Use of the Price/Sales Ratio and an April Portfolio Update

A framework for thinking about the Price/Sales ratio. Also what positions I hold currently.

Last week, I saw this post from Joe Frankenfield on the best performing stocks of the last 15 years.

https://twitter.com/SagaPartners/status/1379534136185126913

He outlines some common themes for across the companies in his thread, but two thoughts immediately popped into my head. 1) only two companies had a P/Sales above 10 ($REGN, $ISRG) 2) only 2 had their P/Sales fall over time ($REGN, $CRM). Putting aside the powerful but simple idea that great stocks need both fundamental growth and multiple expansion, let's ask a different question: what does the P/Sales Ratio tell us?

For some, using a Price to Sales ratio to value a business is second hand with no further discussion of the company. For the more value oriented types, basing valuation on a price to sales is heresy. However, as with most debates, the answer lies somewhere in the middle, away from either side of the factional divide.

Just as analyzing revenue growth often strips a business's fundamentals bare, a price to sales ratio allows us to look at the forest rather than the trees. As with any valuation ratio, it gives us part of the picture. A P/Sales ratio abstracts any fiendish tactics used by accountants to boost net income, but it also removes any information about the margin structure of a business.

A price to sales ratio is certainly useful when comparing relative valuations between companies with similar margin structures, but relative underpricing doesn't equal absolute undervaluation. However, since FCF generation is the ultimate goal of any business, the key phrase in the last sentence is "similar margin structure" (in the sense of both Gross and Operating Margins). The investors at Chit Chat money attempted to adapt the P/Sales ratio with a metric called "Margin adjusted Price to sales" which equals P/Sales/GM. Instead of trying to correct the P/Sales ratio for margin structure or using a different metric which accounts for this, lets frame it a different way.

A price to sales ratio represents the market perception of margin structure.

Say a company is trading at 5x P/Sales; with a 20% FCF margin at maturity, such a company looks cheap. We can also use this framework in reverse to judge the possibility of multiple contraction. A price to Sales ratio of 30x is nearly always poised for contraction at terminal value because the margin structure and terminal multiple can rarely meet expectations (40% FCF margins and a 60x FCF multiple still only gets you to a 24x FCF multiple). Using this framework, we can reverse engineer the market's expectations for a terminal margin structure.

We can especially use this framework for companies about to demonstrate operating leverage. A company growing consistently at 10%, reasonably priced on a P/Sales ratio can be a great long term investment as they scale margins. One company that could fit this framework is Electromed (ELMD), it's a profitable business at priced at <2x Sales but at 30x Earnings. It's consistently growing and could be on the verge of demonstrating operating leverage.

Edwards Lifesciences as an Example:

A company doesn't have to grow at extraordinary rates to win big if it can demonstrate margin expansion and resiliency. Take Edwards Lifesciences(EW): With an 11% Revenue CAGR, one would hardly expect the company to be a generational winner, but it returned an IRR of nearly 25% over 15 years due to multiple expansion and increasing profitability. From 2007 to 2021, the P/Sales ratio increased from ~3 to 20, but the P/E ratio increased from ~20 to 60, only a 3x increase. Why? Because margins increased from 10% to 20%. It's a top notch example of operating leverage and a strong business generating outsized returns after started cheaply priced on a price/sales ratio.

Margin expansion vs ROIC:

Ultimately the two ways to drive incremental cash flow are margin expansion and returns on invested capital (ROIC). Margin expansion is of course capped at the max possible efficiency of a business (Altria isn't improving their FCF margins drastically anytime soon) while returns on invested capital can continue to be above the cost of capital (Looking at you Mr. Bezos). However, the rapid nature through which operating leverage presents itself and the more predictable nature of margins (compared to finding to the next Buffett or Bezos) lends itself as a tool for picking stocks at inflection points.

One need not look on a 10+ time horizon if a business is at an inflection point. Tobias Carlisle on a 2019 podcast with Ian Cassel framed inflection points as follows: "the sweet spot is two quarters to profitability". The same principle applies here; a company on the precipice of flexing operating leverage usually has a grossly undervalued stock on a 3-5 year time horizon. With a fairly short term time period, ROIC matters even less. If you can accurately predict swings in the margin structure, using a price to sales ratio is a great way to find undervalued companies.

Putting it together

Let's summarize the points made:

One framework to look at a P/Sales multiple is as a bet on the margin structure of a company and can be extended to a FCF multiple when looking at a business with predictable margins. In addition, businesses with a modest P/Sales about to demonstrate operating leverage can be a great hunting ground for stocks at inflection points. Since margin structure can be improved much faster than ROIC matters operating leverage shows up in the stock price quicker. Also, a company with mature margins must have an above average ROIC to drive returns.

Let me know if you have any other useful frameworks for thinking about a Price to Sales Multiple and how you use it to evaluate companies.

April Portfolio Update

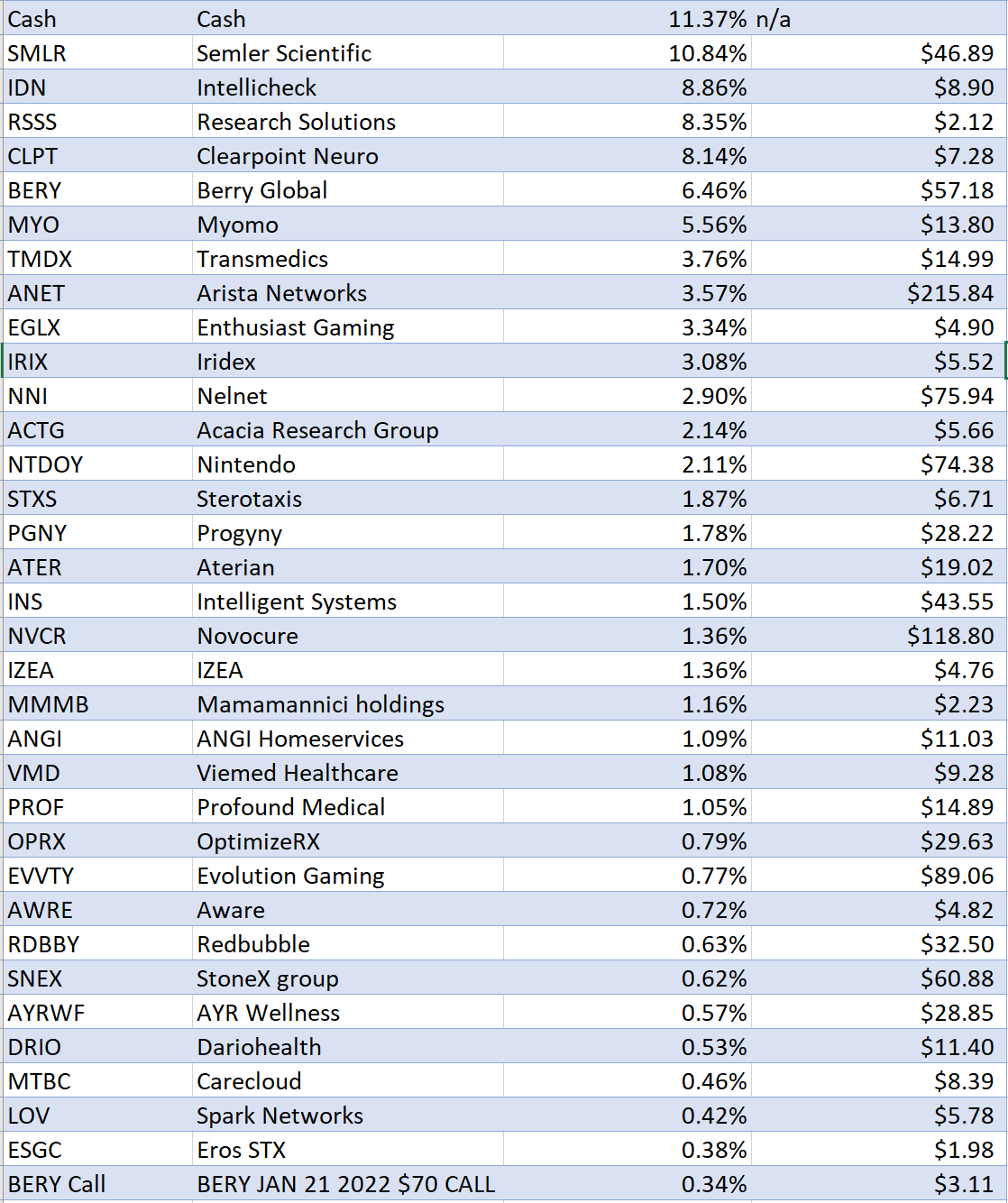

Since it's the end of the month, I thought I would hop on the train of every fintwitter and post my positions and sizing. I don’t know how many people care about looking at a nascent investors portfolio positioning with all the great fund letters out there, but I I'm putting it out there nonetheless.

Current Positions:

There are 34 stocks in total. The top five, excluding cash, make up ~43% and the top ten positions, excluding cash make up ~62%.

The returns for the last year and since inception are as follows:

Top Positions:

At the top of the portfolio, I have written about IDN, RSSS, BERY, and MYO. I have yet to write about SMLR but I'll throw some brief thoughts in here. The valuation is fairly high and buying the stock at this point would be betting on growth into new product areas (at least from my model). With earnings on Monday, I wouldn’t be surprised with a drop in the price due to the outstanding Q4 results and seasonality of the product.

Overall portfolio thoughts:

With a combination of luck and what I hope is skill, I've had some pretty good returns over the last year and have trimmed many of my top positions as the price appreciated. As a result, some of my top holdings are less concentrated and my cash position is higher than at other points in the last year. My selling philosophy is fairly simple. If I'm not a buyer after a 25% drawdown, I'm trimming. This lets my winners run but I can also sleep at night.

New positions:

This past week, I've added a new position: Redbubble ($RDBBY). I will write my thoughts on the company soon, but I believe it sits on the verge of operating leverage and the pandemic has accelerated their dominance. In addition, I am starting a position in Scientific Industries ($SCND), It's a very small company (25M market cap), thinly traded, and on the pink sheets so filling my limit order has been tough. I will write up my thoughts on this company soon too.

Overall Strategy

My strategy is an upside focused one as I am young and non risk averse. I hold positions which can fit into many buckets from microcap growth to midcap value. I tend to invest in smaller companies due to the lack of people smarter than me with more resources investing in these names. I also like to invest in healthcare companies as someone who's a bioengineer with experience and knowledge of both the science, clinical, and public policy of healthcare. Plus, I enjoy reading about medical device companies more than financials.

If anyone has thoughts about my portfolio or using the Price/Sales ratio, feel free to reach out at adu.subramanian@gmail.com. I am always glad to engage on twitter too, @AduSubramanian

thanks. very useful :)