TLDR for the whole post:

You should sign up for www.subradata.com to get updates on clinicaltrials.gov listing and access to a tool for analyzing listings using LLMs. Contact me at adu.subramanian@subradata.com for questions and details

I break down Danon Disease, Fanconi Anemia for Rocket and the state of Gene Therapy (TLDR: not good)

Part 1: Sign up at www.subradata.com

Clinicaltrials.gov lists US-listed clinical trials run by companies, academia, the NIH, and any other organization. A 2007 law mandates organizations to register their clinical trials on the site and provides a valuable insight into trial design for investors, investigators, and patients. We can see the inclusion/exclusion criteria, outcomes measured, locations enrolling patients, and even some results.

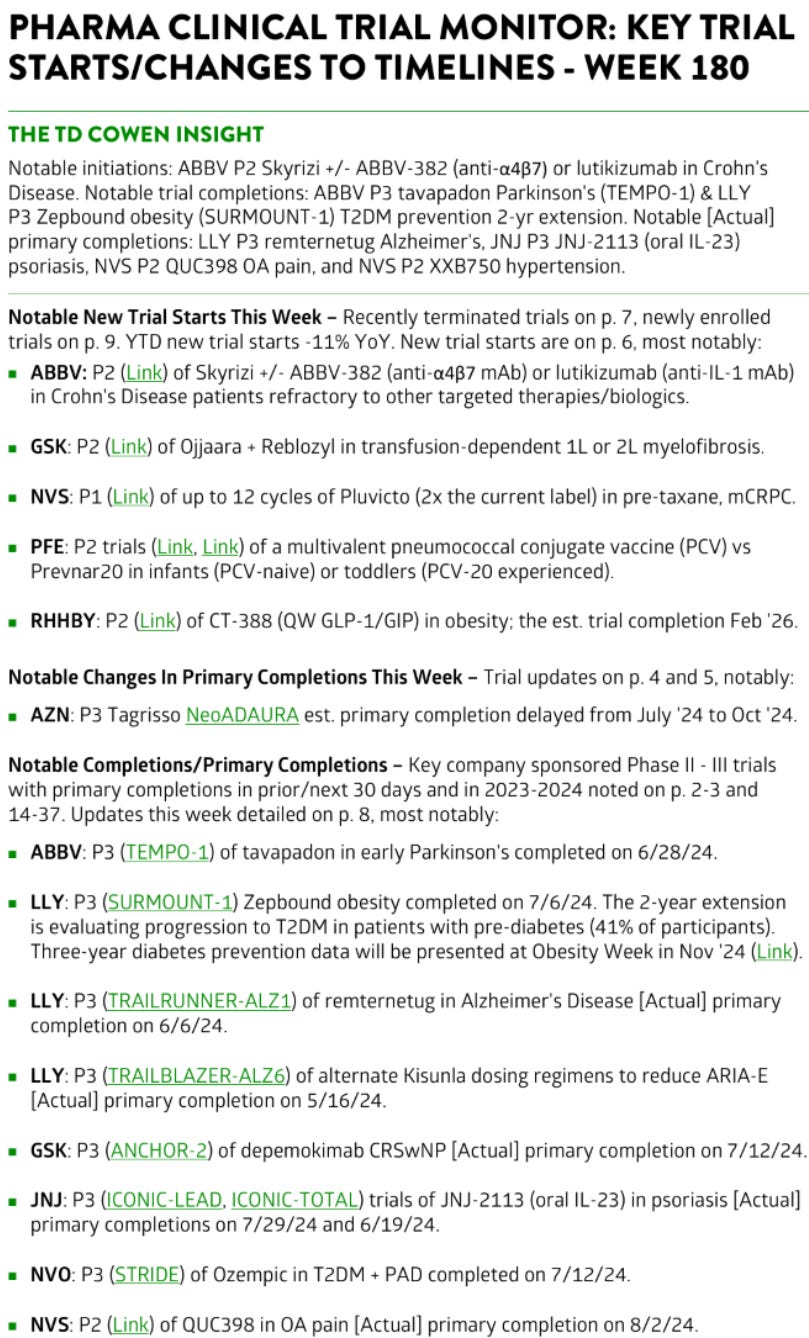

Companies are responsible for updating the status of ongoing clinical trials and thus tracking changes can be valuable. What are the new studies posted this week? Which trials were terminated? Which trials changed their primary outcomes? Some companies pre-empt changes in their listings during earnings call, but many update their trial listing with no associated press release or commentary.

What Happened to TECX Stock this week?

Tectonic Therapeutic is developing a relaxin analog in heart failure (HFpEF). Both Astrazeneca and Eli Lilly also own relaxin analogs and were running trials. However, on January 28th, Eli Lilly terminated their trials for Volenrelaxin (their relaxin analog). No news release, no presentation, the only update was a change in the clinical trials.gov listing. TECX stock was cut in half: if one of three drugs with a similar mechanism of action was terminated, that doesn’t bode well for the class of drugs.

Getting this update would have pre-empted the dramatic price drop. I don’t have access to the same tools as large investors and I don’t like reloading a page excessively to check for changes. So how can I get these updates automatically?

Option 1: RSS Feeds. People can create RSS feeds from searches (see here how to do it) and use an RSS Reader. They cost 5-10$ a month and only give you if a trial is updated or not.

Option 2: Use www.subradata.com, receive emails with trial names and updated fields. Create custom feeds by condition, drug, ticker, or custom searches. Also access www.subradata.com/ask_clintrials for an LLM layer on clinical trials.gov.

What to expect

A single daily email with updates on clinical trials with the fields changed. I’ve deemed some fields “important”, so you’re not bombarded with changes in additional locations. See a detailed explanation on the site. See a website guide here: https://www.subradata.com/static/Monitor_tutorial.pdf

How do I use this information?

I would check your email every day for any updates and if you find something that piques your interest, note it down. If a trial is terminated or initiated: is this new information? Should you ask someone or make a decision on this? For new studies, can you use them to better understand company strategy.

How do I use the LLM search?

I would search for all trials in a given indication and ask for differences in inclusion criteria or primary outcomes. Maybe some drugs have subtle differences. Going from phase 2 to phase 3 can be tricky…. Are those outcomes the same? The inclusion criteria? Instead of pasting into ChatGPT, I would use the tool instead. Find the search tool here www.subradata.com/ask_clintrials

Examples from Sell side, News people, and Some Smart investors.

And I could go on, but you get the point. Go sign up. Send me questions. I will respond personally.

Part 2: Gene Therapy, the doldrums.

TLDR: Gene therapy is in the dumps right now with funding at 10-year lows and equities underperforming. I answer some questions about the downturn: why we’re here, general principles, and issues with gene therapy. I then analyze a few in development programs which illustrate the poor sentiment but may provide an opportunity for investors

What we’ll cover:

A brief state of affairs: TLDR: it’s not good

Commercial Dynamics

Wait, I thought Gene therapy could cause cancer? (nah)

FDA uncertainties

The ideal gene therapy

Rocket Pharmaceuticals

Danon Disease - Basics

Clinical data and FDA alignment

Epidemiology: Enough patients to make a difference?

Finding patients

Fanconi Anemia is Special

Lexeo, Taysha and Regenxbio

More example where they may have a real therapy and are not valued as such

Stock performance of Gene therapy stocks is poor……

Please don’t show me the chart for bitcoin too. Oh god make it stop

Now in all seriousness, let’s take a look at what’s going on in gene therapy. Gene therapy was in favor 3 years ago with record levels of funding pouring in between 2020 and 2021.

The record funding gave way to record lows not seen since 2013, when CRISPR was discovered. As with any hype cycle, the peaks are proceeded by troughs of disillusionment, yet the end result may not be a desolate wasteland of spent dollars chasing targets without materializing into real patient impact or commercial success. Some companies will fail but others have a real opportunity at both clinical and commercial success. Let’s answer some key questions

Defining Terms

Gene Editing (e.g., CRISPR-Cas9)

Gene editing directly modifies the DNA sequence within a cell. It corrects faulty genes, removes harmful mutations, or inserts new genetic material. This approach targets the root cause of genetic diseases. Example: CASGEVY to treat Sickle Cell Disease

AAV Gene Therapy

Adeno-associated viruses (AAVs) deliver functional genes into cells. AAVs are non-pathogenic and can infect many cell types. The therapeutic gene is packaged into the AAV vector, which delivers it to the target cell. However, AAV therapy does not integrate the gene into the host DNA, so effects may be temporary, requiring repeated administration. Example: ZOLGENSMA (Spinal Muscular Atrophy)

Lentiviral Gene Therapy

Lentiviruses deliver therapeutic genes by integrating them into the host cell’s DNA. This ensures long-lasting effects. However, integration carries a risk of insertional mutagenesis, where the insertion disrupts other genes, potentially leading to unintended consequences. SKYSONA (cerebral adrenoleukodystrophy (CALD))

All of the above are “gene therapy” but one usually distinguishes gene editing from gene therapy (AAV/LV). The field has shifted from LV therapy to AAV and Gene editing. I will focus on AAV (and a little LV)

Commercial Dynamics: Successes and Challenges

Approved Therapies

There are 13 FDA-approved gene therapies (excluding CAR-T for cancer), but only a couple stand out as commercial successes:1

Zolgensma: AAV- based therapy to treat spinal muscular Atrophy, a pediatric condition often fatal. Accounts for the majority of gene therapy sales. $1B in 2023 sales.

Elevidys: Controversial AAV-based therapy approved for Duchenne Muscular Dystrophy, another often fatal childhood condition. $200M in 2023 sales.

So why have 11/13 failed to generate significant interest?

Key Issues

Existing Standard of care = Low Unmet need: Many gene therapies target diseases with well-established standards of care which makes regulators, patients, physicians, and investors skeptical. Roctavian, Biomarin’s gene therapy for Hemophilia was rejected by the FDA in 2020 (concerns over efficacy) and even after approval raked in only 7$ million in 2024 revenue, far below their $50-150 million sales target. Now they’re pausing production and paring back spending, even considering selling the asset altogether. The risk benefit analysis matters. The FDA is less lenient, physicians are more skeptical, patients are hesitant to switch, and insurance coverage is difficult. Gene therapies cost multiple millions, so insurers are wary to cover such therapies without long term durability data, especially for diseases with alternative options.

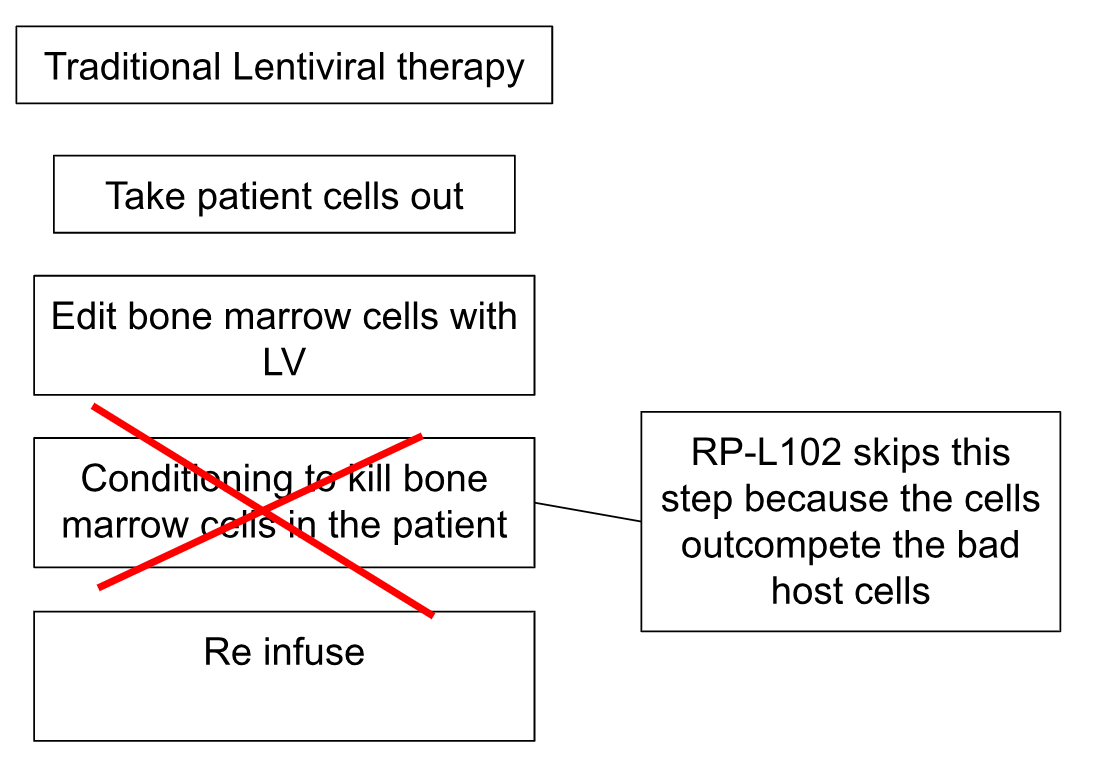

Administration Challenges: The conditioning process for lentiviral gene therapy often involves conditioning the bone marrow to “create space” by reducing the number of existing stem cells. For CRISPR-based therapies, while specific conditioning protocols may vary, the general principle is similar - preparing the body to receive and integrate the edited cells. The goal is to achieve a balance between creating sufficient space for the modified cells while minimizing potential side effects associated with more intensive conditioning regimens. Intense conditioning regimens are brutal. On the other hand, AAV therapies do not require the same conditioning, but still require some immunosuppression (we are injecting large amounts of virus lol)

Small Markets: Therapies for ultra-rare diseases, like Skysona for CALD (< 40 patients/year world wide), have limited commercial potential. Pediatric review vouchers (worth $100-150M), are given to rare disease drug developers help offset costs but don’t guarantee outsized returns. (although they can be meaningful, especially if you have multiple approvable therapies → Rocket has 3 expected PRVs).

FDA Uncertainties

The gene therapy sector faces another challenge: regulatory unpredictability has become a significant factor in the recent downturn. The FDA, under the leadership of Peter Marks at the Center for Biologics Evaluation and Research (CBER), has been notably flexible in approving therapies for diseases with high unmet needs. This flexibility has been a boon for companies targeting rare diseases, but the new administration is creating chaos.

Marks has signaled he would like to stay but other senior FDA officials (Bob Temple worked there for 50 years!) have left and documents show Marks may be scrutinized for how he handled Covid. I believe these concerns are overblown. While RFK represents a sharp left turn (off a cliff?), Marty Makary, proposed head of the FDA, is open to regulatory flexibility and maintaining the status quo.

Everyone Freaked out about Cancer last fall

Reports linking Bluebird Bio’s lentiviral gene therapy to an increased risk of cancer sparked concerns last year. This risk, while real, is not new—it’s a known limitation of lentiviral therapies and is explicitly highlighted in product labels.

The Bluebird case is also an outlier. Here’s why:

AAV Therapies Don’t Integrate: AAV-based gene therapies deliver genetic material without integrating it into the host genome, eliminating the risk of insertional mutagenesis. Blue bird bio uses a lentiviral based approach: basic difference.

Not All Lentiviral Therapies Are Equal: Many lentiviral therapies use different promoters or delivery mechanisms that reduce the risk of disrupting cancer-related genes.

Other Factors May Be at Play: The cancer risk in Bluebird’s case could be influenced by conditioning (chemotherapy or radiation) or the underlying disease biology, not the therapy itself. Rocket Pharma’s therapy for Fanconi Anemia doesn’t require conditioning.

In short, while the cancer risk is a valid concern for certain lentiviral therapies, it is not a systemic issue for gene therapy as a whole. The field has learned from these challenges, and newer approaches are designed to mitigate such risks.

The Ideal Gene therapy

So far, it looks terrible. Funding is at all-time lows. Commercial success is scant. FDA uncertainty still exists. But we can parse out the attributes of a successful gene therapy program and apply those principles to find promising programs.

Target Rare Diseases with High Unmet Need

Rare diseases often lack effective treatments, making them ideal candidates for gene therapy. These markets are less crowded, and the FDA is more likely to grant accelerated approvals. I cannot emphasize this point enough. No one is taking your gene therapy for wet AMD when Eylea is available. No one wants a 1 time gene therapy if we have yearly dosing in ATTR-CM and good generic drugs. Companies like 4D MolecularMinimize conditioning requirements and the burden of therapy

AAV vectors are non-integrating, reducing the risk of insertional mutagenesis. They also have a strong track record of safety and efficacy in clinical trials. Not a novel insight, but easier to administer therapies are…..easier to rollout.Address an Easily Identifiable Patient Population

A clear diagnostic pathway ensures that patients can be identified and treated efficiently. This is critical for both clinical trials and commercialization.Follow a Straightforward Regulatory Path

Programs that align with FDA priorities with a clear path to approval reduces uncertainty and accelerates timelines.

Bonus: Avoid Broader Biotech Concerns

Gene therapy is uniquely insulated from some of the pressures facing traditional biotech companies. Competition from China: Gene therapies are complex to manufacture, creating barriers to entry. Drug Price Negotiation: Rare disease therapies often command premium pricing due to their transformative potential. Genericization: Gene therapies are typically one-time treatments and hard to make, reducing the risk of market erosion from generics.

Rocket Pharma: Danon Disease and Fanconi Anemia

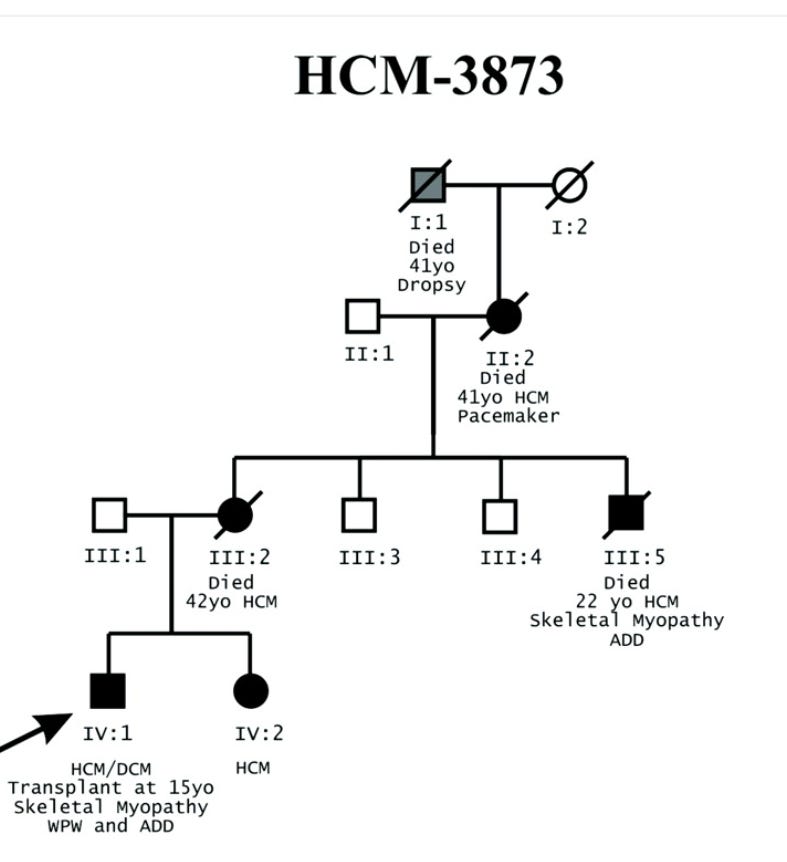

Danon Disease is an X linked (inheritance) glycogen storage disorder caused by a dysfunctional LAMP2 protein leading to the buildup of cellular waste within heart cells and subsequent dysfunction. Rocket Pharmaceuticals is developing RP-A501, a gene therapy to treat Danon. RP-A501 aims to correct this by delivering a functional copy of the LAMP2 gene to heart cells. The functional LAMP2 protein can then clear cellular waste and improving heart function. Danon Disease, while historically underdiagnosed, has distinct presentation: hypertrophic cardiomyopathy (enlarged heart) often accompanied by ECG and neurological abnormalities. LAMP2 mutations are common in patients with HCM and ECG abnormalities so any patient with a big heart and a messed up ECG should be tested. Danon is fatal: boys by the age of 30 and often fatal in women by the age of 50. The only option is a cardiac transplant.

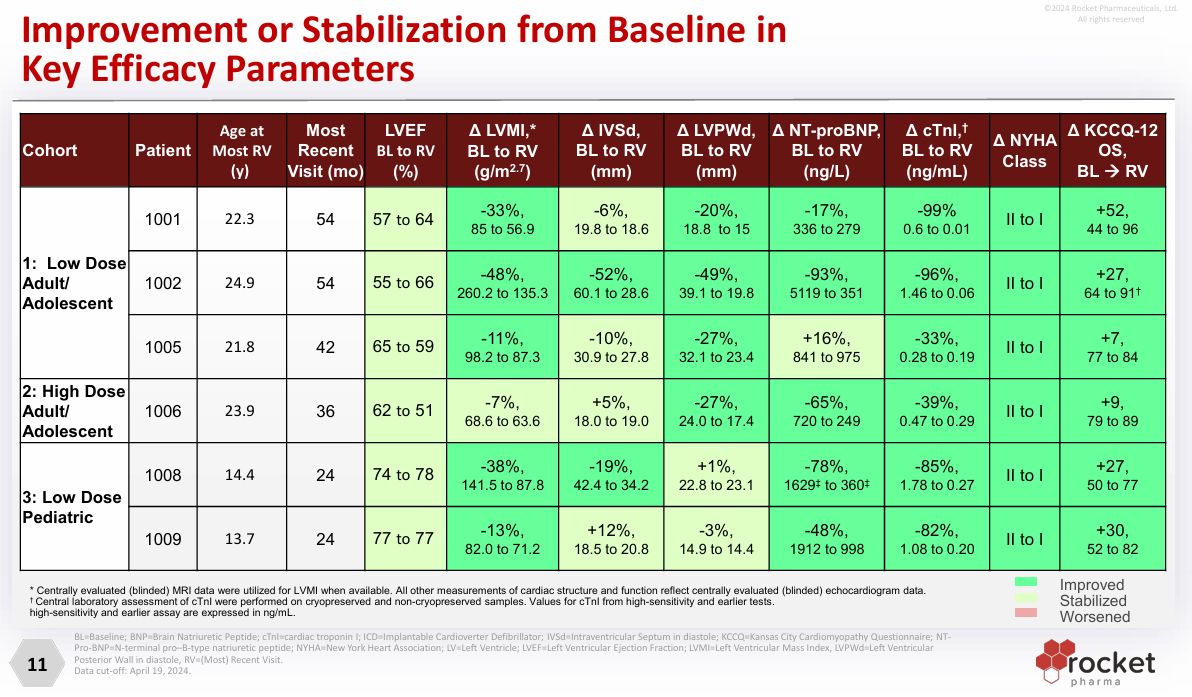

Clinical Data and FDA alignment

Rocket has an ongoing 5-year Phase 2 study in boys. One-year outcomes will support accelerated approval for RP-A501. The primary endpoints are LAMP2 expression and Left Ventricular Mass Index (LVMI). Clinical data from the phase 1 trial demonstrates a clear benefit and meets the bar for approval (25% LAMP2 expression and 10% reduction in LVMI) This slide speaks for itself2

Epidemiology

The key question for Rocket, and its investors, isn't approvability, but epidemiology.. Rocket estimates 15,000-30,000 Danon patients in the US/EU, extrapolating from HCM prevalence (1 in 500) and Danon's proportion of HCM cases (1-4%). However, these figures are based on limited data and likely overstate true prevalence. Indeed, some studies show no LAMP2 mutations in 300,000 patients while others show an incidence higher than Pompe Disease (Another common GSD)

'“There are approximately 15,000 to 30,000 Danon patients in the U.S. plus EU and this is now validated by a third-party partner, namely IQVIA.” - Management January 2021

I’m skeptical of them and their consultants. A more conservative estimate, using a 3% Danon prevalence within pediatric Hypertrophic Cardiomyopathy (HCM), yields dramatically lower figures: ~30 new cases annually and ~300 prevalent cases in the US pediatric population. This is orders of magnitude below Rocket's claim. 3

Rocket's rationale hinges on a large pool of undiagnosed patients.

““Now are there 15,000 to 30,000 diagnosed patients? No. I would say that there's probably 20% of that that's actually diagnosed because Danon is often misdiagnosed or undiagnosed in most cases.”

And that is the crux of the matter: without treatment, diagnosis is inherently limited. While 300 patients may be officially diagnosed, the true numbers may be much higher. X-linked inheritance patterns in diseases like Danon often lead to underestimation of true prevalence, as female carriers may be less severely affected and thus undiagnosed. That uncle who died of a heart attack at 30? Danon. Grandma dies at 50 due to arrythmia? Danon. Family studies reveal multiple affected individuals within single families, suggesting under-penetration of diagnosis so for every identified patient, Rocket will explore their family for more. 1,000 addressable patients are still a multi-billion market with gene therapy pricing (~$2 million).

Rocket is expected to provide updated epidemiology estimates in an upcoming presentation (H1 2025). They highlight 1) an official diagnosis code, 2) genetic testing and 3) working with centers of excellence to find Danon patients.

“But as part of the effort that we've had in identifying patients for commercial success as well as clinical trials, we've done 2 things specifically. One, we put an ICD-10 code in place last year. So having ICD-10 code allows for physicians that are diagnosing Danon patients to really reference them, so over time, we'll have a better idea where these patients are actually coming through.

But the second thing, which is really powerful, is genetic testing. So we are making genetic testing available for free for these patients, not just for Danon, but it could actually be a platform that could be applied for PKP2 and BAG3.

Why is this important? Well, a lot of the times, unfortunately, in rare diseases, especially in these types of diseases, it's too late by the time they get diagnosed. A lot of times what we find out from patients and families is, family members passed away, and they never knew why. And now they're starting to realize that, oh, a grandson has Danon disease and find out when they test multiple family members, many of them, male and female, have Danon disease.

And the third thing that's really important is working with cardiology centers, not just the heart failure centers of excellence around the world, but also cardiologists that are working with pediatric population to see if we can increase the diagnosis based on symptoms they see early on.”

Finding patients

Finding patients should be straightforward because, as discussed previously, the patient presentation is straightforward. Further, updated guidelines recommend LAMP2 testing while prior guidelines did not mention it. Danon Disease is increasingly recognized as a cause of HCM.

Fanconi Anemia: RP-L102 and a Unique Lentiviral Therapy

Danon is Rocket's lead program, but RP-L102 for Fanconi Anemia warrants attention as well.

TLDR: RP-L102 is a lentiviral therapy which doesn’t require the usual conditioning regimen and thus overcomes a major barrier to adoption. About 2000 patients have it world-wide and 100 are newly diagnosed each year. Fanconi Anemia often progresses to bone marrow failure before 10 years old. 70% are eligible for RP-L102 (mutation specific)

Fanconi Anemia: The Disease

What is FA?

FA is caused by mutations in DNA repair genes, most commonly FANC-A (60-70% of cases). These mutations make patients highly susceptible to DNA damage, leading to bone marrow failure and an increased risk of blood cancers. The primary symptom is pancytopenia—low counts of all blood cell types. While medical management has improved survival into adulthood, this also raises the risk of developing blood cancers. The standard treatment is a bone marrow transplant, which carries its own risks, including further increasing cancer risk.

Genetic Mosaicism: The Body’s Own Gene Therapy

What is Genetic Mosaicism?

Genetic mosaicism describes the presence of two or more genetically distinct cell populations within a single individual. In FA, some patients can literally mutate themselves out of disease. They have a few cells mutate back to normal and these cells survive and outcompete the “bad cells”. These corrected cells have a proliferative advantage, leading to stable or improved blood counts. Essentially, the body performs its own version of gene therapy. Rocket’s RP-L102 treatment uses a lentiviral vector to deliver a corrected FANCA gene into a patient’s CD34+ hematopoietic stem cells (HPSCs). These corrected cells are then reinfused into the patient.

The Key Advantage: No Conditioning

Traditional HPSC gene therapy requires conditioning—chemotherapy or radiation to clear out existing bone marrow cells. However, FA-corrected cells naturally outcompetes faulty ones due to their growth advantage. This allows Rocket to administer the therapy without conditioning, reducing the associated risks and side effects.

Rocket’s RP-L102 Program: Data and Outlook

Clinical Data

RP-L102 met its primary endpoints in a single arm phase 1 trial: 7/12 patients show >10% MMC-resistant cells (primary endpoint), These patients have stabilized blood counts, cells remain effectively transduced with the viral vector for 2+ years, and safety concerns are minimal.

Regulatory Path

FA is a rare disease with no acceptable treatments, making a single-arm, open-label trial sufficient for approval. Rocket is submitting their application to the FDA this year. The benefit-risk profile strongly favors approval. RP-L102 addresses a high unmet need with a progressive disease, offering a safer alternative to bone marrow transplants.

Fanconi anemia represents a unique opportunity in gene therapy. Rocket’s RP-L102 leverages the natural phenomenon of genetic mosaicism to deliver a potentially transformative treatment without the need for harsh conditioning.

More examples: Lexeo, Taysha

Lexeo and Friedrich’s Ataxia Gene Therapy

Friedrich’s ataxia (FA) is a rare, devastating disease with no effective treatments. While its primary manifestations are neurological, the leading cause of death is cardiomyopathy—a slow, unstoppable progression toward heart failure in the mid 50s. LX2006 treats the heart failure and recent developments suggest a promising path forward.

Friedrich’s Ataxia: The Disease

FA is caused by insufficient production of frataxin, a protein critical for mitochondrial function. This deficiency leads to mitochondrial dysfunction, primarily affecting the nervous system but also causing cardiomyopathy. Patients typically die in their 40s or 50s due to heart failure. TThe sole approved drug, omaveloxolone, offers limited benefit and doesn't affect cardiomyopathy. This leaves a significant unmet need for effective treatments. Lexeo’s gene therapy aims to restore frataxin levels by delivering a functional copy of the frataxin gene to the heart using an AAV vector. The goal is to halt or reverse the progression of cardiomyopathy, addressing the primary cause of death in FA patients.

Clinical Data and FDA Alignment

Lexeo has made significant progress in aligning with the FDA on endpoints for accelerated approval. In the fall, I wrote

"Management guided to the following targets as goals for accelerated approval with the FDA: 5% frataxin expression, 40-50% IHC, 10% reduction in LVMI, and 30% improvement in troponin.

“IHC measures % of cells expressing the protein, Frataxin level measures % of normal total protein. Lexeo will show their hand soon and It’s one way to bet on increased regulatory flexibility. The aforementioned targets for frataxin expression and LVMI reduction would be a boon because lower dose cohorts have already met this bar."

Management subsequently confirmed the following:

Co-Primary Endpoints: The FDA agreed to use increased frataxin expression and reduced left ventricular mass index (LVMI) as co-primary endpoints.

Target levels: 10% reduction in LVMI and 40% frataxin-positive area (measured by immunohistochemistry, or IHC).

Patient Enrollment: The FDA supports enrolling patients with elevated LVMI, a critical inclusion criterion.

Further, updated biopsy data from treated patients shows promising results:

A 35% increase in frataxin protein expression (measured by LCMS). A 279% increase in frataxin-positive area (from 7% pre-treatment to 26% post-treatment). The post-treatment average across cohorts is 44% frataxin-positive area, exceeding the FDA’s target.

Higher Doses

Lexeo is exploring higher doses to deliver more viral vectors, which could further enhance efficacy. We can expect another update this year. The value of the company is ~0$ with enough cash to sustain into 2027. Contrast this with Reata Pharmaceuticals, acquired for billions for omaveloxolone.

The Value of Focus in Gene Therapy

The gene therapy sector has shifted from platform-driven hype to a focus on tangible results. Companies like Lexeo and Solid Biosciences demonstrate the importance of narrowing focus to deliver meaningful therapies.

Examples of Focused Success/failures - These aren’t comments on the platforms itself but rather examples where platforms are valued less than $0

Uniqure: Aligned with the FDA on a single program and handsomely rewarded

Intellia: Once a darling of the CRISPR space, now struggling to justify its broad platform in disease areas with low unmet need. The delivery platform isn’t valued at all as they burn through cash

Taysha: Reduced its pipeline from 10+ programs at IPO to just one

4D Molecular Therapeutics: “Nobel prize winning science” doesn’t get you an approved drug.

Voyager Therapeutics: Potentially spearheading gene therapy delivery to the brain yet still in early-stage studies

Solid Biosciences: Refining their focus to two programs and trying to deliver value. No credit for manufacturing platforms.

MeiraGTX: Doing Okay partnering therapies, but still no credit for their platform science.

The only platform plays I’ve seen do ok are the “picks and shovels” plays like Clearpoint Neuro (direct gene therapy delivery to the brain). None of the aforementioned companies receive any credit for science, delivery or manufacturing platforms.

Investor Sentiment

Investors are no longer willing to bet on potential. They want proof of concept, regulatory alignment, and a clear path to commercialization.

Taysha and Rett Syndrome

Taysha Gene Therapies is another example where the path forward isn’t reflected in investor demand. The lead (and only) program, TSHA-102, targets Rett syndrome, a childhood disease characterized by developmental regression.

Rett Syndrome Overview

Current Treatment: DayBue, the only approved therapy, is poorly tolerated and minimally effective.

Taysha’s Approach: AAV-based gene therapy with proof-of-concept data showing marginal but meaningful benefits.

FDA Alignment: They plan to use natural history data and functional outcomes instead of randomized controls and a behavioral questionnaire (RBSQ), streamlining the path to approval.

Despite a large, vocal patient base and life-changing potential, the market values Taysha at near-zero. This reflects broader skepticism toward gene therapy companies without clear, near-term catalysts. I expect updates on the trial and regulatory path later this year.

Regenxbio: worth less than $0?

Regenxbio represents the extreme end of investor disillusionment. Despite a robust AAV platform, founded by gene therapy pioneer, the company has struggled to attract investors. The company is worth less than $0. The market is telling them to return cash

Conclusion: The Path Forward for Gene Therapy

The gene therapy sector is at a crossroads: drunk on funding in 2020/2021 and now hungover craving a lifeline. But out of the ashes, some companies will be successful. Multiple products have pathways to an approval in diseases with a high unmet need are still valued as if they will fail. I’ve highlighted a few I like (Rocket, Lexeo, Taysha, Regenxbio, Solid Bio) and I’m sure others are out there with valuable drugs. Some will fail (maybe most). However, I think all time low sentiment creates an opportunity for investors and the lessons from this era will be applied to new platforms in the future.

Gene therapy is uniquely insulated from Chinese Competition, Drug price negotiation, and genericization. We can identify therapies targeting a high unmet need, with an identifiable patient population, and straightforward regulatory path to find some green shoots.

Disclosure: I may own stock in companies discussed, not investment advice.

I exclude Vyjuvek, a commercially successful topical herpes based gene therapy from Krystal biotech to treat a rare skin disease dystrophic epidermolysis bullosa (DEB). It does not fit the theme of the article about AAV/LV/Gene Editing.

Some people would point out details on persistence, durability concerns, etc. but bottom line is this: Danon is a death sentence. FDA has provided them an easy bar for approval and they should meet it. 1 of the 7 patients treated did have to undergo heart transplantation. 6 of the 7 are shown on the slide

Math: ediatric Incidence is ~1/100,000 and prevalence over 10 years was 1/10,000. With 70 million children in the US, the incidence is ~700* 4% = 30 and prevalence ~300,