Transmedix (TMDX) Deep Dive

Founder led Co. moving the transplant world beyond a cooler and at an inflection point.

Just as with the previous deep dive into Intuitive Surgical (ISRG), here is a link to a word doc with the writeup: TMDX Write-up

and the excel doc where you can edit the model and assumptions: TMDX Model

Sadly, I don’t have an interactive TactyC model like MBI deep dives so a protected excel sheet will have to do for now. The excel has a “EDIT THIS SHEET” to edit with unlocked rows label “EDIT THESE ROWS/CELLS”.

History and Business

When organs are transported like drinks for a picnic, we have issues.

The simplistic nature of organ transport methods cannot be overstated relative to the advances made in critical care. We are trying to abstract the need for open heart surgery with aortic valves. We are moving dialysis into the home. We can keep patients alive longer than ever before with a combination of drugs and devices. Yet……organs still go in coolers. The technical name is “static cold storage” but it’s easiest to conceptualize as a simple cooler.

Successful organ transplantation in humans started in 1954 when Dr. Joseph Murray successfully transplanted a kidney between twins. The mechanism of organ rejection was unknown, so most organ recipients didn’t survive past 30 days, but the recipient in this case lived for 8 years post-transplant (since they were twins)! Through years of research, physicians discovered better ways to perform transplantation and the mechanisms behind recipient rejection. Wikipedia has a useful timeline of key developments.

However, cold storage remains the gold standard for transporting organs though one shouldn't mistake the simplicity with complete ineffectiveness. Cold storage is cheap and developed protocols are highly efficient leading to nearly 150,000 transplants worldwide in 2018. Yet limitations remain. The primary limitation of cold storage is ischemic time of organs where the organ is receiving no blood flow. Cold storage means ischemic time starts immediately post donation and ends with transplantation limited the potential distance one can travel to get donated organs. A secondary concern is an inability to donate less than perfect organs. While not an inherent limitation of cold storage, many organs can go unused due to imperfect donor characteristics and differing guidelines for donation.

Transplantation is an effective treatment for end stage organ failure, but a lack of supply has limited our ability to use it.

Enter Transmedics

Transmedics was founded in 1998 by the current CEO, Waleed Hassanein, who saw the limitations of organ transplant technology firsthand during his residency at Georgetown in 1994. He took the leap to create his own company, building the first prototype out of parts from a local hardware store. The road to here was difficult yet straightforward: they ran clinical trials and refined the device en route to FDA approval.

The Technology

Transmedics' deice is the Organ Care System (OCS) for transporting organs. The OCS uses warm perfusion to extend the lives of donated organs. While cold storage simply transports the organ on ice, Transmedics flushes a warm solution akin to blood ("perfusate") through the organ to reduce ischemic time. Using such an approach has several proposed advantages beyond reducing ischemic time. Transplant teams can measure physiologic metrics allowing quantitative evaluation of organs and the OCS has potential to deliver drugs to organs and improve organ quality. Although other companies use perfusion methods to transport organs, Transmedics' Organ Care System is the furthest developed. Both the perfusate and device design are unique to Transmedics. The OCS is a platform technology to increase organ utilization. The investor presentation lays out increases in organ utilization.

Two types of donors

There are two types of organ donation: donation after brain death (DBD) and donation after circulatory death (DCD). DBD means the patient is declared dead in the brain, but the organ continues to be perfused (cardiac output is maintained while the transplant team preps the organ). DCD refers to donation after the heart has stopped beating so perfusion stops immediately. DBD donors are preferred since the organ is perfused for longer, but the number of DBD donors have declined as treatments for brain injuries have improved. DCD donation guidelines for the Lung and Liver are more stringent and DCD hearts aren't accepted with cold storage (source). The organ care system is key to increase utilization of DCD organs as the supply of DBD organs decreases.

Note on the Opioid crisis: The opioid crisis was surprisingly a boon for organ donation due to increased supply of organs. Someone who dies from an overdose at 35 has quality organs. (source)

Business Model

Transmedics sells their OCS in an all-too-familiar razor/razor blade model where hospitals buy a reusable organ care system console and single use disposables for each surgery. While traditional cold storage is essentially free, the OCS console costs ~$270k and disposables cost ~$45k/surgery. (source) Each organ has approximately equivalent costs per disposable.

Summary of overall advantages:

Increased usage of organs

Decreased ischemic times

Ability to monitor organs

Disadvantages:

Increased cost

Upfront training required on the system

Extended criteria organs may have worse outcomes

The story is at an inflection point with expected approval for the heart and liver upcoming and Lung fully commercialized. Given each organ has different specifications, use cases, and approval, it is prudent to look at each organ independently.

Clinical Data: Lung, Heart, and Liver

Each organ is in a unique step of commercialization with distinct clinical data.

Lung Clinical data and approval

The Lung organ care system is the farthest along in terms of commercialization with full FDA approval for extended criteria donor lungs and regular lungs. Lungs are theoretically the ideal organ for DCD donation because they can tolerate a lack of circulation given an adequate supply of oxygen yet utilization is still very low (20-30% of donor lungs). The organ care system increases utilization to 87% (EXPAND Lung Trial). However, the organ care system has yet to demonstrate superior results transporting the same organs as cold storage (source).

Heart Panel + Expected Approval

OCS for Hearts is a hotly contested issue with what I would call a fairly contentious panel meeting on the topic in April. In the end, it was recommended for approval by a narrow margin but there were a number of legitimate concerns.

OCS uses lactate as a measurement for heart function, yet this is unproven (even Dr Schroder says it can be useless in this video (32:30 mark))

The Expand trial had no control arm with both sides presenting good arguments on ethicality and feasibility of such an approach (the FDA did recommend to Transmedics to have a control arm yet Transmedics didn't have one).

If the device is approved for a broad label, indication creep may lead it to being used in situations where cold storage has equivalent or better outcomes. It’s still unclear if the OCS is better for hearts currently being transplanted (better donors with short ischemic times).

The Duke center performed many of the transplants and results were slightly better for the top notch Duke team.

The 12 month survival on the transplant list is 3% (overall about 6% mortality considering those that drop for various reasons) and 1 year survival in the EXPAND study was 85%. While overall, 30% of the list dies waiting, it may be worse for some to take an extended criteria heart in terms of 1 year survival. Longer term data would likely prove a transplant better in terms of survival. This point isn't great and ignores the artificial constraints hospitals place on transplant lists (discussed in the TAM section)

Transmedics presented cardiac related mortality as a key metric (0% cardiac complications), but the FDA was more interested in all cause mortality which was different.

The panel was also anal about study design, but I felt concerns were overblown and missing the forest for the trees. More hearts means more saved lives even with lower survivability

If you want to waste a Saturday afternoon, I suggest reading through the transcript on the FDA panel website here. The panel voted, albeit by a narrow margin, positive on every question of safety, efficacy, and benefit-risk. I won't belabor the panel discussion since FDA approval is expected so soon. The most legitimate concern brought up is mortality with extended criteria hearts. One expects worse hearts to lead to worse outcomes even if the OCS is better than cold storage simply because of the quality of the heart. It may not hinder approval since survival is so good for transplant patients, but not all hearts will lead to acceptable outcomes. This point is discussed later.

FDA approval will likely happen by the end of September and I expect it to restrict the device usage to extended criteria hearts with ischemic times greater than 2 hours though FDA approval could happen for all DBD hearts.

DCD trials are ongoing with a supplementary FDA submission expected in 2022. A supplementary submission is an add on approval to a currently approved device. Results are encouraging (based on Dr. Jacob Schroder's comments) so I expect approval. Expanding the indication to DCD hearts would be a game changer since DCD hearts aren't used at all right now.

Liver Panel + Expected Approval

The liver program is in a similar position as the heart with approval expected in the coming two quarters. Similar to lungs and unlike hearts, DCD livers are sometimes used and approval for the OCS in extended criteria livers means approval for both DBD and DCD livers.

The liver OCS is different than the other two because it seems to demonstrate superiority rather than just non-inferiority. The liver PROTECT trial demonstrated superior outcomes in terms of for both primary(early allograft dysfunction) and secondary outcomes (LT biliary complications). Surprisingly, survival was the same in both arms so some surgeons may not believe in superior outcomes. The Liver FDA panel was much less contemptuous with near unanimous positive voting results across the board.

Though the FDA doesn’t always heed the advice of the panel (@aduhelm), I expect full approval for the OCS in Livers. The superiority results have clinicians especially excited and Transmedics was voted the top presentation at the American Transplant Congress (source)

Improving the system: The progress the OCS has made since 2018 is notable for the liver program. Machine perfusion was thought to be promising yet equivalent to cold storage in liver transplants. Now, with additional engineering progress, the OCS improves outcomes in many cases and may eventually become even better in all cases.

This is key to understanding any new and innovative solution. The promise of new technology isn’t always in the current iteration. Competing against a static target in terms of cold storage inherently favors the dynamic nature of an ever-improving machine perfusion system.

Superiority vs non-inferiority: Non-inferiority isn't superiority. While safety is required for FDA approval, superiority is what makes replacing cold storage worth it for hospitals.

Industry, Commercialization, and Competition

As with the ISRG write-up, the industry section makes up the bulk of the write-up. We know the business history and the status of each organ on the OCS so now we'll talk about the following:

The Total Addressable Market (TAM)

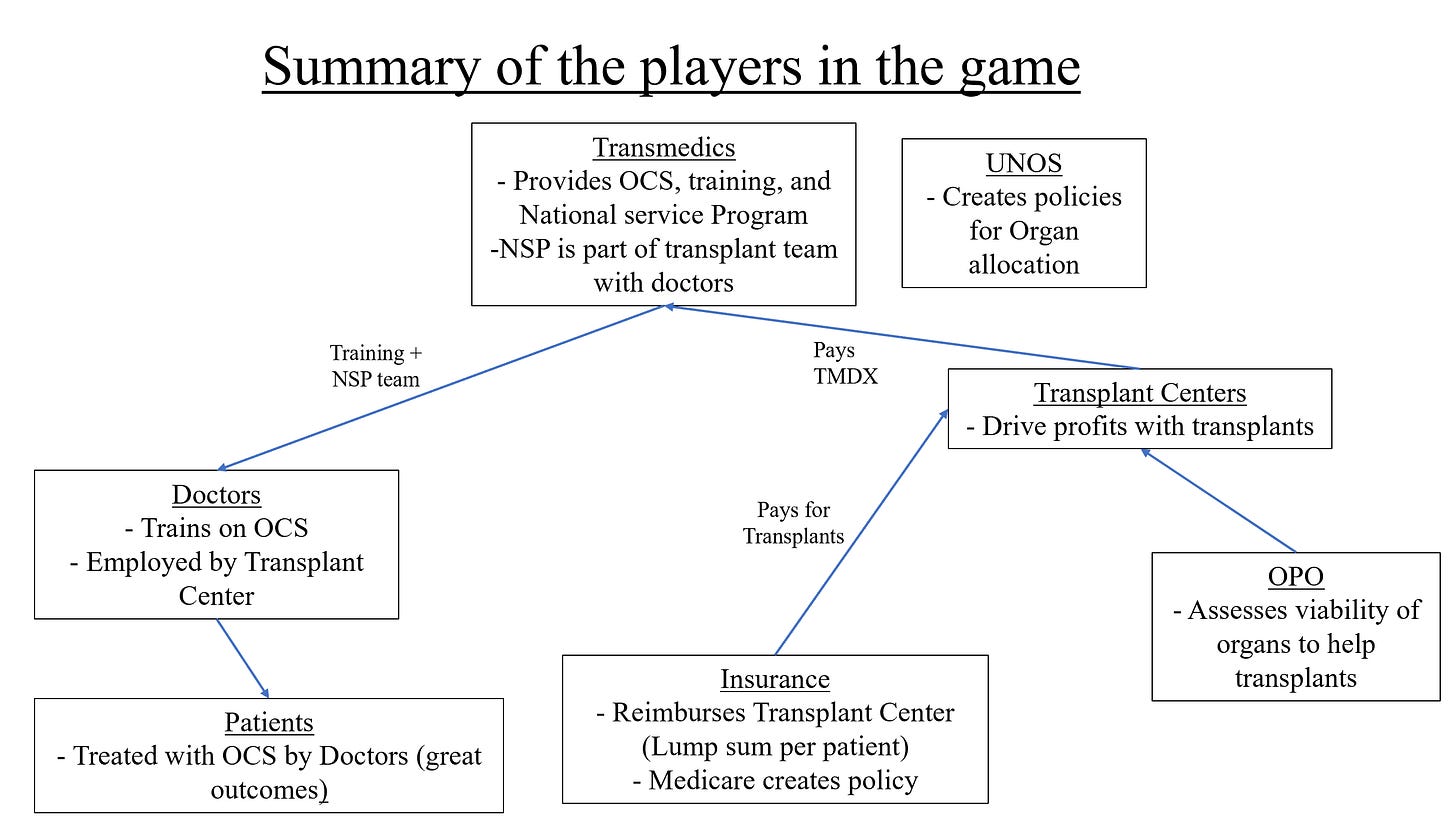

Commercialization considerations including inter-organ differences in rollout, the reimbursement landscape, the national service program, and other considerations for people involved in the game.

Competition

TAM consideration and transplants for solid organs: From the Investor presentation, the TAM is ~8B assuming all eligible organs (both DBD and DCD are donated and transplanted). There are two questions to ask: Does demand match potential supply and how much of the TAM can Transmedics capture?

The estimated TAM comes from the pool of possible donors. A skeptic would point out that yearly waiting list additions (according to UNOS) are multiples less: 13.5k for the liver, 4.7k for the heart, and 3.2k for the lungs. The overall number on the waiting list are currently 11.9k for the Liver, 3.6k for the heart, and 1k for the lungs. In 2019, there were 8.9k Liver transplants, 3.5k heart transplants, and 2.7k lung transplants. All the numbers are purely US stats.

If we use the total number of yearly additions to the waiting list, the TAM dramatically shrinks from 8B to ~1B. However, one must dig deeper to answer whether not demand matches supply.

Artificial constraints: Hospitals manage down their transplant waiting list for better optics.. A hospital's reputation is compromised if 70% of people on waiting list die while on it. For most organs, transplantation is the best option for end stage organ failure to extend lifespan. Transplantation is often indicated for end stage organ failure in younger patients (< 60-70 yrs old) where survival is maximized.

Transplants for Lungs: Current indications for lung transplants boil down to the following: expected survival at 2 years less than 50% due to a variety of lung based diseases including COPD and Cystic Fibrosis. From 2012 to 2017, the number of lung transplants increased as people with more severe diseases were place on the waiting list to match an increased number of donors (source). Science around transplantation continues to improve, but long term mortality is relatively constant given the worse recipient profile of those being placed on the waiting list and nature of complications (source). Median mortality is 6.2 years and if one survives past 1 year, the mortality is 8.3 years (vs <50% survival at 2 years). The literature is sparse for cost-effectiveness (let me know if you know of one), but the rubber will meet the road eventually for choosing other treatments. Transplants won't be the best therapy for each incremental organ as both recipient and donor organ quality worsen. The timing of transplantation is key and other therapies that exist for the same indications will impact demand for transplants (source). The uncertainty around the exact number of people worth transplanting makes estimating the real TAM difficult. However, given the total number of people with end stage lung failure, the TAM shouldn’t be a near term issue. It may not be 66k/year, but it is multiples larger than the current 5k.

Transplants for Heart: Heart transplants is indicated for end stage heart disease and holds greater acceptance among surgeons than transplantation in the lung. The current strategy is to screen patients for a transplant and use a Left Ventricular Assist Device (LVAD) as either a bridge to transplant (because of a supply shortage) or as the final treatment (if they don't qualify). (source). However, survival is actually better for those placed on the waiting list, even without using the 'bridged' approach (source). Only 9k LVADs are placed per year in the world, though estimates for patients ineligible for medicative therapies for ESHD can be as high as 250k (source). A recent article highlights ~50k patients eligible for LVAD/transplants. (source) and another points out 125-250k eligible for LVAD or transplantation (source). The main takeaway is this: Demand drastically exceeds potential supply and acceleration of growth will be fast since transplants are recognized as an effective treatment.

Transplants for Liver: With nearly 17k liver transplants/year and the 67k potential donors, verifying the TAM is less of an issue as scarcity of organs is still the major limit on transplants (there is less a difference between current transplants and potential demand). End stage liver disease affects nearly 5.5 million people and causes 40,000 deaths per year. Transplantation has a significant survival advantage (source) and would be used more often if given the opportunity.

Bottom Line: Transplantation is an effective treatment for end stage organ failure and severely limited by supply of organs. Skeptics may argue demand doesn’t match potential supply, but the number of people with organ failure vastly outnumbers organ donors. Transmedics has a monopoly on incremental (extended criteria) organs in the heart and the liver, where demand and clinical acceptance of transplants are the greatest. Need for transplants is evidenced by demand matching an increase in supply (due to the opioid crisis and better transplant methods).

Other Commercial Factors

Capacity for Transplants: The speed of acceleration hinges not only on potential demand, but also the capacity to transplant more organs. Even though Transmedics can sell a million systems a year, I would theorize the current transplant infrastructure is insufficient to meet such a stark increase in demand. The National Service Program (touched on next) mitigates this potential ceiling by training people on the OCS. However, both transplant centers and the number of transplant surgeons will cap potential growth in the total number of transplants. Initial rollout will certainly be amazing, but if most current organs stay with cold storage (a natural assumption given hospitals want to maximize profits) extended criteria transplants are key for Transmedics. Increasing the total pie will lead to capacity constraints. Where does this ceiling exist? I don't know but expecting the number of transplants to triple in 5 years is unreasonable. See this article on a potential shortage of transplant surgeons from a director at Transmedics, David Weill.

National Service Program: The National Service Program is Transmedics' attempt to accelerate adoption by flexing their first to the field, multi-organ nature. It provides centers with assistance transplanting organs with their own clinical experts. The NSP reduces people power needed from the hospital, a major barrier to adoption, and further integrate the organ care system into hospitals. When I spoke to someone at a lung transplant program, he noted the lost person-hours spent retrieving organs is a huge deal, but he was skeptical about handing over the duties to another team. He discussed the difficulties with separate procurement and transplant teams. Multiple times, organs didn’t show up in the right way for transplant simply because transport team hadn’t evaluated the recipient anatomy.

Reimbursement: Private insurers and Medicare reimburse differently for organ procurement. Private insurers pay on a per-patient basis, but Medicare pays for their fraction of organ procurement costs. The Medicare policy is a bit unintuitive. Say a transplant center spends 3 million to transport organs, and 40% of those organs are covered by Medicare. Medicare will pay the transplant center 40% of 3 million. Payments happen biweekly, but a year end audit is done to ensure everything is in order (great guide to reimbursement policy). Medicare is essentially piggybacking on any cost savings private insurance is responsible for. Another trend in reimbursement policy is a trend towards lump sum payments rather than fee-for-service. Instead of paying for each service performed, hospitals will receive one lump sum for each patient to cover all costs. Any profit margin is driven by better outcomes for lower costs. Hospitals want to lower costs as much as possible to maximize profits thus a non-inferior cold storage solution is favored when possible. The value proposition the OCS has for hospitals is increasing volumes rather than per transplant profit.

Important Note: DRY RUNS. A dry run occurs when clinicians and the transplant team go to evaluate an organ but do not actually use it. In this case, they might place the organ on the OCS and determine it isn't viable for transplant. When I spoke someone who does lung transplants, he noted cold storage has a near 0% dry run rate at his hospital while the OCS rejects 30-40% of potential lungs. Dry runs aren't reimbursed thus costs are borne solely by the hospital. For cold storage, dry runs cost only person time. However, OCS dry runs cost $45k required additional resources to. Dry runs are a major disincentive to use the OCS in addition to the already high costs for a non-inferior solution.

UNOS allocation policy and Medicare OPO policy: Two recent positive changes in policy should be highlighted. 1) UNOS changed their organ allocation policy to be based on recipient need rather than distance travelled. Almost immediately, this changes the picture for Transmedics since it's a solution designed for long distance transplants. 2) In a bipartisan attempt to increase organ donation, CMS changed policies for Organ Procurement Organizations (OPOs). OPOs are nonprofit organizations who serve as middlemen between donors and recipients (). The new policy increases scrutiny for better outcomes and will take a hands-on approach to improve underperforming OPOs. The OCS increases transplantation so the new policy is favorable.

Lung Commercialization Issues.

Transmedics' approval of the Lung was highly anticipated but sales largely disappointed even accounting for COVID disruptions. For such an innovative solution, reasons both within and outside of their control held them back.

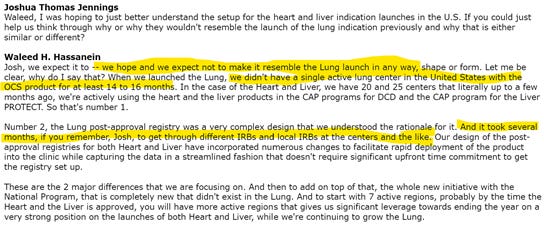

Factors in their Control: In the most recent earnings call, CEO Hassanein comments on the issues with lung rollout that have since been resolved.

The two main issues:

They had trouble getting into multiple centers as they were a completely new product and were off the market for 14-16 months during the FDA approval process.

There were logistical issues rolling out the Lung solution as they were inexperienced in rolling out post approval studies.

Both issues are fixable (and fixed) through better relationships and more commercial experience.

Factors outside of their control: The interplay between hospital economics and clinical data are key factors. Reimbursement dynamics and non-superiority of outcomes means the device was only used for extended criteria lungs. The startup costs of training on the OCS, prior organ allocation policy, and OPO stagnancy were also factors.

Going forward: Q2 demonstrated strong Lung revenue in the US with 3.5M in the quarter. Transplants have nearly recovered to the pre pandemic trend putting them on track for 100% growth vs 2019. Lung utilization from donors still remain in the 15-20% range with OCS utilization drastically improving these outcomes to >80% utilization. I expect Lung revenue to be strong going forward, but the heart and liver rollout will be even better.

Heart and Liver expected Rollout

Using lessons learned from the lung and improved clinical data from the liver, Transmedics should see more initial success for the heart and liver. The excitement is palpable among clinicians for the Liver system (from the Q2 call, award) so roll-out will be better.

Clinical Trials vs Commercialization: Dynamics for a hospital differ between clinical trials for FDA approval and Commercial progress in hospitals. Hospitals love to run clinical trials for something like the OCS. It puts them in the news with positive publicity and TMDX partially subsidizes some of the cost. When they have to buy the system, it's a different decision based on outcomes and profit margins. Another potential difference is the concentration of transplant centers. Some transplant centers are much more willing to use the OCS and are proficient with new solutions (Here’s to you Dr Schroder) so expanding into new sites after a clinical trial can be difficult. Luckily there aren't many transplant centers in the USA and Transmedics is already integrated into most of them.

Competition:

Transmedics owns the transplant market in the US. There is some competition from Lung bioengineering with their XVIVO system for transporting lungs but the XVIVO system is primarily used in Europe. Both systems are different, and no head-to-head comparison exists although one advantage for the OCS could be a reduction of cold perfusion time (source). The transplant center I spoke to had only used the OCS. For liver transplants, there is potential competition from OrganOx which is currently in late stage clinical trials with an IDE from the FDA and approval expected soon (source). XVIVO also has a CE-Marked Liver Assist device which will apply for FDA approval in 2021. Heart transplant devices are still in animal trials though one does have breakthrough device designation (source). Overall, competition is on the way since the market opportunity is large and recognized. Lots of perfusion systems are comparable but the OCS solution and device are both proprietary. In addition, the OCS is the only multi-organ transplant system which makes selling to large transplant centers and training surgeons easier.

Summary and Takeaway: Selling the OCS isn't as simple as "increases donor utilization, it's a win". There are number of factors affecting commercialization summarized below.

A note about timing: a lot of the bear points aren't related to the product itself, but the timing of revenue acceleration. Revenue growth has to be there at 25x sales. Some investors don't care about the timing of revenue, but innovative companies in competitive industries have to accelerate growth fast. Each year without integration into hospitals is an opportunity for new competition increasing uncertainty and risk. Time is a risk for any medical device companies as innovation can happen at the speed of light.

Financials

Now we're at the point where we can try and model the financials for the three organs.

We know the following:

Clinical data and approval outlook for all three organs

Reimbursement landscape for the OCS

The possible TAM for each organ (roughly)

The current TAM for each organ

Dynamics affecting rollout

How Lung rollout differs from Liver and Heart

The role of the National Service Program

Most models tend to use historical revenue growth as a proxy for future growth, but with Transmedics, using such an approach is disingenuous to the company's position. It’s at an inflection point. Past revenue was driven by clinical trials while Transmedics is now entering the commercialization phase for all three organs (I believe both heart and liver will be approved).

Expected Margin Profile: As with most medical device companies, at scale operating. margins will be in the ~30%.

For a company at 25x EV/sales, taking a longer term horizon is appropriate for most investors. Investors aren't looking to play short term trends driven by valuation expansion but rather for the disruptive potential the Organ Care System holds.

For a simple financial model out to 2025, we need to know 1) the estimated transplants in 2025, 2) the market share of TMDX, and 3) an expected multiple on the sales.

All previous factors must be accounted for when making our model.

Lung: The uncertainty around the lung hurts our ability to forecast out to the future> however, increased experience on the OCS combined with the NSP and new policies means revenue growth will be high.

Heart: For the heart, I expect approval for the DBD expanded criteria indication and eventual DCD approval. We can assume a monopoly for extended criteria hearts for the OCS, but any currently transplanted organs will likely still use cold storage.

Liver: Liver transplantation has tremendous potential given the nearly superior nature of the device. It may take time for transplant teams to get used to the OCS, but clinical outcomes could lead to increased usage for all livers rather than just for extended criteria ones.

NSP: The valuation doesn’t account for any NSP revenue because it will likely be lower margin and is extraneous to the overall thesis.

Expected multiple: a reasonable 10x Sales multiple can be placed on the company. For the high expected margins and expected growth, comparable companies trade at such a valuation in perpetuity. With 25% EBIT margins, a 10x Sales multiple is a 40x EBIT multiple (average for fast growing medical device companies). If you are less sure about valuing it at such a steep multiple, feel free to edit the excel model in any way you feel necessary.

Playing around with the model and giving the following parameters, the IRR is 44% over 5 years.

With expected multiple compression, it won't be a smooth ride, but near monopoly status in incremental organs (the head start is huge) and a growing market will lead to rapid growth in my opinion. 75% revenue growth for 5 years is no small feat so we have to take into account base rates.

Base Rates: We must take into consideration the base rate chance they can achieve this outcome. 99.99% of all companies cannot compound revenue at these rates. The level of conviction needed to underwrite this return is high given the assumptions. One is assuming near monopoly status for incremental organs with sustained growth leading to 10x sales multiple. Say the base case is a 5-year revenue growth of 30% making the IRR ~8%. Imagine that, Transmedics has to grow 30%/year and maintain fairly high valuation (dependent on profitability and growth rates) just to hit a market return. TMDX is certainly poised to revolutionize the organ market but there is little margin for error when underwriting 70% revenue growth.

However, this is where growth investors shine. While many investors (including me) become uncomfortable underwriting low probability events (i.e. growing 70% for 5 years), some have enough certainty to buy and hold even at seemingly high multiples. With enough research, you can find alpha in this uncertainty.

What about Cash and potential dilution? Currently, TMDX has 112 million on the balance sheet with 34 million in Debt. With major clinical trial expenses out of the way and lots of free press through different publications, the rollout shouldn't cost as much as a drug rollout. Post-market surveillance studies will be expensive but Transmedics will receive all proceeds from the hospital instead of subsidizing parts of the OCS for the trial. Maturity, in terms of the margin profile won’t happen in 5 years, but they can certainly turn profitable by then if the FDA surveillance studies are complete. Regardless, if potential dilution or cash burn become an issue for Transmedics, I would be wary given the monopoly status of the solution and. Sustained unprofitability (3+ years at current levels) is a potential issue though I expect revenue to decrease operating losses.

Growth and Risks

I've modelled what I believe is reasonable but there are a number of growth opportunities and potential risks beyond those already discussed.

Growth opportunity 1: Potential Therapeutics with the OCS

Warm perfusion as a technique opens a box of opportunities to improve patient outcomes. One could deliver new drugs to the organ while in transport. Such therapeutics could improve recipient outcomes by improving donor organs. The primary concern with using extended criteria organs is recipient mortality. Using incremental organs obviously will lead to worse outcomes and improving those organs could be huge. Obvious roadblocks here include the timeline to develop potential therapeutics and the novelty of using such an approach

Opportunity 2: Kidney Transplants

Kidney transplantation is the best option for those with end stage renal failure. Ever heard of dialysis? It's the multi-billion-dollar industry which hinges on a lack of viable kidneys. Billions have ESRD while only 20k have kidney transplants. The opportunity here is obviously gigantic and everyone knows it. Waleed, in the most recent investor conference noted trials for the kidney were just starting so the timeline to approval is 5+ years out, but the platform nature of the OCS is encouraging.

Opportunity 3: Reducing Costs of Transplants.

Currently, the high cost of OCS drastically reduces their TAM (in the current form). Given non-inferiority rather than superiority of the OCS, using it for patients which could have been transplanted with cold storage makes no sense. If the cost of the OCS dropped to 30k, volumes could dramatically increase. There is a point at which hospitals will make the switch to mostly OCS transplants instead of using the OCS primarily for extended criteria organs.

What kills the opportunity?

Risk 1: Incremental organs have worse outcomes

As mentioned before, one naturally expects worse outcomes from extended criteria organs. Since we currently don't use those organs, there is little survival data on those organs save for the OCS studies. Just as new drugs and engineering modifications could increase the quality of the organs, physiology could take over and keep outcomes for extended criteria organs non-inferior and even make it worse as one goes downstream of current donor characteristics. Although outcomes for organ transplantations are often the best option for end stage organ failure, the rubber will meet the road eventually in terms of cost vs benefit.

Risk 2: Slower than expected uptake

Piggybacking off the previous point, there are a number of reasons which could slow use of the OCS. Experience with the Lung OCS will guide Heart/Liver rollout and growth will accelerate faster, but there still exists this risk.

Risk 3: Faster than expected competition

Obviously, any competition is bad and faster than expected competition would hinder growth. The OCS is a monopoly paving the way in the minds of the FDA and surgeons to use extended criteria organs. Any competitors will have an edge in gaining mindshare simply because physicians and regulators have been through a similar process with the OCS. On the other hand, if competition is slow, the OCS is already integrated into many transplant centers and startups with equivalent devices will have a tough time selling into those centers. The multi-organ, platform nature of the OCS is a key advantage here. Competition risk is lower than one might expect.

Risk 4: Capacity Constraints.

One risk is the capacity of transplant centers to transplant more organs. I couldn't quantify a potential shortage of transplant surgeons, but this risk does exist as a potential cap on growth. This risk falls into the uncertainty category rather than risk category.

Note: I couldn’t get ahold of IR to discuss any of these potential risks so I may mischaracterize certain nuances of the industry and company.

What to Track Going Forward

There are a few key metrics and trends to track for TMDX.

Transplant Growth: most important for Transmedics is the continued ability to grow and an important metric is the increase in overall number of transplants being performed. Incremental transplants would be enabled by Transmedics.

Market share/Competition: keep a close eye on any competition which could affect market share and slow growth. Adjacent to this point is growth in the National Service Program. Growth in the NSP could be used as a proxy for how integrated Transmedics is into transplant centers and represent a switching cost.

Clinical Data: any improvements in the OCS which demonstrate it is superior to cold storage would dramatically increase the TAM to all transplanted organs. On the other hand, if the OCS demonstrates worse outcomes in the real world for incremental organs, growth will stall (I find this scenario unlikely).

Margins: The margin profile should dramatically improve with scale and lower trial costs reaching that of a mature medical device company in the 20-30% EBIT margin range. If they can’t reduce operating loss with revenue growth, there are serious issues.

Legislation: New legislation for insurance companies, OPOs, organ allocation systems, or transplant centers could all trigger or slow growth. Keep a close eye on any moves to increase transplantation.

Kidney OCS: keep a close eye on these trials even if it’s 3+ years away for approval. Kidney transplants are a huge market and any news could move the stock in weird ways.

Lessons Learned

This is quickly becoming my favorite part to write. Putting lessons from research on paper solidifies and improves my thinking for any new companies I evaluate.

1. Talk to people who experience a product: The most informative conversation I had was with someone who had transplanted lungs with the OCS. All questions about outcomes, dry runs, reimbursement, and boots on the ground experience were answered. Use whatever possible channels you have to get into contact with people in the industry. I attended a reimbursement webinar from a competitor which taught me more than any document from the company

2. Trust but verify: the TAM question is one where Transmedics' investor presentation doesn't lie, but also doesn’t paint the whole picture. We aren't transplanting $8B worth of organs….yet. To the best of your abilities, verify all information published by the company.

3. Invest in what you know: Understanding the detailed mechanics of any industry is key to investing in any company for the long term. Time adds uncertainty so long term investing depends on the ability to deeply understand companies. It's very difficult to understand all industries from oil and gas to medical devices, so finding a niche is helpful. If I had no experience in the healthcare industry, researching Transmedics would have taken twice as long. Generalist investors certainly exist, but for nuanced industries (such as medical devices), it's much better to have industry expertise or industry sources. I’ve read “One Up on Wall Street” and am a fan of Peter Lynch’s style of investing, but researching complex companies gives me a heightened appreciation for his lessons.

Medtech, microcaps, and memes!