TTRadeoffs: Patients, Prescribers, Payors, and Prior Auths

Launch Dynamics in ATTR-Cardiomyopathy. Why Attruby will launch fast and Amvuttra won't

3k words + images, 12 min reading time

II. Clinical Comparison of Approved Therapies: Why Amvuttra’s label is disappointing

III. Reimbursement Landscape: How does Medicare Work?

IV. Incentives: Prescriber and payor incentives favor Attruby, Impact of the IRA on Part D plans

V. Case Studies: Leqvio/Repatha, IRA impacts

VII. Near term Market Outlook and Model: Diagnosis, Timing the Launch, a rough revenue model

VIII. Conclusion and Future Outlook

Introduction and overview

ATTR Cardiomyopathy is a large, growing, underdiagnosed population of patients. I’ve outlined the pathogenesis and treatment approaches in my prior articles (link). Here, I will discuss the launch dynamics for all approved drugs: Vyndaqel (tafamidis), Attruby (acoramidis), Amvuttra (vutrisiran). Speculation last fall on the potential label, trial design, pricing, etc is water under bridge because all three drugs are now approved. We know the labels, we know the pricing, and we know, roughly, the strategy.

My Bottom Line: The label, reimbursement landscape, and clinical data support Attruby on par or better than Amvuttra in the near to medium term. Formularies will cover the drug starting in Q1 and management has made it easy to start patients on free trials. Based on new patient diagnosis and tafamidis progressors. I expect 400M in 2025 revenue for both Attruby and Amvuttra. Do with that what you will

This is not financial advice. I can own shares long/short in any company mentioned. The article breaks down merely a piece of each company discussed, the ATTR drugs.

Clinical Comparison of Approved Therapies: Why Amvuttra’s label is disappointing

Three drugs are approved for ATTR-CM: Vyndaqel/Vyndamax (Tafamidis, 2018 approval), Attruby (Acoramidis, November 2024 approval), and Amvuttra (Vutrisiran, March 2025 Approval). 1

Each label is similar with subtle differences. Labels are here

AMVUTTRA’s label includes “reducing heart failure visits” in the indication but the difference results from how the primary endpoint was calculated. Attruby included urgent heart failure visits as part of the primary endpoint.

Amvuttra’s Label Disappointed

Alnylam did not receive their desired label for Amvuttra's cardiomyopathy indication. They wanted to include results from the open label extension but the FDA did not agree.

In mid 2024, Alnylam extended the primary analysis on their phase 3 trial, HELIOS-B, from 30 to 33-36 months. The new statistical plan also added a 42-month secondary endpoint to further demonstrate benefits on mortality. The 42-month data shows stronger results than the 36-month data, and Alnylam presented both primary and secondary endpoints to the FDA.

“Well said. I'll just underscore what John Vest had shared, which is it's comforting also that you have a prespecified second end that is consistent with what we saw in the component of the composite primary. So again, as a function of the data set that we're filing to FDA, we feel very good about that data package.”

In September 2024, they are emphasizing both the 33-36 month endpoints AND the 42 month data.

“We showed a pretty dramatic impact on mortality, in particular, in the overall population at the 33 to 36-month end point, we showed a 31% reduction. And then at the 42 months, we had a secondary all-cause mortality endpoint. That increased to 36%.”

In the label however, the Kaplan Meier curves stop 33 months for AMVUTTRA. The 42-month open label extension data is NOT included. Alnylam puts the OLE data in their marketing materials but it’s notably absent from the label

Attruby vs Vyndaqel vs Amvuttra

The labels place Attruby on par or better than both Vyndaqel and Amvuttra. The hazard ratio for primary outcomes is better (.65 vs .7 vs .67), Separation occurs earlier (indicating a faster treatment effect), and we know acoramidis is a better stabilizer than tafamidis.

Market Uptake depends on non-clinical factors.

Attruby may have a slight edge and clinical data is important, but individual physician preferences vary. KOL surveys will be misleading (doctors do not fill those out seriously) and individual calls will tell us something different. Ultimately, academic prescribers who know the data well likely think acoramidis is better than tafamidis but distinguishing between all three drugs is difficult. Community prescribers (and even some academics) see little difference between all three and want to try new drugs like acoramidis. Doctors are notably less in the weeds than scientists. They want drugs that work quickly, receive reimbursement, and patients will take.

So the bottleneck for new prescriptions is 1) insurance coverage and 2) new diagnosis rates.

Reimbursement Landscape: How does Medicare Work?

80% of ATTR-CM patients are covered by Medicare, but “Medicare” coverage includes both Medicare Advantage (run by private plans, about 55% of patients, cover all costs) and Medicare Fee for Service (combination government - part A/B, private part D plans for prescriptions)

Medicare Advantage will continue to grow as a % of the market

Medical Benefit vs Pharmacy Benefit: Amvuttra vs Vynda/Attruby

Medical benefits are for stuff you get at the doctor's office like IV drips, shots, any infusion. Pharmacy benefits are for the drugs you get from the pharmacy (usually taken at home). So, if you're getting chemo at the hospital, that's medical. If you're picking up your blood pressure meds at CVS, that's pharmacy. In traditional Medicare, Medicare part B covers medical benefit while Prescription Drug plans (part D) covers pharmacy benefit. Medicare Advantage and commercial plans are responsible for both (total cost). Physicians administer AMVUTTRA as a Medical Benefit drug. Patients receive Attruby and Vynda as pharmacy benefit drugs.

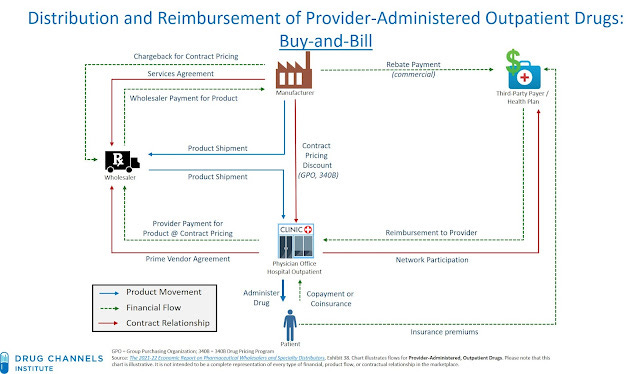

Buy and Bill - Medical Benefit

For medically administered drugs (AMVUTTRA), prescribers use “buy and bill”. They buy the drug, give the drug and are reimbursed after for the average selling price + 6% (or higher for commercial plans). However, “buy and bill” requires a specific set up so some community cardiologists will not have the processes in place.

The reimbursement pathway for medical benefits can be summarized as follows:

Provider → Buys drug from manufacturer/distributor

Provider → Administers drug to patient

Provider → Bills insurer

Insurer → Pays provider

Patient → Pays coinsurance to provider

Why did Alnylam Price at 400k when competition is half the price?

AMVUTTRA was already approved for a different condition, ATTR-Polyneuropathy before receiving additional approval for cardiomyopathy. Hospitals already bought the drug for 450,000 (or 119 per vial) and are reimbursed on a delay. They pay Q1 prices and are reimbursed on prices paid 6 months later!

Thus, Alnylam can't lower prices without undercutting hospitals. If the Average Selling Price (Price after rebates) drops to 200k this quarter, then prescribers will only be reimbursed ~200k for drug purchased at 450k!

The incentives matter: Medicare Advantage/Commercial vs Medicare Part B

The insurance dynamics wouldn’t matter much if every drug costs the same. But Amvuttra maintained a premium price of 450k compared to Vynda and Attruby’s 200k list price. The reimbursement pathways for patients now play a huge role in selecting a treatment.

Payor Incentives: Reduce Total Costs

Commercial payors (including Medicare Advantage) want to reduce cost as much as possible. They limit coverage using step therapy or prior authorizations. They will favor oral drugs .

Medicare part B is run by the government and does not use prior authorizations or step therapy. If approved for an indication and covered, Medicare will pay the price required. Amvuttra will be reimbursed at any price.

Medicare Part D plans are private and do not want high-cost patients. They can change how drugs are covered/perceived through their formulary.

Doctor Incentives: Reduce Administrative burden

For administered drugs (part B, Amvuttra), doctors use “buy and bill” and pay the average selling price + 6% (or higher for commercial plans). However, “buy and bill” requires a specific set up. I estimate 80% of providers have buy and bill capabilities

Doctors want to prescribe drugs without any paperwork.

Patient Incentives: Lower OOP Costs

10% of patients with part B Medicare pay 20% of total cost - untenable to get AMVUTTRA

Medicare patients have a $2,000 out of pocket cost maximum for prescription medications. This is new under the Inflation reduction act (from 2024).

Major impacts of the IRA: increase Part D plan responsibility

The IRA redesigned the part D payment system to shift the payment burden to private plans and drug makers2

The private part D plan paid only 20% above 8,000 pre 2025. Now the plan will pay 60%.

The changes incentivize cost controls so expensive drugs will have extra scrutiny or simply receive less coverage. The trend pans out in the data; plans are reducing coverage across multiple high-cost medications.

And the trend starts specifically in 2025.

This is a headwind for oral drugs like Vynda and Attruby. Part B does not control for costs but part D plans will.

Oral Drugs are still covered, just not on Formulary

Formularies are often used to steer patients away from plans. So patients with expensive medications see a plan without Drug X on the formulary and don’t select it even though requirements are similar to other plans.

“The good news is that 80% of our prescriptions are filled regardless of formulary status in those patients that go on to get INGREZZA medicine, they're out of pocket on a monthly basis less than $10.” - Neurocrine biosciences

Case Study: Leqvio Vs Repatha

Leqvio and Repatha are PCSK9 inhibitors used to treat high cholesterol:. Leqvio is reimbursed under the medical benefit (a la Amvuttra) and Repatha is under the pharmacy benefit (a la Attruby/Vynda).

Novartis (sponsor for Leqvio) faced challenges building out buy and bill for cardiology offices because cardiologists don’t usually have buy and bill capabilities. High cholesterol (treated by primary care and community cardiology) is not comparable to ATTR-CM (treated by specialists), but the general trend still holds. It’s challenging to set up buy and bill for independent cardiologists. I think 20% of the ATTR-CM market won’t set up buy and bill.

“We still have a number of docs who file under the pharmacy benefit which will either get rejected or go through a lot of hassle”.

However, once you set up a buy and bill, the doctors love it. They’re reimbursed an extra 6% for a quick infusion (that’s how most oncologists actually make their money). However, the insurance company does not. Part B Medicare is willing to take it on the chin, but not commercial insurance. They will steer you away. MA plans and Commercial insurance prefer you take pharmacy drugs (Repatha, Vynda, Attruby) over administered drugs (Leqvio, Amvuttra) - United Healthcare has Leqvio as a non preferred therapy.

Patients complain about these step therapy protocols under Medicare Advantage

“If you get the drug through "Buy and Bill", where the provider buys it directly from the manufacturer or a distributor, it'll be billed as Part B drug and needs to go through PA and ST.

If you get the drug through "white bagging", where the drug is purchased from a pharmacy and then administered at the provider, it'll be billed as Part D drug and have no PA or ST.

The same dynamics will play out in the ATTR market. MA plans will encourage use through the pharmacy benefit.

Breaking down the population: 70/30 favoring Attruby/Vynda

Impacts of the IRA: out of pocket costs

Pre IRA, patients were responsible for 5% of drug costs in the catastrophic phase. Now they pay nothing. So instead of a $10,000 bill, they now pay $167/month….a strong tailwind for adherence.

Impacts of the IRA: Pharma responsibility

Pharmaceutical companies are now responsible for 20% of drug cost. This leads to a 20% hair cut in net prices.

Pfizer commented the following

“a higher gross to net impact on our revenue for most of our drugs in the first half of 2025 when compared to 2024, impacting on year-on-year and quarter-on-quarter comparison.

But it is then expected to moderate in the second half of 2025, and the volume and patient affordability benefit is expected then to materialize more fully in the second half of 2025 and partially offset the negative manufacturer discount impact”

Timing the Attruby Launch: Q2 will be big

Based on a select few medical policies and coverage determinations, I expect Q2 will be a big quarter. Coverage tends to start between February and April 2025.

Sources: UHC, UHC, Aetna, Humana, Cigna, Kaiser, Premera, BCBS, BCBS Excellus

These documents are not a comprehensive list but rather reflective of major trends. I expect other formularies to follow similar timing. Attruby was approved in November and 5-6 months to major coverage makes sense.

I would also follow Medicare part D plans monthly to check when Attruby shows up here

Making it Easy: How BridgeBio and Alnylam are launching

Bridge Bio Strategy

Free Drug for a month

Delivered in 48 hours

Paperwork is < 3 pages total

The strategy is clearly working with 1000 scripts written and a broad base of prescribers.

Alnylam’s Strategy:

“As patient uptake of AMVUTTRA increases over time, we will decrease the net price of AMVUTTRA via rebates and value-based agreements or we call VBAs.” - Alnylam Management March 2025

They can try and rebate but rebating under the medical benefit is difficult. A VBA makes little sense if the drug outcomes are the same as lower cost alternatives. They HAVE TO reduce the price, or the incentives favoring competition will not change. The near-term dynamics are unfavorable even if they also offer 3 months of free drug.

ATTR is not a rare disease. I will continue to pound the table on this.

Astrazeneca highlights 200,000 US patients. Diagnosis rates continue to go up. This is a 10-20B+ market driven by new diagnoses. Everyone and their mama agrees.

"In fact, in our best estimates, we believe about 20% patients only across the world are diagnosed. Therefore, this really is in a way, I'm going to date myself a bit of a blue ocean opportunity with some important players, which is only going to actually expand, increase access and availability" - Alnylam

"It is estimated that nearly half of those with this progressive and deadly disease have yet to be diagnosed….Diagnosis remains the biggest unmet need in this condition because there's almost half of patients that are still undiagnosed. So we do see a lot of growth opportunity in Vynda." - Pfizer

"The first is the ATTR-CM, which is one of the largest cardiomyopathies in cardiovascular disease, 300,000 to 500,000 patients, growing significant disease burden." - AZN

"One is the continued identification of new patients moved somewhere from like 35,000 identified patients to close to 50,000 now. And I expect that that's going to continue at an increased clip based on more and more people coming on to the playing field" - BridgeBio

Modeling the Market

I expect the market to grow to $10B by 2028 in the USA (currently $3.5B). Amvuttra is the lead player primarily due to the price

I think both Attruby and Amvuttra reach ~400M in revenue this year. See my rough model here. I assume 20% progress on Vyndaqel yearly, 7000 new diagnoses per year. My estimates are conservative imo.

Bottom Line: We can futz with the numbers all we want, model out in detail each quarter. That’s overkill. The label, reimbursement landscape, and clinical data support Attruby on par or better than Amvuttra in the near to medium term. Formularies will cover the drug starting in Q1 and management has made it easy to start patients on free trials. I expect 400M in 2025. Do with that what you will.

Conclusion and future outlook

The market will change so I do not extend my model past 2028. Tafamidis will likely be generic, Wainua will be approved for ATTR-CM and next generation antibodies will report phase ⅔ data.

Generics?

Let’s assume Tafamidis goes generic in 2028. Would you rather put your patient on a Combination Amvuttra and Tafamidis or Attruby? The initial thinking was combination therapy would definitively be better, but we don’t definitively know that….the aforementioned insurance dynamics may still leave room for Attruby.3

IONS and Wainua (eplonterson)

Wainua, another silencer in development, will have a phase 3 study read out in 2026 and is focused on the combination market. Keep in mind Wainua is reimbursed under the part D benefit like an oral drug, not Part B like Amvuttra. The same tailwinds for price controls apply.

Long term - Antibodies

The future is clearance and disease reversal. Right now, stabilizers can prevent accumulation of toxic monomers, silencers reduce the protein burden, but the real promise is clearing already built up proteins. Antibodies may reverse the disease and will be preferred for many patients if safe and effective. Early data is good (Novo/Prothena Phase 1)

That’s it for today. I think people are underestimating the Attruby Launch.

Love to hear any thoughts. If you enjoy my writing, please subscribe and consider pledging support.

Email me at adu.subramanian@subradata.com

Adu Subramanian

I will use terms interchangeably: Vynda = Vyndamax/vyndaqel = tafamidis. I use Vynda to refer to both -max/qel. Sold by Pfizer. Attruby = ATTRuby = Acoramidis, sold by Bridge Bio. Amvuttra = AMVUTTRA = Vutrisiran, sold by Alnylam.

I discuss the impacts primarily in the catastrophic phase because those are the real needle movers. Catastrophic phase = after initial deductible, OOP max, some cost sharing, etc is met.

Interesting dynamic here: Insurance is preparing by forcing patients to switch to Vyndaqel (four pills) vs Vyndamax (one pill) which creates opportunity for Attruby and Amvuttra.

Incredible analysis! Thank you very much!