Expert (KOL) Calls: A Guide for Biotech

Why we use experts, the major issues, and how I do a KOL call

Outline: TLDR. We need KOLs. But most KOL calls suck. Let me tell you how I do a KOL call and best use cases.

Basics of Expert interviews (Key opinion leader KOL Calls) 1

Appendix – a Note on Surveys, Sell Side, and Sponsored Calls

I’m all sides of the table. I’ve led 100s of KOL calls, talked to 100s of doctors offline, and I’m currently becoming a doctor…..a unique perspective to discuss clinical experts and KOL calls in healthcare. . I’ll walk through the basics, why we use expert interviews, the major issues, best practices, and use cases.

Note: I work for Slingshot Insights as a call leader, this post was not sponsored by them, but I encourage any investor to check them out. I think they do a fantastic job finding the right experts and leading high-quality calls. Tegus et all have a lot of calls, but the quality is unmatched on Slingshot, a healthcare specific platform.

Basics of Expert interviews (KOL Calls)

Expert interviews (aka “KOL calls”) are a research technique used by investors to gain industry insights by speaking directly with experienced professionals who have specialized knowledge. Investors pay expert networks to find the right experts and pay the experts for their time. Usually, a single call (30-60 min) costs ~$1000. Older networks connect investors to experts one on one in private (GLG, Guidepoint) while other companies show the transcripts publicly for users (Tegus, InPractise, Slingshot Insights). Some can also do surveys for a big picture view.

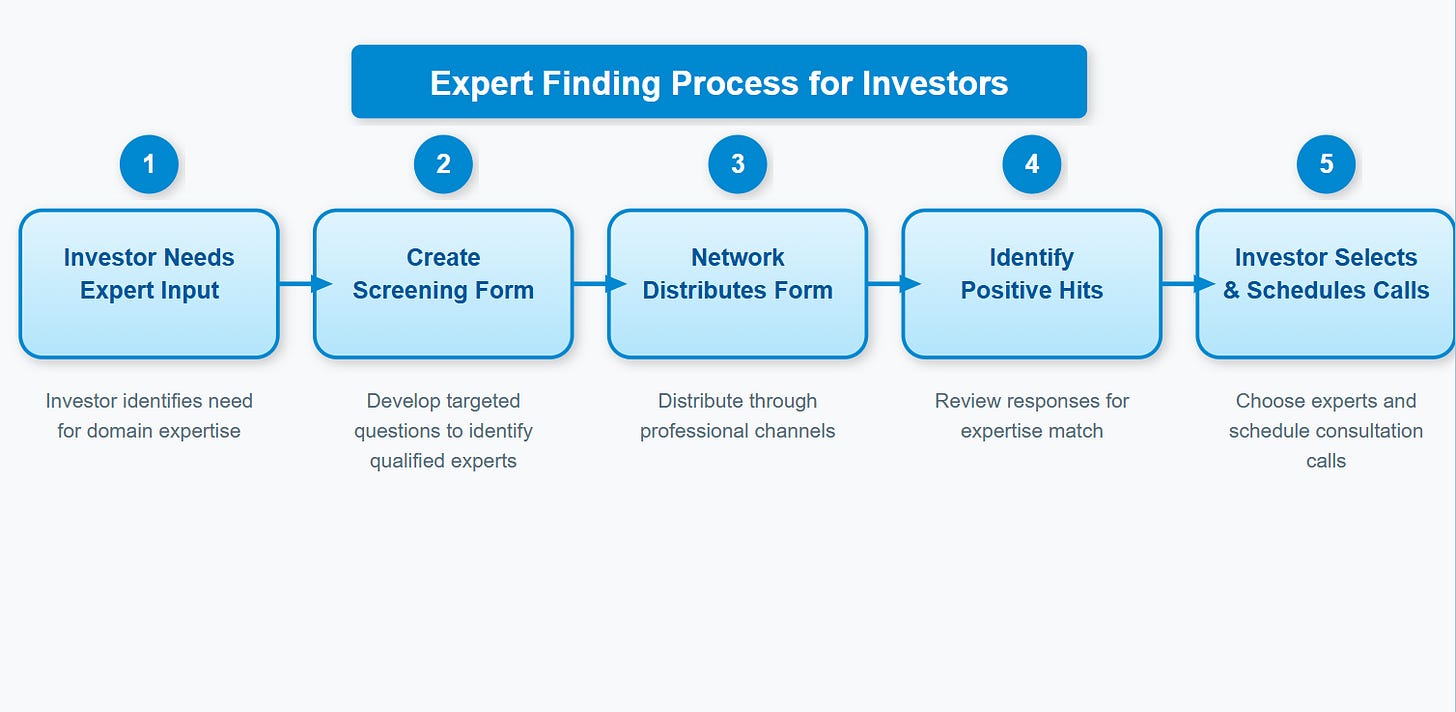

The process to find experts is often

Write a screening form

Disseminate screening form

Assess responses to find the right one

Schedule the call

Hourly rates are set by the expert (customers can choose to pay, they’re often price insensitive) and the network takes a cut for setting it up.

Why do investors do these calls? We talk to experts to learn secrets. They’ve developed tacit knowledge2 through a career working in an industry and we want to harvest those insights as investors to learn about an industry quicker. Investors can discuss the basics of a company, know how customers make purchasing decisions, how insiders view companies, and answer any questions about an industry. They’re most helpful to understand the customer perspective in opaque industries. The only way to understand some topics is to talk to people.

In addition to finding experts, we use expert networks to comply with regulations. Expert interviews are ripe for abuse. They used to be a wild west of insider trading where insiders often provided investors material non-public information (MNPI). In fact, a biotech KOL was the center of “Black Edge”, the insider trading scandal at SAC Capital and eventual inspiration for the TV Show Billions. An Alzheimer’s researcher led SAC Capital investors to believe trial results would be positive, then SAC flipped their entire position short the week before a readout after getting inside information to the contrary. Compliance means investors don’t go to jail. Still, most expert interviews exist in the gray area between “Material Non-Public Info” and “Non-Obvious Insights" is thin.

Expert interviews are essential in healthcare

The ideal use case for expert interviews is healthcare. Investors account for scientific, clinical, regulatory, and financial risks in a short time scale. They’re especially useful for generalist investors3 because healthcare is so opaque. We HAVE to talk to the experts to understand how any new innovation will/won’t be used. We talk to the key decision makers (doctors, hospitals, insurance) in the healthcare chain to understand their incentives and how they make decisions.

Biotech is often the canonical use case for an expert interview……

“In general, the investor will ask the expert questions, and the expert will help the investor get up to speed on whatever company or industry the investor is looking at. A classic example would be an investor looking at a company with a blockbuster drug in phase III trials; an expert network will introduce the investor to experts in the drug’s field who can help the investor decide if the drug is likely to get FDA approval or no” - A generalist perspective

We do KOL calls to understand the basics and any hidden nuances. Ideally, the experts (Key opinion leaders, KOLs) are doctors and researchers with extensive knowledge on a disease/drug. “Doc Calls” are common for investors evaluating companies. Healthcare experts leverage the aforementioned ‘tacit knowledge’ to make decisions, so expert interviews are better than reading documents. Reading a clinical study without context is a waste of time. Without talking to the customers (doctors usually), we don’t know how a product will be used.

In healthcare, A few common use cases come to mind.

Understand the Basics: For those new to a field, ask basic questions. Find a doctor who regularly treats X disease with Y drug and ask about his process. Tell him to explain his thinking. Explore the history of treatment. Good for the first call you do on a topic. Experts: Any “expert” will suffice. 4

Evaluate drug/device launches: discuss commercial dynamics for recently approved drugs. Experts: community and academic doctors. Sometimes salespeople with experience.

Evaluate trial results: Evaluate recently published results as positive or negative. Often after major conferences or readouts. Experts: academic experts affiliated with major trials, maybe even the trial in question.

Predict future success: Will a future drug trial succeed? Sometimes investors are trying to predict future success and want an expert perspective. Experts: researchers with in-depth experience.

Surveys: Broad surveys to understand prescribing habits. Often used to gauge commercial trends.

Company Sponsored Events: Companies sponsor events with multiple KOLs to sell the story. Usually involve researchers involved in the study.

A GOOD KOL call is worth its weight in gold, but most KOL calls are completely nonsense. Let me tell you why.

The Major Issues in the Model

KOL variability: I can find you a KOL to say anything.

Science is gray. Every “expert” will have a different opinion. Prescribers presented with the same data will interpret it differently. For example, in ATTR Cardiomyopathy, a hot and upcoming area, you’ll see different opinions based on the expert. Doctors say they’ll use anywhere from 0 to 100% for each drug in the market, Sometimes the numbers don’t even add up to 100%……(see appendix for why surveys suck too). Imagine talking to two docs in succession with completely different opinions.

Some experts lie - They are not who they say they are

Sometimes, “experts” will straight up lie about their experience. KOLs get paid 400$+ for 30 mins of their time: why not lie? When you’re making millions and the other side is willing to pay it, they’ll stretch the truth.

Some KOLs may not even work at the company requested! Not related to healthcare but too good to pass up this story. 19:20 - 23:00

Sam Jacobs worked for GLG (network used to find experts) with a client project researching Walmart. An easy way to get an edge was talking to some of the district managers at Walmart for upcoming sales trend (straddling, maybe crossing over into MNPI):

“ there's a guy named Mike Eckles …. this man talked to Maverick capital and bluid capital and Lone Pine capital [top hedge funds] making multi-million dollar bets based on this guy with “five out of five” star reviews. He made over a million dollars with GLG” - Sam

Funds called Mike quarter after quarter for insights into sales. These funds are making decisions on Mike’s opinion. After a few successful months, Eckles was flown out to NYC for in person interviews.

We fly him into “the poshest of the posh [funds] this guy's… smoking cools and he wants his diet Pepsi, he’s getting rave reviews like ‘this guy is real salt of the earth’. Talking to this guy like ‘What do you think is gonna happen this quarter? I think they’ll go up, 10-15% sounds right” And these funds are making trading decisions on the data.”

This is obviously straddling the bar for MNPI (probably crossing it). So Sam’s worried when he gets a piece of mail from Walmart: “Oh no, they know about Eckles”. This could be a serious insider trading issue. But the mail didn’t say that. Walmart told him “we just want you to know that Mike Eckles doesn't work for Walmart and hasn’t worked for Walmart in a while”

These KOLs are not always who they seem. They’re paid 1000s of dollars and investors treat their word like Gospel: who wouldn’t bullshit a little bit?

As a corollary: MDs are not drug developers

Experts in healthcare may not lie about their resume, but they will have a falsely elevated confidence. I wouldn’t trust 90% of doctors to predict future trial success rates. Medicine teaches people to be risk averse and use only the information available at the time to make the best decision which means most docs aren’t great at seeing the future. Furthermore, they can’t keep up with all the new research while treating patients. Usually, the expert reads trial results during their lunch break and then provides broad, sweeping conclusions based on their prior experience. Most docs have never heard of what’s in the appendix, competitor data, etc.

Trial success is so much more than clinical data. We can look at a presentation with prior trial results and say, “the phase 3 will be successful”. Doctors often do the same thing. Real insight is piecing together the stats plan, trial design, clinical perspective, insurance perspective to assess what “success” means. Experts do not have the time nor the expertise to do that.

Generic Calls, wasted time, and relying on them too much

Generic KOL Calls

Most interviews are vanilla doctors with generic answers. Here’s how most calls will sound:

Title: Doctor at X Hospital, involved in Y trials, treating 400 patients with Z disease.

Topic: Discussing recent results presented/Evaluating Commercial Prospects/Introduction to Disease

Opening: Thank Doctor for time, *Doctor is audibly eating lunch or golfing in the background*

Background: Ask about background, trying to warm up the doc a little. Get info already answered during the screening process. Doctor name drops some famous trials and his involvement. If he’s older, probably launches into unnecessary historical tangent: "Back in my day, we used bloodletting..."

Treatment approach: Investor trying to gather context on treatment protocols. The doctor recites guidelines. Investors unfamiliar with how to read a clinical practice guideline are wowed, and don't ask for more details. Can sometimes get helpful information on key debates in the physician community.

Patient population: Doctors will segment patients by some characteristics. This information is again in the guidelines.

Unmet need: Ask about Unmet Need, Doctor says we need “better drugs” and “insurance authorization is an issue”, thanks doc, very helpful.

Discuss the data: Jump into the topic de joure. Hopefully the doc has seen the data in depth. I’ll bet you dollars to times the KOL is “cautiously optimistic”. If they’re a researcher in the trial, the results are “stunning”.

Ask about some safety concerns: Obviously, the expert says we need longer term follow-up for the true safety results. Some doctors are mildly concerned, others are not. Can’t tell what matters.

Ask about future success: Expert with no drug development experience says it’s likely to succeed. And what’s the bar for success5? Every KOL sees it differently. Unclear where they get this number.

Patient Adoption: The doctor makes a definitive statement despite knowing nothing about pricing, insurance coverage, or final label: "I'd use it in most new patients, wouldn't switch stable patients."

And that’s a typical KOL call. The investor learns nothing but feels comfortable knowing an MD confirms his priors, the consultant is paid a few hundred bucks and the network takes a cut. Total cost $1000. Same time next week?

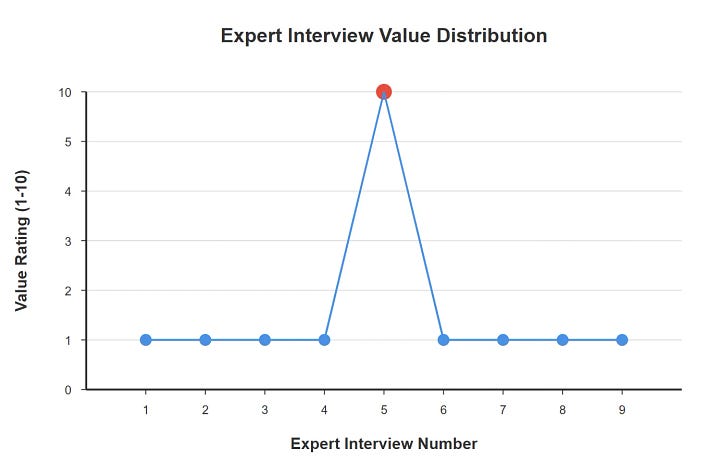

These generic KOL calls will be most calls, but since one good one can make up for a bunch of bad ones, we continue to do them. “I know I’m wasting 50% of my marketing spend, I just don’t know which 50%”.

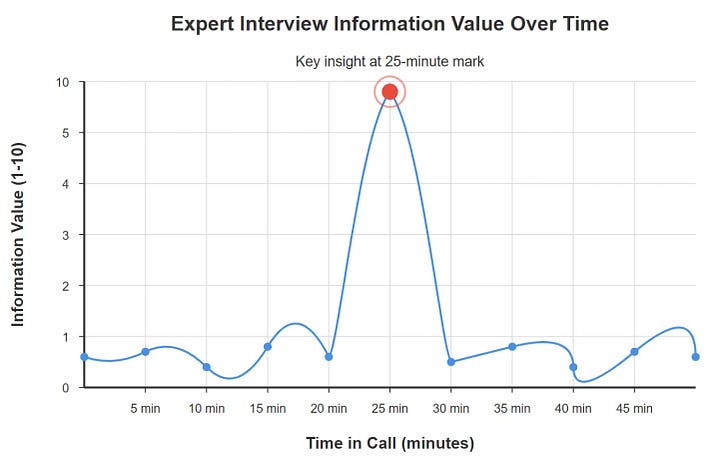

A good KOL doesn’t give you 25 minutes of hits either, we get the fluff mixed in with the hits. Over 30 mins, there’s one or two key insights which are important and we ask the right questions to get there.

See example: Celldex had a drug for hives. In the fall, investors were concerned about potential hair color changes. Prior to the call, a KOL predicted a drug may have such issues, but the insight is buried in a 30-minute call.

Expert Interviews are table stakes

We do expert interviews and ask our questions because we think our research process is unique, but most people have the same questions.

Everyone believes they have a special sauce. You’ll ask that one perfect question, find that key insight, talk to the right expert, find the right data point. But you are not special. EVERYONE wants to talk to the highly regarded KOLs. Many doctors have similar opinions. And EVERYONE is doing these KOL calls to the point it’s become table stakes.

I’ve literally seen doctors with a script they tell every single investor. They know the questions and how to answer them.

Platforms like Tegus and Slingshot capitalize on this opportunity by publicizing the transcripts to members. They realized interviews were largely a commodity good and flipped the model on its head. It’s highly unlikely no one has asked the expert your questions so use these platforms to learn quickly and augment it with your own research. Still, I do think doing your own calls can be useful and we’ll talk about how to actually elicit useful information in the next section.

TOO MANY KOL CALLS

Interviews are a great way to get up to speed quickly and provide some key insights, but if you still have basic questions after a few KOL calls, the answer is not “more calls”. Do more work offline. The number of calls is not correlated to better value. Some investors do 100s of low value calls because they can. Before every interview. ask yourself: “Why am I spending $1000 to talk to this person?” Or even “Why am I reading this transcript?” )

How I do a KOL call (a guide specific to healthcare)

With all these problems in the models, how should we actually do one of these calls? Guides from Alphasense, GLG, Guidepoint. A great twitter thread from an investor on how to talk to experts though I disagree with some of it. Here’s a few tips specific to doc calls to make them better.

Before the Call: Good screening questions

Ask specific questions about the expert’s experience and practice. Make sure they treat the right subset of patients in the right format. Academic physicians and community physicians have a different scope of practice. Sometimes we may even want one or two specific experts who were involved in running a trial. A good screener filters out unwanted interviews.

Before the Call: Do your research.

If you’re not doing a basic intro call, do your research. Going in unprepared is a great wya to waste $1000 for information which is online. We want to unlock insights which require primary knowledge, not a regurgitation of stuff already online. Even for intro calls, understand basic industry dynamics, the history of a company, basic reimbursement dynamics. Go into ChatGPT and ask those dumb questions to see what information is out there. Then note where you’re confused. Ask those questions instead.

Before the call: Go in with a purpose

Why are you there? Why did you select this specific doctor? Know exactly what you want to answer and how the call informs your decision-making process. i.e. I want to understand how the endpoints in a trial are measured becuase I think management is playing games with the statistical analysis. I will ask specifically about the endpoints and then independently draw my own conclusions.

During the call: Assess credibility

Make sure the doctor can answer your questions and has the right experience. We want to make sure they’ve used a specific drug, treated a specific patient population. Good screening questions help but get a sense of their past and current day to day so we can ask questions where they can answer. I may even ask them directly topics where they feel most comfortable speaking.

During the Call: Warm up the KOL, establish your own credibility.

Interviewees are human vaults. We press the right combinations of buttons to open them up. A bit of foreplay to get them talking and establish your own credibility goes a long way to open them up. Experts, especially doctors, will treat you like a child unless you establish some baseline level of knowledge. Furthermore, they will treat the call like an interrogation unless you can open them up.

A few good ways to warm up the doctor

Start with some basic questions. Get a conversation going.

Empathize with the expert’s situation. Doctors always hate insurance cos.

Be informal. Don’t treat the call like a transaction. Treat it like a conversation.

Tell the expert about insights gleaned from other primary research. For example, patients can’t touch hydroxyurea pills, a little known fact about a widely used sickle cell disease therapy. Mention it to a doctor and they may open up a little more.

During the Call: Always ask why

Doctors will draw conclusions but I DO NOT CARE about those conclusions. It’s a false sense of certainty from one specific KOL. Tell me WHY you hold your opinion and I can use your reasoning to evaluate any new information.

I would use the drug in 50% of my patients -> Why?

The trial was successful -> Why?

Safety was an issue -> Why?

During the call: Challenge the KOL

If you’ve warmed them up, we can start to challenge their opinion. Their word is not gospel so can respectfully push back using data. “you say the data is comparable, but the new drug reduced events by 15% more, why not use it in your patients?”. Pushing back may uncover hidden assumptions, or the doctor may reframe their thoughts. I’ve seen doctors change their mind about a drug mid-call when presented with new information.

During the call: Ask open questions then drill down to specifics.

Start with open ended questions to get a broad perspective. Then drill down to details by clicking on specific questions. We start with a broad question like “What were your initial impressions on the trial?” (General) → “Why are you paying attention to that specific endpoint?” (a little more specific) → “Why didn’t they use that endpoint in the other trial? I believe the company said it was X, is that true?” (focused on one use case).

Specific Use cases

A few specific use cases and archetypes I’ve seen in expert calls.

Introductions: the first call is the most useful call you may do

You’re doing basic diligence on a company/drug/disease. Start with basic diligence offline (From 0 to 1 analysis) and find the most confusing parts. Do you want more information on the basic disease mechanisms? Is there a nuance in the clinical guidelines? Unclear patient pathway? Find a solid, not perfect, expert and challenge basic assumptions these calls. Tell the doctor exactly what you know so he can answer and fill in gaps. Ask for a simple walk through for his thought process and workflow.

Commercial Launches

Prescribers don’t foot the bill (an interesting quirk in healthcare) but they are the customer. So it’s helpful to discuss the dynamics of a launch with doctors. Once again, do not ask if they will use the drug, ask them WHY. This will inform how you interpret any future data and if the data actually supports uptake.

Unmet needs - Specifically in Rare diseases

Talking to docs who treat rare diseases are especially helpful because the published literature is sparse. Any niche industry doesn’t have a lot written about it, so primary sources are gold. Doctors in rare disease are helpful to parse out market size, unmet needs, and treatment guidelines. We wouldn’t understand the unmet need in a disease like Prader Willi Syndrome without talking to doctors. “Oh these patients eat too much?” “No, They will literally jump off buildings chasing food”

Hidden incentives driving usage

The hardest part of healthcare is parsing the hidden incentives. What could be driving utilization under the hood? For example, some patients with myelodysplastic syndrome receive transfusions for anemia every 2 weeks. Luspatercept, another drug for MDS, is delivered every 3 weeks. Kinda tough for the patients, especially health ones to come in every week unless it’s a miracle drug…..Talking to primary sources will give you the right perspective how these hidden incentives affect market dynamics

Endpoints and trial design

Any monkey can compare two trials, but what does it actually mean when we say “30M improvement in a 6 min walk test (6MWD”. Is the change clinically significant (beware the bullshitters here)? How would you expect a placebo to respond? That information helps us parse out if results were actually “positive”. Doctors, especially those involved in research are extremely helpful to understand trial design. They can tell you how a placebo tends to respond and interpreting clinical endpoints.

Outsiders see trials miss on patient reported outcomes, but a doctor with experience treating patients knows how to interpret those endpoints.

Know where to look

Experts don’t provide you non-public information, but they tell you exactly where to look. Should I pay attention to a specific metric? I’ve been in many calls where the experts simply point me to the right information in the public domain and speeds up my research. They can

Use expert interviews as a baseline

Instead of using KOLs for insight, use them for the opposite. The generic KOL call represents what other investors doing surface level diligence think. Think about what may change the KOL’s perspective….. maybe a piece of data will answer that in the future. Ask yourself if their opinion will change in a year. Some of the best opportunities are waiting for KOLs to catch up to your opinions.

Conclusion

I’ve seen the good, the bad, and the ugly from all sides of the table. If you enjoyed the post, share it with a friend. If you want to see a part 2 where I break down how to interpret KOLs, comment or email me at adu.subramanian@subradata.com.

Adu Subramanian

Appendix – a Note on Surveys, Sell Side, and Sponsored Calls

Componsy sponsored events:

Take with major grain of salt. These KOLs are paid by the company.

Even if they’re unpaid, any company sponsored KOL will be biased. Use them to understand the positive case.

Use for information as a starting point, treat it like it’s management presenting to you.

Sell Side

Sell side analysts sometimes do KOL calls and publish results

Often have access to good KOLs, but the same issues persist

Everyone sees these calls and results.

Reading an interpretation is not the same as doing a call.

Surveys

Most of these are noisy, some are straight up nonsense.

Doctors do not pay attention when filling these out. docs pay even less attention to these surveys than doing a call.

Response bias, poorly worded questions, lack of detail all create big issues.

Best for large trends rather than specific inputs for a model

KOL in Biotech = Doctor usually. KOL, Expert, Doctor, are used interchangeably.

“knowledge that is difficult to articulate, express, or formally document, often gained through experience and intuition” - Definition of Tacit Knowledge

Investors without dedicated biotech teams or specialized degrees.

I suspect ChatGPT Deep research can replace a lot of these calls.

bar for success = change in primary or secondary endpoint which would be a meaningful improvement and results in significant usage of a drug/device.

Great points throughout this post, especially re: diminishing returns. Can't tell you how many market research projects I or other BioPharma colleagues have reviewed proposals for, where consulting firms have ratcheted up the number of KOL interviews to unnecessary amounts. It's a great mechanism to bloat project costs and often adding little value after a certain point number.

Crazy anecdotes re: PDW. I knew that disease was uniquely challenging, but those patient stories were shocking. The ice cream truck one specifically made me think of the "Clickers" from HBOS' "The Last of Us". Just a terrible disease. Congrats to the Soleno team for getting a new therapeutic over the finish line.

Very insightful/useful breakdown as always; thanks.