Sickle Cell Disease: previewing readouts from Pociredir and Mitapivat

Pociredir works, Mitapivat may work

Doing something a little different and diving deep into a future catalyst for this post. I try to alternate between broad biotech pieces and in depth analysis. This one is on sickle cell disease, Fulcrum Therapeutics, and Agios Pharma.

TLDR

Fulcrum and Agios have upcoming readouts. In my opinion,

Fulcrum Therapeutics has an effective drug in sickle cell disease

Agios Pharma has a partially effective drug for sickle disease.

Both companies are flying under the radar because investors are thrown off by other issues.

Table of Contents.

Sickle Cell disease

Guidelines

Unmet needs

History of failure: Senicapoc, Oxbryta, and Adakveo

Fulcrum Therapeutics + Pociredir

Efficacy - it works

The right type of induction

Competition

Safety

Trial Design

Modeling the Market

Agios Pharma + Mitapivat

Overview

Thinking through the catalyst

Sickle Cell Disease - Some basics

Hemoglobin carries oxygen. It’s four protein subunits, typically two alpha and two beta chains forming a tetramer. Different combinations of subunits create various types of hemoglobin in the body.

Hemoglobin A (HbA): Normal adult hemoglobin. HbA1 made of alpha and beta chains makes up the majority of adult hemoglobin

Hemoglobin S (HbS): Abnormal hemoglobin that causes sickling. Composed of two normal Alpha chains and two abnormal “Sickle” Beta chains

Hemoglobin F (HbF): Fetal hemoglobin made in the fetus and turned off after birth, has higher affinity for oxygen. This type of hemoglobin does not sickle

Sickle Cell Disease (SCD) results from a point mutation in the β-globin gene, changing one amino acid (glutamic acid to valine). The mutation creates abnormal hemoglobin S (HbS, Alpha-Alpha-Sickle-Sickle) causing red blood cells to become rigid and sickle-shaped.

SCD leads to two main problems:

Chronic hemolytic anemia - Sickled blood cells breakdown easily, leading to low hemoglobin levels.

Vaso-occlusive crises (VOCs) - Sickled cells stick to vessel walls and each other, blocking blood flow and causing severe pain and organ damage. I cannot overemphasize the pain of a VOC.

Note: The severity of SCD depends on the genotype. For example, HbSS is the most severe form (two sickle genes) while HbSC is a generally milder form (one sickle gene, one HbC gene). Treatments tend to target HbSS and I do not make a distinction for the rest of the report.

Anemia and VOCs lead to progressive organ damage. Patients typically have unhealthy livers, kidneys, etc after years of pain crises, anemia, or even iron overload due to transfusions (to treat the anemia). The average life expectancy is 40-50 years old.

Understanding this pathophysiology explains why treatments focus on 1 of 3 targets:

Preventing sickling via inducing Fetal Hemoglobin (HbF). HbF isn’t “sticky” like HbS.- → Drugs like hydroxyurea, gene therapy do this

Reducing blood cell adhesion (to prevent vaso-occlusion) → Crizanlizumab

Improving red blood cell health and oxygen delivery → Endari, Oxbryta (lol not anymore)

The best way to treat sickle cell disease is inducing fetal hemoglobin (HbF): Because HbF doesn't interact with HbS, high levels prevents sickling. HbF can deliver the oxygen the body needs. In fact, Hemoglobin F is upregulated in milder forms of disease. This forms the basis for hydroxyurea and gene therapy, both increase HbF levels.

Guidelines and the Standard of Care

Sickle cell disease is a lifelong disease starting at a young age and the treatments are fairly straightforward because there’s so little available.

First-Line Therapy: Hydroxyurea is recommended for all patients with the HbSS genotype. Hydroxyurea works by increasing Hemoglobin F.

Transfusion therapy: Patients with anemia (Hb < 8 g/dL) are often given blood transfusions but chronic blood transfusion raises the risk of iron overload. We don’t want to do this from a young age

Second-Line Options: Second-line therapy for patients with recurrent pain crises and/or anemia typically included monthly crizanlizumab (Adakveo) infusions, though recent Phase 3 data has questioned its efficacy. Oxbryta was used in patients with persistent anemia but has been withdrawn. A few years ago, both of these were considered options. Now, neither are considered real options.

Advanced Therapy: For patients with severe, refractory disease who are willing to undergo the chemotherapy and have insurance coverage, gene therapy (Casgevy or Lyfgenia) or stem cell transplant represents a potentially curative option. < 5% of patients will be eligible.

In 2020, the future looked bright. Oxbryta was recently approved, gene editing was on the way, and Adakveo had shown promise leading to accelerated approval. But flash forward 5 years and the standard of care is quite different.

Unmet need

The current treatments leave a lot to be desired. Hydroxyurea isn’t a bad therapy because it cuts VOCs in half, but HU has too many safety issues and doesn’t work for everyone. It’s literally too toxic to touch with a black box warning for myelosuppression.

Less than 25% of patients with SCD receive Hydroxyurea in certain medicaid cohorts. Adherence is also low among the general population

“Honestly, I just didn’t trust [hydroxyurea]. If I can’t touch this with my hands and I have to bypass my tongue, but it’s being ingested into my body, that’s–something about that doesn’t sound right, you know? (28-year-old female)”

Other disease modifying therapies are rarely used. Crizanlizumab is used in < 5% of patients. Oxbryta is used in < 5% of patients before it’s discontinuation. Keep in mind both of these are $100M+ drugs: the market is huge.

More patients are on Opioids than on hydroxyurea because the pain is so strong.

Chronic sickle cell disease patients are often seen as “drug-seeking” because the pain is so bad. I cannot emphasize how much VOCs can impact you. Patients deal with chronic fatigue, but a pain crises sends you to the hospital. 1

Approximately 50% of SCD patients are considered "high utilizers" of healthcare, experiencing more than 4 hospital visits in a 12-month period despite the options available. These patients aren’t well controlled and need additional therapy.

Why has everything failed so far?

Why did Senicapoc Fail? Hemoglobin isn’t the perfect biomarker

Senicapoc was a gardos channel blocker meant to improve red cell hydration. Dehydration can lead to sickling so hydrating the cells can improve VOCs (in theory). Phase 2 results were promising on various biomarkers of red cell health, but the phase 3 trial failed miserably.

The VOC rate was WORSE in the treatment arm even though the drug worked to increase hemoglobin. But Senicapoc was a bad drug. “Hydrating” RBCs is a bad idea because it doesn’t impact polymerization can instead destress red blood cells. By increasing cell volume and reducing stress, I suspect naturally elevated HbF levels were reduced. It matters how you change these cells. The trial proves hemoglobin isn’t the perfect biomarker.

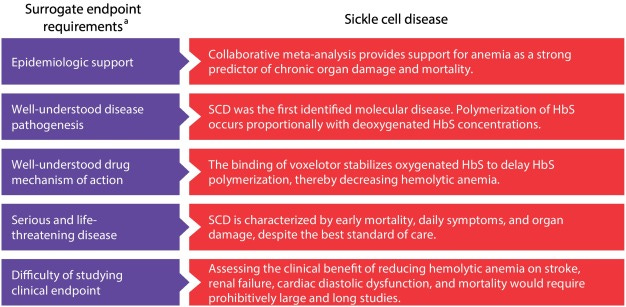

Why did Oxbryta(Voxelotor) Fail? Mechanism of Action

Oxbryta (Voxelotor) was different because it directly stabilizes the sickled hemoglobin converting (in theory) HbS to normal Hb. Thus, even with prior failures, the FDA gave Oxbryta some additional flexibility to allow approval without VOC improvement.

Hemoglobin increase was used as a surrogate endpoint for accelerated approval, heralded at the time as a “case study in novel endpoint selection”. The unmet need of anemia balanced with potential for the drug to eventually reduce VOCs led to accelerated approval in 2019 (HOPE trial).

But it wasn’t smooth sailing from there.

In 2024, the EMA started investigating the drug for safety and efficacy leading to complete withdrawal in September. We’ll get more details later in 2025, likely August, for the final report from the EMA.

“Pfizer Voluntarily Withdraws All Lots of Sickle Cell Disease Treatment OXBRYTA® (voxelotor) From Worldwide Markets. - Pfizer's decision is based on the totality of clinical data that now indicates the overall benefit of OXBRYTA no longer outweighs the risk in the approved sickle cell patient population. The data suggest an imbalance in vaso-occlusive crises and fatal events which require further assessment.”

EMA was concerned about malaria risk and increases in VOC rates, but Pfizer pulled drug before the investigation was over. I suspect Pfizer withdrew the drug while balancing market potential with costs of rollout. The investigation would destroy public perception.

Furthermore, the original Phase 3 HOPE trial failed to demonstrate a significant VOC benefit.

I think Voxelotor failed their VOC endpoint for two reasons

It stabilized hemoglobin but reduced oxygen delivery. So Oxbryta stabilizes the HbS to bing oxygen with more affinity, but this excess oxygen isn’t delivered to tissues…..(because the new Hb binds it better).

Oxbryta reduces naturally elevated HbF levels (protective). Sickle cell disease patients have stressed cells which can naturally induce HbF. Protecting them can actually hurt your VOC rate if the new drug doesn’t improve the VOCs.

Why did Adakveo (Crizanlizumab) Fail the Phase 3? Trial Design

Adakveo (Crizanlizumab) directly prevents cell aggregation by inhibiting P-Selectin, a red cell adhesion marker. This should work for VOCs. Putting aside the commercial considerations for a Q4W IV infusion, directly stopping occlusion by preventing cells from binding to each other should work.

And it did work initially. Phase 2 results from the SUSTAIN trial show crizanlizumab improves annualized VOC rate to 1.63 vs 2.98 for placebo (VOC requiring hospital visits). The FDA and EMA approves the drug in 2020 (EU approval conditional on confirmatory results). But in 2023, the phase 3 STAND trial fails. Full results show VOC rates 2.09-2.45 in the drug arm vs VOC rates of 2.30 in the placebo arm.

Even with high hopes, Adakveo was stalling in sales before the poor phase 3 results, but why did phase 3 fail? I believe trial design played a role. The phase 3 trial ran during COVID when patients were less likely to go to the hospital. Thus the placebo arm has a much lower VOC rate compared to other phase 3 trials.

VOCs are finicky. They’re subjective. Sometimes a borderline VOC can be pushed one direction or the other because of how we track them and monitor patients. The trial design can make or break results.

Lessons learned

Hemoglobin and red cell health isn’t perfect as a biomarker

Trial design matters

Unmet need remains high.

Pociredir and Fulcrum Therapeutics

Setting the stage: Pociredir is an EED inhibitor developed to induce HbF production in patients with sickle cell disease. They have a phase 1 trial reading out later this year. They will report results from the 12mg cohort of patients in early Q3 and 20mg in Q4.

Efficacy - Does Pociredir work?

Pociredir is an HbF inducer. The relationship between HbF and VOC reduction is well established from HU treatment. Once we reach 25%+ HbF, VOCs are reduced to near 0. The relationship is logarithmic plateauing at those levels.

And does Pociredir induce HbF? Yes

In both Sickle Cell patients and healthy volunteers, it works. Dose dependent, quick induction with meaningful changes in HbF induction. The 12 mg cohort shows data improve HbF levels up to 10% by week 7.

Furthermore, the mechanism of action is orthogonal to hydroxyurea and thus additive.

The efficacy data is relatively straightforward because the data is so strong clinically. I cannot overemphasize how well HbF induction works to reduce VOCs. It’s the only drug mechanism that’s worked so far. However, the absolute % HbF change from baseline doesn’t capture the full picture. We need to induce HbF in the right way.

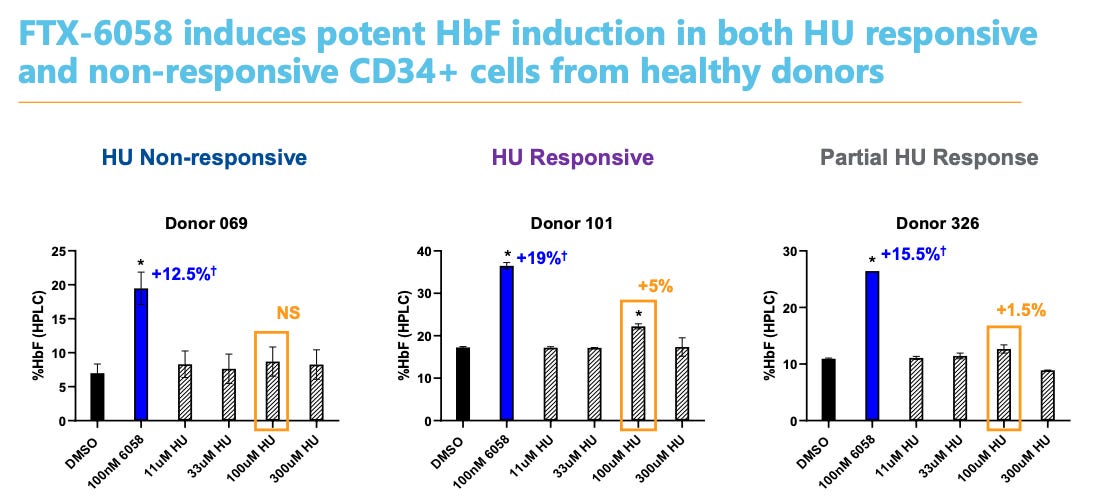

The right type of Induction

Total HbF induction isn’t the right biomarker. We need a per cell concentration to reduce VOC rates. If 2% of cells make 90% of the excess hemoglobin F, Only those 2% of cells are protected. We need to reach an average per cell level ~9-10 pg/mL to protect the body. 2 The numbers are derived from milder SCD patients.

The FDA review for CASGEVY (gene therapy) makes this distinction:

”Although it is known that HbF ameliorates the phenotype of SCD by inhibiting deoxy-HbS polymerization, neither blood HbF concentration, nor the prevalence of F-cells (RBCs with detectable HbF), measures the amount of HbF/F-cell. The best predictor of the likelihood of severe SCD may be the HbF/F-cell, rather than the total number of F-cells or concentration of HbF. It has been reported that even some patients with high HbF can have severe disease because HbF may be unevenly distributed among F-cells, with certain cells having insufficient concentrations to inhibit HbS polymerization. Only when the total HbF concentration is near 30% is it possible for the number of protected cells to approach 70% (Steinberg et al. 2014)”

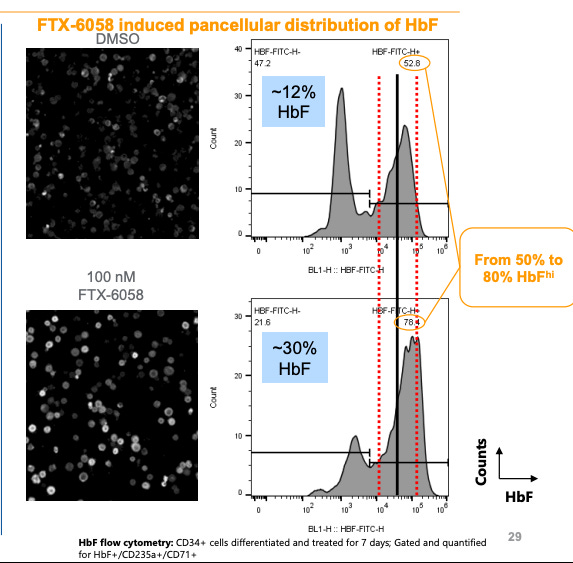

We call this “pan cellular” induction.

HU fails this test because it’s not targeted to increase HbF levels broadly. So absolute levels go up but VOCs are still an issue. In theory, any cell with 9-10 pg HbF is protected, but HU simply doesn’t get there. (unlike the gene therapies)

But Pociredir is better

Let’s do some math: 12% HbF with 52% HbF hi cells → 30% HbF with 78% HbF Hi cells. The average % HbF per cell in the pociredir group is 30-40%. This is protective. If we can get 80-90% of cells to 30% HbF levcls, VOC levels will drop dramatically.3

HbF Inducer Competition

In my opinion, targeted HbF inducers will replace hydroxyurea in the future. Hydroxyurea was never meant for sickle cell disease. A targeted inducer will work and work better/safer.

Some of the competition

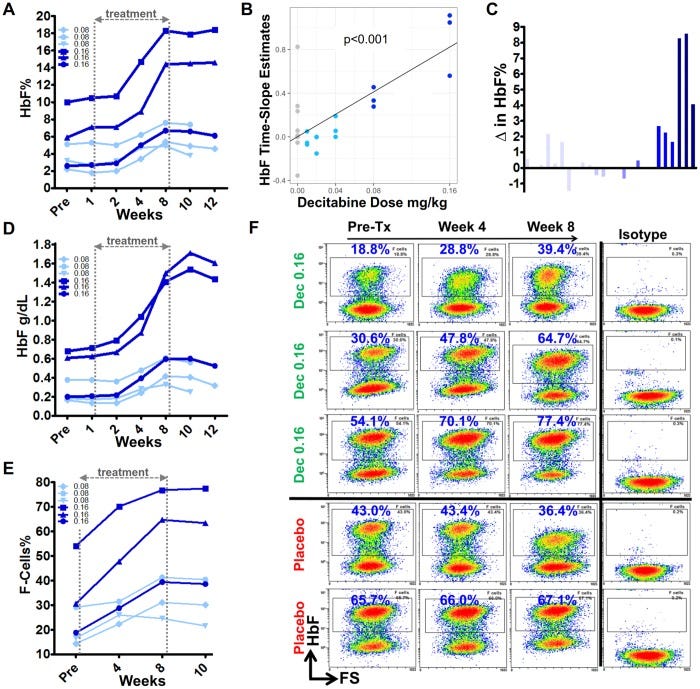

NDec (Novo Nordisk) - A combination of decitabine (a DNA methyltransferase inhibitor) and tetrahydrouridine (which prevents rapid decitabine metabolism). The most advanced

Pociredir (Fulcrum Therapeutics) - A PRC2 inhibitor targeting the EED subunit

WIZ1 degrader (BMS) - Targets WIZ1, a transcriptional regulator of fetal hemoglobin

Panobinostat - A histone deacetylase inhibitor

The most advanced (still in trials) inducer is NDec from Novo Nordisk.A Phase 2 trial is ongoing and recently completed.

Breaking down the Phase 1 data from NDEC (Novo Nordisk)

Six patients with sickle cell disease refractory to hydroxyurea were treated

HbF Induction: The treatment successfully increased HbF levels by approximately 3-9% at the highest dose levels in three patients. - less than the target 10-15% set by prior hydroxyurea data

Decreased Neutrophil counts and elevated platelet levels (only one patient with neutropenia, transient. thombocytosis reached 1.2M platelets, almost criteria for discontinuation)

“Good Erythropoesis”: the new red blood cells are healthy and HbF induction is working well. But the HbF induction isn’t pan-cellular

My concerns:

I’m concerned about the high platelet counts. Platelets -> clotting -> bad stuff in SCD where blocking blood flow is a major issue. The publication discusses the issue saying prior data shows red cell quality is more important than platelet counts, but I disagree with brushing off such concerns. Platelet counts are already high and hyperactive in Sickle Cell disease. Increasing them even more is concerning.

Non pan cellular induction:

Remember, we want all the cells to have HbF. Look at patient 1, If we go from 20 to 40% F Cells (doubling cells making HbF), assuming baseline hemoglobin is the same, then the Total HbF should more than double. It does not, the total HbF increases 1.5x. This is not enough to be protective. Compare that to gene therapy which increases per cell HbF to 40% leading to 0 VOCs.

Conclusions: NDEC increases HbF levels, but it does not lead to pan cellular HbF induction. This doesn’t mean the drug won’t work. Remember HU works really well and has the same issues. However, it’s not as good as pociredir.

Pociredir is Safe Enough

Are we really discussing potential safety issues when the comparison drug is either a) chemotherapy HU with a black box warning for neutropenia or b) Gene therapy which requires 1 year of chemo and recovery? I guess we are.

Short term Safety - Pociredir is safe

Investors have some concerns on neutropenia (low WBCs) but the 12 mg dose cleared safety to start dosing the 20mg group. Further, Fulcrum's data show neutrophil counts typically rebound before reaching clinically significant levels of neutropenia.

Hydroxyurea requires lab monitoring explicitly for myelosuppression and neutropenia and NDec shares similar concerns. Cmon man

What about cancer? Isn’t that why the clinical hold was placed?

The main safety concern with pociredir stems from its mechanism as a PRC2 inhibitor. In 2023, the FDA implemented a clinical hold based on concerns related to the drug class. The FDA's rationale was explicit:

"The agency specifically noted that the profile of hematologic malignancies observed in the nonclinical studies with FTX-6058 is similar to that observed with other inhibitors of PRC2, and that hematological malignancies have been reported clinically with other PRC2 inhibitors. The agency requested that Fulcrum further define the population for the potential benefit of continued treatment with FTX-6058 outweighs potential risk."

The “Other PRC2 inhibitor” is Tazemetostat, a cancer medication. However, Fulcrum emphasizes that Pociredir shows a different safety profile. Specifically:

"In the label for tazemetostat, they noted neutropenia, thrombocytopenia, anemia as reasons for dose modification. And I'd point out that in healthy volunteers and our sickle cell population, we've not observed any of those effects."

Moreover, the observed incidence of lymphoma with similar drugs (~0.6%) aligns closely with baseline cancer risks in Tazemetostat’s indication. An adcom on Tazemetostat describe the risks of secondary cancer as minimal but notable. There is no Black Box warning for Tazemetostat.

It's worth noting that hydroxyurea, the current standard of care for sickle cell disease, carries its own significant toxicity profile. Patient perspectives highlight this concern:

"I kept her off of hydroxyurea for about a year or so because of the chemo aspects of it."

Nearly 30% of prescribed patients avoid taking hydroxyurea due to these safety concerns, demonstrating that some level of risk is already accepted in the SCD treatment landscape. If I told you there is a .6% chance of cancer but the other option was expected death by 50 years old with 3-5 pain related hospitalizations per year, would you take the drug?

Target population and trial considerations

The trial population has undergone significant refinement:

Pre-Clinical Hold Criteria:

Adult patients (18-65) with documented SCD (genotypes S/S, S/β0, S/β+)

Either stable on hydroxyurea for ≥3 months or off hydroxyurea for ≥60 days

HbF levels ≤20% with manageable VOC frequency (0-6 episodes annually)

Post-Clinical Hold Additional Requirements:

Frequent VOCs (≥4/year) or significant complications (acute chest syndrome, sequestration events, priapism, pulmonary hypertension, or chronic kidney disease)

Documented failure or intolerance to hydroxyurea at maximum tolerated dose

Prior treatment with at least one additional therapy (voxelotor, crizanlizumab, or L-glutamine)

By restricting the trial to patients with on additional therapy, the population shrinks. Currently, only about 5% of SCD patients receive any therapy beyond hydroxyurea. Maybe people are concerned the FDA label after a phase 2/3 trial will reflect that smaller population.

But that view misses 1 important detail. Oxbryta and Adakveo have failed in late stage development so the “2L” is just “after Hydroxyurea” Pociredir will fit after hydroxy urea treatment (remember 50% of people fail treatment) It doesn’t have to beat HU, rather it has to reduce VOCs in patients who have failed treatment or do not want to take it.

The phase 1 trial is run well

Management has reported substantial improvements in trial execution, particularly regarding patient adherence:

2022 (Early Cohorts): Investor concerns focused on patient dropout rates: "Given that you basically lost three patients out of the six-patient main cohort, why aren't you considering expanding that cohort, especially since you want to get combination data with hydroxyurea?"

2025 (Current Cohorts): Management reports significantly improved compliance: "We're seeing adherence to study drug rates in the north of 90%."

Fulcrum reported baseline hemoglobin F levels were 7.7%, in line with prior phase 1 trials. This is important for consistency from the phase 1 trial.

Valuing the program:

Approach 1: acquisitions. EpiDestiny (developed NDEC) was acquired for up to 400M after 6 patients worth of data. Global Blood therapeutics was acquired for 4B without full approval for the drug. I suspect some of those SCD folks at Pfizer are looking to make up for their sins.

Approach 2: Oxbryta did ~400M in sales pre withdrawal and was growing ~20%/year. This was without any benefit on VOCs, the major clinical endpoint. Peak sales for pociredir is likely 500M-1B+ especially considering the market landscape isn’t crowded.

I think pociredir is worth between 500m and 1B based on both of these approaches. Currently the market cap for FULC 0.00%↑ is approximately 350M.

Success Criteria for Upcoming Readouts

The mid-year readout for the 12 mg cohort will be evaluated against these benchmarks:

HbF Induction Threshold: Achievement of ≥15-20% HbF levels would provide strong validation for the drug.

Dose Escalation Decision: Progression to the 20 mg cohort would indicate acceptable safety → This is done already. I was writing this before they reported Q1 ha.

Absolute HbF Changes: Increases of 10-20% from baseline would be clinically relevant.

Safety Profile: Absence of significant neutropenia or other dose-limiting toxicities

Pan cellular induction: I hope they show us detailed data on HbF, total F-Cells, and maybe even HbF per cell.

Summary

Pociredir induces HbF. This reduces VOCs. We will see data early Q3.

Pociredir induces HbF in the right way. Compared to other drugs, I think it’s better.

The market is large with a high unmet need after the withdrawal of other therapies. Pociredir will fit in after HU treatment fails.

Competition is sparse

The drug can do peak sales of 1B+ if current data holds.

Part 2: Mitapivat, Etavopivat, and PKR activation.

Setting the stage: Mitapivat is a pyruvate kinase activator currently approved in PKD with an ongoing phase 3 trial in SCD. The trial should report in Q4 with co-primary endpoints hemoglobin and VOC reduction.

TLDR:

We know only one really effective way to reduce VOCs: HbF induction, not regular hemoglobin induction. Mitapivat increases hemoglobin.

Prior clinical data shows a consistent benefit on hemoglobin response but is iffy on VOC rates.

Investors are concerned over liver toxicity and commercial viability, but the unmet need is so high that the drug is a commercial blockbuster in sickle cell disease if approved.

I expect win on Hemoglobin and a trend on VOCs, lean positive on stat sig but still toss-up.

Overview

Pyruvate kinase is a metabolic enzyme in red blood cells catalyzing a key step in ATP production. Activating the molecule is like a vitamin for your red blood cells. Low energy = bad, high energy = healthy.

In theory, a PKR activator could address both anemia and VOCs because it increase affinity between hemoglobin and oxygen leading to less sickling and lysis. However, the data, while positive, is not groundbreaking and the mechnanism is very “trust me bro it just works”.

Two milestone readouts for PKR activators are approaching:

Agios Pharmaceuticals: Q4 readout from the RISE UP study for Mitapivat. Prior results

Novo Nordisk: Mid next year for etavopivat results. Phase 2 results

Comparing the two drugs and the promise of PKR

Both Etavopivat and Mitapivat look similar.

Similar increase in hemoglobin, Mitapivat is a little better in a slightly healthier population

Both hover around VOC reductions ~50%, in line with hydroxyurea. Note: these trials are run in patients with concomitant HU usage.

Mitapivat is given twice a day, Etavopivat once a day. Mitapivat will require liver monitoring when initiating therapy. Etavopivat’s liver toxicity is unclear.

Thinking about the Q4 Mitapivat readout:What’s the bar for success?

Given dual primaries, the goal is hitting both and approaching the FDA with a complete data package. We know it’s going to be a positive phase 3 for the hemoglobin response. but the VOC reduction is still iffy.

Trial Design - Overpowered, but concerns on Placebo response

They’ve overpowered the trial to show a benefit on both endpoints. Hemoglobin response rate 33% is easily achievable. But assuming the placebo rate is 3 SCPC is a high bar. We’ve seen issues with trial design with the Adakveo trial.

Management is shifting their tone on dual endpoints.

Initially, they presented both anemia improvement and VOC reduction as equally critical outcomes:

Early Positioning (2023): "I think that it's clear there's 2 mechanisms by which sickle cell patients face bad outcomes. It's clear that there's devastation from anemia... In addition to that, sickle cell pain crises... is a driver of health care utilization, it's also a driver of mortality. I think showing benefit independently in anemia and sickle cell pain crises is a very valuable thing for patients."

Recent Positioning (Late 2024): "We did choose the 2 primary endpoints because they can provide relevant information for the totality of the disease. So in a situation in which we would not be able to hit on one endpoint, but only would hit on the other endpoint, we still have an opportunity to transfer alpha to secondary endpoint testing, which would allow us to further look for clinical benefit."

At most recent conference in May 2025: “And so for secondary testing, one of the really important measures that we'll be looking at is fatigue.

So we're looking for improvement in hemoglobin, which we've demonstrated now across three different hemolytic anemias, and the plus could be vaso occlusive crises improvement and or fatigue benefit as well. And any of those permutations would be a very compelling package for patients”

Management is waffling on their confidence. Every change in wording matters and a subtle shift in tone may prepare investors for potential scenarios where only one primary endpoint reaches statistical significance. They've introduced more nuanced language about regulatory pathways that could support approval with partial success instead of broad success.

Is Liver toxicity an issue

AGIO 0.00%↑ fell 50% late last year when investors were spooked by potential liver toxicity which required additional monitoring. 5 cases of reversible elevations in liver enzymes were reported, mostly complicated by prior history. The FDA added a specific section on hepatocellular injury in the label which requires monitoring for 6 months.

In the label:

““Hepatocellular Injury in Another Condition: Obtain liver tests prior to the initiation of PYRUKYND and monthly thereafter for the first 6 months and as clinically indicated. Interrupt PYRUKYND if clinically significant increases in liver tests are observed or alanine aminotransferase is >5 times the upper limit of normal (ULN). Discontinue PYRUKYND if hepatic injury due to PYRUKYND is suspected.”

Management brushed it off as nothing but it does limit the speed and total market for a few reasons.

Practical Burden: hydroxyurea also requires regular monitoring when starting therapy, patients are

Patient Perception: The more significant issue lies in patient trust and adherence.. Additional safety monitoring requirements will discourage treatment adoption for low trust patients. Doctors will also hesitate to prescribe the drug in a population with already sick livers due to iron overload or chronic damage.

Etavopivat vs Mitapivat: If Etavo skirts the liver toxicity, then mitapivat would be severely disadvantaged even if first to market.

Commercial Considerations

Mitapivat will be used after unsuccessful first line treatment. If it demonstrates both VOC reduction and hemoglobin improvement, this can be a potential blockbuster because sickle cell patients need another option. It’s also an easy add on to patients with uncontrolled disease with minimal safety concerns (the liver monitoring isn’t a “real” safety issue).

The phase 2 data didn’t show a benefit on PROMIS scores:

But this measure is extremely noisy and confounded by a “response shift” in chronically fatigued Sickle Cell patients. All the real world evidence demonstrates a profound benefit on fatigue. Your RBCs are on steroids.

Scenario Analysis:

Bull Case (what I think represents upside, 30% chance): Statistically significant on both endpoints, 35%+ reduction in VOCs with significant improvements in PROMIS fatigue scores and no further safety concerns

Base case (what I think is expected): Hemoglobin response profound, Stat sig on fatigue but not VOCs with VOC reduction ~35%. This is still a commercially viable drug to the tune of $500M

Bear Case (you’re screwed) < 10% chance: Misses hemoglobin response

I’m not comfortable with the phase 3 readout. People can make reasonable arguments on either side of the table and I lean towards “statistically significant, but barely” camp. The stock price reflects the uncertainty so I could see investors paying attention closer to Q4 driving the stock price up in anticipation of the readout given failure is priced in. I can’t see a clear path to holding through the Q4 readout.

I would be a buyer on potential commercial or regulatory uncertainty if the data is mediocre but good enough for approval because I think the unmet need will justify broader usage. I’m not worried about etavopivat as competition for the first few years (etavo will be slightly behind).

Conclusion

This one was a bit in the weeds but in summary

Unmet need is high in sickle cell disease with a large market

Fulcrum Therapeutics has a drug that works. It works better than the competition

Agios has a drug that might work

There’s a whole lot under that iceberg though.

Love to hear any an all thoughts. Am I overthinking this? Will these fail? What did I miss? Do you agree?

Adu Subramanian

adu.subramanian@subradata.com

There’s a racial component to this, but I won’t get into that

F- Cell positivity is measured at 4-6 pg/mL but protection conferred at higher levels so we need both F-Cell % and HbF/cell

in vitro data, blah blah blah

Hey Adu

Given your interest in Biotech, you might enjoy my recent biotech piece on eXoZymes Inc. They’ve just commercially launched a cell-free enzyme biocatalysis platform that converts biofeedstocks into targeted chemical products.

Plus they just announced their first subsidiary, which synthesises N-trans-caffeoyltyramine (NCT) to treat MASLD/MASH. Very very interesting compound that has immense potential

https://www.slack-capital.com/p/exozymes-research-report

very thorough and easy to understand.