What a weekend of news, especially in the world of transthyretin amyloidosis (ATTR). My plan was to share updates via the “chat” and Twitter (it’s still not X to me), but with so much to cover, a blog post feels more appropriate.

The American Heart Association (AHA) Scientific Sessions (Nov 16-18) delivered multiple noteworthy publications, and there’s a lot to unpack.

If you’re new here, I’ve written about ATTR before

ATTR Cardiomyopathy Breakdown

ATTR Cardiomyopathy is a lone bright spot for Pfizer (according to activist starboard), a part of a foundation for Alnylam, and a piece of a complicated puzzle for BridgeBio. The disease was rare until new diagnostics and effective treatments demonstrated an increased incidence and prevalence (

If readers do enjoy this type of article, I can make it a staple reviewing recently published clinical data and relating it to companies.

Pro tip: All posters can be found here. Search for specific titles here: https://www.semanticscholar.org/search?venue%5B0%5D=Circulation&q=INSERT YOUR SEARCH LIKE THIS&sort=relevance. The Semantic scholar site has all the abstracts.

Tirzepatide for HFpEF → GLPs continue to demonstrate benefit in a variety of diseases. I do wonder about the potential mechanisms beyond GLP1…….(here’s one editorial)

Lp(a) silencing - Lp(a) is a causal risk factor for heart disease. (source)> This is the next generation of Cardiovascular therapy imo. Two updates from Silence and Lilly look good

Now to the meat

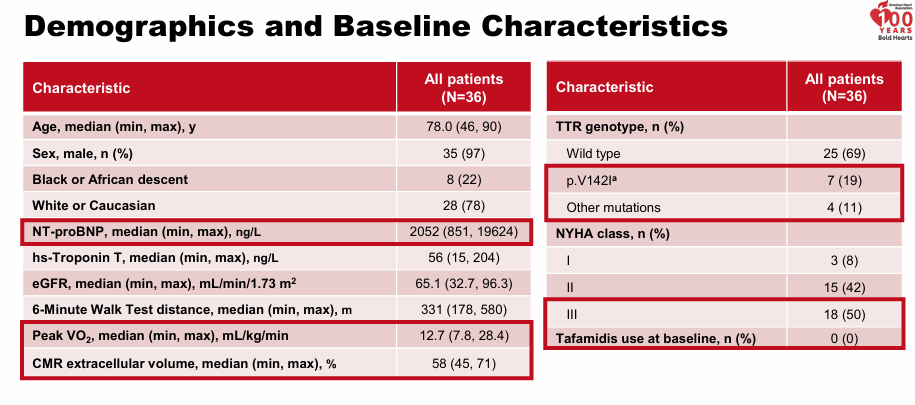

Intellia: Gene Editing for ATTR

Intellia presented long term data on their gene editing therapy, NTLA-2001, for ATTR (both cardiomyopathy and peripheral neuropathy, presentation). They showed sustained reduction TTR levels (90%) starting at day 28 and extending to month 24. Biomarkers were stable for all patients over 12 months.

The data is good. Bulls will point to the high number of Class III patients enrolled in the trial, “Look at the benefit in a severe population!” but they miss the discrepancy between NYHA class (functional outcome, can be shifted a little) and NT-proBNP (an objective biomarker).

I commented on the discrepancy here. I trust the NT-proBNP results and believe the population enrolled is likely most comparable to one in between Alnylam’s and Acoramidis from their phase 3 pivotal. Keep in mind the data is an early phase 1 trial.

Overall, the mortality out to 15-18 months is great with nearly 100% of patients still alive

“So I'm not sure if it's from Class III or not. But this would suggest that your Class III survival rate is either 95% or 100% at 12 months. And in natural history, we've seen that the survival rate in Class III is 80%.”

My Take:

The data looks good but does not matter commercially. Intellia won’t have an approvable drug until 2028 at the earliest and ATTR Cardiomyopathy will be a tough market, especially for a drug which doesn’t reverse disease. Gene editing requires patients to take a permanent risk. People may point out the injection/pill burden as a reason for single administration, but the ability to reverse drug effects are important! If ANY adverse event shows up, the drug is DoA. The data looks quite good compared to other therapies (Vutrisiran/Acoramidis show about -20M 6MWD at 12 months in comparable population), but the trial is a phase 1, open label, short term trial. Take with a grain of salt. I wouldn’t be selling plasma or skipping down payments IYKYK to buy this, or any, stock.

There is a scenario where interim data is so good that they get the drug to patients earlier…..but remember, the comparison to best available therapy will include tafamidis/acora/vutrisiran.

One can certainly make the case the drug is better than available silencing therapy and if a one time dose works, then it’s truly amazing, but I find it odd gene editing companies are trying to tackle diseases with limited unmeet need instead of going after rare diseases with nothing available.

Alnylam: Toward Once Yearly Dosing

Alnylam released data from their next generation TTR silencing therapy here. The Single ascending dose study measured TTR reduction and safety. The company plans to release plans for the drug, ALN-TTRsc, in 1Q2025.

The goal is a yearly dosing schedule. I have no official way to estimate the expected TTR silencing on a 6 month/yearly dosing schedule because silencing duration is driven by a combination of A) loading onto RISC (complex that degrades RNA) and B) stability in liver cells. (source, not half life in serum). For context. Alnylam progressed the 25mg dose of vutrisiran at Q3M dosing after it demonstrated silencing of 80% maintained for 90 days. They expected the 3 month dosing to increase silencing from 80% to 87%.

“At steady state, the 25 mg quarterly regimen is expected to achieve a similar magnitude of TTR reduction as the 50 mg single dose” (would be 87% held for 90 days). Phase 1 Data - Vutrisiran

My take:

I cannot tell you the precise steady state silencing at yearly dosing, but I expect it to be greater than 90% if dosed every 6 months. In my opinion, I think they can reach yearly dosing if they progress a higher dose level (600mg). A yearly silencing therapy would be a game changer but as with Intellia, the unmet need in 5 years will be much lower. I do wonder why they didn’t advance a higher dose of vutrisiran…..they reached higher silencing levels with higher doses (graph).

I still think the future of ATTR will be antibodies.

“Antibodies, on the other hand, could be potentially transformative because they are the only potentially disease reversing therapy in the pipeline.” - ATTR Cardiomyopathy Breakdown

BridgeBio: Acoramidis Takes Center Stage

Intellia and Alnylam presented early-stage data while Acoramidis is in the opposite situation. BridgeBio expects approval November 29, 2024.

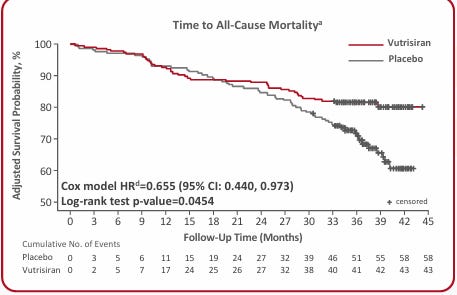

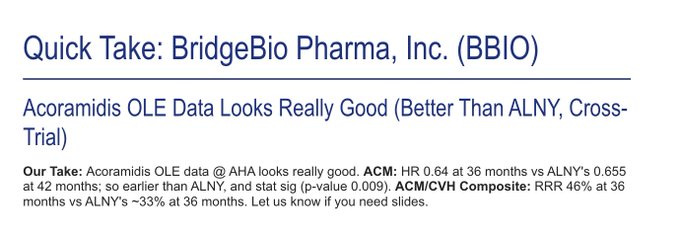

Alnylam made the case for long term mortality benefit with Helios-B.

Now BridgeBio has matched (beat?) their data. All-cause mortality continued to improve in the OLE patients out to 42 months. Presentation here. The benefit in Hospitalizations, biomarkers, etc continued to be strong.

Consensus view: the data looks good, potentially better than Alnylam, concerns over commercial viability and Tafamidis loss of intellectual property.

My take:

Cross trial comparisons are hard, but this data meaningfully shifts the picture in favor of Acoramidis. Doctors should view the drug as equivalent (or better) vs Vutrisiran and likely better than Tafamidis. New patients will be given the option between 1) a drug with established use (Tafamidis, once daily) 2) a drug with the same mechanism of action but higher stabilization and greater than/equal demonstrated benefit (Acoramidis, taken twice daily) or 3) a drug which works in a different manifestation and also has good long-term efficacy (Vutrisiran, Injection in office Q3M). Acoramidis likely takes >30% of new patients. Over time, Tafamidis share will decline as a monotherapy for new patients.

Further, the long-term OLE data support including a mortality benefit on the label, a prior concern for investors. Keep in mind the total market is $6B and growing 25%. 50% + of patients are not diagnosed. As laid out in my prior article, every single company agrees:

"In fact, in our best estimates, we believe about 20% patients only across the world are diagnosed. Therefore, this really is in a way, I'm going to date myself a bit of a blue ocean opportunity with some important players, which is only going to actually expand, increase access and availability" - Alnylam

"It is estimated that nearly half of those with this progressive and deadly disease have yet to be diagnosed….Diagnosis remains the biggest unmet need in this condition because there's almost half of patients that are still undiagnosed. So we do see a lot of growth opportunity in Vynda." - Pfizer

"The first is the ATTR-CM, which is one of the largest cardiomyopathies in cardiovascular disease, 300,000 to 500,000 patients, growing significant disease burden." - AZN

"One is the continued identification of new patients moved somewhere from like 35,000 identified patients to close to 50,000 now. And I expect that that's going to continue at an increased clip based on more and more people coming on to the playing field" - BridgeBio

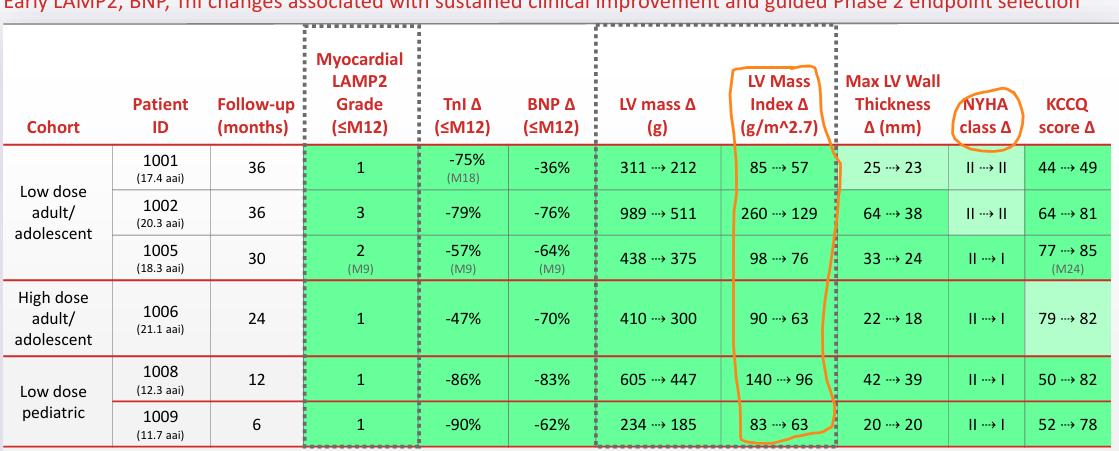

Beyond ATTR: Rocket’s Progress in Danon Disease

I wrote in my article about FDA flexibility

“Rocket has what Lexeo wants: A clear path to approval with strong data to back it up. Rocket is seeking accelerated approval for their AAV gene therapy targeting Danon disease (RP-A501). The FDA agreed to a 1-year, natural history controlled, single arm study for approval. The primary endpoint is a combination of LAMP2 protein expression (>=grade 1 IHC, 25% expressing cells) and Left Ventricular Mass Index (> 10% reduction) at 12 months with supporting secondary markers. (link)

Rocket published long term follow-up from the phase 1 study for RP-A501, a cardiac gene therapy for Danon disease. RP-A501 edits cardiac cells to increase LAMP2 expression, the deficient protein in Danon disease. Danon is a disease of enlarged hearts (failure to clear cardiac cells of waste) and LAMP2 is a ‘cleanup protein’ than helps clear cells. Presentation here

The LVMI reduction remained consistent over time and every patient in the study met the expected bar for accelerated approval (10% LVMI reduction and > gr. LAMP2 expression at 12 months). Serious adverse events did occur (Gr. 3 +) but all patients were alive at the end of treatment. Gene editing was sustained out for years. Danon is a progressive disease where boys die before 20 years old without treatment. Any patient given the opportunity will take this drug.

Consensus view: Data looks good and few don’t believe the drug will be approved, but does the market exist? Also, is there a potential concern for safety?

My Take:

The bogey for efficacy has been met. Every patient meets the bar set by the FDA for accelerated approval. The primary concerns now become commercial. Danon Disease is a nascent disease with no effective treatment options. LAMP2 was discovered recently, and the internally estimated prevalence (15,000) extrapolates from small studies. However, I believe concerns over commercial potential are overblown and the commercial potential for RP-A501 is in the billions. Once an effective therapy hits the market, diagnosis rates shoot up. In addition, new guidelines from 2023 outline more detail for physicians managing Danon with recommendations to test early for LAMP2 mutations. Rocket is proactively taking steps to make genetic testing regular practice and identify patients in the community.

Future steps: Potentially report interim data if all patients meet the primary endpoint at 12 months. Enrollment completed recently. I expect data in late 2025.

Signing Off

Let me know what' y’all think about the above. Do y’all enjoy these quick takes-should this format become a staple for clinical data recaps?

Adu Subramanian

Email: adu.subramanian@subradata.com

Website: https://www.subradata.com

Bonus: Tectonic’s Relaxin Analog

Tectonic Therapeutics presented proof of concept data on TX000045, a long-acting relaxin analog for group 2 pulmonary hypertension (PH-HFpEF), a disease with no current treatments. The abstract is worth tracking because I think the MoA is validated, big pharma has molecules in development and Tectonic is well capitalized/backed by real investors (yes, that Tim Springer)

Relaxin works acutely for heart failure even though it failed trials for long term outcomes. (source). The abstract shows proof of concept for TX000045 via increased renal plasma flow, a biomarker for cardiac output. Noisy data, but seems to work.