Biotech Analysis: From 0 to 1

Breaking down my process with a couple examples. End with the future of the blog and Subradata

TLDR: I break down my process for analyzing biotech companies/drugs/diseases.

Healthcare isn’t for specialists only. Let’s stop lamenting lack of generalists and instead encourage them.

My process of biotech analysis

Identify key questions driving value

Break down the disease and drug from 0 to 1 - a structured process

Keeping up with news

Case example: Cidara Therapeutics

The role of AI

The future of my blog and website

Healthcare, specifically biotech, can seem like a field for specialists, reserved for people with advanced technical degrees. Most investors are ubercurious but gunshy because they don’t know where to start. I’ve received a few messages from smart generalists looking to learn more about the field.

Popular biotech podcasts often lament the lack of generalist interest.

“The edge for biotech specialists is interpreting clinical data. Interpretation of data is subjective. When I talk to the occasional generalist, the debates on a stock are around some esoteric biomarker and whether it truly does or doesn’t correlate with progression. Back 2015, there was tons of activity in Gene therapy as a concept. Generalist interest is cyclical. “ - Biotech Hangout Podcast (paraphrased for brevity)

But I’ve seen non specialists succeed where MD and PHDs fail miserably. I want to encourage more people to invest their time and money in healthcare, a field where we can make meaningful change. For anyone completely new to analyzing companies and drugs, I would recommend a few resources to capture the essentials.

Daron Evans on Life Science Investing in Microcaps - Focused on small companies with great case studies.

Life Sci VC's Introduction to Pharmacology and Diligence - Tailored to venture betting on drugs rather than public companies.

Pharmagellan's Framework for Clinical Trial Risk - A structured approach to evaluate the likelihood of success in clinical development.

Biotech Investing Thinkific - A free comprehensive course on public biotech investing.

The History of Pharma - A thorough read on the history of pharma, relevant to understand broader sector trends.

The aforementioned videos and courses are free and accessible to all. They provide a strong baseline framework we can adapt to a more specific process to analyze drugs, diseases, and companies. I’ll walk through how I think about it.

**Note: I will focus on drugs/diseases/companies rather than trading stocks. My interests lie in analyzing drugs, not options trading. Analysis is one piece of successful investing.

Defining Biotech

I define “biotech” as any company running clinical trials for a drug. For the absolute basics of clinical trials, refer to the Thinkific Course I posted above. I will focus on my process.

Key Questions drive value

Start with key questions that can change a drug's value. The core of any investment thesis remains simple:

What do other investors currently believe?

What do you believe differently?

When/Why will their views shift toward your view?

The principles apply broadly, but biotech analysis requires a different approach. Traditional companies converge on two metrics—sales growth and profitability. Despite all the accounting gymnastics, alternative data, and specialized calculations, it boils down to 1) Will the company grow? 2) Can it turn a profit?

Biotech follows the same fundamental logic with unique complexity. The typical lifecycle spans a decade of deliberate unprofitability, high-risk clinical trials and (hopefully) commercialization. Unlike other public companies, the end goal is often acquisition by pharmaceutical companies. Companies in each phase of development require different analytical frameworks. Early-stage assets must demonstrate proof of concept, while later-stage programs must differentiate among competitive landscapes.

Still, I believe the core objective remains simple and constant: increase probability of success and maximize peak/long-term sales. Investors and analysts should identify the key debates which can change a program’s value. If you’re a prospective investor, knowing the questions is step 1. Answering the questions is step 2. We can spend days researching superfluous information or we can identify the right questions and spend hours instead.

How to Identify Key Questions

Start with earnings calls and investor presentations. Companies construct narratives, and your task is determining whether they're presenting reality or not. Are they “gaslighting” you? Pay attention to sell-side analyst questions asked on earnings calls—they target investor concerns and highlight unresolved issues.

Consider this example from BridgeBio and their drug, acoramidis, to treat ATTR-Cardiomyopathy last year. Acoramidis was successful in phase 3 trials but faced competition from other drugs. Their JP Morgan SEC filing revealed four critical narrative elements for acoramidis:

Competitive positioning: Management claims their therapy surpasses tafamidis (the current standard)

Market dynamics: The ATTR-CM market continues growing with premium pricing

Administration advantage: "Cardiovascular markets are dominated by orally administered products" (suggesting they'll capture greater market share than injectable competitors)

Patent protection: While tafamidis faces potential generic entry in 2026 (reducing the potential for acoramidis), management believes Pfizer can defend intellectual property until 2028 and beyond.

So instead of researching the early phase 1 data, investors should focus on those debates. Will the drug be positioned for success in a crowded market?

**Note that this example merely demonstrates a framework.

Example set of questions to verify at each stage.

Preclinical: Before human trials

Do we have evidence to pursue a target?

Can we modulate the target with a drug?

Will the pharmacokinetics/Pharmacodynamics support dosing at appropriate intervals? Details here

Early-stage assets: phase 1 trials

How does preclinical data (mice, primates, cells) translate to clinical data?

When will a drug reach “proof of concept” in humans?

Will biomarkers from early studies translate to later phase studies?

Is the market size large enough to pursue further development?

Later Stages: Phase ⅔ Trials

How does the asset compare to competition?

Does the drug fulfill an unmet need?

How do we define and breakdown the target population?

Are trials designed appropriately to show a clinically meaningful, statistically significant benefit in the target population?

Early commercial Stages: Near or at approval

How will the FDA interpret the data and will the drug be approved?

Estimate expected market share and pricing based on prior data

Who is the target market? How large is the target market? What work is required to commercialize the drug?

Later stage Life cycle management

What is the patent life?

Will Insurance continue to reimburse for the product?

Is the company a candidate for acquisition?

Definition: A catalyst is a piece of news which changes the market perception of the value of a program. It’s an event which answers an open question. (clinical trial readouts are common ones).

Part 1: From 0 to 1 - Building Your Baseline

What if terms like "tafamidis" and ‘transthyretin” sound like Greek characters in a play? We must learn background information.

For most companies, the first 60 hours follow a standard playbook. Read the filings. Build a model. Talk to customers, Talk to management.

Biotech demands a fundamentally different approach. While SEC filings provide a starting point, you'll quickly need to dive into scientific publications from PubMed and conference proceedings. Here is my process.

1. Disease Fundamentals

Understand the disease and drug intervention. What causes the condition at a molecular level? How does the candidate drug address this cause? Map epidemiology to estimate total addressable market.

2. Treatment Landscape

Review current standards of care. Talk to KOLs and identify specific unmet needs that create opportunity. Define the ideal target product profile that would address these gaps.

3. Competitive Assessment

Map all drugs in development targeting the same condition. Compare mechanisms of action and available clinical/preclinical data to evaluate relative advantages. Examine drugs with similar mechanisms of action to establish proof of concept. Look back at prior failures and successes for lessons.

4. Data Translation

Analyze relationships between early signals and later-phase outcomes. Determine if the target has established proof of concept (tied to before). Evaluate whether the mechanism is validated through genetics, existing drugs, or biomarker evidence.

5. Trial Design

Evaluate statistical power and endpoint selection. Verify appropriate target population definition. Confirm consistency between early and pivotal trial design. Will the design support regulatory approval?

6. Regulatory & Market Landscape

Review FDA precedent for similar programs (Advisory committees, drug review docs) Analyze pricing potential and insurance reimbursement dynamics. Evaluate patent strength and duration.

7. Financial Modeling -

Project market share, pricing, and valuation to a rough discounted cash flow model (DCF). Some standard heuristics: approximately six years from approval to peak sales, valuation is 4× peak sales discounted back at 10-15%. Use comparable company valuations as a benchmark (similar drugs, similar markets, etc.)

Part 2: Staying at 1 - How data is released

With your baseline established, what’s next? in addition to traditional earnings calls, biotech investors often pay attention to data published in press releases (ad hoc), conferences, and publications. Companies often release trial results through a standard sequence spanning 2-3 years:

Press Release - Initial topline results, limited detail

Companies sometimes prerelease interim results at predefined milestones

Conference Presentation - Details major medical meetings

Journal Publication - All information in an official publication

Each step reveals progressively more granular information, gradually assembling the complete picture of a drug's potential.

Real-World Example: BridgeBio and Acoramidis

December 2021 - Negative interim results released, shares plummet

Impact: Significantly lowered probability of ultimate successJune 2023 - Positive topline results announced in press release

Impact: Dramatically reversed market perception, reestablished viabilityAugust 2023 - Full dataset presented at medical conference

Impact: Minimal new insights, primarily confirmed previous releaseJanuary 2024 - Peer-reviewed publication in medical journal

Impact: Limited new information, formalized existing knowledgeNovember 2024 - Long-term extension data published

Impact: Critical for resolving investor debate about potential mortality benefit on FDA label

This sequence illustrates the process. Each data release serves as an inflection point that either strengthens or weakens your investment case. Most events aren't binary but instead shift value slowly.

Medical Conferences follow a Cadence. Every field has a few key conferences. I’ll highlight some here.

Oncology:

ESMO Congress (September): European Society for Medical Oncology Congress

ASCO (June): American Society of Clinical Oncology

AACR Annual Meeting (April): American Association for Cancer Research Annual Meeting

Immunology:

AAAAI (February): American Academy of Allergy, Asthma, and Immunology

AAD (March): American Academy of Dermatology

ACAAI (October): American College of Allergy, Asthma, and Immunology

Hematology (Blood):

EHA (June): European Hematology Association

ASH (December): American Society of Hematology

Neurology:

Alzheimer’s/Parkinson’s Disease Conference (March): International Conference on Alzheimer's and Parkinson's Diseases

AAN (April): American Academy of Neurology

Metabolic:

EASL (May): European Association for the Study of the Liver

Endocrine Society (June): The Endocrine Society

Obesity Week (November): Obesity Week (organized by The Obesity Society)

Cell Therapy:

ASGCT (May): American Society of Gene & Cell Therapy

ESGCT (October): European Society for Gene and Cell Therapy

Nephrology:

WCN (Spring): World congress of Nephrology.

ASN Kidney Week (October): American Society of Nephrology Kidney Week

Cardiovascular:

ESC (August): European Society of Cardiology

ACC (March): American College of Cardiology

AHA Scientific Sessions (November): American Heart Association Scientific Sessions

Medical conferences, investor conferences, earnings calls, earnings releases…that’s a lot. Some would say too much. So, we have to tier and prioritize new information from companies and about diseases.

Tier 1: I know a disease space or company in depth and track every primary source in all formats. No Summarization tool will ever help me because I must read the primary sources.

Tier 2: Monitor these through filtered sources. AI generated summaries and secondary sources can parse through noise for quick understanding

Tier 3: Background noise. The most important words one can say is “I don’t know”. I ignore information for diseases and companies in this tier.

We’ve reviewed the 0 to 1 and some basic steps. Let’s put this process in practice.

Cidara Therapeutics and Universal Flu Prevention

How I found it:

A GPT-based tool that summarizes earnings flagged acceleration of their flu program. Cidara shifted timing from Q3 to first half because the flu season was severe. Moving readouts earlier is a good sign. Companies don’t hide bad data.

Catalyst Identification:

The investor presentation highlighted a definitive catalyst: Phase 2b trial readout scheduled for first half 2025.

Background Research:

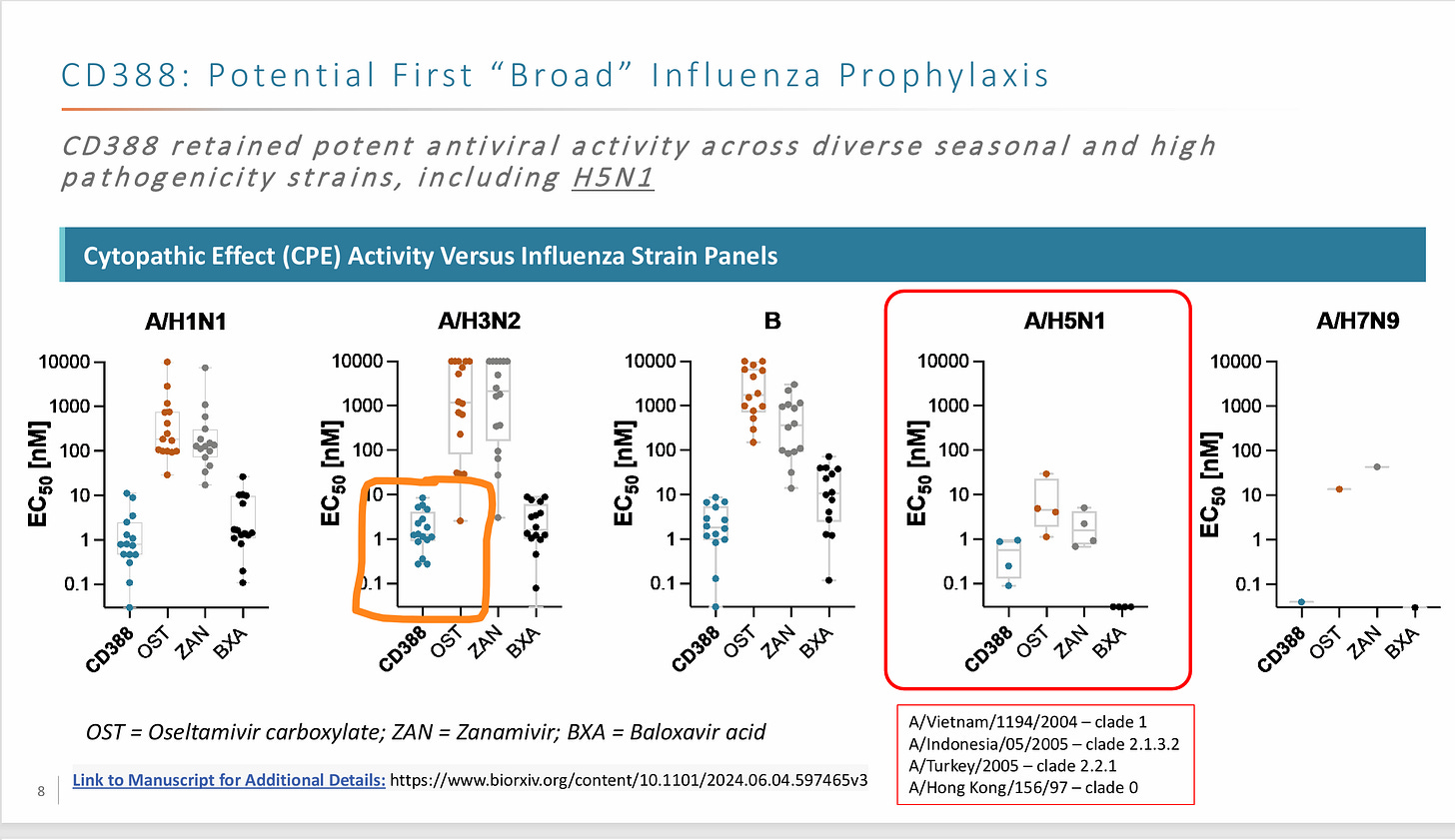

Cidara is developing CD388, an Fc-conjugated zanamivir designed for universal flu prevention. Zanamivir is an approved drug with poor pharmacokinetics (Short half life in the body, cleared quickly, and poor bioavailability). CD388 combines zanamivir with an Fc domain to extend half-life and allow one time injection. Currently, Zanamivir is primarily used for treatment, not prevention, and is very effective.

Neuraminidase inhibitors like zanamivir work by preventing virus release from infected cells. Thus, the key site of action is at the respiratory tract where flu replicates. The drug, while injected, has to somehow reach the respiratory tract.

"Flu" encompasses multiple influenza virus strains, while most vaccines target only predicted seasonal strains.

The market opportunity is substantial—oseltamivir (Tamiflu) has $3B in peak sales.

A similar program from VIR Biotechnology failed primarily due to endpoint definition issues rather than efficacy.

The EC50 represents concentration to kill 50% of the virus. Measured in Vitro

Key Question: Will the Phase 2b trial demonstrate efficacy?

With a large market and a clear catalyst, the key question is easy to identify: does the drug work?

This breaks down into three critical sub-questions:

Efficacy Threshold:

Standard flu vaccine effectiveness ranges from 30-60%. A 50% reduction in infection rates compared to placebo would likely constitute success.Tissue Concentration:

Fc-conjugated molecules (CD388) are much larger than small molecules Zanamivir) so they don’t reach respiratory tissue if injected. We need to convert from serum to respiratory tract concentrations. Serum concentration at 2 months (10 nM) converts to approximately 150 μg/mL in blood (using a molecular weight 65 kDA, ChatGPT can explain this conversion). Approximately 30% of CD388 made it to the respiratory tract in mice. Other Fc conjugated drugs show between 5-20% concentrations.Trial Context:

This year's severe flu season dominated by A/H3 strains creates favorable conditions for demonstrating CD388 efficacy, as verified through CDC surveillance data. Furthermore, Cidara is using a stricter definition for “infection” compared to Vir, thus increasing probability CD388 shows a statistically significant effect.

Putting it together:

Cidara should have effective flu prophylaxis. The EC50 (concentration required for 50% of response) is lower than the expected concentration. Furthermore, a severe flu season and the trial endpoints are designed for success.

A full analysis would require deeper investigation into specific assay methodologies, the financials, and comparative efficacy.

Note: This example illustrates analytical process rather than investment advice.

AI in biotech: Can I use ChatGPT?

One up and coming alternative to manually sifting through 100s of publications is using an AI based tool to get a summary. Why can’t it replace the work of a Junior?

I’ve used the commonly available consumer tools and come to a few conclusions. Linking a few examples:

ATTR- Cardiomyopathy, Heart Failure/Pulmonary Hypertension, Myasthenia Gravis, AATD, my previous article on using AI.

Strengths:

Compiling basic information from multiple sources

Summarizing standard scientific concepts

Finding obscure publications/sources

Current Limitations (Likely Solvable):

Missing recent developments. If we provide up to date information, we can fix this

Hallucinations: sometimes, even when provided with the right information, the models can make up values and fool non experts. Larger and better models will be better and fix these errors

Fundamental Limitations:

Cannot access tacit knowledge that experts develop through experience

Lacks interpretation skills, recognizing when "early separation" on a Kaplan-Meier curve represents a meaningful signal

Doesn’t understand the “real world” incentives

Lacks Taste: we have to ask the right questions to receive good answers. The tools are best used by experts who have taste

How I add value

I want to make biotech accessible. I’m not a stock picker. I'm not here to pick stocks—plenty of others do that already (and do it well). But picking stocks gives people borrowed conviction. Borrowed conviction is like borrowed money: it costs more than you think.

Instead, my analysis will focus on understanding the science, the unmet need, and putting it together with financial/regulatory incentives. I believe my experience (medicine, engineering) is best suited to be at that intersection.

What's Next - Enabling analysis

Instead of paying hundreds of thousands for equity research, I want to make it more accessible to get up to speed and stay up to speed. I believe we can automate a lot of the process to enable analysts to operate at the top of their license.

I have tools that track earnings calls, trial updates, and conference schedules automatically on my site. My site also includes disease overviews mapping every trial, approval, and drug in development. Further, I’m indexing all the conference abstracts for easy access.

Going forward, I'll create in-depth, disease-focused reports as definitive references for first-time investors in these areas. There will be a paid component but if an AI can do it, you get it for free. The first report is on sickle cell disease.

If you made it this far, I'd appreciate you sharing this with others. Email me with feedback. adu.subramanian@subradata.com

Adu

Appendix

Some red flags

A few heuristics which may not be obvious at first

Single stock investors: People who discuss only one company tend to be biased and promotional.

Sell side bias: Sell-side analysts need management access. This creates obvious conflicts

Small Company targeting big markets: Be wary of small companies touting a “first in class” therapy for Large, difficult to treat markets like

Post hoc analysis: A post hoc analysis is used a study is done on data that wasn't initially planned to be analyzed.

Sub group analysis: Be wary when management creates new subgroups to focus on

Change in wording: Every word is deliberate. "Pursuing accelerated approval" differs significantly from "exploring expedited pathways." (A reference to Dyne Therapeutics)

Prior history of frauds: Avoid anyone previously associated with known frauds (like Cassava). Past behavior predicts future problems.

Institutional ownership doesn’t equal success: Big funds can be just as wrong as you.

The “All is well” thesis: Nothing is ever perfect. Do NOT trust someone who says it is.

Changing the bar: When management sets a bar for success, they should stick to it.

Recently joined substack and this was one of the first articles I came across in my search for breaking down and better understanding biotech and the healthcare sector. Wonderfully laid out, I appreciate it!

This post is fantastic thank you. Practical, succinct and informative. This is the tone I’m hoping to achieve in my own posts, I recently wrote about biotech in China here https://open.substack.com/pub/chinahealthpulse/p/biotech-in-china-four-important-truths?utm_campaign=post&utm_medium=web