Q1 portfolio Update:

Are you being Gaslit?, Thinking IS working, and reviewing Myomo, Performant, and Semler.

Thinking is working, brief thoughts on the topic:

As someone who's always consuming information, I've realized sitting idle and letting my mind wander can be more valuable than consuming. When I'm finished a session of work or learning, I try to take some time to mull the information. In a society values working, it's difficult to appreciate the value of thought. Thinking IS working. I'm still learning to appreciate it.

1Q 22 Review:

YTD returns to 3/31/2022: -7.31%

1 year Returns: -21.79%

3 year returns (since inception in 3/2019: 27.46%.

Index returns for the same periods

S&P

YTD: -4.60%

1 year: 15.65%

Since inception in 3/2019: 18.92%

NASDAQ:

YTD: -8.95%

1 year: 8.06%

Since inception in 3/2019: 23.57%.

Russell 2000

YTD: -7.53%

1 year: -5.79%

Since inception in 3/2019: 11.74%

Those 1 year returns are U-G-L-Y, UGLY. I could proclaim that forward returns are now greater than ever, the opportunity set is unprecedented, and the stocks I invest in are dirt cheap, but I know none of these things. For one, I'm too new to the markets to proclaim anything is 'unprecedented'. Two, valuations for many companies are still not historically low and there are a number of risks afoot in the market (from inflation to geopolitical). Although bearish sentiment is prevalent, it can easily get worse as rates rise to curb economic growth. We have fear, not capitulation. This being said, the recent contraction increases the opportunity set. I'd argue one isn't paying up for quality anymore and there are quite a few bad businesses trading in line with quality ones. Such an environment favors the discerning investor willing to make long term bets with the necessary diligence.

What's driving performance?

In times of increased macroeconomic stress, management teams can make plausible excuses for underperformance. Part of our job is to analyze the information at hand to determine if said reasons are plausible. The same principle can be inverted to outperformance. Investors must discern whether short term business outperformance is sustainable or the result of fleeting tailwinds.

To measure the causes behind outperformance/underperformance, there are a few questions to ask. How is the competition performing? Are there recent industry developments which could affect their results? Has management overpromised before? These are all answerable questions to guide your point of view on a company. If the industry is outperforming, yet management is making excuses, you’re likely being gaslit. If management says there is no competition when there are clearly competitors entering the market, you’re likely being gaslit. Shifting goalposts, decreased amount of disclosure, and incongruence with outside information are all signs of gaslighting. The same principles apply to outperformance. Anomalous outperformance supports the thesis that the company is well positioned for the future. Relative performance measures business quality.

Use a combination of internal and external facts to arrive at an independent decision. The analysts on the call saying “great quarter guys” won’t alert you if a business is about to fall off a cliff. In this post, I'm discussing two companies whose near term results have disappointed, Myomo and Semler, with different end results with respect to my portfolio. I sold my Myomo shares, but still hold my Semler shares which I will explain in a few paragraphs.

Earnings Season review

I want to touch on three companies, each with different results and a different future outlook.

The Good the Bad and the Ugly: MYO, PFMT, SMLR.

Performant Financial, The good.

Although the guidance for profitability was light, there are a number of positives. On the earnings call, management mentioned 20%+ EBITDA margins achieved on mature contracts. In addition, Performant won RAC region two in a competitive bid, a signal for the quality of Performant's product offering. As COVID related claims become eligible for recovery, we could see an acceleration in revenue. It's impressive how well the stock has held up even with large shareholders, first invested when PFMT was a different business, liquidating their positions. Applying a 15X EBITDA multiple and 25% EBTIDA margins on the 2022 expected 91M in Healthcare revenue gives as a target $4.50 share price, 50% greater than the current $3 share price.

Semler Scientific, The bad:

For those who missed it, I did a podcast with Luke Hallard of 7 Investing after they reported 4Q results. Link. Semler badly missed estimates as a pull forward in demand mentioned in the third quarter was worse than expected. Management did a poor job with communication thus the stock dropped like a rock. Although the new product initiatives were revealed, the synergies with Semler's core product are a shaky. However, I still believe Semler can provide attractive returns for investors. They're trading at a 25x P/E, recently initiated a $20M share buyback, and I expect them to grow 15-20% a year. As more data comes out on the clinical value of early PAD testing, insurance companies will be incentivized to test more people.. I believe 25% of the Medicare Advantage market is at risk for PAD and at $40/test, this is a $240 million market. Semler should continue to grow and the highly profitable nature provides a floor on the stock. I find concerns about competition and Medicare Advantage overpayments valid, but at these prices, I believe we are well compensated for those risks.

Myomo, The Ugly:

it's been slightly over one year since I entered my Myomo Position and after experiencing the company's results and rhetoric, I've fully exited my position. It's a short turnover time, but I'm willing to admit where I think I went wrong.

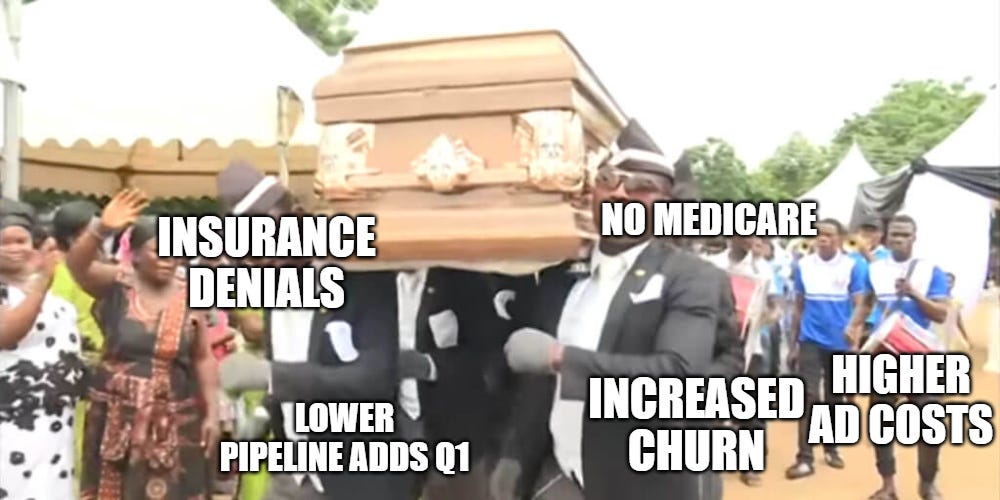

I could summarize the 4Q results in one image.

Here are some more thoughts and memes because that's how I process pain and being wrong: There are a number of qualitative issues hurting the company even with no competition. 1. Insurance: Ongoing insurance headwinds with authorizations add time and difficulty for patients in the backlog thus increasing total churn and SGA expenses. Ambitions are Medicare are sloth-like (no fault of their own), but they plan to apply for benefit reclassification in the later part of this year (coverage wouldn't be received until 2023).

Advertising: Here is where the story gets worse. Net adds were negative (221 adds vs 229 churned) because ad costs were up for the quarter. The average SG&A expense per pipeline addition shot up to nearly $20k! For the first quarter, they're expecting about 300 total pipeline additions, less than 1Q21 and 3Q21. Now here's the cognitive dissonance: They said they had weak adds in 4Q due to higher social media costs, thus they expect to spend more before ad competition heats up during election season. However, they're still only planning to add 300 to the pipeline in 1Q21.

Refreshingly, they broke out advertising costs specifically citing 5k per pipeline addition. This is great, right? Only 5k per pipeline add for a device with 18k gross profits? In theory, yes. But the godforsaken appeals process and clinical training creates scaling issues. Most of their jobs aren't sales but rather G/A including clinical specialists to interface with doctors/patients. The insurance appeal process should scale over time, but a lack of disclosure on progress with insurance is concerning.

Churn: Churn was higher (25%) but this was because they chose to focus on patients they can win with insurance . It's concerning their chances of winning an appeal aren't scaling appropriately. Management's decision to cut loose unproductive patients could lead to lower churn and higher profitability in future quarters, but this is yet to be seen. 10% backlog churn should only get worse with insurance issues. They did not touch on the average time in the pipeline.

The two good things: 1. They have strong international growth especially in Germany (10%) of revenue. 2. In-housing manufacturing to increase gross margins.

With Myomo, one can see operating efficiency before they shows up through leading indicators such as the pipeline, faster patient timelines, and reducing churn. However, these trends are not improving fast enough. The lack of recurring revenue is killing them because they have to re-acquire every. Single. Goddamn. Patient. They're on a treadmill of spending to acquire patients and can only sustain growth through increased acquisition costs. The DTC shift might have increased Gross margins on the device itself, but instead of paying doctors, they are now paying "COGS" in the form of customer acquisition

Updated Portfolio Positions

Disclosure: None of this is investment advice, Please do you own due diligence.

On the topic of Semler Scientific. Currently SMLR is partnered with two large payers in the US, accounting for 70% of total revenue in 2021 between the two. Do you see an opportunity for a significant jump in revenues if SMLR managed to partner with another large payer in the coming years? I would appreciate any perspective you could share regarding the likelihood and potential of such a scenario.

SMLR was disappointing but 2 bad quarters doesn't spell the end of the world. This next one will show February - May results—this will be crucial to see if the seasonality is front-loaded like management said