How Does Roivant Work?

And does it?

Roivant, and its founder, Vivek Ramaswamy are polarizing figures.

Some cite a “legacy as one the most interesting new models in biotech that actually worked” while others point out multiple failures, and restructurings. Some accuse Ramaswamy of questionable business practices and insider trading, while others herald him as a visionary. Some point to Axovant, the flagship company when roivant started, as evidence the model doesn’t work. Others point myovant and Urovant, major successes, as evidence it can work.

The duality is further amplified by Vivek’s public persona as “biotech whiz kid” who was on the cover of Forbes at 30 years old. Most profiles focus on his personal story, but I want to analyze the history of each of the vants. How Does Roivant Work?

Roivant was created in 2015 and went public in 2021. Vivek stepped down in January of 2021 from the CEO position and left the company in 2023. In 2015, FORBES estimated it was worth 3.5$ Billion. The current market cap is approximately $8B.

Initial Vision

Roivant’s strategy is to license discontinued drugs from large pharmaceutical companies and create individual subsidiaries (“-Vants”) operating independently to develop those drugs. Each “Vant” focuses on one or two drugs or diseases. The model strays from traditional biotech which often develops drugs from start to finish, but instead skips the earlist stages of discovery. Licensing drugs is not new in biotech, but creating a company to formalize the process is different. Ruxandra Teslo has a nice piece on the business model.

Vivek lays out his vision in a 2015 Forbes article:

“"So many drugs that would have been of use to society are cast aside. Certain drugs have gone by the wayside for reasons that have nothing to do with their underlying merits." - Ramaswamy.

The article further cites multiple blockbuster drugs abandoned by big pharma for one reason or another. Repurposing left behind drugs is a tried-and-true practice in biotech and pharma.

Vivek further elaborates in a 2017 interview. He wants Roivant to design innovative payment models and use computer science-based analysis to identify novel targets. They hire “MIT trained computer scientists” instead of “people walking on white coats”. Core to his promise is bringing an outsider perspective to change drug development.

“Big pharma does a good job at discovering molecules. They do a terrible job running clinical trials. We are often taking these products on later in their development cycles and because our businesses core competency I believe is to make that process more cost-efficient of developing those medicines “

Roivant’s premise was based on 3 key ideas

Align incentives: Scientists and researchers in large pharma companies often don't participate in the upside of successful drugs and bear all the downside of failure. Roivant’s model provides scientists with equity stakes and the opportunity to be re-invested in other projects within the Roivant ecosystem if their initial project fails, fostering a culture of risk-taking.

Hire key talent, have an outsider’s perspective: Roivant deliberately seeks out scientific advocates who still believe in the potential of drugs that have been abandoned by other companies. Hiring the key players ensures internal support and passion for the projects. Roivant recruits talent from both within and outside the pharmaceutical industry, focusing on bringing in bright and passionate individuals, including computer scientists, not just traditional scientists. Outsiders may not be shackled by the restraints of the old guard.

Cheap development leads to lower cost drugs: “because our businesses core competency I believe is to make that process more cost-efficient of developing those medicines to market we cannot be under the same pressure as a conventional pharmaceutical company that needs to charge a price”. Each Vant will license drugs for cheap, thus they can sell the drugs for cheap

Roivant has 10 years of track record so we can finally analyze a few questions.

What Happened with some of the major “-vants”?

Does the strategy work? Where does it work best?

Were they successful at approving drug? Revolutionizing biotech?

Part 1: Axovant, Urovant, Myovant, Enzyvant, Altavant.

Note: Roivant’s stake in each Urovant, Myovant, Enzyvant, and Altavant was bought out by Sumitomo pharma in 2019 for $3 Billion. The acquisition realized value for roivant and allowed future investment. (story)

Vant 1: Axovant - Why did we buy this?

Origin: In 2014, Axovant acquired intepirdine, a drug that had already failed four clinical trials for Alzheimer's, from GSK for $5 million (source)

Timeline:

2014 Axovant acquires intepirdine

2015 Axovant goes public at a valuation of 3 billion

2017: Intepirdine fails in phase 3 clinical trials.

Intepirdine was a bad drug. Industry experts, including medicinal chemist Derek Lowe (source) and controversial “pharma-bro” Martin Shkreli (source), expressed skepticism about intepirdine's potential. Even some of Axovant’s flagships investors may have known it.

I believe raising 315 million to run a phase 3 trial for intepirdine was poor capital allocation based on the prior results and proof of concept data. Ramaswamy received some criticism for “hyping the drug” at the time (and even now), but raising capital is the lifeblood of biotech. Raising capital is difficult and required to fund large trials ‘hyping the drug’ and raising capital to fund operation is core to competency for biotech leadership

I believe Axovant highlights Ramaswamy's core strengths: his ability to craft a compelling narrative and raise capital. While not a biotech expert, he assembled a team of reputable scientists and effectively sold the 'Vant' vision to investors, securing funding for future ventures." A scientist may throw stones from an ivory tower of intellect, but successful drugs require more than strong data and a good idea. Companies NEED business development, capital raising capabilities, and exceution. His expertise naturally flows into Roivant’s values.

Axovant was unsuccessful, but Axovant strayed from the model! The goal was taking drugs which has proof of concept and were discontinued for non-clinical reasons. Interpirdine was discontinued for lack of clinical efficacy. While 5-HT6 modulation, the mechanism for intepirdine, was promising, it was nowhere near proven (e.x. Pfizer). The case is still instructive as we look at how Roivant has succeeded in other ventures.

2. Myovant and Urovant - It’s Alive!

Myovant

Origin: Myovant, a company initially part of the Roivant family, licensed relugolix, a drug for prostate cancer and uterine fibroids from Takeda in 2016. Takeda conducted Phase 2 trials and was conducting Phase 3 trials in Japan for approval but saw limited potential internationally and were moving away from women’s health.

Timeline:

2016: Myovant licenses relugolix from Takeda, gaining global rights (excluding Japan and certain Asian countries).

Mid-2019: Myovant reports positive Phase 3 results for relugolix in prostate cancer.

April 2020: Positive Phase 3 results in endometriosis.

December 2020: Myovant announces a commercialization collaboration with Pfizer.

2020: Relugolix (Orgovyx) is approved by the FDA for advanced prostate cancer.

2021: Relugolix and combination therapy approved for uterine fibroids.

2022: Sumitomo acquires Myovant.

“It's a medicine that has applications in prostate cancer, as you've mentioned, and also in women's health, specifically uterine fibroid condition. So as you've heard, women's health is no longer within our strategy……So when we put all this together, what we've concluded is that there is an opportunity in Japan, that's clear, both on the prostate cancer side and also on the women's health side. We don't think that the opportunity in prostate cancer is as competitive, for a variety of reasons, outside of Japan. So given all of this, we're in the process of looking at a creative partnership that would allow the molecule to be developed globally for both indications but would also allow us to retain rights to the molecule in Japan.” - Takeda 2016

Takeda knew relugolix worked. They were running multiple phase 3 trials in japan and eventually received approval in japan before Myovant’s phase 3 trial was published. But they were moving away from women’s health so they partnered the product away. At the time, the standard treatment involved using drugs called GnRH agonists (i.e. leuprolide). Agonists initially stimulate hormone production before ultimately suppressing it, which can cause undesirable side effects. Relugolix, a GnRH antagonist, offered a more direct approach by immediately blocking hormone production.

Relugolix fit an unmet need as an oral medication (unlike other GnRH antagonists which were injectable) with improved safety compared to standard of care (“80% fewer major adverse cardiovascular events reported compared to the leuprolide acetate group”) (source). Relugolix wasn’t more effective than standard of care but still fit an unmet need.

Relugolix was approved in 2020 and Pfizer paid 650m for rights to commercialize the drug (story) with up to 4.2 billion in sales milestones/royalties. Sumitomo acquired the company in 2022. It’s expected to do 500m in revenue this year as a key growth driver for Sumitomo.

Urovant - Part 2.

Origin: Urovant licensed vibegron, a drug for overactive bladder (OAB), from Merck in 2017. Merck completed Phase 2 trials demonstrating the drug's potential The mechanism of action was validated by mirabegron, an approved drug with a similar mechanism of action. Kyorin, which had licensed Asian rights from Merck, had also completed a Phase 3 trial. However, both companies had deprioritized the drug for strategic reasons.

Timeline:

2017: Urovant acquires the drug from Merck

2019: Positive phase 3 results in OAB

2020: The FDA approves vibegron (GEMTESA) Sumitomo Dainippon Pharma, already a majority shareholder, fully acquires Urovant.

By the time of Urovant's IPO in 2018, vibegron had a strong foundation of clinical evidence. This included successful Phase 2 data from Merck, multiple Phase 3 trials conducted by Kyorin in Asia, and market validation from mirabegron (Myrbetriq), another beta-3 agonist already approved for Overactive bladder (OAB (Merck, Kyorin).

Commercial Success

I suspect Merck was willing to give up the drug because the incumbent beta-3 agonist for overactive bladder (Myrbetric) was set to go off patent in 2024 and overactive bladder is a niche market. Merck was also restructuring circa 2014.

“Merck is working on a global initiative to sharpen its research and development focus and has decided, in that process, to out-license Vibegron to Kyorin” - Merck

Vibegron was able to navigate commercial concerns from investors and now sells 400M/year, growing 40%. Generic miragebron, the other competing therapy entered the market in 2024 and we’ve yet to see an impact. Maybe insurance companies force step therapy and limit sales but Urovant is successful regardless. Urovant licensed the drug for 10 million dollars (Sumitomo, launch)

Solabegron is Solabe-gone

Urovant's success with vibegron is underscored by the contrasting fate of Velicept Therapeutics. Velicept, developing a similar beta-3 agonist called solabegron, failed to capitalize on promising Phase 2 results and ultimately went bankrupt. (phase 2 results show comparable efficacy and safety). The Vant structure works! Solabegron is Solabe-gone. While Vibegron is vibing.

Pricing

However, Vibegron also exemplifies where Roivant has failed: they haven’t substantially changed pricing. Urovant’s pricing strategy strays from Roivant’s vision to lower drug costs. (see the introduction)

Urovant's CEO indicated that they would price

“Gemtesa competitively with Myrbetriq”, suggesting a focus on maximizing revenue rather than significantly reducing costs for patients.

Further, they comment on a “market of this size with 18 million prescriptions is that each percentage point at a brand price represents about $70 million in revenues” - JPM 2020

I highly doubt Gemtesa is priced below substantially below myrbetric.

Takeaways

Myovant and Urovant exemplify Roivant's successful strategy of identifying and acquiring late-stage drug candidates with a clear proof of concept. These "Vants" effectively took drugs that had been deprioritized by other companies, often for non-scientific reasons, and successfully navigated the final stages of clinical development and commercialization. Both companies contrast sharply with Axovant, where Roivant acquired a drug with limited clinical evidence and promising potential. The successes of Myovant and Urovant, underscore Roivant's ability to add value in the later stages of drug development, particularly when a drug's potential has already been demonstrated.

Enzyvant: A Success Story in Rare Disease

Enzyvant licensed their main drug, RETHYMIC (allogeneic processed thymus tissue-agdc), a treatment for congenital athymia, from Duke University in 2016. The therapy was developed at Duke with decades of research to support efficacy (source). RETHYMIC was approved in October 2021 and is a one-time regenerative tissue-based therapy designed for immune reconstitution in pediatric patients with congenital athymia. For the non scientists: RETHYMIC gives babies without a thymus, responsible for a major part of our immune system, a fake thymus which works well.

Infants with athymia are expected to die in infancy. 70% of patients on rethymic survive to be a teenager (and beyond).

Unlike other Roivant companies that often acquire assets from pharmaceutical companies, Enzyvant sourced RETHYMIC from an academic institution, Duke University.

Enzyvant's success is lends itself to an easy narrative: license and evidence based academic treatment, formalize development through clinical trials, and bring it to market for broad distribution. Roivant's ability to navigate late-stage development, filling a common incompetency in academia

On pricing: RETHYMIC sells for $2.7 million so Enzyvant draws ire from journalists (the NYT article on Vivek specifically ends with it), but the therapy is hard to manufacture and life changing. As discussed before, vibegron is better fodder to criticize pricing.

Altavant - Unsuccessful foray into PAH

Origin and timeline: Roivant formed Altavant to develop rodatristat ethyl, a drug for pulmonary arterial hypertension (PAH), acquired from Karo Pharma. Rodatristat ethyl aimed to treat PAH by inhibiting an enzyme involved in serotonin production. While serotonin is linked to PAH, its role is not central to the disease's primary mechanisms. In 2022, rodatristat ethyl failed in Phase 2b clinical trials.

Altavant strayed from the prior models of success and turned Roivant into a biotech. Unlike other -vants that focused on late-stage, de-risked assets, Altavant was built around rodatristat ethyl, a drug with a novel but unproven mechanism for treating PAH. A bit like Axovant’s intepirdine. Rodatristat ethyl targeted the serotonin pathway, which, while implicated in PAH, is not a primary driver of the disease. This lack of a strong proof of concept, coupled with the complexity of PAH, contributed to the drug's failure in Phase 2b trials. That’s what you expect when you take a unvalidated mechanism into late-stage trials in a tough disease (source)

Dermavant - Commercialization is hard

Origin: Dermavant acquired tapinarof, a topical treatment for psoriasis and atopic dermatitis, from GSK in 2018. GSK had conducted multiple positive Phase 2 trials but was undergoing a restructuring. Tapinarof is a novel aryl hydrocarbon receptor agonist.

Timeline:

2018: Dermavant acquires tapinarof from GSK.

2020-2021: Dermavant reports positive Phase 3 results for tapinarof in psoriasis and atopic dermatitis.

2022: Tapinarof (Vtama) is approved by the FDA for psoriasis.

2024: Organon acquires tapinarof for up to $1.2 billion.

Dermavant aligns with Roivant’s model. Tapinarof was developed by GSK and purchased in July 2018 by Dermavant (source). GSK was undergoing a “major restructuring program” so it sold the product. However, executives touted multiple, successful phase 2 trials citing how it could be the first topical medicine for psoriasis in 20 years.

“We have taken a strategic decision to divest or partner medicines in our R&D portfolio that are a better fit for other companies allowing us to concentrate our resources on other promising assets. Tapinarof has the potential to be a first-in-class therapy and a convenient, once-daily topical agent that postpones or potentially eliminates the need for systemic treatment in two of the most common dermatological conditions, psoriasis and atopic dermatitis. “ - GSK

Tapinarof was touted as a topical medication with a novel mechanism of action and “game-changing” potential by both Dermavant and GSK. Dermavant successfully ran the phase 3 trials in psoriasis and atopic dermatitis (Psoriasis, dermatitis). The Drug was approved and launched in 2022. However, Tapinarof (VTAMA brand name) faced commercial challenges. Competition from well-established, cheap, topical steroids likely contributed to its slower-than-expected sales (Analysts slashed peak sales estimates after a year on launch). In 2024, Organon acquired the rights to tapinarof for an initial payment of $250 million, with the potential for up to $1.2 billion based on future milestones (source).

Roivant’s return on investment wasn’t outstanding since they bought the drug for 150M upfront and sold it for 250M (assuming approval in atopic dermatitis), but I think it’s another example how Roivant succeeds. Roivant licenses a drug with proof of concept and runs the phase 3 trials to get approval. I’m starting to sound like a broken record.

But Dermavant crystalizes another pattern. Roivant’s multiple approved drugs but has commercialized none of them. Commercialization is challenging, particularly against established treatments. Partnering with Organon, a company with greater marketing resources, was a strategic move to maximize tapinarof's market potential. Pharmaceutical companies are well positioned to commercialize drugs which is why Mergers and Acquisitions are the lifeblood of biotech returns, a model Roivant has yet to buck.

Restructuring post IPO, Aruvant, Cytovant, Lysovant and others in 2022

Roivant went major restructuring in 2022 to refocus their pipeline on a few key companies, Spring cleaning of a sort. I think they realized the pipeline wasn’t fulfilling their original premise and made the necessary changes.

Aruvant, the “game changing” sickle cell disease was shut down.

Dermavant terminated all development except for VTAMA commercial peraparations

Revealed IMVT-1402 to improve on Batoclimab (will discuss later)

Discontinued other programs such as LSVT-1701, CVT-TCR-01

Launched Priovant for Brepocitinib

Roivant focused their priorities to align with their expertise. All the science experiments were deprioritized. Roivant has restructured twice in 4 years (2018, 2022) ye still maintains a successful track record. The ability to do deals fast is a key advantage for roivant. They’re not beholden to the same constraints as pharma not tied to one asset or platform like a biotech.

Televant: Blockbuster Success

Origin and timeline: Pfizer developed PF-06480605 (now RVT-3101), an anti-TL1A antibody for inflammatory bowel disease (IBD), but partnered with Roivant to form Televant to further develop the drug.

2022: Pfizer and Roivant form Televant, a joint venture, to develop PF-06480605 (now RVT-3101), an antibody targeting TL1A for inflammatory bowel disease (IBD).

2023: Roche acquires Televant for $7.1 billion upfront, with potential for additional milestone payments.

Televant is Roivant’s flagship success, a 2 year multiple 100% return. People point to it as one in a long line of Pfizer failures to why Pfizer is terrible at R and D (twitter)

But the deal shows exactly why Roivant can be a perfect partner. I’d argue Pfizer knew exactly what they had in the pipeline, a potentially transformative mechanism of action in a crowded space which distracts from their commercial launches. They used Roivant as a commercial stage Contract Research Organization (CRO) to run the late stage trials and Roche swooped in earlier than expected to purchase the asset.

Side note: A CRO is an outsourced research organization to run clinical trials (wiki). They are paid per trial and hired to execute trials.

Pfizer’s comments on TL1A were uber bullish. Licensing the drug sounds like a parent letting a child go off to college. They maintain a 25% share in the program.

“from time to time, you're going to see programs like the TL1A that have very clear scientific merit, but we think we're sharing the cost, the risk and capabilities with the partner is the best way to create value. “ - Q4 2022, Pfizer

“we just have more than we can prosecute on our own” December 2022, Pfizer

Roivant’s goal was to develop TL1A to commercialization and expected to spend hundreds of millions to run phase 3 trials. However, Roche offered a significant amount ($7 Billion) and Roivant couldn’t say No. Matt Gline, Roivant CEO expressed regret over selling the program “I was just talking to one of my colleagues about the pangs of regret for having sold it, even at that price, just because of how great the opportunity was” (source)

However, I disagree with his assessment. I think the drug would be acquired by a large pharma company eventually and selling it early for a good price is an acceleration, not a deviation of the pathway.

Immunovant - if at first you don’t succeed

Origin + timeline: Immunovant, another Roivant subsidiary, is developing therapies targeting the neonatal Fc Receptor (FcRN). FcRN is a receptor used to recycle antibodies in our body to extend their half life. However, in auto immune disease, our body produces antibodies against our own body, so we want to reduce those levels of “pathogenic antibodies”. Stopping FcRN is one way to reduce antibody levels and is broadly applicable to many auto immune diseases. Immunovant initially licensed batoclimab, an anti-FcRn antibody, but later developed IMVT-1402, a next-generation anti-FcRn antibody, from HanAll Biopharma after encountering safety issues with batoclimab. Both batoclimab and IMVT-1402 are anti-FcRn antibodies which work by blocking the neonatal Fc receptor (FcRn).

Timeline

2018: Immunovant formed to develop Batoclimab

February 2021: Batoclimab's development is paused due to safety concerns (elevated cholesterol levels).

September 2022: Immunovant licenses IMVT-1402 from HanAll.

September 2023: IMVT-1402 shows promising early clinical data with improved safety compared to Batoclimab.

The “Anti FcRn” market is large and currently dominated by Argenx's Vyvgart (Efgartigimod, Infused drug). While some believe Immunovant has the potential to disrupt this market, others are skeptical, viewing its candidates as 'me-too' drugs with limited differentiation. The reality likely lies somewhere in between.

Batoclimab aims to address similar indications to Vyvgart, while differentiating itself with potential advantages in efficacy, dosing, and delivery. Vyvgart is either infused intravenously and require healthcare providers for at home administration. Immunovant is seeking to create an easy to administer subcutaneous version.

“Look, [the trial] designed to underscore in the world's mind that deeper IgG suppression can yield clinical benefit that matter.” - They think 1402 will be the best drug

“Patients would prefer a convenient at-home administration with short injection time because I think there is no question.” - at home administration is quick and easy

- Matt Gline, Roivant CEO, JP Morgan Conference, Jan 2025

Batoclimab first drug licensed by Immunovant, but hit a safety snag in February 2021 (source). In typical biotech fashion, the stock drops 90% from highs of $50 to $4, woof. The promise for a subcutaneous, easy to administer, FcRn inhibitor was delayed significantly, but Immunovant persevered and eventually licensed IMVT-1402, a next generation version from HanAll (September 2022). Early phase 1 studies are promising with similar efficacy but improved safety compared to batoclimab (September 2023 results). Immunovant is using batoclimab’s clinical results to validate 1402’s clinical efficacy profile. They will commercialize 1402.

FcRn inhibitors are a multibillion dollar drug class, exemplified by J&J's $6.5 billion acquisition of Momenta Pharmaceuticals so the mechanism has passed proof of concept. But Immunovant’s dvelopment strategy departs from Roivant’s traditional strategy to take an abandoned drug from pharma with proof of concept. IMVT-1402 is a novel drug targeting an established market. Roivant likes the opportunity specifically because the target is difficult to drug

“Because otherwise, I think it's just like a pretty scary competitive dynamic and very different from the competitive dynamics in FcRn. In part, frankly, FcRn has proven to be a relatively difficult target to drug. And so the truth is like how many really good anti-FcRn antibodies are there in the world, 3, 4, 5, like not very many.” - Matt Gline at EverCore ISI conference December 24.

Immunovant will face the traditional biotech challenges navigating trials from phase 1 to approval. They’ve been less than perfect given the history with batoclimab and recently delayed trial readouts.

Next Steps: Immunovant will report results for batoclimab in myasthenia gravis and Graves disease this year. Baseline expectations are to match the efficacy for established players while showing greater efficacy would be a positive surprise. But their goal is to be the best option in a large market.1 2025 is a “make or break” year where we can see if they prove batoclimab works which supports 1402 development.

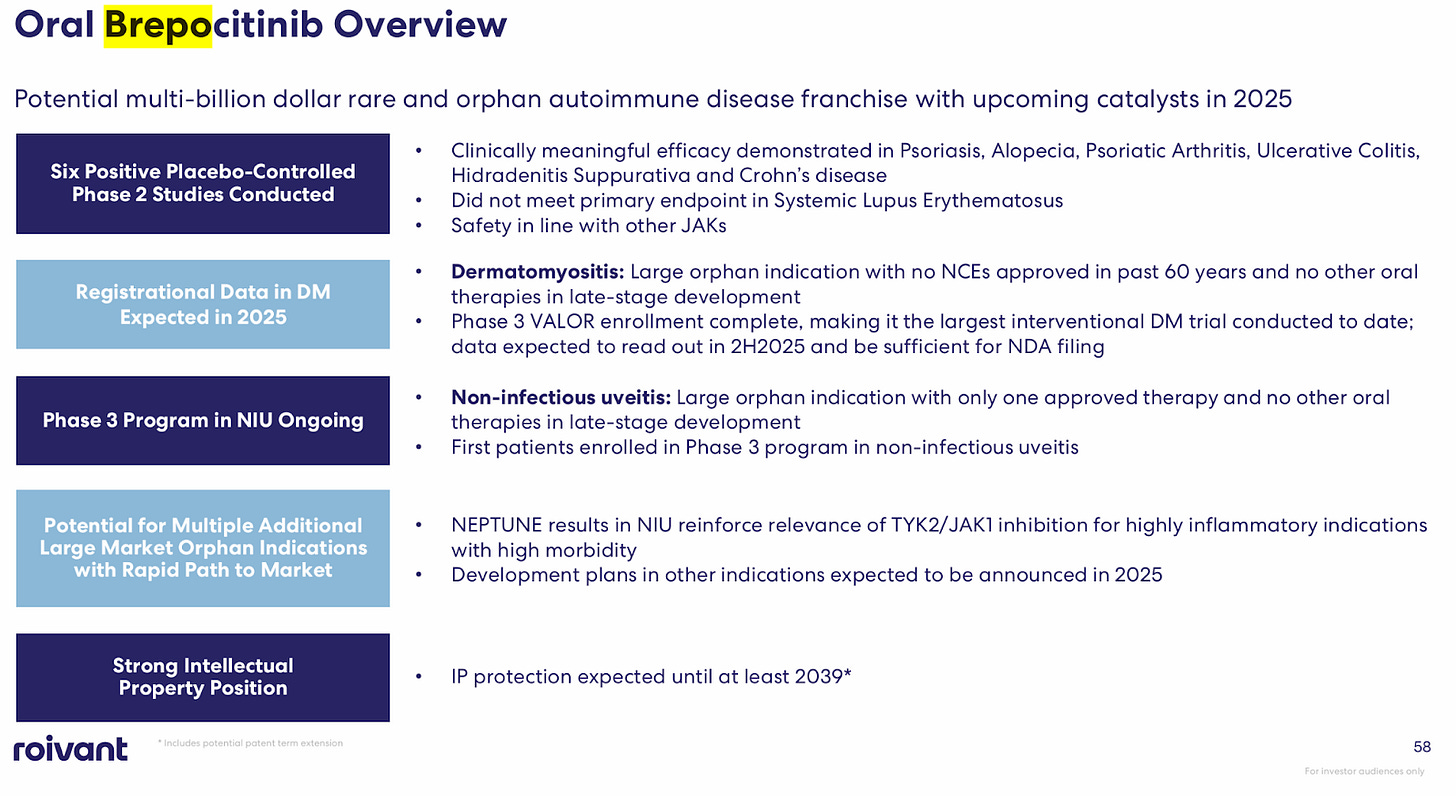

Priovant - A Classic -Vant

Origin: Priovant is developing brepocitinib, an oral TYK2/JAK1 inhibitor for autoimmune diseases, licensed from Pfizer. Brepocitinib inhibits both TYK2 and JAK1, two proteins involved in cytokine signaling pathways that drive autoimmune diseases. Pfizer and Roivant formed Priovant in 2022 to develop brepocitinib. Brepocitinib had completed seven Phase 2 studies with 1,400 subjects. It's now in Phase 3 trials for dermatomyositis and non-infectious uveitis.

Priovant follows the canonical Roivant model. Pfizer knows Brepocitinib is an effective drug but stopped in house development for non clinical reasons.

“Brepocitinib that we are co-creating a new company with another investor group that will share the name of a very experienced group that we have worked with before. We retain certain commercialization rights. We see it as just an opportunity to partner. It's a great drug. It's the only TYK2/JAK1. It has very strong data in rheumatology and great data in topical atopic dermatitis treatment. It's just we have to make choices on how to use our efforts most wisely and welcome others to co-invest. It's been successful before. “ - Pfizer Commentary on Brepocitinib

Pfizer ran trials in large auto immune conditions (Psoriasis, ulcerative colitis, etc) so Roivant is using Pfizer’s established proof of concept to target niche indications with poor standard of care (Dermatomyositis, Non-Infectious uveitis). The strategic shift another piece of the puzzle for why Roivant is an appropriate partner. Pfizer needs the next Humira, a block buster multi billion drug: Roivant doesn’t. Winning in dermatomyositis and non-infectious uveitis, two orphan indications is significant for Roivant.

Next steps: Priovant will report phase 3 results in dermatomyositis later in 2025. This will be the first major phase 3 trial and would support FDA approval. I fully expect success and eventual acquisition once commercial.

Kinevant - Failure in Sarcoid

Origin: Roivant established Kinevant to develop namilumab, an antibody targeting GM-CSF, a cytokine implicated in various inflammatory diseases. Namilumab had a long and complex development history, having passed through multiple companies, including Micromet, Amgen, Takeda, and Izana, before landing at Kinevant. (source)

After years of development, the plug was finally pulled after namilumab failed a phase 2 trial run by Kinevant in pulmonary sarcoidosis in December 2024. Sarcoidosis is a multifactorial, hard to treat, cause for lung disease. GM-CSF is a cytokine implicated in multiple immune diseases but plays an unclear role in sarcoidosis. The research implicating GM-CSF in disease pathology shows mixed findings (source).

So we’re taking a molecule with little proof of concept, a vague theory of benefit into a multi factorial disease?

I suspect CEO Matt Gline was skeptical as well:

“Obviously, sarcoid is a complicated multifactorial disease. That said, macrophages plainly play a role in the flammation of granulomas in sarcoid and GM-CSF has biological relevance to that. Probably the success is still comparatively low, just given the biology and the nature of the disease. But if it does work, it's a huge commercial opportunity. And so I think we feel pretty good about it“

Pulmovant - The newest Company

Origin: Roivant's newest subsidiary, Pulmovant, is developing mosliciguat, a drug for pulmonary hypertension, a complication of interstitial lung disease (PH-ILD). Pulmovant acquired mosliciguat from Bayer who is undergoing recent restructuring (source, source). Mosliciguat is a soluble guanylate cyclase (sGC) activator.

Pulmovant strays from the traditionally successful roivant model but straddles the line between “late stage with proof of concept” and “early stage with some signal”. Mosliciguat is clearly not a science experiment. Riociguat, a sGC stimulator, is a standard treatment for pulmonary arterial hypertension (PAH), but there is no established proof of concept for its use in ILD, a distinct condition despite some similarities to PAH.

Ricociguat failed in ILD but mosliciguat can improves upon efficacy because it’s an activator rather than a stimulator. sGC stimulators work by enhancing the activity of the sGC enzyme in the presence of nitric oxide, leading to vasodilation. However, in chronic diseases like ILD, sGC can become oxidized and less responsive to stimulation. sGC activators, like mosliciguat, are designed to work even when sGC is oxidized, potentially offering greater efficacy. While an older sGC activator, cinaciguat, was discontinued due to safety concerns, newer activators have shown promise in other diseases(source). Mosliciguat could be a first-in-class treatment for PH-ILD.

Pulmovant isn’t the perfect “-Vant” but it contains some of the best characteristics. Bayer got rid of mosliciguat for non-clinical reasons. sGC activation is a logical mechanism of action. ILD is a disease with high unmet need. Preliminary data is strong. But the data isn’t perfect and Pulmovant will face the traditional challenges in biotech: Long timeline, early-stage execution, and commercial risks

How Roivant’s Changed

Roivant's early investor presentations compared with more recent ones reveals a shift in the company's self-perception and strategy. The S-1 dreamed of combining discovery with deal making, but the current presentation emphasizes incentives, business development, and efficiency. The dream to revolutionize biotech with an outsider perspective, taking abandoned drugs off of pharma’s shelves and developing them is only partially realized. Roivant succeeds when they have to be neither biotech nor pharma. Neither early-stage discovery, nor commercialization. Their role is perfect as a partner to run clinical trials for late phase drugs with proof of concept, a CRO of sorts.

So let’s answer the question: How Does Roivant Work?

Roivant works. Multiple -vants have approved drugs and the pipeline includes multiple phase 3 assets with potential to be approved. Axovant was an ill fated initial foray into the “-Vant” model, but was followed by successes at Urovant, Myovant, and Enzyvant. However, even with success, their role is different from the initial vision. Roivant navigates late-stage development well but has failed thus far at early-stage development and even commercialization.

Roivant’s public perception may paint it as a biotech company: I disagree….. Roivant succeeds when taking derisked molecules from large pharma companies and confirming their efficacy in late stage clinical trials. Most ventures into biotech-land with drugs lacking proof of concept have failed (Altavant, aruvant, kinevant). Further, each ‘-Vant” has been acquired after less than 3 years of commercialization, emphasizing the need for pharma after approval.

They seem to work best as a “Late Stage Contract Research organization”. Roivant swoops in when pharma has a good asset but lacks the resources and focus to develop the drug. Instead of shelving it forever, Roivant runs the phase 2/3 trial, directs it to specific indications and when approved, another company acquires the drug for commercial rollout. The strategy focuses on niche indications which may not fit a pharma’s strategies. Sometimes, pharma companies will continue to develop the drug for a specific market (Takeda with relugolix) or even partner with Roivant (Pfizer and Televant).

Further, Roivant’s successes aren’t revolutionary but incremental progress. They’ve developed another beta 3 agonist for Overactive bladder (Urovant), a safer/convenient prostate cancer drug (Myovant), and a topical for psoriasis competing with generics (Dermavant). They’re shifting into earlier stage development recently but trying to maintain their focus on proven mechanisms/drugs (Immunovant, Pulmovant, Priovant).

The original promise to change every aspect of drug development didn’t happen.

“It will be a pipeline every bit as deep and diverse as the most promising pharma company in the world but with a capital efficiency that is unprecedented.” - 2015

But multiple approved drugs and a pipeline with multiple phase 3 assets? I’d say that’s successful. Roivant isn’t perfect, but it has worked

The future: Roivant is positioned well

Roivant’s expertise is late-stage clinical development positioning them well for a world where early-stage innovation becomes easier. Two trends are accelerating the pace of early-stage drug development: 1) artificial intelligence and 2)chinese innovation.

Artificial Intelligence: Alex Telford highlights AI’s potential and pitfalls in his article A New Breed of Biotech

“if it’s quick to generate 10, 100, or even 1,000 drug candidates the capital and work (indication selection, pipeline construction, trial design, vendor management, etc.) required to oversee and progress such a broad potential pipeline become binding constraints”

Chinese innovation: Further, Chinese innovation is speeding time to market by up to 200%. Big pharma is taking note and acquiring companies from China in a flurry of recent deal activity (source).

Vivek’s original vision described how pharma was “good at discovery” but Roivant could fill the gap running clinical trials. The rise of AI and breakthroughs from China may accelerate early-stage drug development placing more value on late-stage development: exactly where Roivant shines.2

Roivant has three key advantages

Nimble: They can pivot on a dime, not beholden to shareholders and commercial concerns like pharma. They can go after diseases and buy drugs as they please

Experienced: They’re the go to deal maker in the space so companies will come to them with drugs which may fit the model.

Expertise: each successful clinical trial is another rep in the tank which informs future development. The collective Roivant should be greater than the sum of it’s parts.

A note on Vivek

I can’t discuss Roivant without talking about Vivek Ramaswamy, Roivant’s controversial and charismatic founder. He was heralded as a “biotech whiz kid” in his late 20s but Ramaswamy's real strength lies in his ability to identify promising scientific projects, assemble talented teams, and secure funding. Intepirdine wasn’t worth the dirt on my shoe, but he was able to leverage investor interest in other Roivant ventures to secure funding for Axovant (another example of perverse incentives!). He was successful at QVT financial as a biotech investor, buying Pharmasset and other Hepatitis companies for a 20x return. People point out some odd trade timings, but there’s a lot of gray area between “insider trading” and “meeting management” (see this criticism). Ramaswamy leveraged his success at QVT to found Roivant, which has grown into a multi-billion dollar enterprise. He’s clearly smart (Yale Law, Success at QVT, Roivant) but I’d categorize his primary skill as selling a vision, not drug development. This is not to diminish his accomplishments; he’s played a key role bringing drugs to market and he believes he can change the world. Recently, Vivek took a position as the head of the Department of Government Efficiency (DOGE) and I hope he can bring some of his experience developing drugs to improve incentives and increase efficiencies. 3

Part 2 - Lessons and Ideas

Can Roivant work now? Roivant was started 10 years ago: how can we improve upon it? Where are the opportunities now?

Pharma scientists are still incentivized to keep their jobs, executives are beholden to shareholders, and effective drugs can sit on shelves forever.

Idea/Lesson 1: Formalize the seemingly implicit agreement

Why not codify the implicit agreement Roivant makes? Instead of partnering away an asset for a future pharma to be successful, let executives hand off partial risk, and codify re acquisition based on milestones. I’m curious how we can structure this deal. A royalty-based financing seems too low risk because pharma has capital. Full risk doesn’t make sense because these companies shouldn’t be expected to commercialize the drug. Standardizing and accelerating clinical trials is a big deal in psychiatric conditions where trial sites are highly regulated to minimize placebo response. I think Lilly is already trying something similar with their investment into a16z (see here)

Idea/lesson 2: Smart people do dumb things for good reasons. + a few examples where drugs are repurposed

Always ask “why?”. “Pfizer got rid of TL1A: Why?” -> To meet near term investor expectations. Lots of drugs have “failed” but in reality, simply didn’t meet the bar for “go forward” criteria for big pharma. The core Roivant idea lives on.

If I was dumpster diving, I’d look for drugs which were a) safe, b) effective in a phase 2 trial c) targeting an indication with commercial concerns and d) dropped in times of restructuring. A few come to mind.

Idea/Lesson 3: Niche markets are underestimated…..until proven

Big Pharma needs drugs that meaningfully synergize with their current revenue base while moving the needle. Small, unproven markets can’t be modelled by McKinsey consultants. They’re underestimated until proven so it’s possible to think differently

A few current examples come to mind: Tarsus is beating launch expectations in demodex blepharitis, a disease some didn’t even believe existed. Investors won’t believe in BridgeBio’s Acoramidis until sales come in. No one wanted Pulmonary arterial Hypertension (PAH) drugs until approved drugs proved the market. There’s still a gap between clinical need and business development where consultants can’t price new markets.

Idea/Lesson 4: A company dedicated to licensing fast followers from Chinese companies?

I briefly touched on the acceleration in Chinese innovation, but I wonder if we can create a biotech specifically dedicated to fast followers in validated modalities using Chinese drugs. Instead of going after big indications, we would target less crowded, niche indications.

The acceleration in Chinese deals could be preempting harsh regulations from the Trump administration, but until that occurs, there’s opportunity abroad.

Idea/Lesson 5: Is there a role for incubating companies from start to finish?

If early-stage development is easy, what is the role of biotech? I think Roivant fits well for one-off drugs, but full-scale technology platforms and drugs targeting gigantic markets are still the realm of biotech/pharma. Therapeutic areas such as obesity, oncology, and cell therapy are not within Roivant’s scope because they require a large salesforce and manufacturing expertise. Further, we still need transformative early-stage drug development from biotech.

We’ve seen a rise in crossover investing where large funds invest in companies early and then follow them into the public markets. The alternative to plug and play is full scope investing. One interesting company is Rocket Pharmaceuticals, formed by investors at RTW investments (story) who identified an unmet need and incubated the company. I’m curious to track how investors change strategy over time. What other innovative models exist?

Conclusions

Roivant works. Roivant works best when developing proven drugs. The original vision is partially realized but the future is bright because they fill an unmet need. The same incentives that led to roivant’s creation still exist which create opportunities for investors, drug developers, and enterprising individuals.

The goal of the post is not to speculate on successes in the future. But I am biased towards IMVT-1402 as one of a few option sin a large market. The timeline to market is long becuase of batoclimab’s failure. 2

Every product in the marketplace has substitutes and complements. A substitute is another product you might buy if the first product is too expensive. Chicken is a substitute for beef. If you’re a chicken farmer and the price of beef goes up, the people will want more chicken, and you will sell more.

A complement is a product that you usually buy together with another product. Gas and cars are complements. All else being equal, demand for a product increases when the prices of its complements decrease. source

I characterized him less as whiz and more as finance bro in my tweet here

Hey Adu! Finally got around to reading this, greag article!

Could you please share where did you find Roivant's equity grant policy for employees? I'm interested in how does the option to reinvest in other projects work. I'm looking to implement something similar in my company

Great read and history on ROIV. thank you.