Viemed Part 1: the stock

Part 1 of 2 on a company that looks exceedingly cheap but carries some serious risks

So what's the thesis? Viemed has a best in class service offering with a target market of 1.25 million people that is less than 10% penetrated. With growth rates of 20-40% and a FCF multiple of < 20x, it should be a no brainer buy but concerns over reimbursement cuts are a constant overhang for the stock price.

As a preface, I'd like to point you toward Andrew Walker's podcast with Cove Street Capital on the bull case for Viemed. They go through a lot of good information regarding the business, the risks, and the opportunity

There is quite a bit to unpack so I wanted to break it into two parts instead of dumping in all into one post. The first part will cover the business, competitive advantages, management, and valuation (all the typical things in a stock pitch), while the second part will dive deeper into the medical aspects of the company including pricing risk from Medicare, the recent audit from the OIG, and the different types of home ventilation.

Let's get started.

Business:

Viemed is a durable medical equipment (DME) company specializing in at home ventilation. They were spun out of Protech Home Medical (Now Quipt Home Medical Corp) in 2016 and have since grown to be larger than their former parent company with a market cap of ~$300M. Thought they have expanded their product offering, the core business is selling non-invasive ventilators (NIV) and respiratory therapist services to stage 4 COPD patients with chronic respiratory failure. They don't manufacture the ventilators themselves and focus on delivery of care unlike other DME companies such as Apria and Lincare. They service 45 of 50 states as of the last quarter. Future growth will come from penetrating new markets (they entered 6 states last year) and adjacent products in the remote patient monitoring (RPM) or DME space that can either developed or acquired.

Home Non-Invasive Ventilation TAM

Home ventilation, in Viemed's case, means bringing life support into the home. There are two classes of ventilation devices: Respiratory Assist devices (RADs) like BiPAPs and Mechanical Ventilators. Part two will dive deeper into the difference between two classes but the important part is that reimbursement for HMVs is ~1000/month, which is the primary device Viemed sells. Looking at the investor presentation, the company estimated TAM is 1.25 million people who have Chronic Respiratory failure from COPD. With an approximate $950/month per patient (Investor presentation), the TAM is ~14.25B. If we use only the 60k patients currently using at home NIV, the TAM is a smaller at $684 million/year

However, the large TAM numbers can be misleading because of the high rate of 'churn' for their services. In Viemed's case, churn is simply patients dying (they call it the 'patient attrition rate'). There is no way around it: there are a finite number of patients who can use the device and although the revenue is recurring monthly, the rate of churn makes it akin to selling hardware. In addition, the identified 1.25 million target patients includes all COPD patients with chronic respiratory failure which could overestimate the TAM. Some may not be eligible for HMV and the overall TAM could be shrinking as smoking rates have drastically lowered in the past couple decades.

At-Home Care of Chronic Respiratory Failure: Respiratory failure is when a patient cannot get enough oxygen and need help with an external device that pushes air into the lungs. Due to years of smoking, people's airways can become damaged leading to a chronic disease where they can have constant issues breathing. When a patient at home without support has a breathing issue, they are hospitalized to be ventilated which costs a metric ton of money. Viemed wants to bring this ventilation into the home so patients aren't hospitalized, in theory saving the healthcare system money. Looking at some of the data, at home ventilation does seem to save the hospital system money (source 1, source 2) when comparing either BiPAPs or HMVs to no device at all.

Competitive Advantages

Competitive Advantage 1: As a potentially large and lucrative market, there are competitors but the home ventilation market is different than typical DME products. Typical DME suppliers focus on devices that don't require extensive monitoring (think walkers and even oxygen tanks) or the constant use of respiratory therapists (RTs) unlike at home ventilators. Viemed differentiates itself by being the best service provider through relationships with Respiratory therapists (RTs). You can clearly see the enthusiasm on this Tegus call with a former employee of Viemed:

Viemed seems to understand the intimate nature of end of life care.

Competitive advantage 2: Tying into the first competitive advantage is their specialization. By specializing in the ventilator market, they can focus on provided the best services in a niche market rather than trying to source medical equipment. Viemed has the reputation to go into new markets and get RTs to join them. They also buy their equipment in bulk reducing costs and recycle older ventilators which drives down capital expenditures

Optionality with Remote Patient Monitoring (RPM): Yes, I know that might trigger buzzword warnings for many, but I think Viemed has real substance in their ability to expand. Their network of RTs gives them optionality when adding new services and Viemed can enter the remote patient monitoring (RPM) space to help patients at home because of their current in home presence. In fact, they acquired a 5% stake in Verustat to do just that. RTs can check in with patients and use technology in addition to clinical judgement to make decisions in the home rather than in the clinic, all of which is brought together under Viemed.

Management:

Let's start with the good. Insiders own a sizable chunk of the company with > 10% of shares outstanding and according to the tegus interview, the company has a great culture.

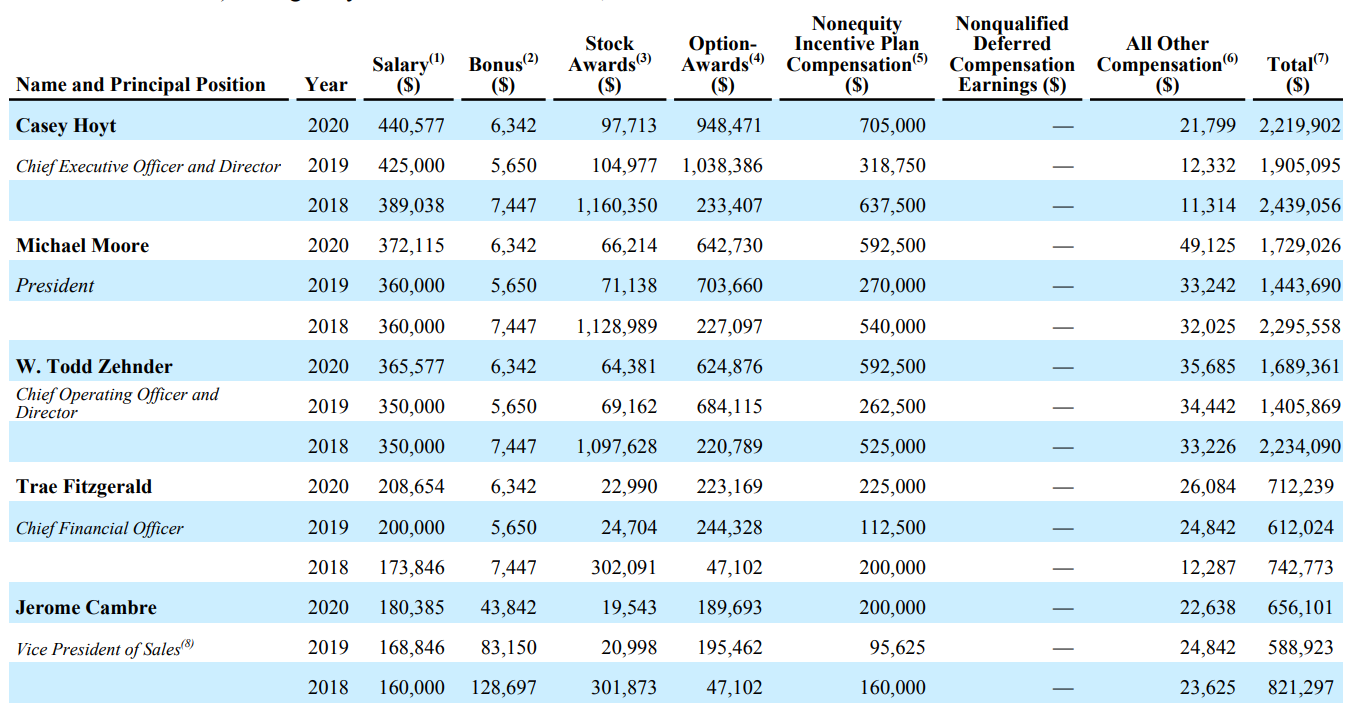

The Glassdoor reviews certainly corroborate that opinion with an overall 4.5/5 rating and a 75% approval of CEO/Founder Casey Hoyt. By leading Viemed to >$100 million in revenues with 30% organic growth for 5 years and positive FCF margins, his track record certainly speaks for itself. Management is focused on investing for the future, using cash to fund acquisitions in adjacent spaces and diversifying their revenue base. They successfully lobbied to remove ventilators from competitive bidding in 2021 and know the market well. The one red flag is their compensation. Looking at the compensation page from 2021, they are paid an EGREGIOUS amount of money.

In 2019, five people made $5.9 million dollars, more than half of net income and >10% of the OPEX. With over 511 employees, this is a lot of money though they did maintain profitability. Management may be fleecing Medicare for money but their margin profile is still nice.

Financial Results:

The financials look pretty damn good.

Even after backing out the $34.5 million in COVID related revenue in 2020, growth is still stellar with revenue more than doubling since 2017, going from $41M to $97M. However, growth at in their Core ventilator business has been slowing and grew only 10% in Q121. Much of this can be attributed to COVID related slowdowns as patients can't get to the hospital and as we open up, management is targeting >20% growth.

The margin profile looks generally nice with gross margins around 70% (normalized) and EBIT margins in the 10-20% range. The business is scalable as RTs can service several patients in one area, but it does require extensive work, capping their possible margins. With $30M in cash and no LT debt, the balance sheet is clean and provides them ample liquidity to make acquisitions. Overall, even though growth at the core business is slowing, the growth profile and margins of the business look nice, especially considering the valuation.

Valuation:

I could build out an elaborate DCF and try to model their bad debt expense and the potential growth within the target market along with any optionality…or I could tell you they aim to grow 20%+ per year and trades at a FCF multiple of < 15x with a target market that is less than 10% penetrated. Without modelling it, I couldn't give you a precise price target, but if it can sustain that growth, it's clearly undervalued. Even if you back out the COVID related FCF (assuming it has the same margins as their vent business) the EV/FCF is still ~20x based on 2020 numbers, clearly undervalued.

Risks:

But the Moby Dick of all risks exist through an uncontrollable entity determining prices (and demand to a degree): Medicare. This risk extends beyond just pricing and I'll dive deeper into it in part 2 but here's a quick summary. Most of their patients are over 65 and pay Viemed through Medicare. If Medicare cuts pricing for at-home ventilators, Viemed has to make up for it through increased volume. Even if they are the lowest cost provider and will ultimately come out on top, the price cuts may still hurt growth. We have seen price cuts before (in 2017) and Viemed weathered that storm well. Although congress seems to want ventilators off of the competitive bidding process (SMART act H.R. 4945) and there are clear benefits to having at home ventilation, the medical community has unclear guidelines and recent attention on rising costs could place pressure on the business.

There has to be a reason why this isn't a screaming buy at these prices and it ultimately rests on the Medicare cut risks. I'll spend part two describing this risk, the different ventilation devices, the recent MEDCAC panel on home ventilation, the recent office of the inspector general audit, and my current position.