Myomo ($MYO): An Update

Asymmetric outcomes given 50%+ growth for an EV/Sales <5. Updating the Medicare coverage information and charting out profitability.

Since I published my First Myomo Post in the beginning of February, the stock is approximately flat to slightly down from ~$12.50 to ~$11.50 today. It trended down and reached $8 before rebounding recently back to the $11 range. It was one of my first write-ups and provided a good overview of the business.

I addressed some concerns about the recurring revenue aspect of the business, but there are other relevant risks and developments in the intervening period. In this post, I want to

Provide an operational update

Review the patient process with insurance

Give and update on Medicare coverage

Chart out profitability

And give my take on the stock

Update on Operations:

The company exceeded all expectations with respect to revenue growth. For the TTM period, revenue is $11 million, representing 179% revenue growth vs the comparable period ending June 30, 2020. Even with the COVID affected thesis. Both pipeline1 and backlog2 continues to grow as they invest diligently in acquiring and authorizing patients. Backlog is a proxy for shorter term revenue while the pipeline is a proxy for revenue 6-9 months out.

Management’s commentary on insurance coverage is encouraging.

All signs point to a hidden hyper growth gem of a stock, but operating margin is solidly negative (although it is improving).

On another note, the company plans to in-house part of the manufacturing which will improve margins. They are participating in a brain-computer interface trial using the MyoPro in collaboration with Jefferson University.

They have expanded internationally into both Europe (specifically Germany) and China. They sell their product in Europe through clinics and are selling their products in China through a JV. European revenue was 10% of revenue last quarter and matched growth from the domestic side of the business. The China JV will likely hit milestones and pay out in the following year.

Cash position: Myomo has $13M in cash meaning they can fund themselves for a little less than 1.5 years at the current burn rate. However, I could see them continuing to issue shares and dilute shareholders if unprofitability persists.

Quest for a Fee Schedule

A key next step for Myomo is to receive Medicare Part B coverage and a Medicare Fee schedule. Currently, the device isn't reimbursed by Medicare Part B and the Centers for Medicare and Medicaid Services (CMS) doesn't have an established fee for the device. Without a fee schedule, each device is reimbursed differently and insurance approval isn't standardized. Signing on new insurance companies takes time and most approvals require appeals. An established fee schedule changes the picture in multiple ways: It increases awareness among providers and patients so customer acquisition cost decreases. Insurances authorization becomes easier so the time needed to authorize a patient decreases. Less time in the backlog is less churn. Easier authorization also means less people-power and reduced SG&A costs.

Myomo withdrew their application to change the coding classification for the MyoPro which would make a Medicare Fee Schedule easier. This was no fault of Myomo but rather a result of a changing administration. Myomo had applied under a proposed rule change to change their device classification but the rule change was delayed with a new administration, thus Myomo withdrew the application. Management expects CMS to re-propose the rule (which allows them to ask for a reclassification of the device) in the next few months.

The rule then needs to be approved after which Myomo can re-apply for a benefit classification change.

The MyoPro is classified as Durable Medical Equipment (DME) like a bed or CPAP machine and reimbursed with a capped rental (13 month rental after which the patient owns it). Given the nature of the MyoPro, I expect the reclassification application to be approved but the process will take time especially considering their reliance on a slow-moving government body.

Charting out Profitability

I'm cautious about putting more money into Myomo because I have yet to see a detailed analysis on profitability. Myomo's Investor Relations confirmed guidance for 7M in a quarter to achieve cash flow breakeven and they believe it is achievable by 4Q21. With a history of operating losses and a needed 53% contribution margin from last Q4 to get there, it's difficult to take management's word at face value.

I calculated the incremental margin need with the following formula: cash flow needed to breakeven (from 4Q20)/revenue needed to reach $7M (from 4Q20)

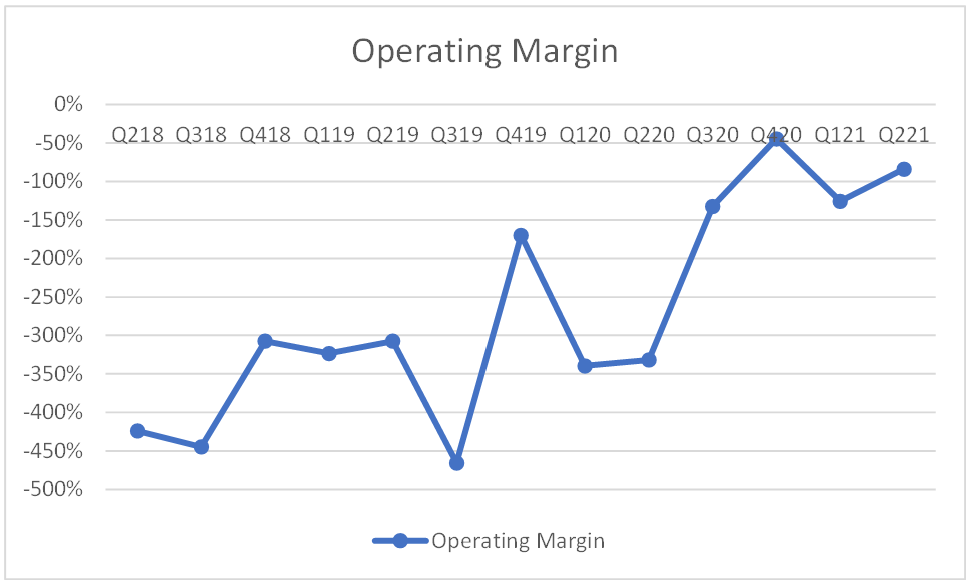

Just look at this ugly chart. Operating Margin was -45% even in their best quarter.

Here's my rough method of calculating how they get to breakeven.

The current insurance authorization process occurs primarily on a case-by-case basis thus requiring people power. Selling a one-off device in a DTC model also costs money to acquire patients given they are not the standard of care…yet.

Without any recurring revenue, there a few ways to get to profitability.

1) The customer acquisition cost (CAC) to decrease for patients into the pipeline (less advertising $ per lead)

2) The churn out of the pipeline can decrease (currently 15-20% per quarter). Longer wait times means less people proceed to approval as dropouts are typically tired of waiting or have other issues while waiting. Less churn means a higher conversion rate

3) insurance authorizations take less time and resources. This would impact both the percent of people who get approved (by reducing overall churn) and the SG&A costs per person to get approved (by making the process easier).

Looking at the cost of adding new people to the pipeline, it varies Q to Q but hasn't significantly decreased. All numbers in thousands so the absolute numbers represent adds into the pipeline per $1k SG&A.

The Y axis takes additions into the pipeline for the most recent quarter and divides by the SG&A expense for either the previous quarter, 2 quarters, or trailing twelve months (TTM). The units on the chart matter less than the general trend. in all time periods the number of adds per $1k isn't increasing substantially. It can be skewed because SG&A includes non marketing expenses, but a lack of a well-defined trend means CAC isn't decreasing substantially.

Each add into the pipeline costs ~14k (divide 1 by the adds per $ SG&A last Q to get to the CAC). The most recent quarter had ~.07 adds per 1k SG&A.

With a 9 month conversion cycle and 20% churn out of the pipeline/quarter (Q3 earnings call), the chances of converting to backlog is ~50%. With Gross Margin at 70% and R&D at 20%. each device sold has profits of 17.5k (assuming ASP = $35k) before taxes and SG&A. For a patient to be worth it, the cost of acquisition/chances of converting to revenue to be less than the profit from the device. Cost/50% < 17.5k. The cost to acquire a patient and transition them to backlog has to be less than 9k (~.12 adds per 1k spent).

How will they get there? Myomo has numerous tailwinds but it hasn't shown up in the numbers…yet.

Returning to the three paths to profitability:

A) Decrease SG&A per customer which can either come from less advertising (Word of mouth/becoming Standard of Care) or decreasing costs required for insurance authorization. Myomo continues to sign on new insurance plans and 80% of patients in the pipeline at the end of Q2 had plans which previously authorized the device. As more people are approved for the MyoPro, the friction for the next approval will decrease.

B) reduce churn/quarter to improve high conversion rate. I don’t expect churn per quarter to decrease substantially, but there are some levers to pull. If Myomo can encourage patients to stay with a quicker authorization process, some impatient people may not churn out of the pipeline

C) shorten time from entry to authorization thus decreasing the impact of churn. This metric is seasonal, but the most recent quarter showed an acceleration in the time from patient acquisition to backlog conversion. 14% of the pipeline were converted to revenue and Myomo had it's highest number of revenue units authorized and delivered in a single quarter. This is once again reliant on insurance familiarity with the product.

An established Medicare Fee Schedule would dramatically change the picture but improved reimbursement conditions (as awareness increases) could lead them to profitability even without coverage/fee schedule. Timing the shift to profitability is difficult, but tracking some key metrics is important to ensure they are on the right path.

Key Metrics: Conversion rate from Pipeline to revenue, Churn, time to from entry to authorization, first time approval rate, CAC

The equation I used to calculate unit level profitability is as follows: Cost to add to pipeline * churn per quarter * number of quarters < (Profits after Cost of Goods sold (Gross margin) + R&D expense) * average selling price. It accounts for what I think are the major factors and you can modify it as you see fit.

If any readers have insight into how Myomo is going to achieve profitability, I would love to hear it. Any critiques of my approach are also welcome.

One pitfall of my approach is the potential delay in operating metrics. Patients acquired into the pipeline now won't show up in revenue for 6 months so the current cohort of acquired patients could be profitable, but it won't show up until later, given how spending in the most recent quarter supports revenue for the coming 2 quarters.

Further Questions:

What is the split in SG&A expense between marketing cost and authorization cost? Patient acquisition cost is harder to bring down that patient authorization cost in my opinion.

What changes the first-time acceptance rate and where does it need to be to see profitability (currently at 10-15%)? The first time acceptance rate is the percent of patient not requiring additional appeals. I didn’t touch on this during the post because the outcome of an increased first time approval rate is reduced SG&A costs. However, the first time approval rate is the building block of many of the key metrics tracking insurance acceptance of the product.

What is the timeline for Medicare submission and approval? An uncontrollable factor but it would be nice to have a timeline in mind given they withdrew the application

My position:

I still hold my original position from when I originally wrote about it. My cost basis is ~$13. Myomo was included into the Russell Microcap index and awareness of the stock is rising (2 recently issued research reports with PTs of $36 and $17). They have a JV in China to sell the device as well as initially successful European operations (10% of sales). With a large addressable population and nearly monopolistic solution for regaining arm function, I find it hard to sell at < 5x EV/Sales.

Hiring at Myomo hasn't stopped so I don't expect SG&A costs to decrease substantially, but the company is working hard to increase awareness of the device. Inflection points such as profitability, becoming standard of care, and Medicare coverage still lay ahead for Myomo.

The most dangerous words in the english language are supposedly "This time it's different", but the situation has shifted in Myomo’s favor. Myomo has a history of burning cash and diluting shareholders, but all tailwinds are in their favor to reach profitability with continued growth. This is a company that becomes better as it get ramps.

If they can execute, I could see a $525M Market Cap in 5 years (1500 Units * 35000 * 10x Sales multiple = MC of 525 Million). This is still only 40% revenue growth. If they reach profitability with minimal dilution that is a ~$87 stock. This also leaves some room for dilution if we believe revenue growth will persist (With 10m shares outstanding, it would be a 52$ stock in 5 years and they would have raised ~$40M in cash assuming $10/share). I could also see them at the exact same place in 5 years if demand slows down for the product and they continue to burn cash, but I find this scenario unlikely.

I like asymmetric bets with room for revenue growth and multiple expansion. Myomo is one of them.

Pipeline refers to patients who have engaged with Myomo and are in the process of being evaluated and getting insurance authorization. This is a longer term indicator of revenue (6-9 months, about the time for a patient to be authorized and a unit to be delivered.

Backlog represents units which have been delivered but revenue has not been received yet. The goal is to have backlog eventually be 0 once they can recognize all units on delivery as Insurance becomes more familiar with them. Currently 40% of units are recognized on delivery. This drives near term revenue.

52$ stock in 5 years?