Performant Financial (PFMT): All in on a growing Healthcare business.

Payment Integrity solution with a best-in-class product gaining market share, possible 4x Upside in 5 Years

For this writeup, I've got to give a shoutout to Chris Krug of Chatham Harbor Capital. After seeing him reply numerous times to people I follow, encouraging them to look at $PFMT, I took a look and even with the recent run-up, it's still got room to run.

TLDR: Performant historically recovered defaulted student loans and other wrong payments. Over the past decade, they have transformed their business and are now focused on recovering erroneous healthcare payments and catching fraud/waste in the healthcare ecosystem. The healthcare business is a high growth, high margin business, obscured by the historical business and large amounts of debt. Performant is undervalued based on recent acquisition multiples, is gaining market share, and can return 4x over the next 5 years (IRR ~ 32%).

What does the company do?

Historically, the company provided financial recovery services to government clients ranging from the Centers for Medicare and Medicaid Services (CMS), the Department of Education, and State Tax departments. Performant uses a combination of data analytics and people to find and recover erroneously made payments or defaulted payments. For example: they would be the person to recover any defaulted student loans. When it IPO'd, >60% of the business came from recovering student loans, but legislation in the early 2010s killed their business. In short, Performant's customers received less funding from the government to recover student loan assets and the government took an increasing share of the student loan market. They lost contracts as customers looked to other, more full service vendors. However, this part of Performant’s story is hardly relevant to the current bull thesis, considering they recently sold these assets to grow the healthcare business and pay off debt. The CEO has been in place since 2002, so the dicey company history may dissuade investors, but the downturn was created by regulatory factors outside of Performant's control (i.e. government regulation). They have always had a best in class technology platform and efficient workflows and are now leveraging that technology combined with experience recovering payments to grow in the healthcare vertical.

Healthcare Business:

Performant's healthcare business dates back to the early 2000s and even did nearly $70 million in revenue in 2013. They were a Medicare Recovery audit contractor (explained later) and had not entered the commercial market significantly. In 2014, legislation hindered Performant's ability to adequately audit providers effectively destroying their business. In addition, rebidding for the Medicare contract hurt their ability to do business as the bidding process partially restricted their access to medical records. However, since dropping from $67 million in 2013 to $10 million 2017, the Performant's healthcare revenue is back up to $68 million in 2020 on the back of investment into their tech and diversification into private insurance.

What is a Recovery Audit Contractors (RAC)? A recovery audit contractor is used by Medicare to review suspicious claims and ensure the right insurance is being billed. Insurance fraud is rare, but waste and misuse is common, thus RAC contractors are necessary to catch provider who misbill items. Currently, Performant serves 2 of 5 regions for Medicare, the Northeast region and a 5th 'region' of nationwide Durable Medical Equipment/Home Health (DME/HHE) claims.

Performant's services:

Performant also serves Medicaid (through managed care organizations1) and commercial insurers. The upshot of their offerings are all similar: Performant analyzes claims data to find improperly billed claims and recovers lost dollars by pursuing those who may have benefited and the doctors who misbilled the treatment. They are a payment integrity company that ensures payments are correct. Performant then sends the money back to their customers and takes a cut (typically 10%).

Competitive advantage:

Performant's competitive advantage stems from their technology to find inappropriate claims and their ability to recover those lost dollars. Performant's been able to gain traction with insurance because of they offer a great solution for payment integrity regarding Durable Medical Equipment (DME) and outpatient claims. They use their experience with Medicare to create easy to integrate, effective technology to catch waste. Another competitive advantage stems from a company culture that helps them be aggressive in recovering any lost money. Even when competitors identify larger amounts in fraud, Performant could return more to the insurance company via their ability to collect. Recovering is half of 'find and recover' and Performant does it well. Based on expert calls and case studies from management, Performant's solution is better than other vendors at returning wasted dollars.

The Industry

Industry TAM:

The amount of medical waste in the system is absolutely gigantic and TAM concerns aren't top of the risk profile for Performant as a $200m company.

From the slide above, there is approximately 200B in total medical waste. With a 10% take rate, this puts the TAM at 20B. Looking closer at just Performant's key markets, Medicare FFS and managed Medicaid, the TAM is ~9B for payment integrity solutions. One can look at companies like HMS, Change healthcare, Equian, Optum, and Covitity to see the potential opportunity.

Industry Makeup:

Performant's major competitors are Optum health and their subsidiaries like Change and HMS/Covititi. As evidenced by recent deals(Optum acquires Change and Equian, Covititi acquires HMS), the industry is consolidating. The makeup of the industry is such that insurance companies often employ multiple vendors to serve different point purposes. Rather than choosing a single vendor, insurance companies are at multiple restaurants, using numerous vendors for breakfast lunch and desert. The bigger players in the space have started to buy out the smaller ones to be the one stop shop for insurance companies. This hurts Performant as customers may choose to go with a more full service offering, but at the end of the day, market share is driven by performance. Even if customers choose to go with larger players for a more full-service offering, the insurance company incurs minimal costs to give Performant data to analyze and recover. Often the system is tiered where companies at the top of the list get first pass at the data but smaller companies get a section to analyze, or a second pass to catch any additional fraud. Larger insurance companies may employ all the potential payment integrity vendors!

Performance Based System:

This brings me to a key attribute of the industry: it is performance driven, but hard to break into. Systems are often relationship driven and slow to adapt (especially healthcare), but the payment integrity space is slightly different. Once you've got a foot in the door, it's up to your performance to swing it open. The process to switch vendor tiers can take up to 18 months, but once given access to claims data, newer companies can analyze the data pitch potential savings to the insurance company. when upselling, a vendor would cite claims they would have caught if given the chance at a higher tier. Beyond just the aforementioned algorithms and collections capabilities, having a base set of insurance data on people is key to creating a successful solution. Performant was able to use their experience as a RAC to sell themselves, but any new competitor would have to go through extensive regulation and need to prove themselves somehow before being adopted.

The system is setup such that Performant doesn't compete on price. Companies usually follow standard pricing and even if competition attempted to undercut Performant, Insurance companies have little incentive to switch and save chump change. They would rather pay up and capture more waste.

Why not in-house? Ah, the age old question, with all the data generated by insurance companies, why not in-house the solution? UnitedHealth is certainly trying, using Optum, a division of theirs to gobble up payment integrity vendors such as Equian and Change healthcare. However, an issue arises when asking a competing insurer like Humana to hand over data to Optum, a subsidiary of United Health for the explicit purpose of analyzing it. The incentives just don't align. In addition, insurance companies don't have the necessary skills to develop a solution, but do have the cash to pay for one. As long as the ROI stays high, insurance companies will gladly outsource their payment integrity solutions.

Industry Tailwinds:

Numerous tailwinds exist for the industry with medical waste on the rise. Coding is becoming more complex, thus errors are becoming more common. The move to home-based care also increases the likelihood of waste and creates headaches for insurance providers without a way to track services offered, especially in situations where the patient may not have control over their facilities (very sick patients, late stage dementia).

Another thing to note is a gradual shift to managed care organizations for those on Medicaid. Since Performant currently serves MCOs, this shift increases their potential business and consolidates the customer base, thus making it easier to sell their services. (they would sell to one insurance instead of 10 states)

Why this opportunity exists?

Optically bad financial statements

Recent deal and Debt refinance: The first thing that catches the eye on the recent 10k is 60M in 'current debt' supposedly due in August 2021. This looks extremely bad, but with a recent deal, the debt expense isn’t as bad as on paper. They extended the due date out a year with the option to extend it for two more and paid off 6 million of it to reduce payments. The deal sold their recovery assets and reduced the Net Debt to ~40 million, a more manageable amount. It also offered additional shares and amended the deal on warrants held by the debt holder (ECMC). Overall, I wouldn't expect the debt to catch up to the company causing it to fail since ECMC owns 10% of the shares outstanding and is incentivized to keep the company going. With strong FCF generation and the ability to issue new shares, they should be able to manage the debt

Student Loan Forgiveness: When your business relies on pursuing those who miss student loan payments and there is a moratorium on those payments, s*** hits the fan. Performant's loan recovery business took a huge hit last year which caused the overall revenue to dip, although healthcare revenues were strong.

Lack of Profitability: Starting in 2018, the company spent heavily to build their healthcare technology reducing near term profitability. In addition, a $27 million goodwill impairment and the hit the recovery business took caused a significant reduction in net income for 2020. All of this obscures the high margin nature of the healthcare business. As a technology driven platform, the mature EBITDA margins would likely be around 30% (source: Q1 Earnings Call).

Future Growth:

Performant's current offering is clearly gaining traction among insurers as revenue growth is faster than the industry's overall mid-single digit growth. The dynamics of the growth are also in Performant's favor. They are just starting to gain traction with payors in different markets meaning they are on the lowest tier, left to go through the scraps of other competitors. If Performant can demonstrate superiority of their solution, they can move up tiers and capture more business. TO move up tiers, Performant should offer a more holistic solution within payment integrity which management is building. In addition, they need to

New payors: Performant can also expand to new customers such as Medicare Advantage Payors, state Medicaid payors, and smaller insurance companies. They recently launched a Medicare Advantage offering that gained traction quickly. Their reputation will help them sell new products and the technology based nature of the platform makes integration into a system easy once a sale is completed.

New Services: Another seemingly obvious step is to expand their offering horizontally to encompass new services beyond just payment integrity. However, This would be a mistake in my opinion. With a leading niche offering and a runway for growth within their current offering, expanding horizontally at this time would open them up to well-capitalized competition. For the next couple years, they should focus on penetrating their current market and investing in the infrastructure to offer better payment integrity services.

Valuing the business:

Chris Krug lays out a simple valuation on the most recent earnings call:

HMS, a mature competitor, was acquired for 17x EBITDA as a steady-state mid single digit grower with ~25% EBITDA margins. If Performant continues to grow at 30%, they will have 150 million in 2023 revenue. At 30% EBITDA margins and a 17x Multiple, the market cap is ~$850 million (Price/share = $15.5). That's 4x the current share price and an IRR of 60% over 3 years. Pretty damn good upside. Even if you take their current revenue of 68 million, apply a 25% EBITDA margin and 15x multiple, the target share price = $4.63

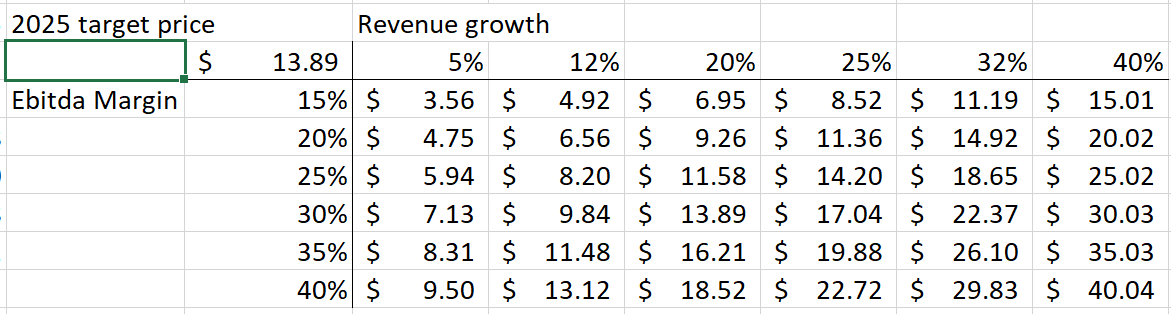

We can also do a slightly more in depth model with a sensitivity analysis, modelling out any debt payment and reinvestment. Based on EBITDA margins at maturity and revenue growth, the 5 year CAGR is as follows.

That's a whole lotta upside if they can execute well.

What about the Debt?

Looking at the Debt expense, we can model out if they can get rid of the debt by 2024. The sensitivity analysis models out the amount paid to debt based on revenue growth and the % of the revenue they use to pay off that debt.

They will likely need to dilute shareholders with the issuance of additional warrants to further extend the debt. With a recent runup in the stock, they could also issue stock to service the debt. At an average price of $3.50, they would need to issue ~10 million shares to pay the debt. Although this would dilute shareholders, even with 65 million shares outstanding (10 million more than current levels), the 2025 target price is as follows:

Assuming the 10 million share dilution and assuming a 20% EBITDA margin on the current $68M revenue and a 15x EBITDA multiple, the bear case target price is $3.13.

The big picture from the valuation is this: there is limited downside considering recent acquisition multiples along with gigantic upside. Even with potential dilution due to debt repayment, the Risk/Reward at these levels is amazing.

Risks

Tech obsolescence:

Although entering the market is difficult and an oligopoly dominates, a dip in performance could cause them to lose contracts. In a bear case, they keep their current contracts but cannot grow any further and the downside is the mentioned $3.13 target price as they grow with the industry. In an ultra bear case, external factors such as regulation kills their business (similar to what happened to their student loan business) and the downside is huge as they struggle to pay off debt. However, the combination of the people advantage (from recovery business) and technology advantage (evidenced by recent growth/case studies/expert calls) reduces this risk. In addition, their markets are only expanding as medical waste is a bipartisan issue and only increasing over time.

Inability to Expand:

Although the debt could be paid off fairly easily in my opinion, there is execution risk in terms of reinvestment into their technology. If they choose to use funds to pay off debt or demonstrate profitability, rather than invest into the business, that puts them at an increased risk of losing customers.

Insurance changes strategy:

Right now, insurance companies use numerous payment integrity services, but increased consolidation in the industry might lead them to choose only all in one vendors such as Optum who offer services beyond just payment integrity instead of point solutions like Performant.

Ultimately,

The potential upside is extremely high. Performant has a best in class solution attacking a growing market while gaining market share. They are worth more than they are today if the business continues to execute, even with the recent run-up.

Managed care organizations are companies Medicaid pays a set fee to insure a group of patients.

I have a small position mostly out of FOMO because Chris Krug, among a few others, keep saying what a great opportunity this is (as in a potential 100 bagger). I've looked at the business and this one is outside of my expertise. It's hard for me to wrap my head around the long term prospects. It's not as clean of a business as I typically like, but that's probably where the opportunity lies.

The recent run up has given me some pause. Maybe this one is worth looking into more though.