Data I/O (DAIO): Buy for Cyclicality tailwinds, Security is the gravy

Multiple tailwinds are aligned for Data I/O leading to near term upside as a speculative position

Before I start I would like to make this clear: I am not a Semiconductor expert. There are more knowledgeable experts in the field who I may be betting with or against. If you know the company well, I do not anticipate much new information in the write—up. Unlike other long term positions, my position in DAIO is intended to be a play on short term upside and the write-up is intended to provide a framework on the stock rather than a detailed breakdown.

I may be the only person on Substack starting a post off touting my non-credentials, but I felt it necessary to frame the thesis. With that said, let’s get into it.

I alerted readers to the opportunity in DAIO in my Q2 portfolio update.

"DAIO is undergoing a business transformation yet it's cheap solely as a cyclical equipment manufacturer and the potential shift in business is just icing on the cake."

Lots of the information in this write-up is presented well in the investor presentation, but I wanted to talk about my mentality buying the stock.

Business

Data I/O sells programming systems for microcontrollers. Yea, I also didn't understand what the hell that meant the first time I read it.

Programming serves as the middleman between semiconductor manufacturers and the final product. Every chip needs to be programmed to give it life and each chip is programmed in a different way depending on the final application. Programming is analogous to teaching a child language; it's readies them for use and is essential for the functioning of the chip.

Data IO sells the capital equipment needed to program these chips. If you want a visual for how the system works, check out the Youtube Channel.

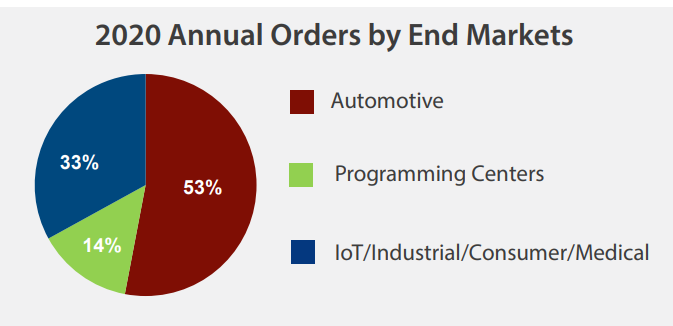

Their primary end market is automotive customers, a niche the CEO pursued starting in 2012 when he was hired.

In addition to the capital equipment, they have two other revenue line items which are "recurring" : adapters and services. Adapters are consumables used by their devices and replaced every 12-24 months. These count as recurring revenue, but are still dependent on usage of the capital equipment. Services are contracts for maintenance of machines predetermined before machines are bought.

Industry/Competitive Advantage

Semiconductor programming is a mature yet fragmented industry which some think is highly commoditized, but Data IO continues to improve their products based on speed, modularity (easier to use), and new features. Data IO has a number of awards and is as an upper tier manufacturer of programming equipment, especially in the automotive market where the ability to program fast and with flexibility is needed.

From the Q1 conference call, CEO Anthony Ambrose notes a couple advantages regarding trends in semiconductors towards more UFS programming needs:

They have the best equipment to program the newest requirements (UFS). Think of UFS as a more different language than typical eMMC programming which is useful for certain industries and a limited number of programming companies can support the format. Even if this isn’t a huge revenue driver, it anecdotally demonstrates company’s innovative nature.

Still, even as the company has faster speeds and better capabilities, the business of selling programming equipment is highly cyclical. Data IO is especially reliant on automotive demand. Data IO notes programming demand is equal to Chips * Bits. Even as the # bits/car grows, the automotive industry was in a downcycle from 2018 to 2020. This dragged revenues down from 34M to 20M from peak to trough.

Security and the SentriX pitch

Data IO has attempted to transition beyond cyclical equipment manufacturer through programming security on chips (i.e. embedded security). I'm still unclear on the exact advantages, but programming security onto a chip is useful for certain applications, more flexible than other security approaches, and allows chips to be secure earlier in the product cycle exposing them to less risk. For more info on the advantages, I suggest this video.

SentriX is intended to be a pay-per use model instead of the typical capital equipment sale. They did license it out for a customer in Q2 for an annual fee rather than usage based, but essentially they sell the system upgrades for free and derive revenue on chips programmed. They have a 370 system installed base which can program 1B chips/year with about 50% eligible for SentriX (source: Q2 earnings call). Assuming a price of 20 cents/chip, the SentriX market has a current TAM of $100M in high margin revenue. From their investor presentation, they identify 3-4B chips which can be programmed with security putting the whole embedded security TAM at $600-800M.

When SentriX was introduced, some investors jumped on the thesis. Shareholders Unite has a number of articles on Seeking Alpha and Avi Fisher over at Long Cast Advisors pitched it in 2018. They pitched it as follows: an innovative company mitigating cyclicality with a new recurring revenue business model (sound familiar?) Data IO would have a higher margin recurring revenue stream driven by an increase in security demand even though the stock was priced as purely cyclical. The thesis hasn't played out yet because of difficulties with the SentriX system and a general lack of demand for security programming at the chip level.

Why Now?

At risk of sounding like a gold bug saying inflation’s around the corner, I believe the company is positioned better than ever before to capture this security market. The SentriX system was upgraded to ease implementation (one day turnaround for a system upgrade) and Data IO now wholly owns the IP behind SentriX. The previous model had Data IO licensing IP from SecureThingz. Anthony Ambrose, who owns 5% of the stock, believes security is the future of programming even if it takes time.

Their original partner for programming security, SecureThingz, was acquired by IAR Systems suggesting embedded security will be part of the future of the semiconductor industry. In the most recent quarter, management pointed to increased interest in SentriX and a key win of an automotive customer (though they are licensing the tech rather than using a usage based model).

The Upcycle is here

Putting aside security, all signs point to an upswing in automotive demand. Industry estimates, management commentary, and recent financial results from both DAIO and bigger chip manufacturers like NXPI and Infineon point towards increased automotive demand. Although chip shortages may slow down the upcycle, demand is there. As older machines from the previous cycle need to be replaced, Data IO’s financial results will follow through.

Management

I'm an outsider to the semiconductor industry and management knows the business much better than I do which means I need to trust them. CEO Anthony Ambrose joined in 2012 and restructured the business to focus on the automotive market with effective capital allocation. Data IO improved their financial position through innovation and returned cash to shareholders through 8M in buybacks. I trust his judgement regarding long term industry trends and the ability to effectively allocate capital.

Valuation

“History never repeats itself, but it does often rhyme"

Typically, I like to use Excel to value a stock so the numbers make sense and give me conviction. The macro reliance and my general lack of insider knowledge would make most assumptions moot, but modelling isn’t necessary in my opinion. The story here is one as old as time. Investing in cyclical businesses isn't my forte, but let’s speculate nonetheless (seems to work for lots of “Fintwit gurus”).

DAIO had 20M in revenue for 2020 with -$3.9M in net losses. At the peak in 2017, they had $34M in revenue with $5.5M in net income. If we simply assume the cycle repeats itself, at $6.43 a share, their market cap is 55M putting them at 10X peak earnings. This is appropriate for a cyclical equipment manufacturer so where's the upside? It comes in three forms. 1) increases in peak net income. 2) changed business model 3) investor psychology.

Peak cycle improvements: DAIO has improved their industry positioning since 2017 positioning them to capture more demand this time around. The incremental margin on sales is 50% (source: management guide and latest Q results) so any increases in sales are extremely profitable. A combination of increased peak cycle automotive chip demand due to the electronification of cars and improvement in market positioning could increase peak cycle net income.

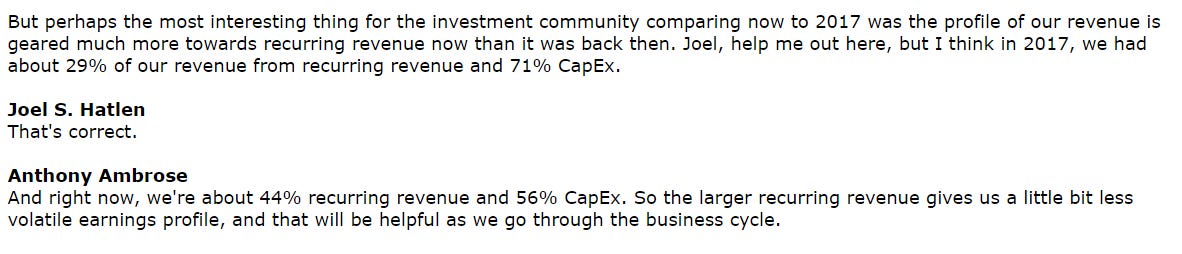

Change business model: As discussed before, the SentriX business change is well underway having matured since 2017. In addition, recurring revenue now represents 44% of revenue vs 29% in 2017 meaning less volatility,

Investor psychology: "if it is a Ponzi, get in on the ground floor"- Dave Portnoy. Even if the business cannot transform and we simply invest in a cyclical company, I believe we're on the ground floor of the cycle.

On a more serious note, Data IO's stock history is illustrative for those looking at a trade.1 The stock peaked at $14/share in 2017 as people jumped at the opportunity to buy an optically cheap stock. When Data IO reports similar operating metrics to the previous upcycle, people will once again drive the stock up based on simple metrics such as P/E and revenue growth. With an added bonus of a transformation story and improved positioning, demand for the stock could be even higher. Putting everything aside, stock prices move based on supply and demand. I could see seeking alpha articles touting Data IO as a play on IoT/Security demand at the peak of the cycle.

The stars have aligned three fold: growing market, best-in-class business, downcycle prices. I expect shares to be worth $10+ in the next upcycle which could happen in less than a year. After reporting good Q2 results (setting aside comps against a COVID weakened quarter), the stock should be worth more than it is today.

Risks and Downside

Risk 1, Timing: The trading thesis hinges on catching the timing of an automotive upcycle. If the upswing in demand is delayed, upside in the stock will be constrained. Cars are still supply constrained given the chip shortage so true demand is hard to parse out. However, management and industry estimates believe we are in the beginning of an automotive demand upswing which will accelerate into 2022.

Risk 2, Unknown unknowns: Semis are hard and I am no expert. A few Youtube videos, podcasts, transcripts, and conversations are not nearly enough to understand the future of chip programming. Semiconductors are a nuanced industry with layers of people, nations, and innovation. The CEO strongly believes programming security onto a chip will be important and transactions in the space certainly indicate such a shift, but new innovation or other industry factors may continue to limit SentriX growth. Unknowns unknowns are the worst form of risk and investing in DAIO contain this risk. The position remains speculative.

Limited downside: Especially attractive about DAIO is the limited downside profile. Management has prudently set up a cash pile with >25% of the market cap in cash. They have bought back shares in the past suggesting willingness to put cash to work for shareholders if the stock is materially undervalued.

If you enjoyed this thesis, follow my twitter account @AduSubramanian too! Any nascent ideas and simple comments are posted there. Subscribe for one medical device deep dive and a stock idea/update each month.

I previously wrote about disregarding stock history but this is only so for fundamental analysis. Data IO is a play on investor psychology just as it is a fundamental play.