from 110, this requires 250 procedures per system, also reasonable. Placing a 10x sales multiple on the 140m (assuming 3,500/procedure) high margin recurring revenue, the MC is 1.4B, a 36% IRR with 300% upside.

I started with a much more complex model trying to analyze the each ablation market (AF vs VT) and the TAM for installed systems, but Stereotaxis is nowhere near their total addressable market. This is a company where complexity obscures the opportunity. The main questions are:

Can it capture the VT market?

How fast will it capture the market?

Can they create an in house catheter?

Other companies highlight relative undervaluation:

Corindus Vascular robotics, a maker of robotic systems for vascular surgery was acquired for $1.1B in 2019 with only $10M in revenue. Mazor robotics was acquired by Medtronic for $1.7B in 2018 with ~$55M in revenue. Even Asensus Surgical, a small player in a competitive market with a terrible product is valued comparably to Stereotaxis with a $417M Market Cap (< $5M in revenue). Procept robotics is valued at $1.7B on $30M in annualized revenue. Vicarious surgical sports a market cap of 1.5B on no revenue. Need I go on?

What stops this company?

I see three main risk factors:

New technologies simplify manual ablation: RMN is most useful for complicated ablation procedures, but new technology is constantly in development both to prevent arrhythmia and simplify ablation. Pulsed field ablation could simplify all ablations and reduce the utility of RMN. However, there are potential limitations for PFA use in VT and any innovation will chase the larger and simpler regular ablation market

Reimbursement Cuts for Ablations: In a recent proposal for the 2022 fee schedule, the Centers for Medicare and Medicaid Services(CMS) cut reimbursement for ablation procedures. The exact details are difficult to comprehend, but Heart Rhythm Society (a group of Electrophysiologists) sums it up well.

The proposed cuts are 30% for most procedures which hurts the more expensive robotic surgery. Still these cuts are mainly for AF and VT ablation reimbursement was cut by 5%. VT ablation remains difficult so reimbursement is high.

Adoption of New Systems: Adoption hinges using innovation and published data to clear the bas taste hospitals have in their mouth. Unlike IBM, people will most certainly get fired for buying a Stereotaxis after a history of underuse. In addition, doctors hate switching from the status quo if unnecessary. Further, young doctors may not understand the toll of manual navigation, thus find little use in the slower, harder to set-up Stereotaxis system. In addition, proud doctors believe they can perform any surgery adequately without any help. 99% of doctors believe they are above average (no source, just a hunch).

Growth Opportunities

Three stand out to me: improved margins allow increased sales expenses, automation and collaborative surgery, and further improving outcomes.

Margins allowing for more sales people: With the current margin profile and responsible nature of Fischel, Stereotaxis is limited in their marketing activities. With a new catheter, the incremental revenue will allow them to assign one sales person to each hospital, a more common system, which would drive even more growth.

Automation & Collaborative surgery: Stereotaxis' goal is make surgery cognitive rather than mechanical. By accumulating data, they can start to automate parts of surgery. The collected data can be used to improve surgery by providing feedback to doctors. Telesurgery is hyped, but completely remote surgery is difficult to execute with minimal benefits. Instead, Stereotaxis is pioneering collaborative surgery where surgeons can consult experts remotely during surgery. It may not apply during every case, but it could prevent complications in tough cases.

Outcome improvement: Robotic surgery will only get better over time. As they introduce innovations with new catheters and upgraded systems, patient outcomes will improve. At some point in the future, it may well be irresponsible for doctors not to use RMN for complex ablation.

Putting it all together

We have company which came public without the right technology to commercialize effectively. A new CEO kickstarted innovation pointing toward a brighter future if they can execute. If you missed the boat on $ISRG, $STXS could be the next robotic surgery giant.

Disclosure: I own a small amount of shares, willing to add on execution and/or stock continuing to drop. Do your own Due Diligence

Medtechs, microcaps, and memes