Q2 Portfolio Update and thoughts on borrowed Ideas

An update on my portfolio. Also, does being the first one to a stock matter?

When I updated my holdings back in April, I wrote about my frame work regarding the price to sales ratio. Here, I want to discuss another relevant topic, especially with my recent post on Performant Financial.

“Being first to a stock doesn't make you better at making money. “

About a month ago, I started to fall into a trap: looking past companies because they had recently run-up in price. I wanted to find the most obscure, least analyzed company out there so I could be "first". I equated being first to being the best. As someone who published his work, being first lends some credibility but the goal of any investor is to make money. No one cares if you're first or if you come up with some unique insight if you don't make money.

Sure, one derives satisfaction from being the first to an insight, but it isn't the ultimate goal.

I would argue being first can actually detract from long term returns if you're too early. Let's look at a very popular former microcap: XPEL. With XPEL, you had the opportunity to buy at the same prices in 2015 and 2018 in the low $3's/share. Early wasn't necessarily better. Beyond that, if one analyzed XPEL in 2019 at 6$ after appreciating 400% from 2018, one could dismiss the stock as overvalued with little further upside. "Bah, it's already run-up so much, can it be worth that much more?" This would be amongst the largest mistakes of omission of an investor's career with XPEL at >80$/share right now.

Past performance isn't indicative of future performance in a stock. Businesses and stocks should be separated when doing fundamental analysis. Sure, business history is relevant, but stock history isn't. Many investors, including me, fall into a trap of assuming a hot stock has little room left to run. This isn't always the case. Price anchoring is a killer vice.

Performant Financial, the stock I wrote about most recently inspired these thoughts. Initially, I was hesitant to invest because of the recent runup and resisted writing about it because others on seeking alpha had already done so. However, neither of these are relevant to the overall thesis: it’s undervalued and going to make me money. Who cares what the stock has done? I want to know what it’s going to do. Look at the stock price last when analyzing a business.

Beyond ignoring stock history, don't dwell on being first or even having a unique insight. It’s the essence of this meme.

A great portfolio is often 20% original ideas and 80% borrowed ideas. The best investors are have a great network and take pride in their ability to synthesize ideas. The best ideas I have are often from others. (insert obligatory DYODD statement here)

YTD/Q2 Portfolio Update

Below are my current holdings.

My last portfolio update was at the end of April here

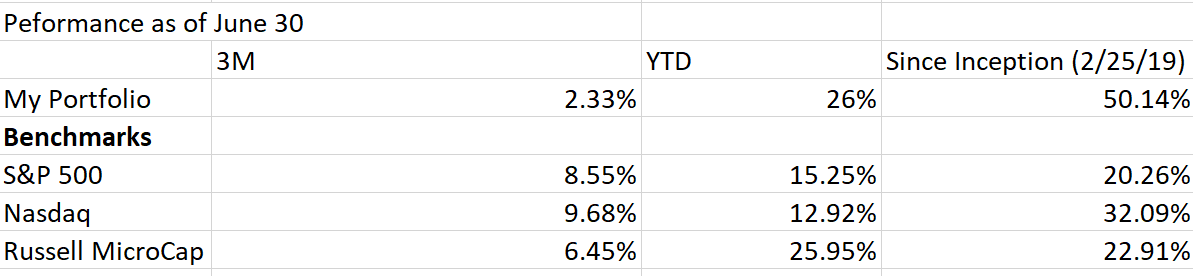

Performancehere

Recent Key adds: At the top of the list of new adds is Performant Financial (PFMT) which I wrote about here. Also added to the portfolio was TableTrac (TBTC), which I also wrote about. Even up 50%, I think TableTrac represents a fantastic Risk/Reward, but a lack of liquidity prevents me from building a huge position. Overall, the top 5 positions make up 44% of the portfolio (vs 43% in April) and the top 10 positions make up ~70% of the portfolio (vs 62% in April).

One addition I have not written about is Data I/O (DAIO), a manufacturer of programming systems for semiconductors. Historically, they sold equipment to chip manufacturers and were subject to semiconductor cycles with no recurring revenue. They tried changing the business to add recurring revenue by adding the ability to program security and price based on volumes. This shift diversifies the customer base and stabilizes the revenue. Data I/O's potential switch from a cyclical equipment manufacturer to a recurring revenue business has excited investors since 2018 (look at Long Cast Advisor's pitch and other Seeking Alpha articles). The thesis fits an often successful framework of a business transition from one time sales to recurring revenue. (IDN, RSSS both fit this bill). However, uptake of the new systems was slow and coincided with a downcycle in semis so the thesis failed to play out in 2018. Now, the company is at the start of an UPCYCLE in semis and I believe at an inflection point for selling the new systems (based on product development). It's cheap solely as a cyclical equipment manufacturer and the potential shift in business is just icing on the cake. I still need to put together a model and will write it up when I can better quantify the opportunity or the stock drops to a level where the pitch is too fat to ignore.

Another smaller addition was Thunderbird Entertainment (THBRF). A quick twitter search will reveal lots of writeups, but the overall thesis is straightforward. They produce content in an age where streaming content sells at a premium. They are building an IP portfolio to monetize outside of purely producing and selling content. It trades at < 20x FCF, cheap for the growth, but I have concerns over a possible bubble in the demand for content and their ability to build an IP base, which hold me back from buying more.

Other smaller additions since April are Psychemedics (PMD), Compumed (CMPD), and Procyon (PCYN)

Subtractions: Though the top 5 and 10 positions represent similar percentages of the portfolio, there are less positions (27) now than in April (34) with lots of turnover. I sold out of Enthusiast gaming(EGLX), Nintendo (NTDOY), Progyny (PGNY), Aterian (ATER), Novocure (NVCR), IZEA (IZEA), Angi Homeservices (ANGI), Profound Medical (PROF), Evolution Gaming (EVTTY), Aware (AWRE), StoneX (SNEX), AYR Wellness (AYRWF), DarioHealth (DRIO), Carecloud (MTBC), Spark Networks (LOV), Eros STX (ESGC). Wow, quite a few sales, but you could put them into two buckets: either I wasn't confident on the business (most of the sells) or unsure of further upside based on the valuation.

Performance has certainly slowed in 2021, but still remains above my target 20% return. I will continue to research new stocks and build on my still infantile performance history.

![Symbol

SMLR

BERY

IDN

PFMT

TBTC

M YO

TVIDX

DAIO

NNI

IRIX

ACTG

H3RF

PMD

MMVIB

SCND

OPRX

GKPRF

VVID

ANET

RDBBY

Description

Research Solutions

Semler Scientific

Berry Global

Intellicheck

Performant Financial

Clearpoint Neuro

FIDELITY GOVERNMENT MONEY MA

TableTrac

Myomo

Transmedics

Galaxy Ga ming

Data IO

NelNet

Stereotaxis

Iridex

Acacia Research Group

Thunderbird Entertainment Group

Psychemedics

Intelligent Systems

MamaMancini holdings

Scientific Industries

optimize"

Gatekeeper Systems

Viemed Healthcare

Arista Networks

RedBubble

-BERY220]BERY JAN 21 2022 $70 CALL

crv1PD

PCYN

Compumed

Procyon

Percent Of Accou nt

11.12%

9.38%

8.54%

7.77%

7.52%

7.02%

6.80%

5.37%

4.98%

4.38%

3.55%

3.35%

2.81%

2.37%

2.30%

2.09%

1.70%

1.30%

1.21%

1.08%

1.02%

0.84%

0.77%

0.74%

0.57%

0.51%

0.36%

0.28%

0.25%

Last Price

53.09

S127.oo

$66.30

58.12

53.97

$18.54

51.00

53.65

59.74

$34.51

53.75

55.90

$74.17

59.40

56.62

56.12

53.58

56.86

$31.92

52.60

$10.80

$55.46

50.58

57.12

978.03

$27.02

53.80

50.22

50.33

Cost Basis Per Share

52.12

$48.35

$59.38

58.79

53.61

57.28

5247

$13.91

$14.99

53.55

55.58

$75.94

56.71

55.52

55.66

53.35

56.84

$43.55

52.23

510.00

$29.63

50.76

59.28

$280.79

$32.50

53.11

50.21

50.33 Symbol

SMLR

BERY

IDN

PFMT

TBTC

M YO

TVIDX

DAIO

NNI

IRIX

ACTG

H3RF

PMD

MMVIB

SCND

OPRX

GKPRF

VVID

ANET

RDBBY

Description

Research Solutions

Semler Scientific

Berry Global

Intellicheck

Performant Financial

Clearpoint Neuro

FIDELITY GOVERNMENT MONEY MA

TableTrac

Myomo

Transmedics

Galaxy Ga ming

Data IO

NelNet

Stereotaxis

Iridex

Acacia Research Group

Thunderbird Entertainment Group

Psychemedics

Intelligent Systems

MamaMancini holdings

Scientific Industries

optimize"

Gatekeeper Systems

Viemed Healthcare

Arista Networks

RedBubble

-BERY220]BERY JAN 21 2022 $70 CALL

crv1PD

PCYN

Compumed

Procyon

Percent Of Accou nt

11.12%

9.38%

8.54%

7.77%

7.52%

7.02%

6.80%

5.37%

4.98%

4.38%

3.55%

3.35%

2.81%

2.37%

2.30%

2.09%

1.70%

1.30%

1.21%

1.08%

1.02%

0.84%

0.77%

0.74%

0.57%

0.51%

0.36%

0.28%

0.25%

Last Price

53.09

S127.oo

$66.30

58.12

53.97

$18.54

51.00

53.65

59.74

$34.51

53.75

55.90

$74.17

59.40

56.62

56.12

53.58

56.86

$31.92

52.60

$10.80

$55.46

50.58

57.12

978.03

$27.02

53.80

50.22

50.33

Cost Basis Per Share

52.12

$48.35

$59.38

58.79

53.61

57.28

5247

$13.91

$14.99

53.55

55.58

$75.94

56.71

55.52

55.66

53.35

56.84

$43.55

52.23

510.00

$29.63

50.76

59.28

$280.79

$32.50

53.11

50.21

50.33](https://substackcdn.com/image/fetch/$s_!NZyW!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fb944836c-71e9-433e-8daa-528bdd31b627_1215x1150.png)

Excellent article. Focusing on being 'first', unwillingness to borrow ideas, and believing in stocks' being over extended purely from their charts, are all traps I've fallen into in the past, but which I find are rarely discussed.

Congrats on great returns tooAdu :)