There are some great sources out there, linked at the bottom. Shoutout to @RS3688 and @JoseCapital for being great sources of info.

Business and thesis summary:

Intellicheck is a provider of identity authentication software to verify the authenticity of driver's licenses and verify a person's ID. Their three primary markets are for law enforcement agencies, underage fake IDs, and retail point-of-sale fraud. Their advantages stem from the ease of implementation and industry-leading fraud detection rates due to proprietary ID data. A business transformation started in 2018, with the introduction of Bryan Lewis as CEO and is reflected in the financial performance. Revenue growth was in excess of 70% before the pandemic closures and continued to exceed 40% during the pandemic while achieving GAAP profitability. At current levels, their forward looking opportunity isn't priced in as COVID has hampered results for their primary business: in person ID scans. Though lockdowns hampered the business, it offered a window into the resilience and innovative nature of the management team They quickly pivoted to their online, person-not-present offering to salvage revenue and add use cases in ecommerce especially. As people return to stores, Intellicheck is well poised to accelerate growth and with an asset light high incremental margin business, the profitability trends will trend in the right direction and FCF margins could reach 35%+ at scale.

History and transformation

Intellicheck was originally founded in 1994 by a former firefighter to offer ID checking services to government agencies. They formed a relationship with the American Association of Motor Vehicle Administrators (AAMVA) and state DMVs that gave them the responsibility to check IDs against industry standards to ensure the formatting was done properly. This relationship gave them access to the ID format of the barcode on the back of the card (explanation in the next section). The previous CEOs were focused on the government market and used a monthly fee structure. When Bryan Lewis came in, he changed the direction of the company to focus on selling to financial institutions with a large in-person fraud problem.

In addition, he changed the pricing model to a per-scan basis with a monthly minimum payment exposing them to upside for increased scans but protecting against downside in the possibility of tail risks(say a pandemic). This pricing structure also meshes with the mentality of banks/stores as the number of scans is what matters for the amount of fraud stopped. Bryan Lewis brings experience in growing a business to Intellicheck which improved implementation efforts and rebranding efforts to increase awareness.

The Barcode: Intellicheck's Advantage

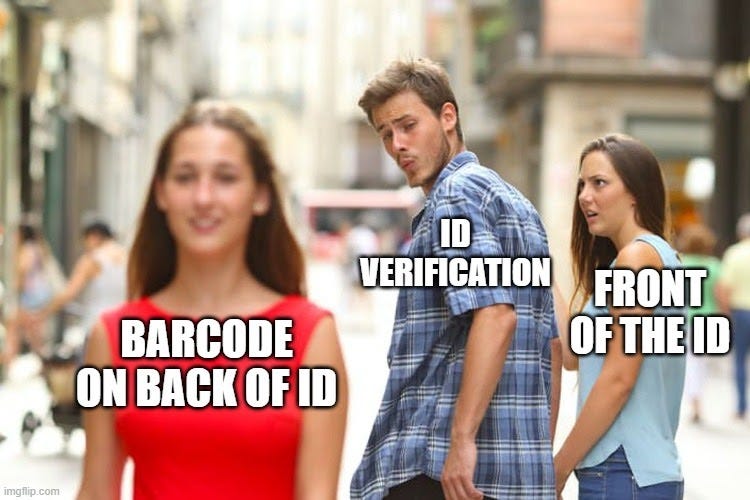

The primary competitive advantage for Intellicheck stems from access to the DMV barcode format for all 50 US states, Canada and most of Mexico. For those who have a US driver's license, you can see this barcode on the back. The barcode on the back of an ID is a PDF 417 file and contains a lot of information. Anyone can read this information, thus giving them information such as the name and address, which can be matched to the front of the ID which catches fraud where the person doesn't have the right barcode data. However, Intellicheck is given the correct format of the back of the ID, thus giving them an advantage in the speed and accuracy of authentication. A card could have the matching information in the barcode, but the wrong format and Intellicheck would still catch them. Some companies can try and reverse engineer this formatting, but this takes resources and the DMV wants to keep this information as limited as possible. There are rumors from other companies that you can buy this data from AAMVA for a price, but AAMVA doesn’t cover all 50 states and any extra cost allows Intellicheck to capture more of the market with lower prices.

Competition and the Rest of the ID

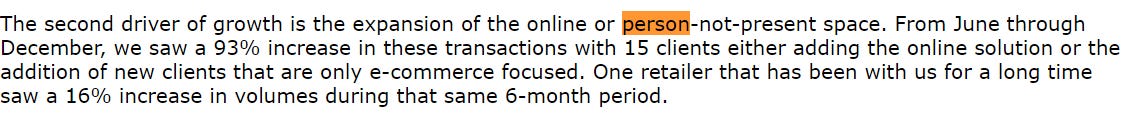

While Intellicheck has typically relied solely on back of the ID scans to verify the authenticity of the ID, other companies use the front and back of the ID to match information and the face to the person scanning the ID. This uses a process called Optical Character Recognition (OCR) and templating which uses digital watermarks, holograms, and other sources of data on the ID to verify it. The primary competitors here are Acuant, Mitek, and Jumio. Competitors are all better at front of the ID scans, but still have lower accuracy (60-85%) than Intellicheck (95%)1. Even though Intellicheck has a higher overall effectiveness rate, scanning only the back of the ID has pitfalls. It verifies that the ID is government issued, but the wrong person may be scanning it. This makes Intellicheck leaps and bounds beyond competition for in-person, point of sale applications where a person verifies that the face matches. But Intellicheck may lag competitors for online applications because criminals may have a real ID issued, but not match the face on the card (synthetic ID). Criminals may also just create fake people to get issued real IDs, but this issue cannot be solved for in-person situations by anyone unless asking for lots of information. In recent months, Intellicheck has adapted and now offers OCR technology and biometric scanning for in-person and person-not-present applications.

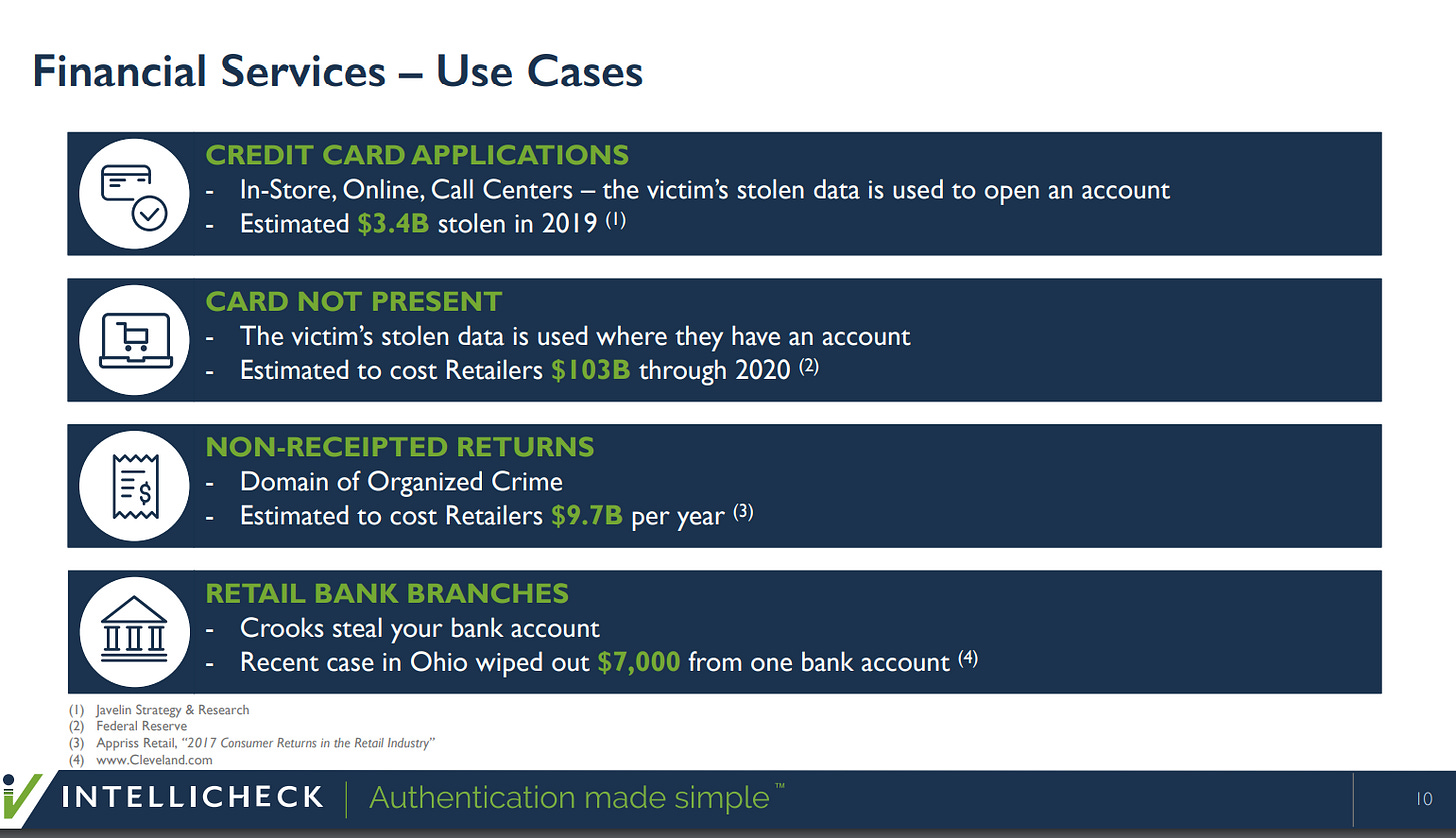

Use Cases and TAM

The primary current use case for Intellicheck is for big banks and financial institutions looking to reduce fraud for new account openings, non-receipted returns, and stores with loyalty card that people lose. Say you are checking out at Best Buy and forgot your Best Buy card. The cashier can scan your ID to ensure you are the person registered on the account and reduce the amount of fraud.

Regarding bank accounts, Intellicheck is more applicable to new account issuing as dual factor authentication is preferred for current account login. Another salient application are non-receipted returns where the store requires an ID to return an Item without a receipt. Intellicheck can also be used as a general use case for suspicious actors to prevent fraud.

One competitive advantage Intellicheck holds is that their solution requires no additional hardware and can be integrated into either a phone or the appropriate scanner. It is also a frictionless scan, placing no burden on the customer or cashier. It is usually a plug and play solution into current hardware, but some customers still hold old barcode scanners that need to be upgraded thus Intellicheck has a small amount of hardware sales. This contrasts with competitors in the retail space which require extra hardware for their templating based ID verification. Intellicheck is really the sole player for the in-person retail space. Even in use cases where hardware may be needed, Intellicheck usually sells hardware near cost and makes money off the scans.

The estimated TAM within the current customer base is ~$60-70M which includes 5/12 top card issuers and lenders in the USA. The TAM for all 12 institutions under the current use cases is $200-250M. As they penetrate other markets such as new lenders, e-commerce and healthcare fraud, their TAM will grow. The TAM for US ID verification services is in the billions. Ultimately, Intellicheck may not be the best solution for every ID verification task, but the market is large enough for multiple players, especially at current prices.

Unit Economics

Even though Intellicheck just turned GAAP profitable, the operating margins at scale should be much higher. Contracts signed by banks are typically 3 years long and sticky. In addition, each additional scan comes at little to no cost for Intellicheck. Estimates from the company put the incremental EBIT margin on a scan at 70%. Since Intellicheck's competitive advantage is based on access to DMV data, the costs of running the business are extremely low. For future growth, research and development is needed to build out their non barcode based offering through licensing other companies or internal development. In addition, increased sales expenses are expected for growth into current and new markets.

When Intellicheck is fully integrated into their customer base, the FCF margin can be 40%+ (85% Gross margin, 30% R and D margin, 10% SG and A margin). For many growth stage companies, the unit economics are hard to flesh out thus FCF margins at scale are over estimated, but Intellicheck's business model lends itself to great operating leverage. In addition, at current price-per-scan levels, Intellicheck also has potential to grow by flexing its pricing power.

In the industry, Intellicheck has the lowest per scan cost with estimates in the $0.2-0.3 range. Competitors typically price ~$1 for an often inferior product, suggesting Intellicheck has some pricing power. As older contracts expire, Intellicheck can renegotiate for higher prices per scan while offering a value add at a lesser price than competitors. However, I am wary of assuming too much pricing power as competitors have attributed Intellicheck's growth to their low cost and a primary reason for possibly switching cited by Intellicheck customers is a steep increase in pricing.

Balance sheet and Investing for Growth

During the pandemic, they were able to strengthen the balance sheet via stock issuance and now hold $13M in cash with no debt. This cash position gives them the ability to spend for growth either through acquisition or increased sales/marketing. Current gross margins range from 85-90% depending on the amount of hardware sales in a quarter, but management has guided to long term margins of 85%, which gives them even more cash to invest into the business.

Impact of Covid-19

Before the pandemic, Intellicheck had just begun to see accelerating revenues and the operating leverage expected by a business with high incremental margins and a best in class product. SaaS revenue doubled from 2018 to 2019, but growth slowed to 50% in 2020. Imagine that, in a year where stores were shut down, Intellicheck still saw >50% SaaS growth when most of their business is dependent on in-person retail. If we assume retail traffic was 20% lower than normalized 2021 levels, the normalized growth in 2020 was above 70%.

Factors supporting acceleration in growth

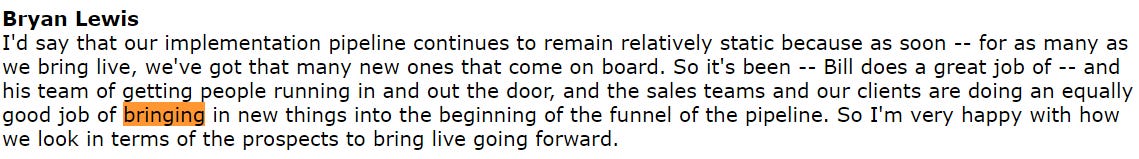

As the economy reopens, Intellicheck will see accelerating revenues as older stores return to normal levels of traffic and the 32 new implementations during 2020 start seeing traffic (Source: Q4 earnings Call). In addition, Intellicheck's solutions were still in the pilot phase for most banks in the last couple of years. With good results, the pace of adoption will increase. Their customers are recommending the products to other potential customers citing it as the best possible fraud solution. Awareness has always been an issue as many competitors had never heard of Intellicheck, thus this word-of-mouth marketing is encouraging. With more awareness, the sales cycle will shorten and adoption will accelerate. We are in the beginning phase of the S curve for Intellicheck with 10-15% penetration among the current customer base. Big banks can be bureaucratic when adopting new solutions, but Intellicheck will eventually be a needed solution due to the externalities of preventing fraud. Think about this: if you're a criminal and know you're gonna get caught at store X, you go to store Y instead, which means store Y now needs prevention measures creating a 'flywheel effect'. There is evidence of the Intellicheck's implementation capabilities are being taxed to the max as new customers to onboard join the queue immediately as others are onboarded.

Bryan Lewis has also committed to increasing the sales staff to accelerate growth. He has historically been conservative, but wants to take advantage of the strong operating results, cash on hand, and momentum to push for new customers.

In addition, their online offering which was brought to the forefront during COVID has seen accelerating adoption.

Risks

Before we model out the financials to make sure the valuation makes sense, let's explore some of the risks.

Risk 1: DMVs stop giving them access to barcode formatting. If the DMVs decide to stop working with Intellicheck for new IDs, Intellicheck could lose access to the proprietary data that lends them a competitive advantage. This is the worst case scenario but extremely unlikely. First, the DMV has worked with Intellicheck for 2+ decades and governments are extremely slow to move, thus they are unlikely to switch if Intellicheck continues to serve their purposes. In addition, changing vendors would require vetting of the new company which takes time and money. More likely, but still improbable are one or two DMVs switching vendors or building in house solutions. Intellicheck relies on having national coverage, thus even one or two states switching could hurt their ID verification abilities.

Risk 2: Leakage of Barcode formats. In some states, namely Connecticut and Kansas, the barcode formatting were leaked, allowing criminals to make fake IDs with legit barcodes. This reduces Intellicheck's effectiveness to below that of competitors for those IDs (since their OCR tech isn't built out…yet) and brings overall efficacy down to 95% from oft-touted 99%. If this occurs in more states and continues to reduce their effectiveness, their growth will slow and customers may choose not to renew their contracts (those IDs will stay in circulation for 8-12 years before requiring renewal). Although this risk is legitimate and can reduce effectiveness, any leaks of the barcode makes the DMV more protective of the barcode format, which reinforces Intellicheck's competitive advantage. In addition, Intellicheck is building out their OCR and biometric tech to improve efficacy even in the absence of the barcode formatting.

Risks 3: Other companies reverse engineer the barcode format. This risk does exist, but is largely mitigated by the costs required to reverse engineer the formatting every time a new format comes out. Intellicheck has a clear pricing advantage even if others can reverse engineer the barcode since they receive the format for free.

Risk 4: Switch to different ID formats. One oft-quoted possibility for DMVs is a switch to a different barcode format or to a digital ID verification method. However, even if the DMV switches formats, Intellicheck can leverage its relationship for continuing access to the barcode format. In fact, when Delaware rolled out their recent Mobile ID feature with QR codes, Intellicheck was a part of the pilot (according to a former employee).

Risk 5: Rise in two factor authentication. While two factor authentication is often used for people with current accounts as an easier ID verification method, dual factor authentication doesn't work for new account signups or even for older people who lack tech savviness.

Risk 6: Continuation of Covid effects. Decreased scan volumes and long sales cycles were the primary effects of the pandemic but large COVID risks are in the rearview mirror. As retail volumes return with increased vaccinations, these risks are largely mitigated. Some may argue that normalized 2021 spending will mark a return to services rather than goods (where Intellicheck dominates) but this is a temporary blip and doesn't affect the long term trajectory. Some may be concerned by a slowdown of growth in Q4 this year with SaaS growth of only 20% but this can be attributed to two things: increased lockdowns and a slow selling season due to the holidays. Even though Q4 typically dominates the revenue for the year (33% of scans in non-COVID years), the reduced scan volumes made YoY growth numbers look slow even though implementations for the year and the pipeline continued to indicate future growth is on the way.

Risk 7: Scale issues. Intellicheck may have some issues scaling their sales team with new members joining the staff in the last year. Intellicheck’s sales spend will increase and issues could happen if their growth spend is overly ambitious and they overspend for their growth. We will likely need a year to see if the new hires on the executive team and the sales side were effective. I believe in the company’s ability to scale because the product is better, cheaper, and easy to implement(according to the customer). With cash on hand, they also have the leeway to overspend for growth. I would rather they overshoot than undershoot because the product is that good.

Modeling the Financials

Now let's try and put some numbers to the story. We know the following about Intellicheck: they have a best in class solution for the in person retail space ($200-250 mil TAM) with a $60-70 mil TAM among current customers. They are expanding to other verticals and have a person-not-present offering which is seeing increasing adoption. The total addressable market is in the billions for ID verification. Their model has extreme operating leverage with little fixed costs and the possibility for pricing increases to match competitors.

All of the following scenarios use an 11% discount rate.

Base Case: Assumptions: 40% revenue CAGR through 2025, increasing FCF margins from 15% to 30% in 2025 and a multiple of 20x FCF in 2025. At 57 million in 2025 revenue, this assumes they penetrate their current customers' TAM, but do not sell to additional customers or expand into other markets. This is a conservative base case that focuses on monetizing the current customer base. Base Case PT: $11.39.

Bear Case: Assumptions: 20% revenue CAGR through 2025The FCF margin grows from 15% in 2021 to 30% in 2025 with a 15x FCF multiple in 2025. They have difficulty increasing penetration of current customers who are slow to rollout and new innovations in ID verification slow progress. This case models inability to continue penetration of their current market as they turn to monetizing the base. Bear Case PT: $5.5.

Bull Case: Assumptions: 60% revenue CAGR through 2025, FCF margin growing from 10% in 2021 to 20% in 2025 with FCF multiple of 35x in 2025 This assumes they sustain their current revenue growth by penetrating the current market with other customers and begin expanding to other use cases. Bull Case PT: $28.28.

Ultimately, the business model has predictably high margins, thus the drivers of the stock price will be the Final FCF multiple and revenue growth. Assuming the margins for each of the next 5 years are 10%,10%,15%,15%,20%, the sensitivity analysis for the multiple vs revenue growth is as follows.

These two will likely go hand in hand, but it looks like the market is pricing in growth of 40% and a FCF multiple of 20x. Since predicting granular details to reach a single price target is often a futile attempt, seeing the assumptions priced into a stock and doing a 'reverse DCF' is often much more helpful. If you think Intellicheck can grow at a 5 year CAGR of >40% and will be assigned a FCF multiple > 20, then invest in the stock (this is just one combination of numbers, 35x multiple and 25% growth also leads to a similar price target.

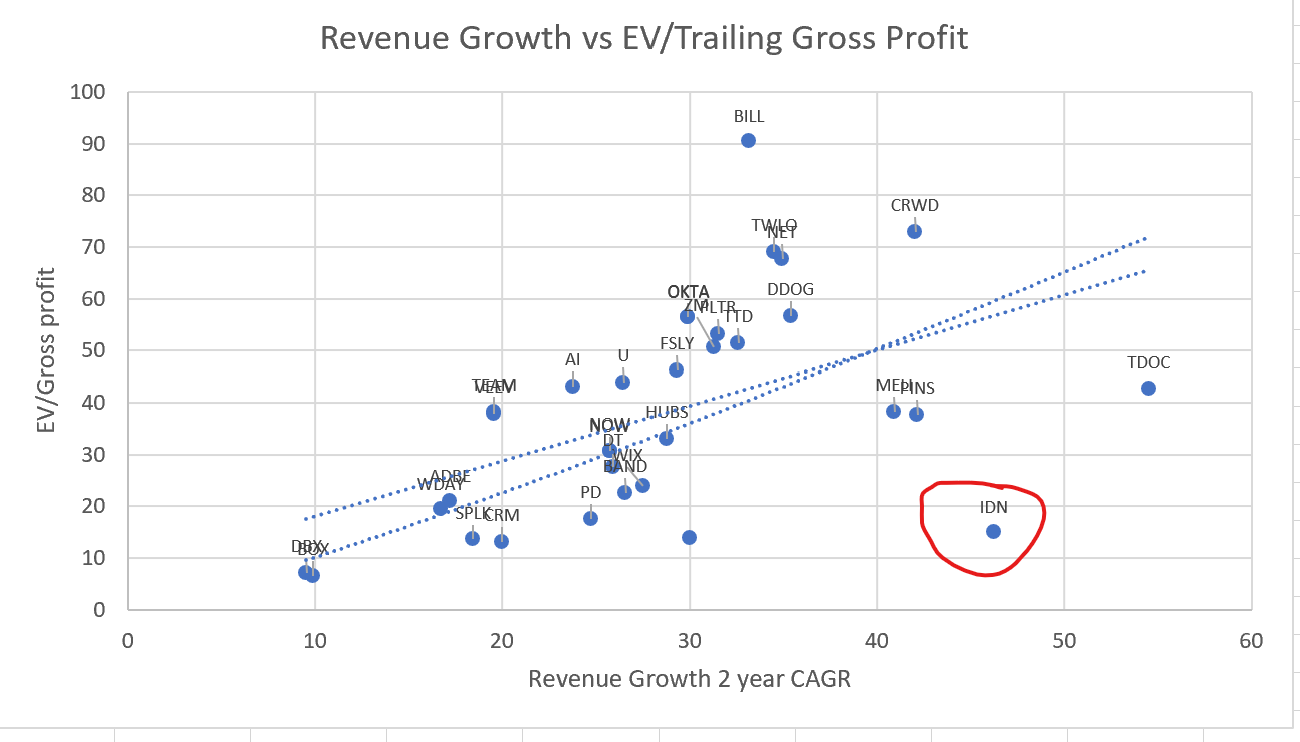

Relative Valuation: If one wants to look at similar stocks in the market, we can turn to the following graph which plots EV/Gross profit vs Expected 2 year revenue growth from analysts. Intellicheck is circled in red, underpriced relative to other SaaS plays.

Summary:

Intellicheck's current price doesn’t reflect the competitive advantages it holds and the future growth opportunities. Although their advantage relies on a relationship with DMVs which can change, if the relationship holds, the upside isn't properly priced in. Intellicheck represents a way to play the reopening trend through a high growth SaaS company, with large upside to current levels. The market is currently is pricing in ~40% revenue growth and a FCF multiple of 20x, both of which I am comfortable with and even find conservative for the company

Sources:

Twitter thread explaining a phenomenal interview done with the CEO: Link

Investor presentations, SEC filings, earnings calls, and calls with customers, former employees, and competitors.

Article on Intellicheck scanning 1,000 IDs perfectly: link

Great writeup here on the competitive landscape and Intellicheck from @RS3688: link

Even though the company touts a 99% effectiveness, their effectiveness is closer to 95% because the format for the barcode leaked in Kansas and Connecticut.

This is a very interesting company. Have you been able to coraberate the companies TAM calculation? $180mm-$220mm for PLCC, ~$21mm / credit card issuer and $500k/ retialer sounds compelling but it would be nice to be able to back into how they get there, rather than just hoping Bryan is telling the truth. Also, have you been able to track historical KPI's? Seems like most people don't even know their current retialer customer count. I had trouble getting this, but If I had that I would have a better sense of where they are interms of retialer/credit card issuer penetration, and Rev/Retailer penetration.

What do the 2 lines mean in the EV/Gross Profit versus Revenue CAGR mean?